- The volume of Bitcoins contributed by miners has dropped since 19 April

- This has fueled the low rate at which new Bitcoins are created and entered into circulation

As an analyst with extensive experience in cryptocurrencies and blockchain technology, I believe that the decline in Bitcoin’s miner contribution to the total volume since the last halving event on 19 April is a significant development. The reduction in miner rewards has led to a decrease in the share of new Bitcoins being added to circulation, resulting in a lower inflation rate of around 1.66%.

As a crypto investor, I’ve noticed that the proportion of Bitcoin’s [BTC] trading volume coming from miners on its network has been gradually decreasing since the last halving event, based on the latest data from IntoTheBlock.

The most recent Bitcoin halving took place on April 19th. With the objective of decreasing the total supply of Bitcoins in circulation, this event reduced the compensation given to miners by half, from 6.25 Bitcoins to 3.125 Bitcoins.

After the halving event, the proportion of the entire Bitcoin trading volume contributed by miners has markedly dropped.

This is likely the result of a lower inflation rate, which currently sits at 1.66%.

— IntoTheBlock (@intotheblock) May 9, 2024

After a Bitcoin network’s halving event, the quantity of coins earned by miners decreases significantly, leading to a substantial drop in their representation of the overall coin supply.

According to IntoTheBlock’s analysis, the decrease in Bitcoin miner rewards has led to a reduction in the number of new Bitcoins entering circulation. The current inflation rate, as indicated by their on-chain data, hovers around 1.66%.

Mining activity on the Bitcoin network

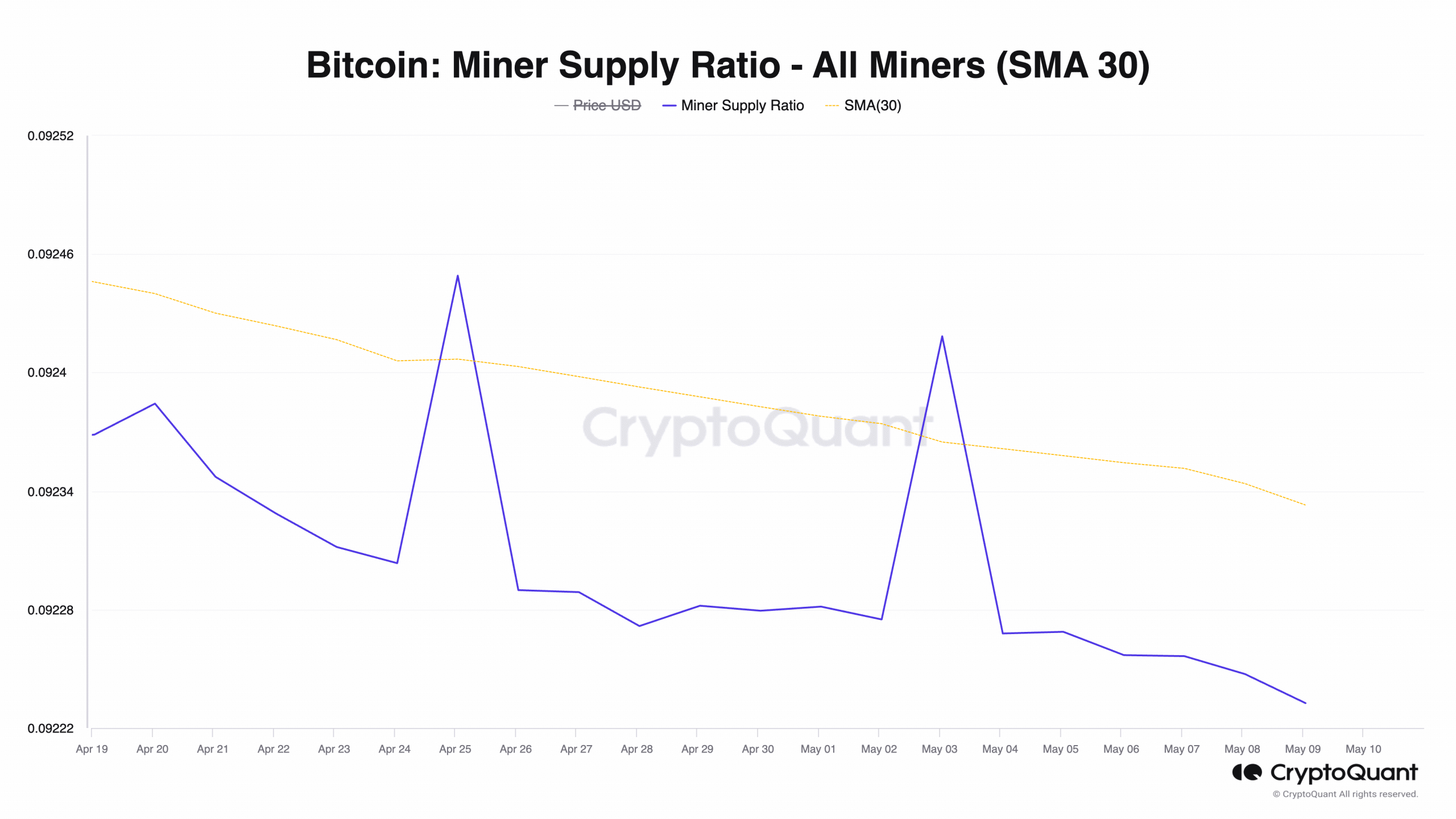

After the halving occasion, the miner supply ratio of Bitcoin, as indicated by CryptoQuant’s data, has experienced a slight decrease. This particular metric signifies the percentage of fresh coins that miners have contributed to Bitcoin’s overall supply.

As a researcher studying Bitcoin’s supply dynamics, I’ve observed that when the rate of new coin creation by miners on the network decreases, it leads to a decline in the proportion of fresh coins being added to the total Bitcoin supply. Currently, this metric stands at 0.09, representing a 0.1% decrease since April 19th.

Since the Bitcoin halving in late April, there’s been a slight decrease in the amount of Bitcoins held by miners. Currently, the miner reserves stand at approximately 1.8 million BTC, marking a 0.11% drop compared to the figure on 19th of April.

As an analyst, I would describe this metric as follows: I examine the quantity of cryptocurrency coins kept in the digital wallets of affiliated miners. The magnitude of this measure signifies the volume of coins that these miners have not yet decided to put up for sale.

Read Bitcoin’s [BTC] Price Prediction 2024-25

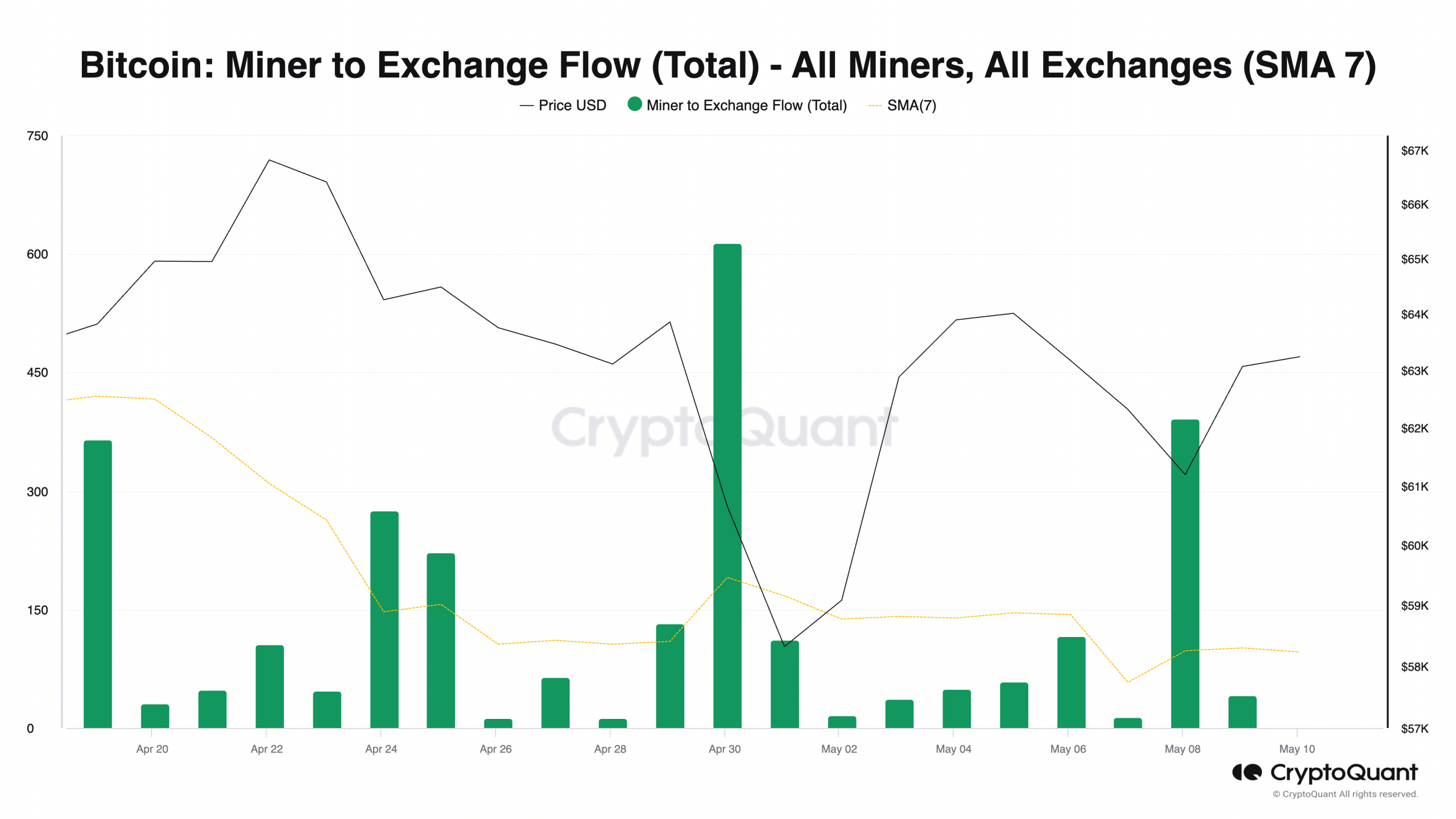

As an analyst, I’ve observed the mining community on the network and noticed that while some miners have indeed chosen to sell a portion of their coin holdings following the halving event in order to realize profits, the overall selling activity has remained relatively subdued.

The decrease in the number of coins moving from miners to exchanges was substantiated by the fact that this metric has dropped by 76% over the past seven days, as calculated using a moving average, since the last halving occasion.

As an analyst, I would interpret the Miner to Exchange Flow metric in the following way: This metric signifies the quantity of Bitcoin (BTC) transferred from miners to cryptocurrency exchanges. A decrease in this flow indicates that miners are offloading fewer coins into these platforms.

As an analyst, I’ve observed a significant decrease in Bitcoin’s Miner to Exchange Flow recently. However, this trend doesn’t indicate a bearish sentiment among the miners on the network. Instead, it suggests that they remain optimistic about the coin’s future price action despite its recent performance.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-11 04:07