-

BTC was experiencing a strong downward momentum at press time, as BTC dropped by 2.45%.

An analyst predicted a bearish reversal, based on two momentum indicators.

As a seasoned crypto investor who has weathered numerous market cycles, I must admit that the current downturn in Bitcoin (BTC) is giving me a sense of deja vu. We’ve been here before, and I remember the feeling all too well – the anxiety, the uncertainty, the fear of missing out on potential gains. But as the old saying goes, “the market doesn’t care about your emotions.

2024 saw Bitcoin (BTC), the leading cryptocurrency, exhibit significant price swings. This year, BTC hit an unprecedented peak of $73,794 in March, but unfortunately, it couldn’t sustain that upward trend and dipped to a low of $49,000 later on.

Currently, Bitcoin is being traded at approximately $55,774 following a 2.45% decrease in its daily value. This downtrend has been ongoing for the entire month so far, with a drop of around 2% over the past thirty days.

Consequently, at the current moment, market circumstances have sparked doubts about whether Bitcoin might continue to plummet.

According to the analysis by CryptoQuant’s Yansei Dent, Bitcoin may be showing signs of a potential bear market trend, based on the indicators MVRV (Market Value to Realized Value) and Active Addresses.

Market sentiment

On their recent post (previously from Twitter), the analyst noted the use of moving averages on MVRV and active addresses led to a “death cross” formation. This pattern, which appeared during the downward shift of the 2021 market cycle, was noticed during a bearish trend reversal.

According to my analysis, it seems that the 30-day moving average has dipped beneath the 365-day moving average, signaling a potential decrease in active addresses, which could be a negative indicator for the short term. This reduction in new and active addresses appears to indicate less on-chain activity from my perspective as a crypto investor.

Additionally, our examination revealed that the 50-day moving average was declining, but remained under the 200-day moving average. Yet, should the 50-day moving average drop below the 200-day moving average, this would indicate a potential bearish trend.

Consequently, since the 30-day moving average is below the 365-day moving average (indicating an active downtrend momentum), and if the 50-day and 200-day moving averages seem to be approaching each other, it might hint that the market could experience a brief period of bearishness.

What Bitcoin’s chart indicates

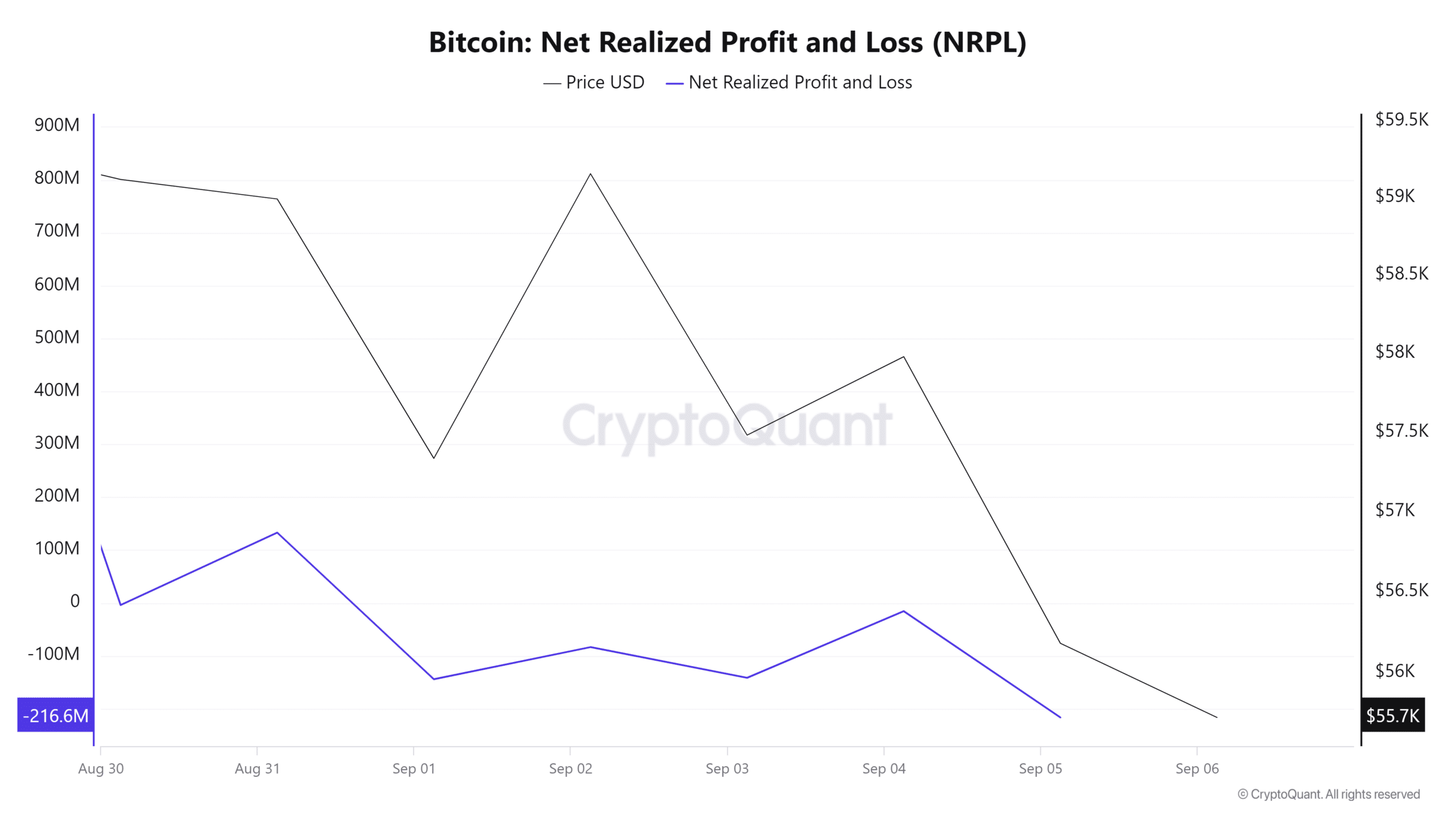

Contributing to the ongoing trend, Bitcoin’s Net Realized Profit/Loss (NRPL) has been in the red for the past week. Typically, a decline in NRPL indicates a bearish market, where investors are selling off their holdings at a loss.

When investors doubt the future value fluctuations of cryptocurrencies, they often decide to offload their holdings to minimize potential losses.

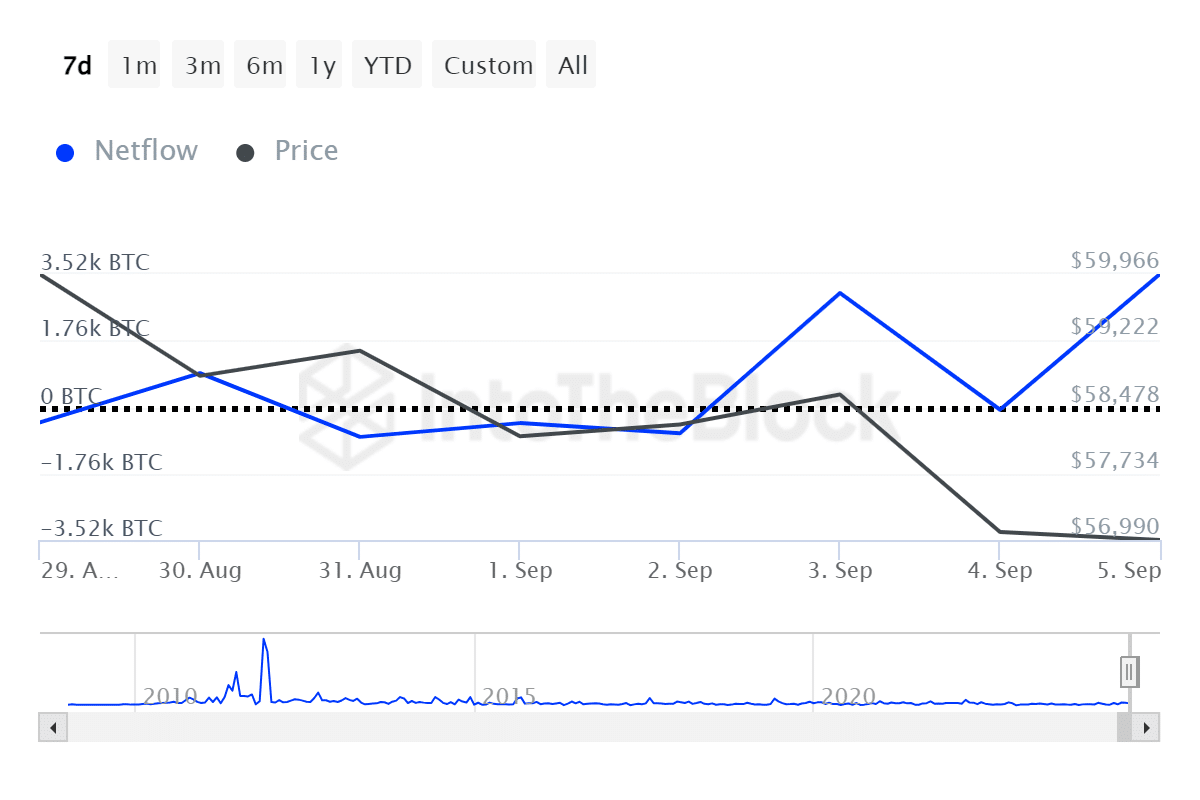

Over the past week, four out of the seven days experienced a significant decrease in large holders buying (or inflow). If these large holders proceed to move their assets to exchanges, it could lead to increased selling pressure.

As an analyst, I’ve observed that such behavior from whales could potentially trigger a decrease in price. This could be indicative of reduced confidence in the future outlook, serving as another bearish indicator. Large-scale investors seem to be preparing for falling prices or cashing out their current profits to minimize potential losses.

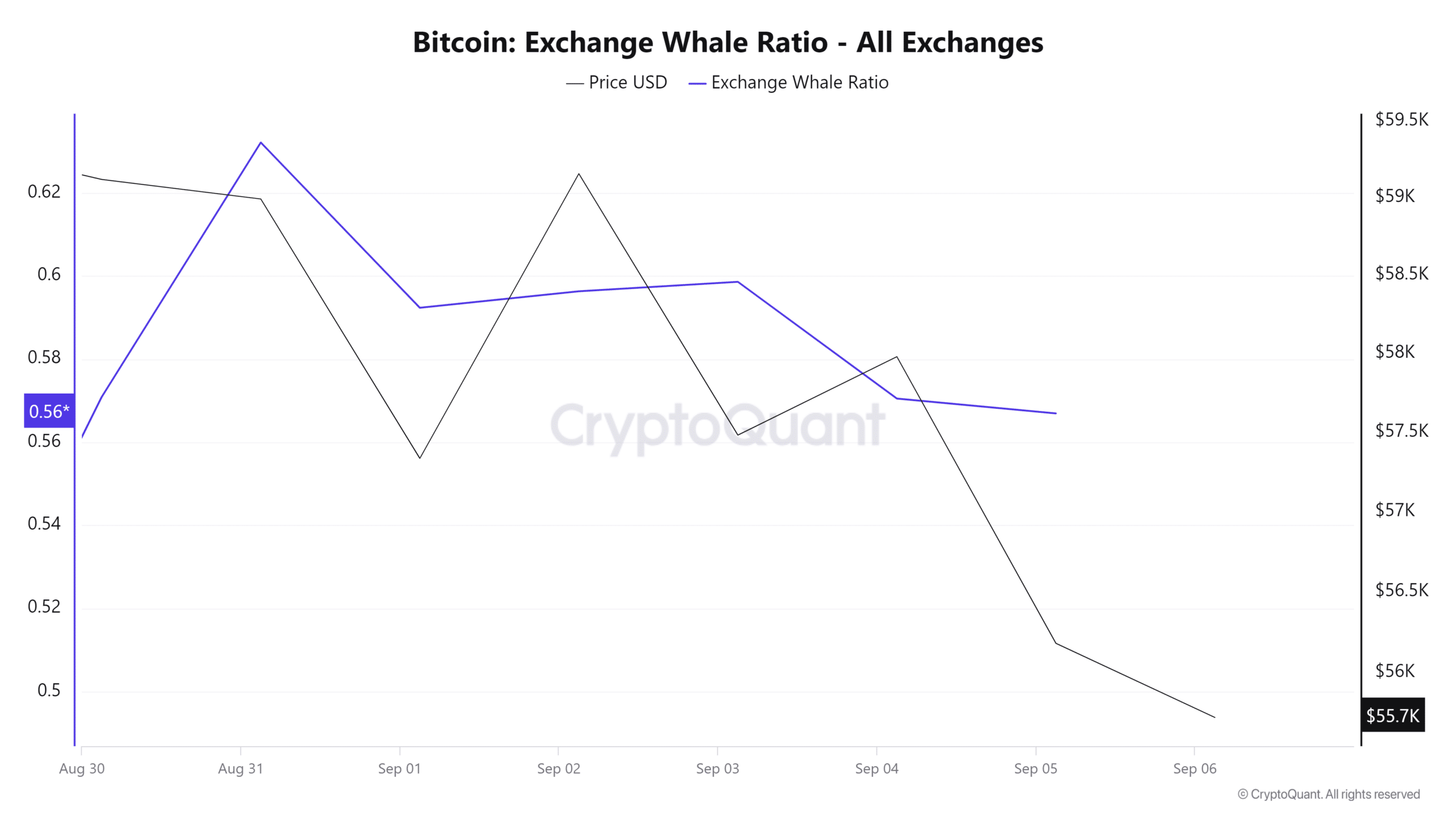

Over the last week, the average proportion of Bitcoin transactions involving large investors (whales) was approximately 50%. This suggests that nearly half of the Bitcoin entering the exchanges originated from these significant investors.

Moving their holdings to trading platforms suggests that whales may be planning to offload their assets, potentially increasing the supply available for purchase and thereby creating selling pressure.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Therefore, as Yonsei Dent posited, the current market conditions showed potential further decline.

As an analyst, based on the current market trends I’m observing, it appears that Bitcoin (BTC) might dip down to around $50,670 if these sentiments continue. To trigger a trend reversal and potentially shift the momentum back in favor of the bulls, they need to successfully defend the $55,000 support level.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

2024-09-06 22:16