- Low UTXO Age Bands and dominant short liquidations suggest that the price can hike

- Old hands have reverted to accumulating too

As a researcher with extensive experience in analyzing cryptocurrency market trends, I believe that the current state of the Bitcoin market is far from reaching its peak based on several key indicators. The low UTXO age bands and dominant short liquidations suggest that the price can continue to rise. Old hands in the market have also reverted to accumulation, further indicating a bullish trend.

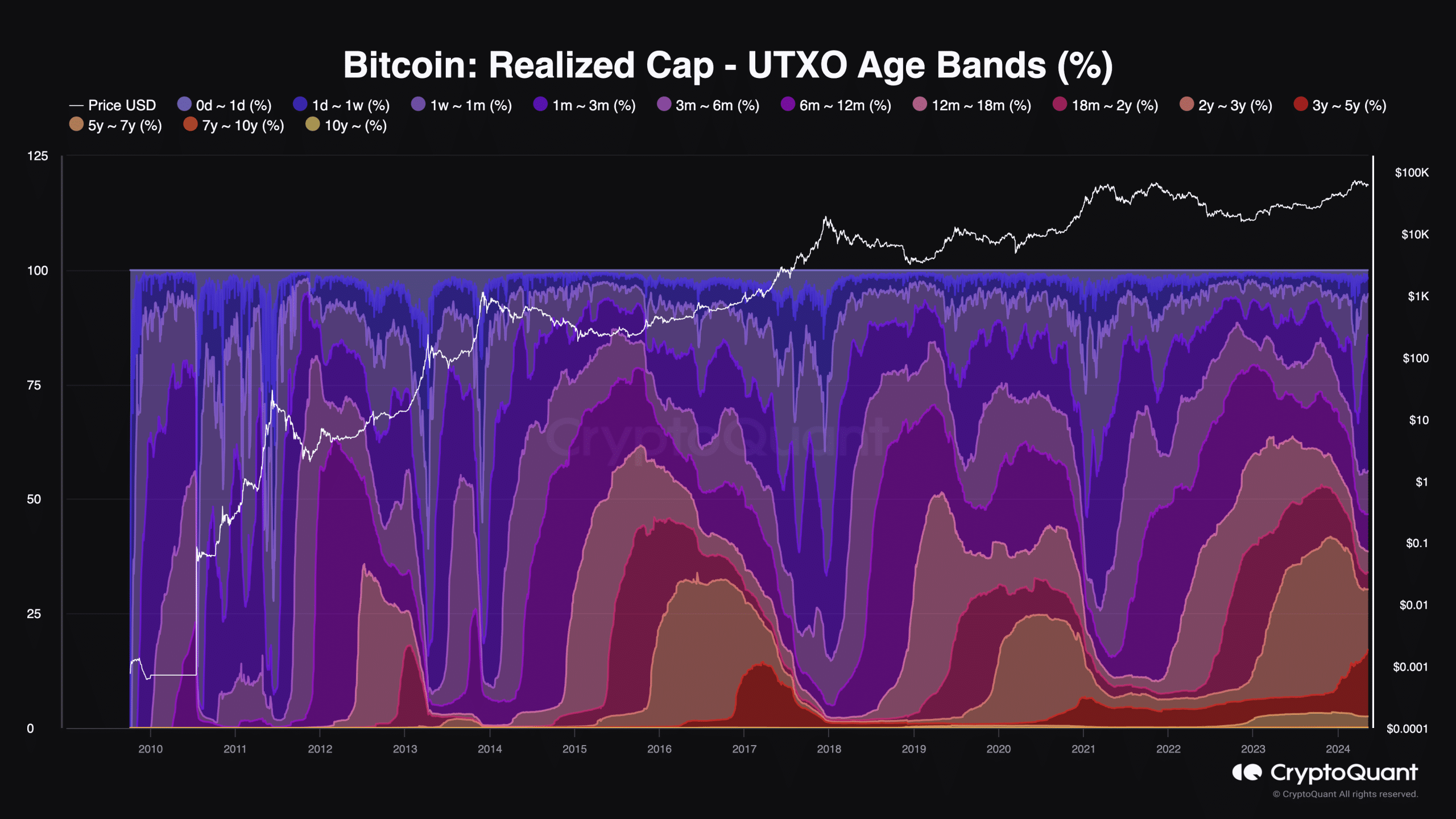

According to the Realized Capitalization model, which takes into account the price at which every Bitcoin was last transacted, the peak of this BTC cycle has not yet been reached. To clarify, this metric measures each unspent transaction output (UTXO) based on its previous spending price and compares it to the current value of the coin.

UTXO, which stands for Unspent Transaction Output, signifies the remaining Bitcoin following a transaction. An analysis by AMBCrypto using CryptoQuant’s data indicated that the UTXO Age Bands hadn’t approached the peak they reached during the 2021 bull market at the current moment in time.

As a crypto investor, I would interpret a significantly elevated level of individual buying activity in the Bitcoin market as an indication of substantial capital inflows into the asset. This trend suggests that Bitcoin is experiencing strong demand from retail investors. However, it’s essential to keep in mind that such intense buying interest might also signal the approaching end of the current bull cycle for Bitcoin.

Is another 80% hike possible?

Despite the fact that the percentage is currently significantly lower than its past maximum, it’s reasonable to infer based on this information that Bitcoin’s price may surpass its previous record high of $73,750.

As an analyst at CryptoQuant, I’ve come to share a perspective similar to many in the industry: Bitcoin has yet to reach its full potential in this current bull market. Based on my observations and research, I estimate that we’ve only seen about 20% of the total price increase for Bitcoin during this cycle.

As an analyst, I would put it this way: “Compared to the peak of the previous bull market, the present influx of short-term funds is remarkably less.”

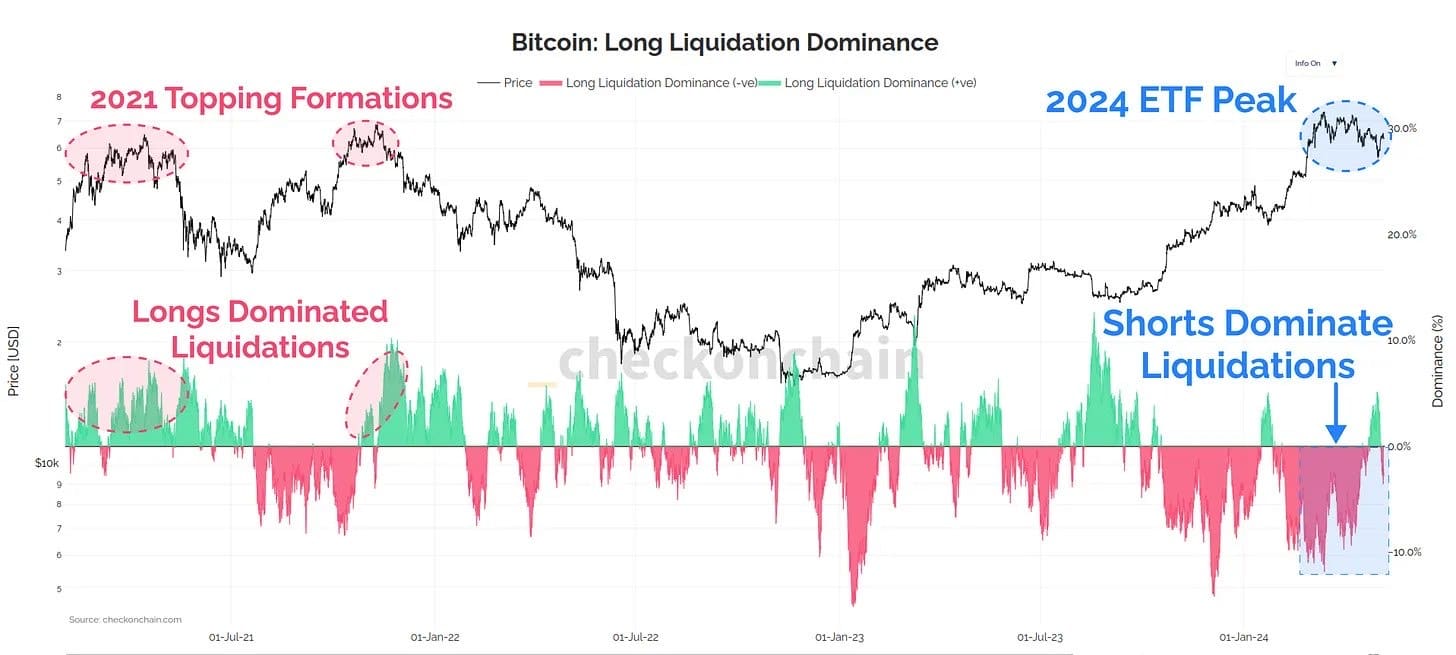

Yet, there were other indications suggesting Bitcoin’s potential for further growth during this cycle. Notably, Checkmate, an anonymous on-chain expert, voiced their perspective on the subject.

Instead of his previous analysis, this time the expert scrutinized the derivatives market’s current situation. Based on the information provided, the 2021 peak was marked by a significant increase in long positions being closed out. In his latest communication, he expressed that.

“Last time, this was actually a signal the market had topped out.”

As a crypto investor, I’d explain that liquidations refer to the forced closing of my positions in the market due to two main reasons. Firstly, when my account balance fails to maintain sufficient margin to keep the trade open. Secondly, if I set a stop loss order and the market price reaches that level, resulting in an automatic closure of the position.

HODLing is the way to go

As a crypto investor, I’ve noticed an interesting trend in the market this year. Long liquidations, which typically occur when positions betting on price increases are wiped out, have been relatively scarce. Contrastingly, short liquidations, triggered by positions betting against price appreciation, have dominated. This imbalance suggests that Bitcoin may have the potential to reach new all-time highs, as the majority of market participants have been betting against significant price hikes.

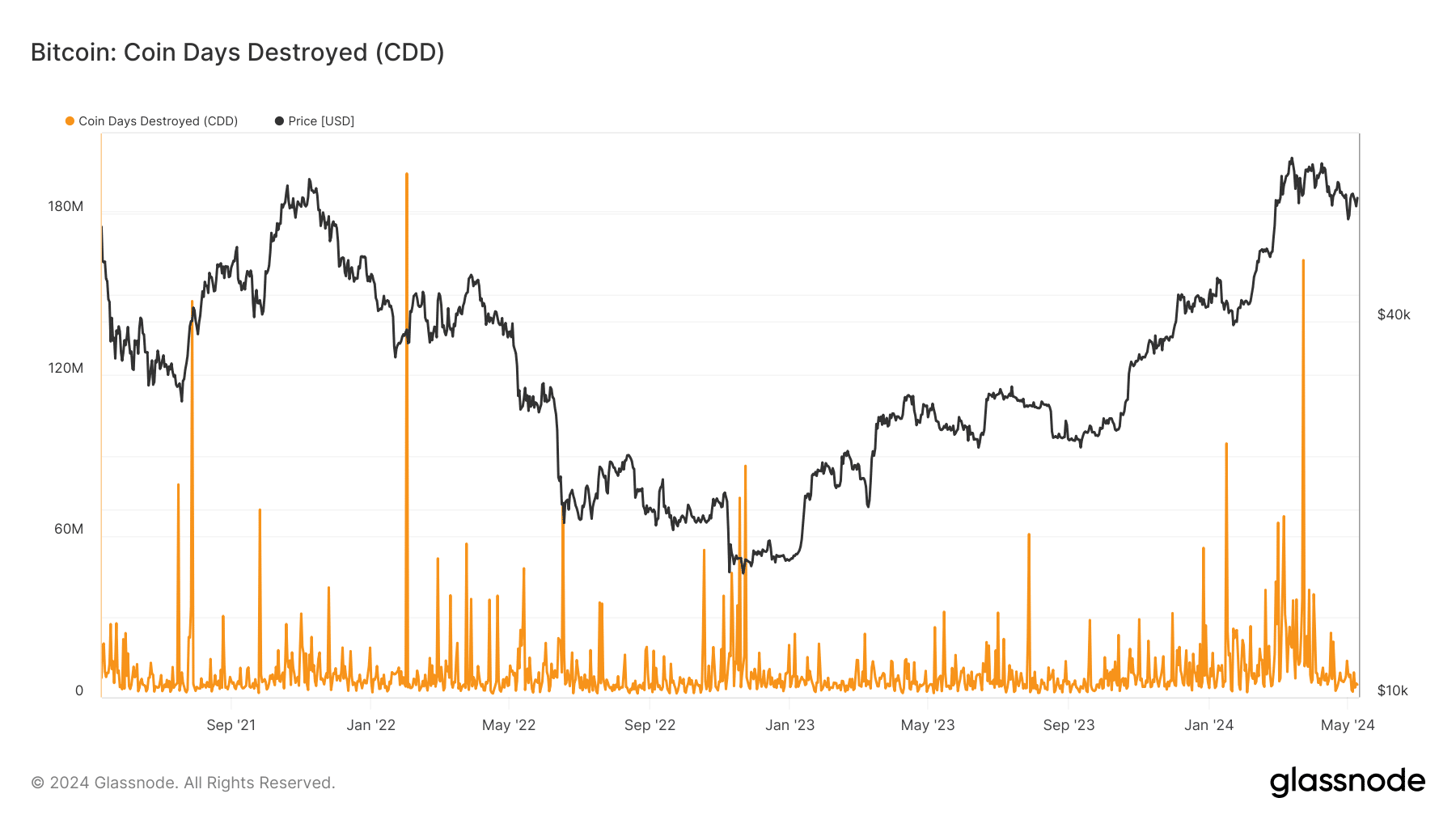

Furthermore, according to AMBCrypto’s analysis, the Coin Days Destroyed (CDD) indicator was taken into consideration. This metric signifies whether cryptocurrency holders are currently spending their coins or continuing to hoard them.

A substantial increase in the Coin Days Destroyed (CDD) metric implies an uptick in spent coins, potentially contributing to a downward trend in Bitcoin’s price. Our examination uncovered that this heightened activity occurred on March 24, subsequently triggering a decline in Bitcoin’s value.

Is your portfolio green? Check the Bitcoin Profit Calculator

Currently, the CDD has reverted back to its level from the year 2020, prior to the significant surge in 2021. With HODLing remaining popular among investors, there is a possibility that Bitcoin may yet experience a substantial rally before reaching the peak of this cycle.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-05-10 21:11