- Experts like Tom Lee believe Bitcoin will climb higher

- Metrics suggested the market hasn’t bottomed yet in light of the persistent sell-side pressure

As a researcher with experience in analyzing cryptocurrency markets, I believe that while there is optimism among some experts like Tom Lee that Bitcoin will continue to climb higher, the current market conditions suggest that the coin may not have reached its bottom yet. The persistent sell-side pressure and minimal buying activity are evident from various metrics, including Age Consumed data and Network Realized Profit/Loss (NPL) data. Furthermore, an uptick in Bitcoin outflows in April indicates selling pressure in the market. Therefore, while it’s possible that Bitcoin may experience a reversal and resume its bullish cycle, it’s essential to exercise caution and consider these metrics before making any investment decisions.

Over the past few weeks, Bitcoin [BTC] has faced considerable challenges, with its value dipping beneath the pivotal $60,000 mark. Subsequently, after notable adjustments, Bitcoin rebounded and is currently trading at $63,167 as of now.

The significant 6% increase in Bitcoin’s value within a day could indicate a shift in its market trend. This development has brought newfound enthusiasm amongst investors and onlookers.

Is there a buying opportunity amidst volatility?

Despite Bitcoin’s current instability, numerous executives view this situation as an opportune one. In particular, some are seizing the chance to buy. Notably, Tom Lee of Fundstrat expresses this perspective in a recent interview.

It seems to me that the market turbulence in April has deceived us, making this an opportune time for purchasing both Bitcoin and stocks.

He added,

“It doesn’t mean it’s going to turn around today but, I don’t think this is a top.”

As a researcher examining the latest financial trends, I’ve come across an explanation from executives attributing the recent dip to profit-taking, suggesting it as a healthy market correction.

As a researcher, I’ve come across an intriguing observation from another analyst, @el\_crypto\_prof, on the platform previously known as Twitter. They’ve drawn a comparison between the current market trends and a historical one.

As a crypto investor, I’ve noticed that while history may not exactly repeat itself, there are often similar patterns or trends that emerge. In early 2023, Bitcoin ($BTC) has touched a trend line that holds significant importance for me, as it has played a crucial role in shaping the market since the beginning of the year.

Shedding light on Bitcoin’s future outlook he added,

“The thing will be sent higher. It’s only a matter of time, imo.”

Crypto-analyst TechDev chipped in too, with the analyst stating,

“The impulsive structure of the last 1.5 years says 90-100K is next. $BTC”

In simpler terms, most analysts believe that these market conditions represent a brief interruption rather than the finale of the bull market.

What are the metrics hinting at?

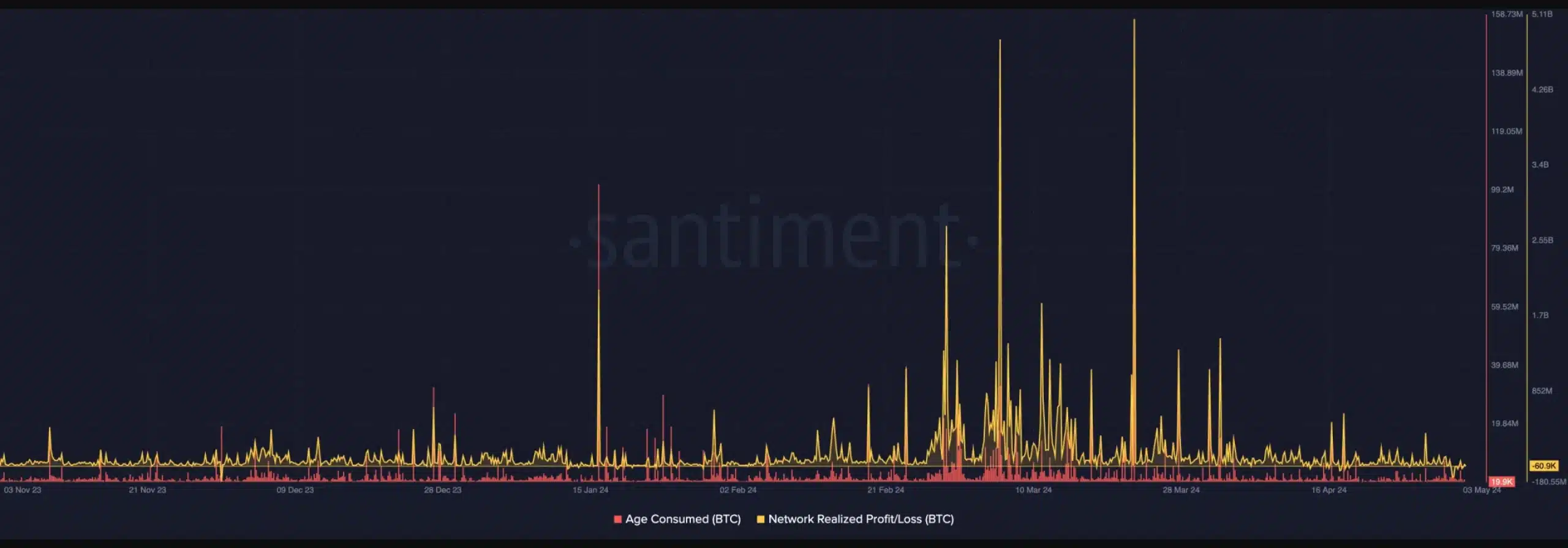

In line with AMBCrypto’s earlier conclusions based on Bitcoin’s Age Consumed data, the recent analysis indicates a lack of significant activity since April 3rd. This observation does not provide any clear signs of a price bottom having been reached.

Furthermore, Bitcoin’s Network Realized Profit/Loss (NPL) figures, indicating the variance between the last transaction price and the present market price, did not indicate a price bottom.

In other words, based on these figures, it appears that Lee and others’ optimistic views might be premature, implying that the market could still be in a downturn.

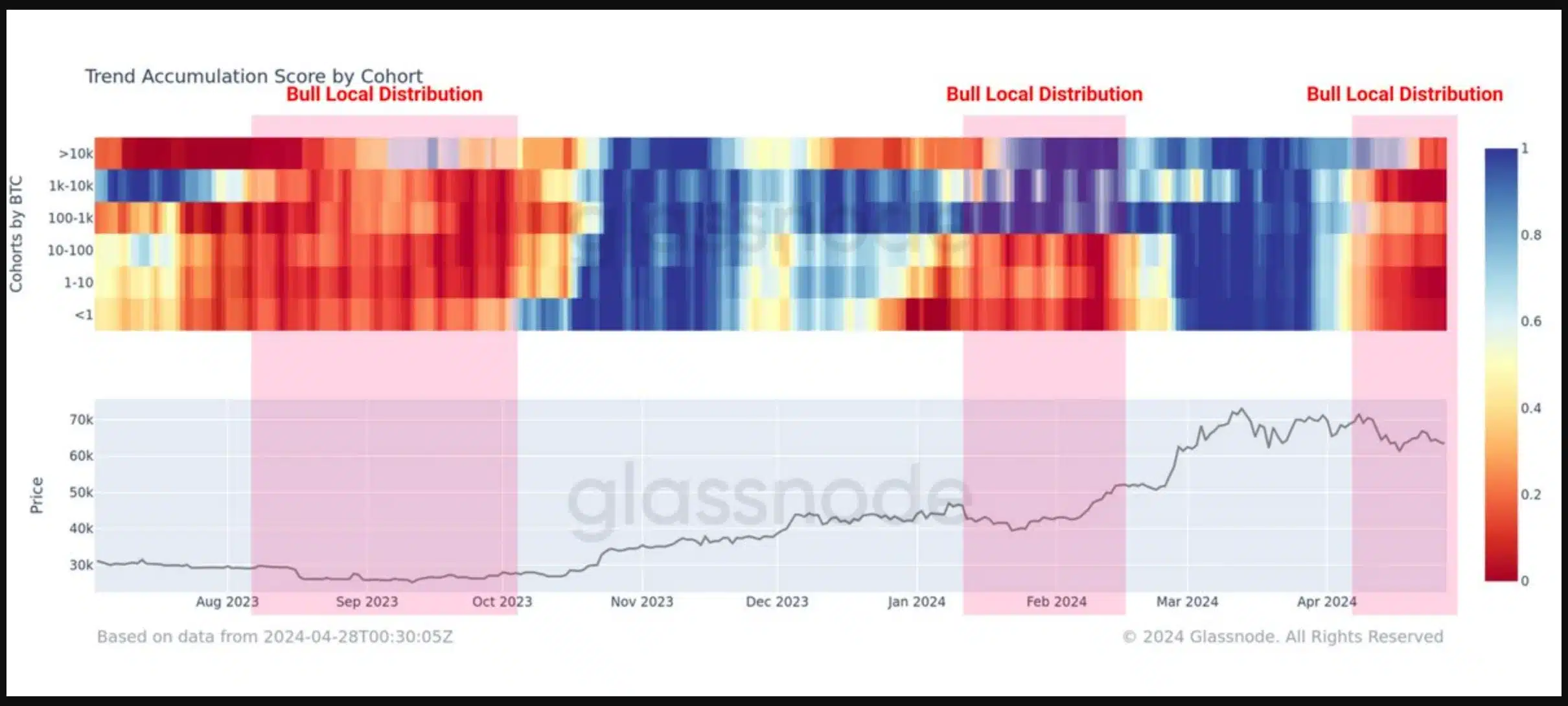

In line with Glassnode’s assessment, there was a noticeable increase in Bitcoin withdrawals during the month of April – Indicating a potential surge in sellers within the cryptocurrency market.

Read More

2024-05-05 07:03