As I sat in my armchair, sipping my tea and staring out the window, I pondered the mysteries of the universe. And then, it hit me – the news that would change everything. Fidelity Digital Assets had released a report that would shake the very foundations of the cryptocurrency world. It seemed that Bitcoin‘s “ancient supply” – coins that had lain dormant for 10 years or more – was accumulating at a faster rate than new bitcoins were being mined.

I couldn’t help but chuckle at the absurdity of it all. An average of 566 bitcoin per day was entering the ancient supply category, compared to the current daily mining reward of 450 Bitcoin. It was as if the old guard was rising up, determined to show the young whippersnappers how it’s done.

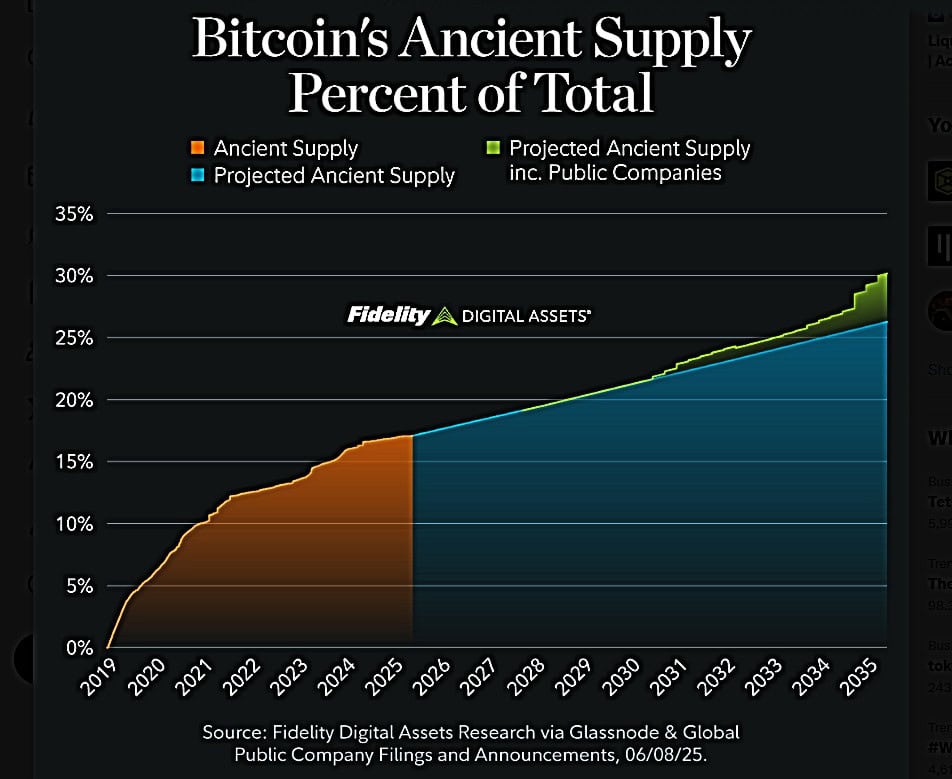

The scale of this phenomenon was staggering. Nearly 3.4 million bitcoin had joined the ultra-long-term category since January 1, 2019. At Bitcoin’s current price of $107,000, this represented a whopping $360 billion in value. I couldn’t help but wonder what Satoshi Nakamoto, the pseudonymous creator of Bitcoin, would make of it all.

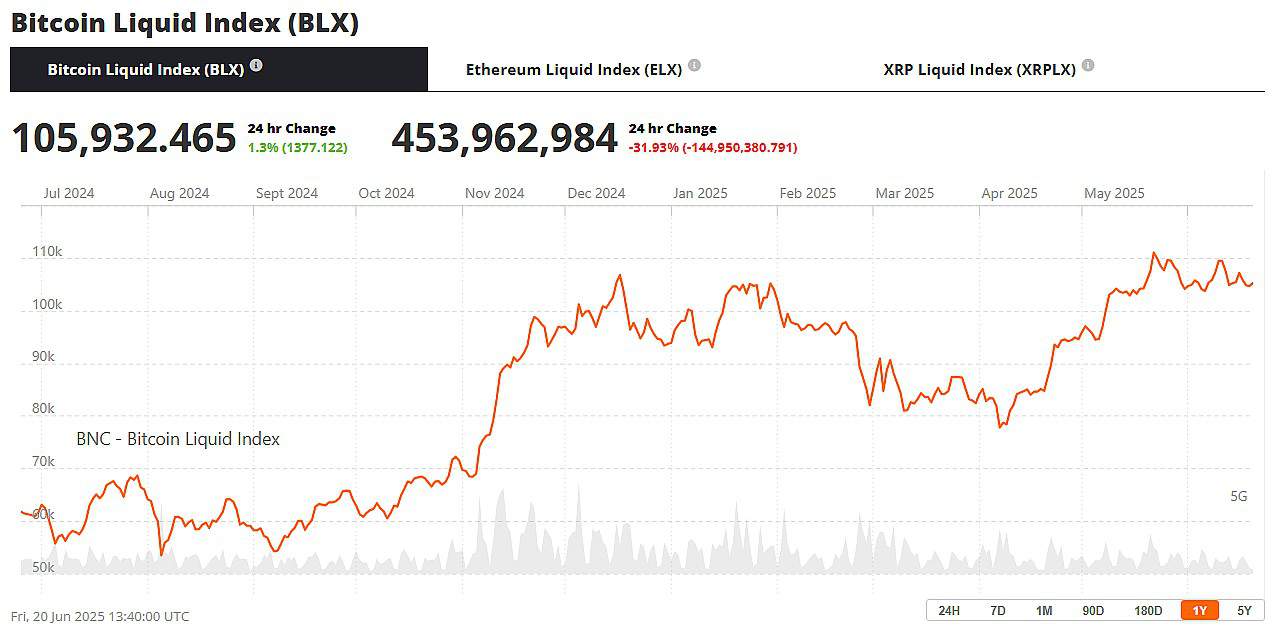

A Bitcoin supply squeeze seems all but inevitable, and yet, the price continues its steady climb. Ah, the mysteries of the market! 🤔

As I delved deeper into the report, I discovered that ancient supply now accounted for more than 17% of Bitcoin’s total issued supply. And it seemed that even the most committed holders – the “diamond hands” – were not immune to market conditions. Since the 2024 U.S. election, ancient supply had declined on a day-to-day basis 10% of the time.

“Even the strongest among us can falter,” I thought to myself. But what did it all mean? Was this a sign of things to come, or just a blip on the radar? 🤔

The report also highlighted the growing influence of corporate Bitcoin treasuries. As of June 8, 2025, 27 public companies held over 800,000 bitcoin. It seemed that the big players were getting in on the action, and ancient supply could potentially reach 30% of total Bitcoin supply by 2035.

I couldn’t help but wonder what the future held for Bitcoin. Would it continue to defy expectations, or would it succumb to the whims of the market? Only time would tell, but one thing was certain – the ancient supply phenomenon was a force to be reckoned with. 💥

The research introduced a new metric called the “ancient supply HODL rate,” which calculated the net flow of bitcoin into the 10-year category after accounting for new issuance. This figure had turned positive for the first time in April last year, marking a potential inflection point for Bitcoin’s long-term supply dynamics.

As I finished reading the report, I couldn’t help but feel a sense of awe at the complexity of it all. The world of cryptocurrency was a mysterious and wondrous place, full of twists and turns. And at the heart of it all was Bitcoin, the enigmatic and elusive cryptocurrency that continued to defy expectations. 🔮

The full research report is available on Fidelity Digital Assets’ website under “Research and Insights.” For those who dare to venture into the unknown… 😏

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-06-20 17:31