- The influx of institutional demand has likely been one of the major factors that explained why Bitcoin hovered around the previous cycle ATHs.

- Investors need not fear lower timeframe volatility, as metrics support a buy-and-hold strategy.

As a seasoned analyst with over a decade of experience in the ever-evolving crypto market, I find the current Bitcoin [BTC] performance nothing short of remarkable. The resilience shown by BTC amidst various FUD events and its ability to hover around previous ATHs is a testament to its growing institutional demand and overall market maturity.

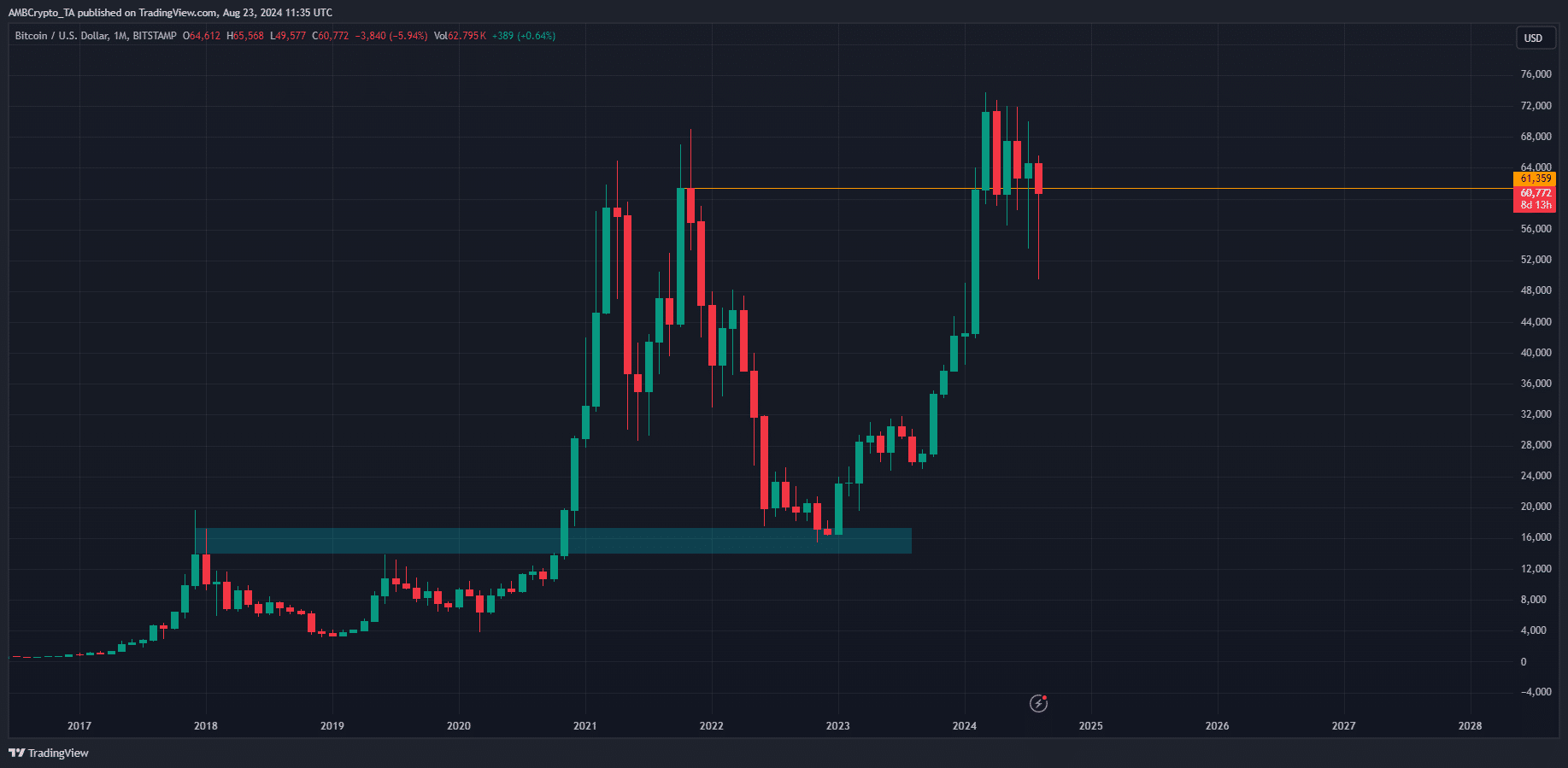

On a weekly basis, Bitcoin [BTC] appeared to be in a descending trend. However, if we look at the monthly chart, it showed an upward movement. Since March, the cryptocurrency has been holding steady within the range of $50,000 to $70,000.

As a crypto investor, I may feel a bit disheartened by the apparent stagnation in the market, but when I zoom out to the higher timeframes, Bitcoin still looks extremely bullish to me.

According to a well-known cryptocurrency expert’s observation, Bitcoin has finished six consecutive monthly trading periods with a closing price higher than its March 2021 monthly close.

As a market analyst, I can attest that despite the occurrence of the halving event and various fear, uncertainty, and doubt (FUD) incidents throughout the market, Bitcoin managed to retain its throne as the leading cryptocurrency.

Unprecedented Bitcoin price performance

Compared to past Bitcoin cycles, previous growth rates were more substantial. However, this current surge possesses an unprecedented quality. In contrast to earlier halving events, during the April 2024 halving, the price soared above the $61k threshold.

During and following the halving event in the most recent cycle (2020), Bitcoin’s price was approximately 60% below its all-time high (ATH). In contrast, during this current cycle, the price has been trading at or very near to its previous cycle’s ATH, only deviating by around 10%.

Despite the short-term fluctuations, I found Bitcoin to be remarkably optimistic for long-term investors like myself.

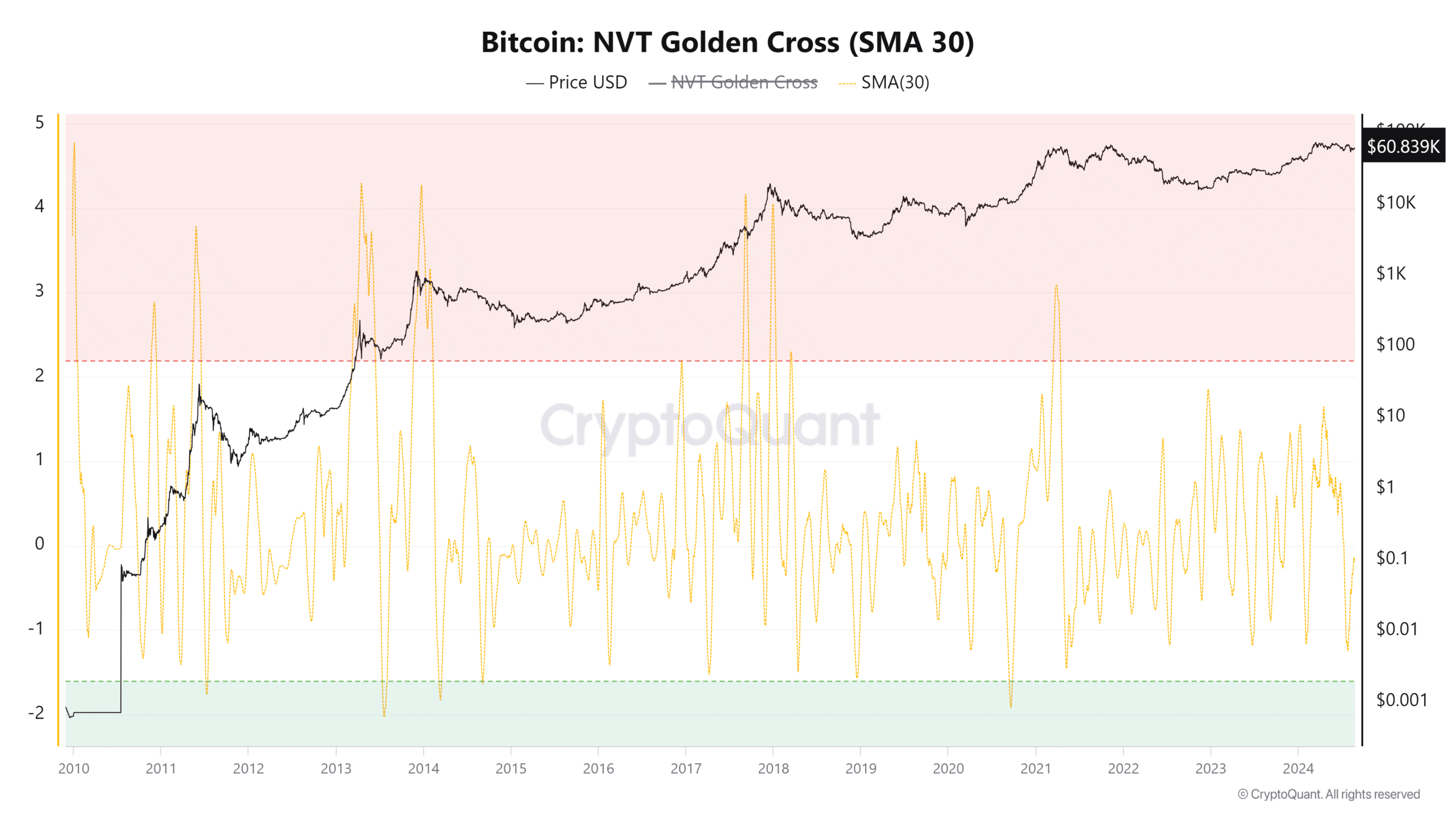

The NVT values encouraged buyers

As an analyst, I have observed that the 30-day simple moving average of the NVT (Network Value to Transactions) golden cross stands at approximately -0.14. Typically, values exceeding 2.2 suggest a cycle top, whereas readings below -1 might indicate a potential bottom. Given this data point, it appears that the Bitcoin bull run may still have some distance to travel.

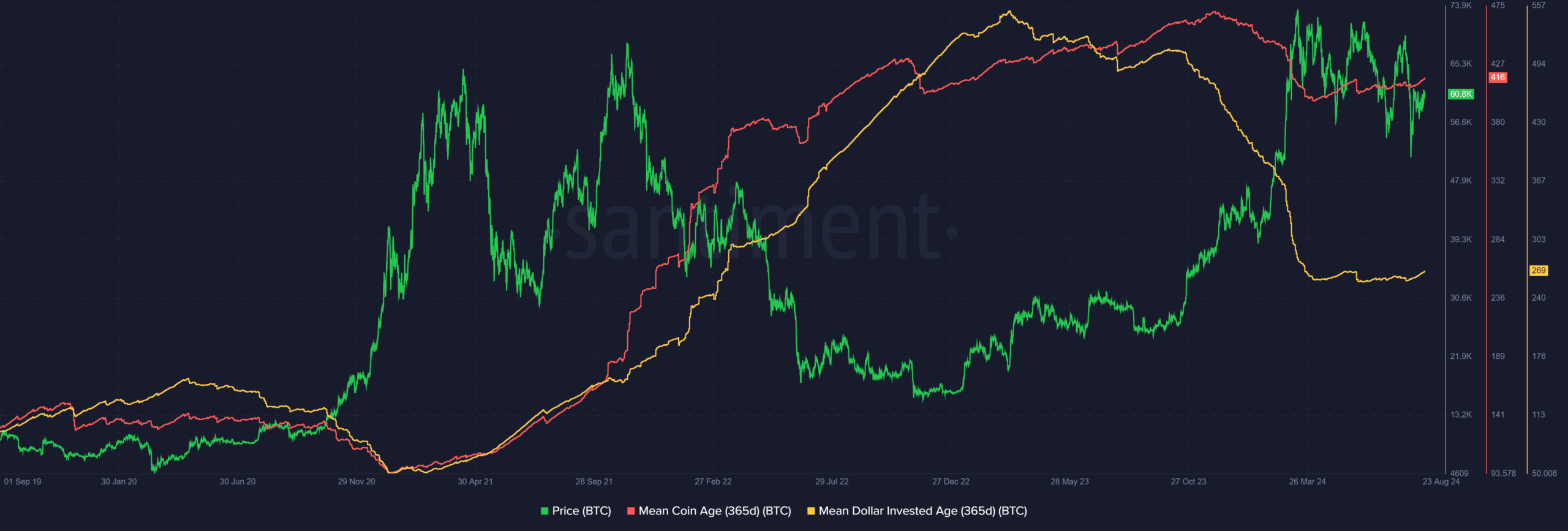

Starting from November 2023, the Average Dollar Investment Age saw a decrease due to rapid price increases. Over the recent period, it has remained fairly stable.

A falling MDIA is a sign of investments flowing back into circulation and of newer investments.

In simpler terms, if the MDIA keeps dropping from its current value of 269, it might reach as low as 51 (previous cycle lows) before we start noticing signs of a potential network slowdown or stagnation, and then possibly resume its uptrend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher examining the data, I noticed that the average age of coins started subtly climbing upward following the significant decline in February and March. This was likely due to the rapid price increases causing investors to cash out and apply selling pressure.

A continuation of this uptrend would denote network-wide accumulation.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-24 04:07