On the morrow of January 31, 2026, Bitcoin awoke with a countenance as somber as a Russian winter, its once-proud market capitalization of $1.65 trillion now a mere shadow of its former glory. Priced at $82,699, it wandered aimlessly within the confines of $81,953 to $84,367, its daily volume a paltry $53.64 billion-a sum that, while ample, lacked the conviction to dispel the bearish gloom. From the charts, it is clear: Bitcoin is a wounded beast, its path to redemption as uncertain as a Tolstoy novel.

Bitcoin Chart Outlook

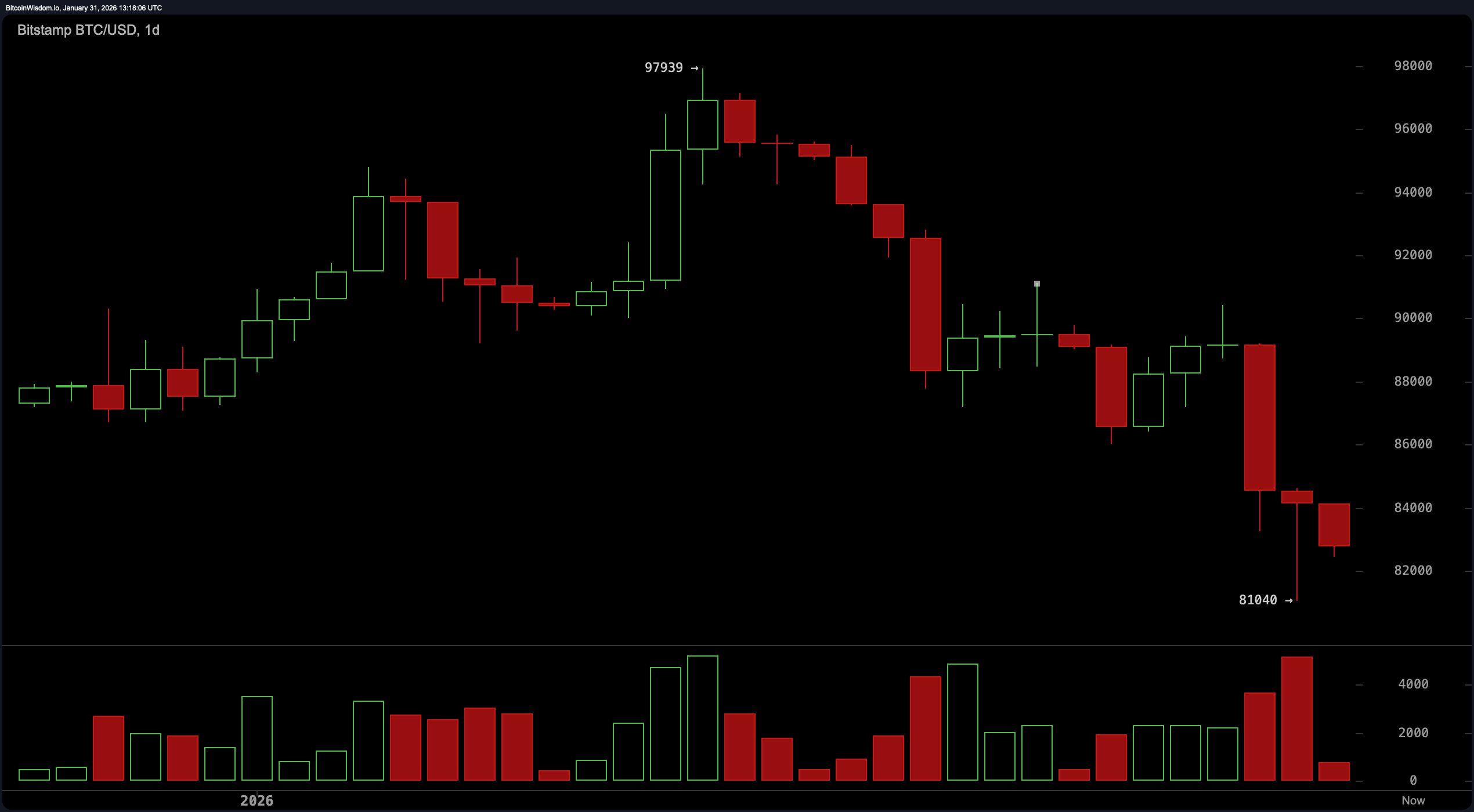

Let us begin with the daily chart, where Bitcoin’s rejection at $97,900 stands as a monument to its hubris, a firm lower high that opened the gates to its current descent. This sharp breakdown, accompanied by rising red volume, suggests not mere profit-taking but a wholesale distribution-a betrayal of trust, if you will.

The wick down to $81,040 marks a line in the sand, a key swing support, yet without a resolute reclaim of the $88,500 to $90,000 range, the broader structure remains in a state of existential limbo. Call it bearish-to-neutral, but do not mistake it for conviction. The bulls, poor souls, have their work cut out for them, and the charts whisper caution, like a disapproving aunt at a family gathering.

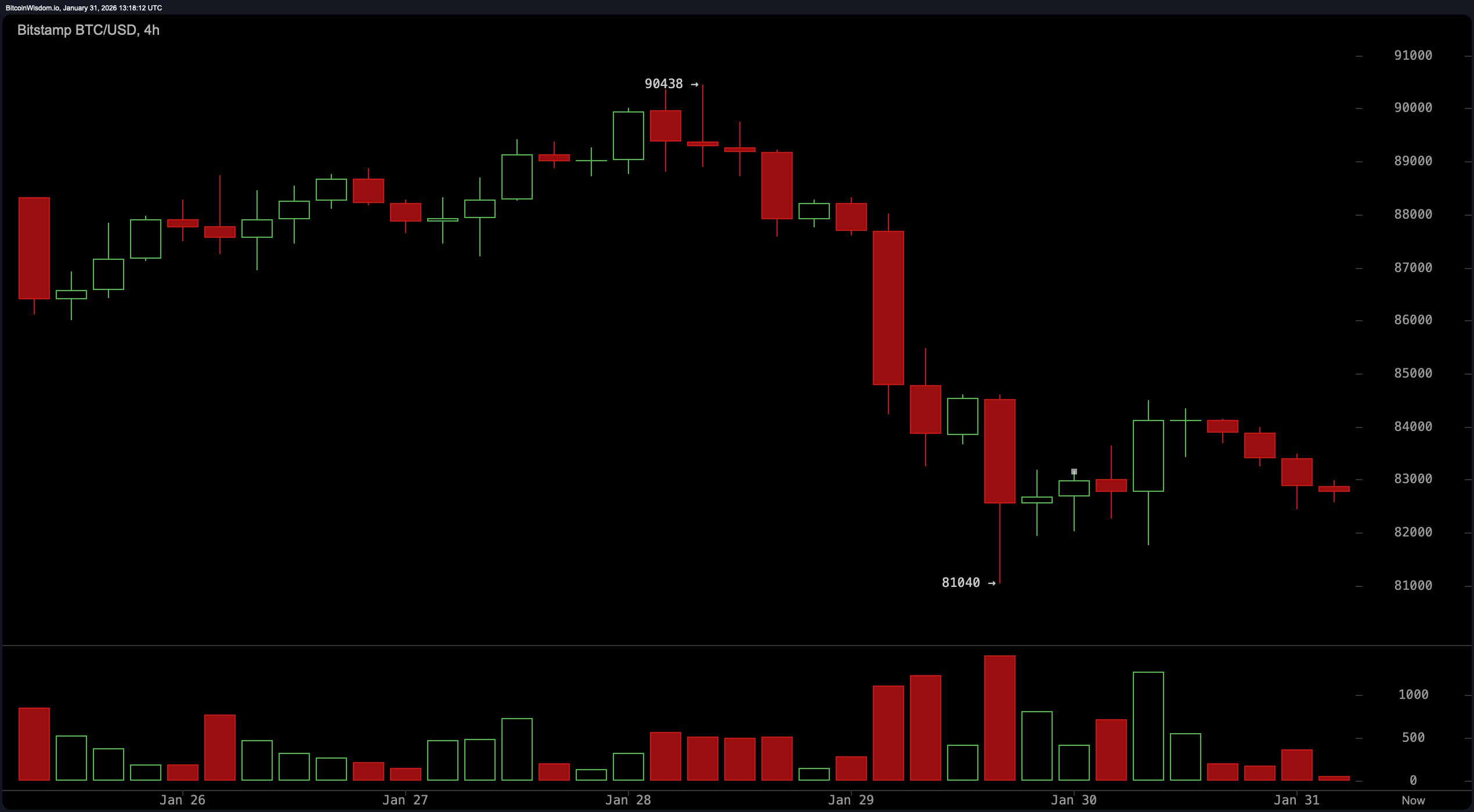

Shift your gaze to the 4-hour chart, and the picture sharpens-into something as grim as a peasant’s life in 19th-century Russia. A textbook pattern of lower highs and lower lows reveals that the sellers remain firmly in control. Attempts to climb above $85,000 were rebuffed with the force of a disapproving matriarch, establishing $84,500-$85,000 as a near-term fortress of supply. Even the bounce off $81,040 lacked vigor-more a whimper than a roar, more corrective than impulsive. With momentum indicators like the MACD skewing negative, the price remains pinned beneath $86,000, a prisoner of its own inertia.

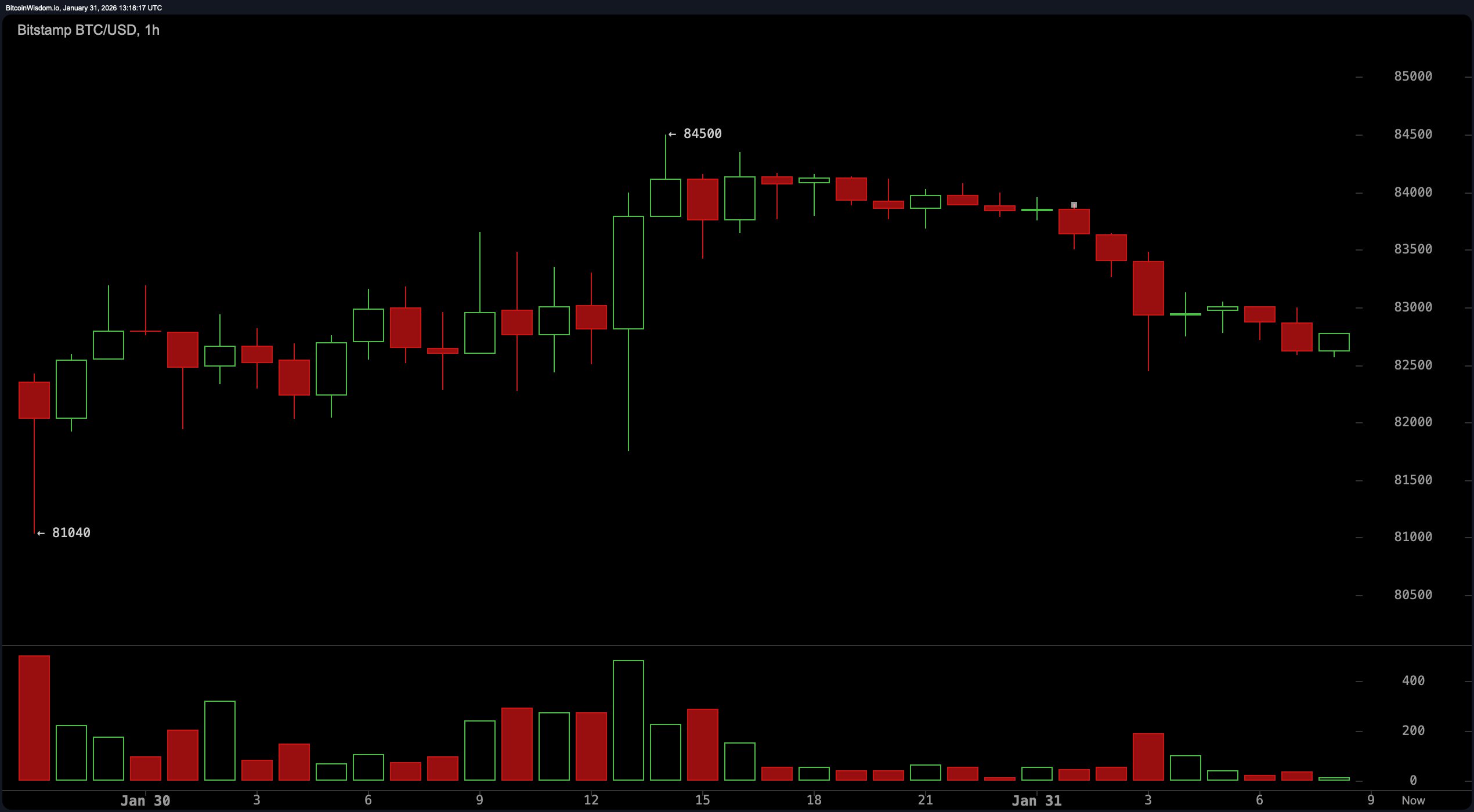

Zoom in on the 1-hour chart, and Bitcoin’s plight becomes a tragicomedy. Price action shows a narrow range capped by descending highs-a signature of absorption, not accumulation. The recent rejection just shy of $84,500, after sweeping prior bounce highs, confirms that sellers are as relentless as a Tolstoy protagonist’s inner turmoil. Weak volume on green candles only reinforces the narrative: the bid side is as feeble as a sickly serf. Current support sits at $82,800, but should it falter, eyes turn inevitably to $81,000-a zone as structurally significant as a plot twist in Anna Karenina.

Indicators, alas, offer no redemption arcs. The RSI lingers at a tepid 31-hovering just above oversold without signaling strength, like a character trapped in a Tolstoy novel. The stochastic oscillator and ADX sit in neutral territory, reflecting a lack of clear trend leadership. The CCI screams “oversold” at -150, while the MACD shows continued bearish momentum at -1,682. Meanwhile, all major moving averages-from the 10-period EMA at $86,881 to the 200-period SMA at $104,173-loom above price like a chorus of disapproving relatives.

The bottom line? Bitcoin is not broken, but it is bruised, its structure tilted toward the bears with no confirmed reversal in sight. For now, the range between $81,000 and $85,000 is a battleground-a field littered with failed rebounds and tentative bounces. Momentum, as ever, rules the day, and right now, it wears no bullish colors. Until volume arrives and levels are reclaimed, the charts remain skeptical, not celebratory.

Bull Verdict:

For the bullish case to gain traction, Bitcoin must reclaim and close above the $88,500-$90,000 resistance range on strong volume. That would break the sequence of lower highs, recover lost structure, and potentially flip momentum indicators toward positive territory. Until then, any upward movement remains a counter-trend rally, not a confirmed reversal.

Bear Verdict:

The trend remains in the bears’ favor, with structure, momentum, and moving averages all leaning south. Rejections at $84,500-$85,000 reinforce short-term resistance, and the inability to hold above $86,000 limits upside potential. So long as price stays trapped below these zones, $81,000 remains vulnerable-and the charts continue to favor downside liquidity.

FAQ ❓

- Where is bitcoin trading now?

Bitcoin is trading around $82,699, fluctuating between $81,953 and $84,367. - What key levels should traders watch?

Support lies near $81,000, with resistance at $84,500 and $88,500. - Is momentum favoring buyers or sellers?

Momentum indicators like MACD currently favor sellers. - What does this mean for global crypto markets?

Ongoing weakness in bitcoin could weigh on broader market sentiment and altcoin performance.

Read More

- Best Controller Settings for ARC Raiders

- ‘Crime 101’ Ending, Explained

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Ashes of Creation Mage Guide for Beginners

- 7 Best Animated Horror TV Shows

- Dan Da Dan Chapter 226 Release Date & Where to Read

2026-01-31 17:27