-

BTC’s 2024 post-halving rally is yet to start, says Capriole Investments executive.

Market dynamics shifting towards a possible upside later in 2024, per analysts.

As a seasoned researcher and analyst with over a decade of experience in the financial markets, I’ve witnessed many bull and bear cycles in various asset classes, including Bitcoin. Based on my analysis of historical data and current market dynamics, I believe that BTC‘s post-halving rally is yet to start.

Bitcoin has been trading between $60,000 and $71,000 for the past four months without experiencing substantial price increases. Following a remarkable 68% growth in the first quarter of 2024, BTC‘s value has remained relatively stagnant.

I’ve analyzed the data, and it appears that the price took a significant hit, decreasing by 11% following the halving event in Q2 of 2024. To date in Q3, there has only been a partial recovery, with a 6% increase observed.

Post-halving BTC gains still likely?

In the time frame following the Bitcoin halving in April, the cryptocurrency experienced a 9% increase in value overall. Nevertheless, it had not yet exhibited the characteristic parabolic surge that has been observed after previous halving events.

This outlook was according to Charles Edwards, founder of crypto hedge fund Capriole Investments.

‘This Bitcoin cycle hasn’t even started yet’

In contrast to the present modest increase of less than 10%, historical occurrences of Bitcoin’s “halving” have been followed by significant triple-digit price surges post-event.

Based on the chart provided by Capriole Investments, Bitcoin experienced a significant surge of 630% following the 2020 halving event. In contrast, the asset recorded even more impressive gains in the past – it jumped by approximately 1,400% after the 2016 halving and an astounding 5,500% after the 2012 event.

A similar and earnest start of 2024’s parabolic run could start in September, per some analysts.

Actually, according to analysts at Coinbase and JPMorgan, the current surge in Bitcoin’s price beyond $67,000 may not last.

In short, the recent rally might not be the start of the much-awaited post-halving parabolic run.

Whale demand for Bitcoin surge

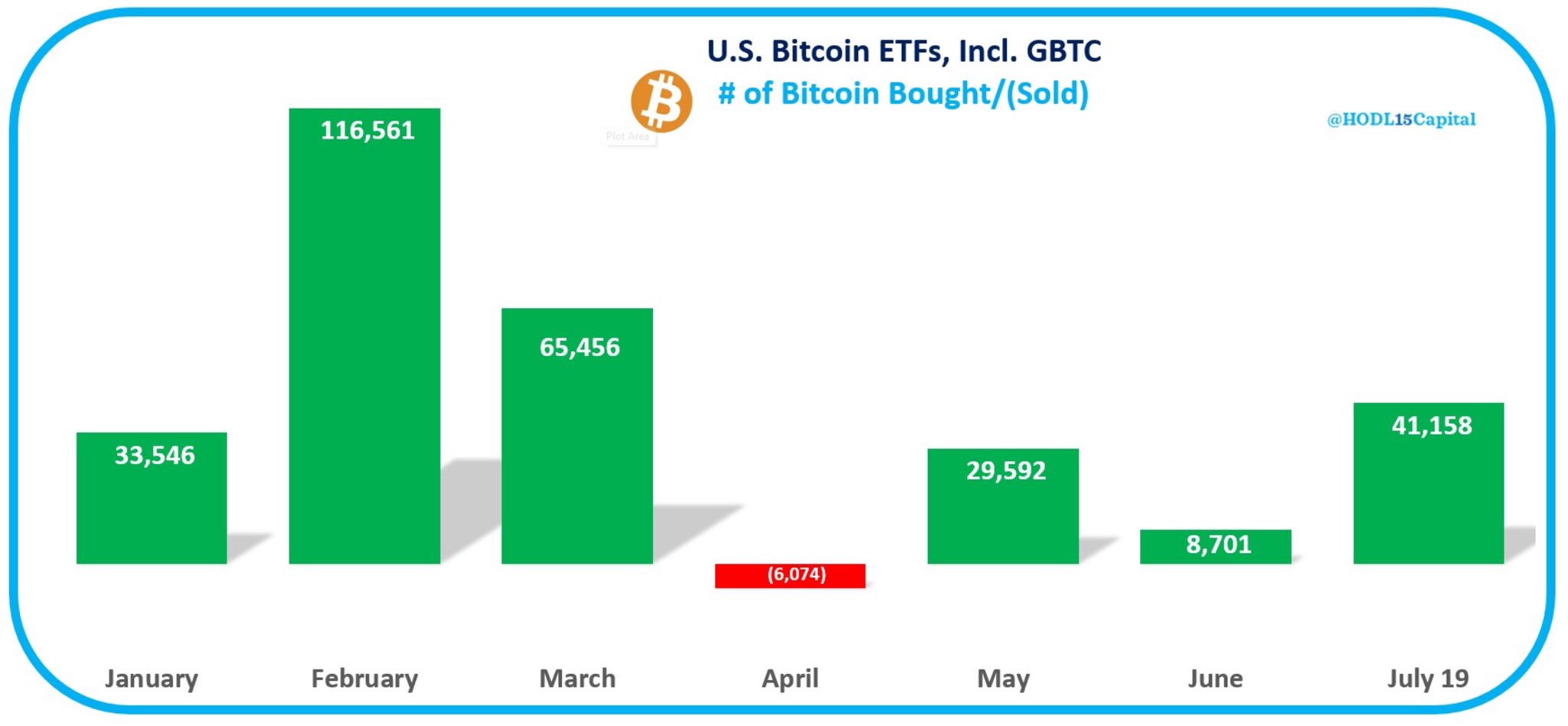

In the past three weeks of July, there has been a significant increase in requests for US Bitcoin spot ETFs. These products have amassed approximately 41,000 BTC during this period. This accumulation wave, spearheaded by BlackRock, has caused year-to-date net flows of Bitcoin ETFs to surpass $17 billion.

Bitcoin’s surge has driven the number of large Bitcoin holders, or “whales,” to their highest point in the past two years. Furthermore, there has been a notable decrease in short positions on Bitcoin in the Chicago Mercantile Exchange (CME).

In response to a decrease in short positions on CME futures contracts for crypto, CryptoQuant’s founder, Ki Young Ju, commented.

The demand for taking both bullish and bearish stances on a particular asset has risen, yet the overall sentiment remains somewhat bearish. This current stance is analogous to the one held approximately ten months ago when Bitcoin’s value was around $27,000.

If the pressure from the Mt. Gox Bitcoin supply is alleviated, we may witness an impressive surge for the digital currency.

If Market Analyst Stockmoney Lizards envisions a bullish market trend, they predict that Bitcoin’s price could reach $90,000 by Fall 2024.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-07-21 19:03