Bitcoin‘s Boom Days Are Over? Here’s the Surprise

Once the darling of internet hype and retail dreamers, Bitcoin (BTC) is apparently growing up — slowly, reluctantly, and perhaps with a touch of snooze. According to on-chain analyst Willy Woo, those wild, head-spinning triple-digit annual returns? Well, they might be a thing of the past. Yes, the glorious days of cryptocurrency rocket rides seem to be settling into what might be politely called a “more mature” phase — which is economist-speak for “possibly boring, but at least less likely to make your hair turn grey.”

Once seen as a rebellious digital punk rock star, Bitcoin now appears to be behaving more like a responsible, middle-aged investment that has finally filed its taxes. Woo suggests that the days when Bitcoin was powered by internet hype and retail fantasies — picture a toddler on a sugar rush — are fading. Instead, it’s now more about the big players stepping in, scrutinizing, and apparently, calming things down.

He cheerfully compares Bitcoin to a “magical unicorn that climbs to infinity on moonbeams,” which is a lovely image unless you’re a unicorn lover who just realized the unicorn might have retired. He points to a chart that shows the heady days of 2017, when Bitcoin’s annual gains hit triple digits, are now just a wistful memory. As Woo notes, those days are well and truly behind us.

People think BTC is like a magical unicorn that climbs to infinity on moonbeams. Here’s the actual CAGR chart. We are well past the 2017 year where we’d see many 100s of percent growth.

Now look at 2020, that was the year BTC got institutionalised, corporations and sovereigns…

— Willy Woo (@woonomic) May 18, 2025

And what happened in 2020? According to Woo, that was the year Bitcoin decided to grow up and let the big boys — corporations and governments — start hoarding. Since then, the annual growth rate has tumbled from a jaw-dropping 100%+ to a more modest 30-40%. Basically, Bitcoin’s growth has slowed like a snail in a marathon, as more and more capital floods into its digital coffers.

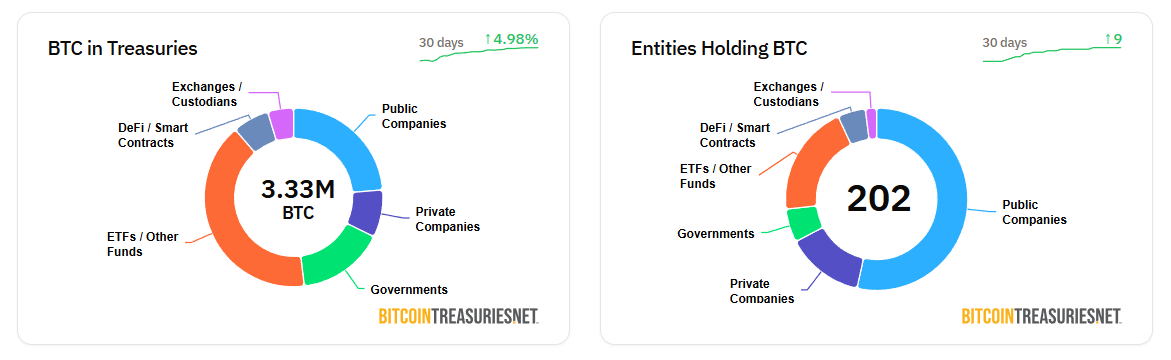

Based on data from Bitcoin Treasuries, nearly 3 million BTC are floating around in the wallets of private companies, public firms, ETFs, and governments — collectively holding a hefty stake. After tossing in an estimated 3.5 million lost coins (poor Satoshi’s lost hardware), about 18.75% of Bitcoin’s circulating supply is essentially out of reach, like a treasure chest buried in a very deep hole.

Woo jestingly suggests that with so much of Bitcoin’s supply now in the hands of big institutions, it’s more like a macro asset — the boring kind that grumbles along with the economy, not a speculation rollercoaster. He predicts Bitcoin will keep absorbing capital until reaching some sort of balance, or as he puts it, “reach its equilibrium.”

Long-term, Woo believes Bitcoin can still grow — but at a more relaxed pace. He estimates a compound annual growth rate of around 8%, which sounds conservative compared to the wild wild west of 2017, but then again, considering long-term monetary expansion averages about 5% and global GDP around 3%, that’s not terrible. Just enough to keep the adrenaline junkies interested, but not enough to send your hair ablaze.

Despite the slowdown, Woo remains surprisingly cheerful about Bitcoin’s future. His advice? “Enjoy the ride,” he says, implying that the next 15 to 20 years could be more about steady growth than rollercoaster chaos. Very few investments out there can boast the same long-term performance — even if Bitcoin’s growth rate is taking a leisurely stroll down the block instead of jumping off the rooftop.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-05-19 14:40