-

BTC has retested $67k after an early week decline.

Market analysts foresee a new ATH as soon as next month.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely monitored Bitcoin’s [BTC] recent price movements and market analysis. Based on my observations, I believe that the latest dip below $64k was merely a temporary setback for BTC as it retested the significant resistance level of $67k.

The price of Bitcoin [BTC] bounced back to challenge the $67,000 mark following a dip below $64,000 on July 25th. This rebound demonstrates the digital currency’s robustness amidst the ongoing distribution process instigated by the Mt Gox estate.

The price’s ability to withstand current pressures might be a sign that we’re in for a repeat of the range top or even the all-time high (ATH). There’s growing agreement among traders that this could be the case.

According to Quinn Thompson, the founder of Lekker Capital, there’s a strong possibility that a new all-time high (ATH) for the markets might be reached as soon as mid-August. This prediction is driven by the expectation of Federal Reserve quantitative easing measures, which may include rate cuts.

Based on current market trends, I believe that Bitcoin’s all-time high will be reached around mid-August. This expectation stems from the imminent easing of inflation by the Federal Reserve, which is expected to have a positive impact on the prices of commodities such as Oil, Gold, and crypto including Bitcoin.

Macro setup and easing supply overhangs for BTC

Based on the consensus among market analysts, the favorable macroeconomic conditions, particularly the anticipated Federal Reserve interest rate reduction in September, may boost the performance of riskier assets such as Bitcoin and cryptocurrencies as a whole.

The explanation behind Thompson’s perspective is that the price of Bitcoin might reflect an anticipated September interest rate reduction as early as mid-August.

Based on the Fed Watch Tool’s data, approximately 87% probability exists that the Federal Reserve will reduce interest rates in September. This implies that around nine out of ten traders anticipate a rate reduction.

An alternate macro analyst held the view that the general consensus was overly optimistic and proposed the possibility of the Federal Reserve reducing rates as early as the upcoming meeting on the 31st of July.

Without delving into the technicalities of macroeconomic settings, Bitcoin’s price has shown notable resilience in the face of recent surplus offerings, most notably Mt.Gox’s repayments. This reaction bolsters faith that a new growth spurt may emerge imminently.

One of the market watchers, DeFiSquared, noted,

Based on my extensive experience in the cryptocurrency market, I’ve observed that Bitstamp and Kraken have recently distributed large amounts of Bitcoin (BTC). In my opinion, this could create a significant downward pressure on the price of BTC, especially for the German market where all their BTC holdings have been sold. This is a concerning development for me as I’ve seen similar situations lead to bear markets in the past. However, there seems to be a silver lining as FTX, a major player in the crypto space, has announced that they will be returning $16 billion in cash to crypto natives. This injection of liquidity could potentially counteract the negative sentiment and even lead to new All-Time Highs (ATH) for Bitcoin sooner than most anticipate. I’ve learned throughout my journey in this market that unexpected events can drastically impact prices, so it’s important to stay informed and adapt quickly.

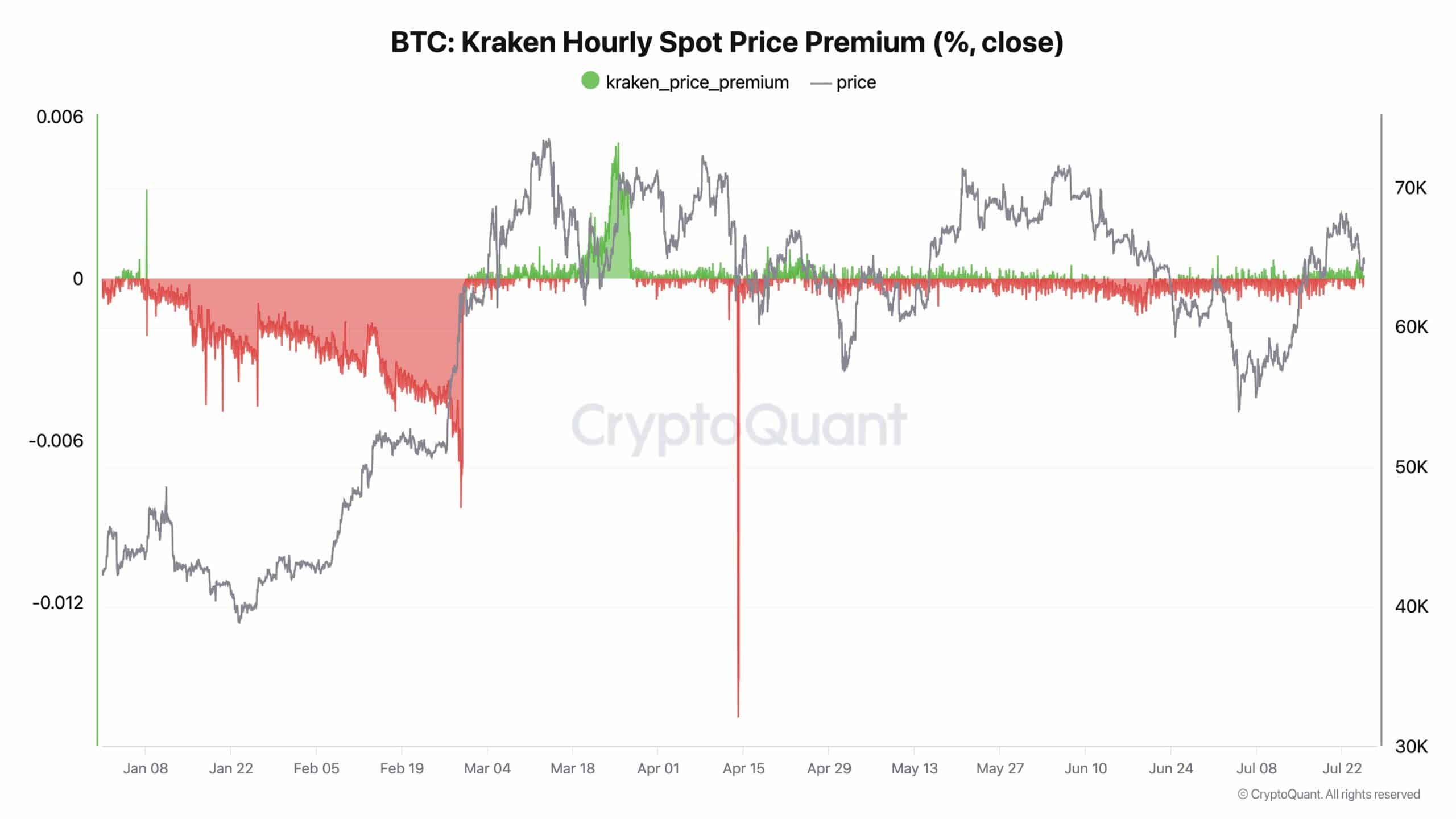

According to CryptoQuant’s analysis, the Bitcoin dip we recently experienced wasn’t influenced by Mt. Gox repayments observable on the Kraken exchange.

At Kraken, there’s no significant difference in prices or an increase in trading volume. The normal flow of funds in and out indicates that recent price decreases are not linked to Mt. Gox creditors.

However, the US government could be a crucial BTC sell pressure.

Recently, the United States disposed of a portion of its Bitcoin stash, causing apprehension among some observers. However, it’s important to note that the US still possesses over 200,000 Bitcoins valued at approximately $14.3 billion, according to Arkham Intelligence’s latest data. With elections just three months away, this significant quantity of Bitcoin cannot be ignored.

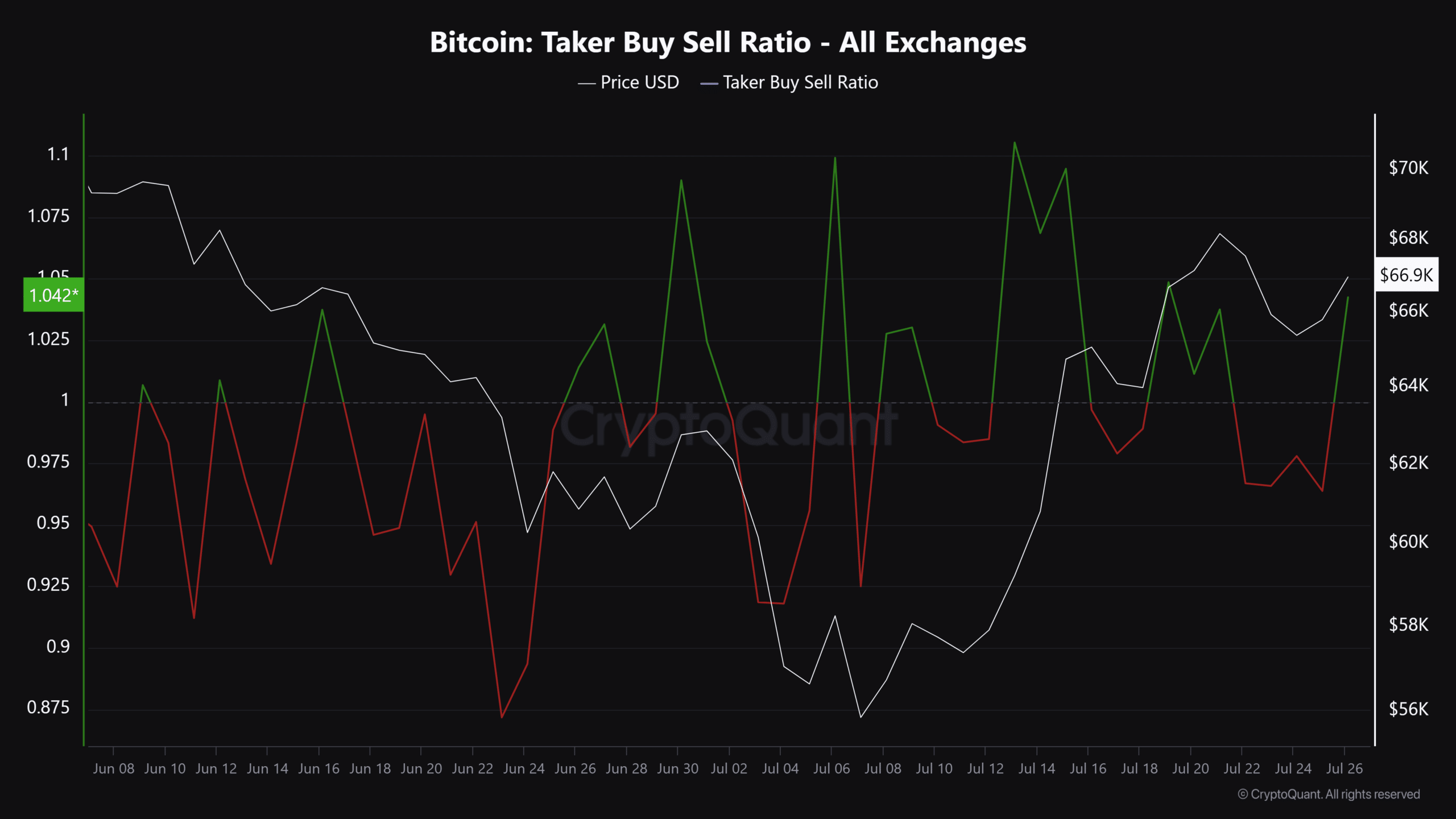

During this period, the broader market outlook remained optimistic, particularly in the derivatives segment. This was indicated by a favorable Taker Buyer Ratio, implying that more buy orders than sell orders were being executed.

With the substantial clustering of liquidations occurring at the price level of $68,900, this became a crucial focal point for Bitcoin bulls to monitor closely.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-07-26 17:12