-

Despite ETF inflows and SEC’s Ethereum ETF approval, the crypto market faced a downturn.

Traders foresee Bitcoin’s rise even as BTC dropped to $67k.

As a researcher with a background in finance and cryptocurrencies, I’ve been closely monitoring the crypto market and its trends for quite some time now. And based on my analysis of recent events, I believe that despite the SEC’s Ethereum ETF approval and significant inflows into Bitcoin spot ETFs, the overall crypto market has taken a downturn.

On May 23rd, Bitcoin [BTC] ETFs experienced inflows amounting to $107.9 million. However, Bitcoin seems to be exhibiting a downward trend.

Along with Bitcoin, major altcoins were also in the red, signaling a crypto bloodbath.

Analysts foresee Bitcoin’s bullish trend

In spite of intense selling efforts, certain traders believe that Bitcoin’s price is about to experience a substantial surge. Expanding upon the recent price trends in Bitcoin, Mags, a seasoned cryptocurrency trader, shared his insights.

As an experienced crypto investor, I’ve noticed that Jelle, an independent analyst, has brought up a compelling observation. By examining Bitcoin’s past price cycles, he’s identified a pattern that warrants our attention.

As a researcher studying the cryptocurrency market, I’ve observed some striking similarities between Bitcoin’s current trend and its behavior during the 2016-2017 bull run. Once we surpass the all-time high (ATH) of 2021, it’s reasonable to anticipate that there will be no impeding the upward momentum of this digital asset. The prospect of reaching a $100,000 price point may not be far-fetched in such a scenario.

What’s on the price front?

Opposing the common belief that Bitcoin would experience a bull market surge, the cryptocurrency in question saw a 3.71% decrease as of the current report, with its price settling at approximately $67,000.

Although Bitcoin (BTC) has seen a downturn in its price, some positive signs from technical indicators persist. For instance, the RSI (Relative Strength Index) continues to stay above the 50 threshold, which typically suggests that the asset is not oversold and could potentially experience a rebound. Additionally, the MACD (Moving Average Convergence Divergence) line remains positioned above its signal line, indicating that the short-term trend is still bullish. In simpler terms, while BTC’s price might be heading downward, these technical indicators hint at an underlying optimistic outlook for Bitcoin investors.

Bitcoin’s growing investor sentiment

During a recent live conversation between Anthony Pompliano and Jack Mallers, I found myself pondering over Mallers’ perspective on why Wall Street tends to favor Bitcoin over other digital assets.

To which Mallers replied,

As a financial analyst, I believe that Bitcoin offers the most authentic representation of the antithesis to fiat currency. Unlike fiat money, which relies on a central bank and government for issuance and monetary policy, Bitcoin operates independently with a fixed supply and unalterable monetary policy. In essence, if your concern is the potential debasement of fiat currency, then I would suggest expressing this issue through the lens of Bitcoin’s inherent properties.

He even went further and added,

“I think Bitcoin hits 250 to a million in this cycle.”

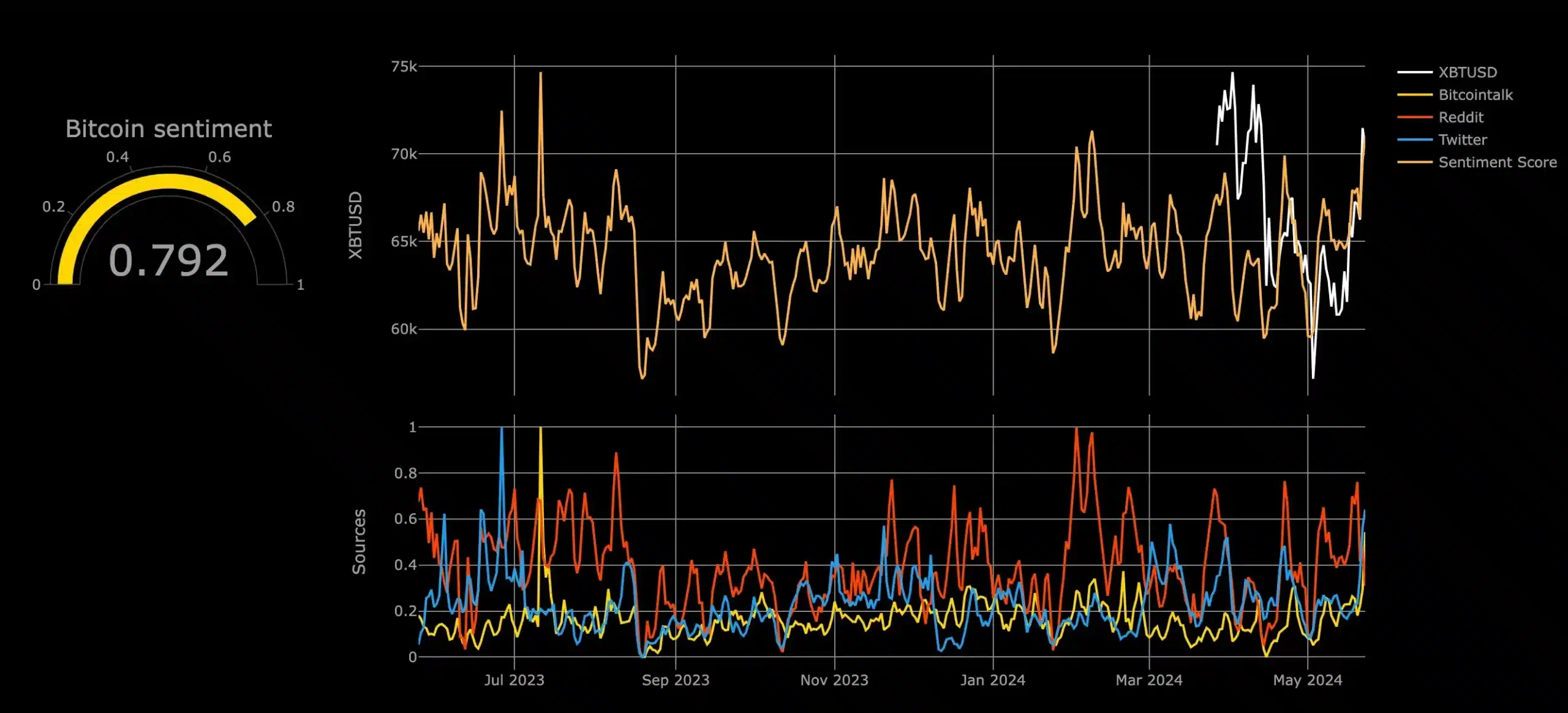

The conversations indicate a potential surge in Bitcoin’s value based on recent trends, as supported by Augmento’s analysis of social media chatter.

Based on my analysis as a crypto investor using Augmento’s sentiment scale, the current Bitcoin sentiment stands at 0.792. This reading suggests a predominantly bullish outlook for Bitcoin, with values closer to one indicating increasingly optimistic market sentiments.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-24 17:12