- Bitcoin was down by more than 6% in the last seven days.

- Market indicators were bearish on the coin.

As a seasoned crypto investor with years of experience in the market, I have seen my fair share of bull rallies and corrections. Bitcoin [BTC]’s recent price increase was a welcome sight after weeks of sideways trading, but the sudden bearish indicators have left me cautious.

For the past week, Bitcoin’s [BTC] value has surged significantly, leading to a bull market. Yet, a warning signal from a crucial market indicator suggests that a price adjustment could be imminent.

Let’s have a look at what’s going on with Bitcoin.

Bitcoin’s liquidation is rising

Bitcoins price had a significant surge of over 6% within the past week according to CoinMarketCap’s data. At present, Bitcoin was being exchanged at the price of $67,055.86 and boasted a market capitalization that exceeded one trillion dollars ($1.32T).

While we wait, renowned cryptocurrency analyst Ali made a noteworthy announcement on Twitter. According to his post, approximately $30.33 million in positions will be liquidated if the price of Bitcoin reaches $68,838 again.

In general, an increase in liquidations can indicate that it’s time for price adjustments. So, let’s examine Bitcoin closely to determine if a correction is imminent or if the market remains unobstructed for further growth.

Which way is BTC headed?

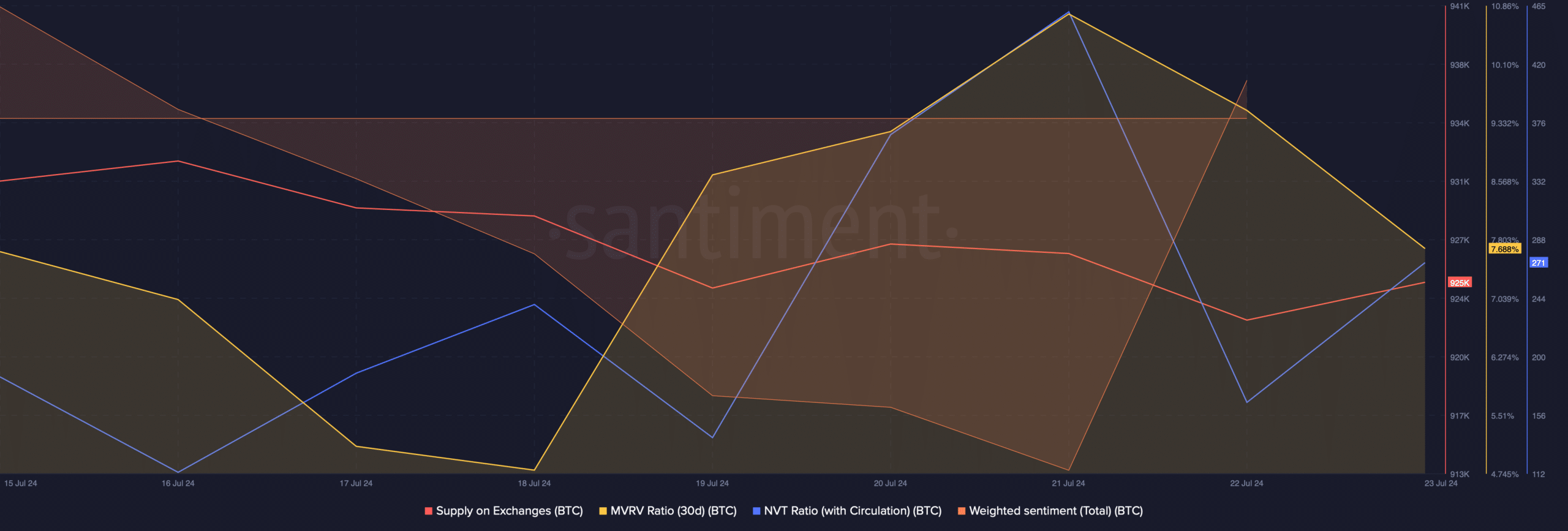

After considering the trends of the leading cryptocurrency according to AMBCrypto, we turned our attention to its key performance indicators for insights. Based on Santiment’s data, Bitcoin’s MVRV ratio showed an increase over the past week, signaling a potential bullish outlook.

Furthermore, the coin’s weighted opinion shifted toward positivity. This signaled a surge in optimistic feelings towards the coin among investors in the marketplace.

Although the other performance indicators showed signs of downturn, for instance, there was a surge in the amount of the asset available on exchanges, which could be interpreted as increased selling activity.

Additionally, the Non-Fungible Token Value (NFTV) ratio of the leading crypto’s king showed an increase. This metric signifies that the asset is overvalued when it goes up. Subsequently, the probability of a price adjustment becomes more significant.

Analysis of BTC’s daily chart

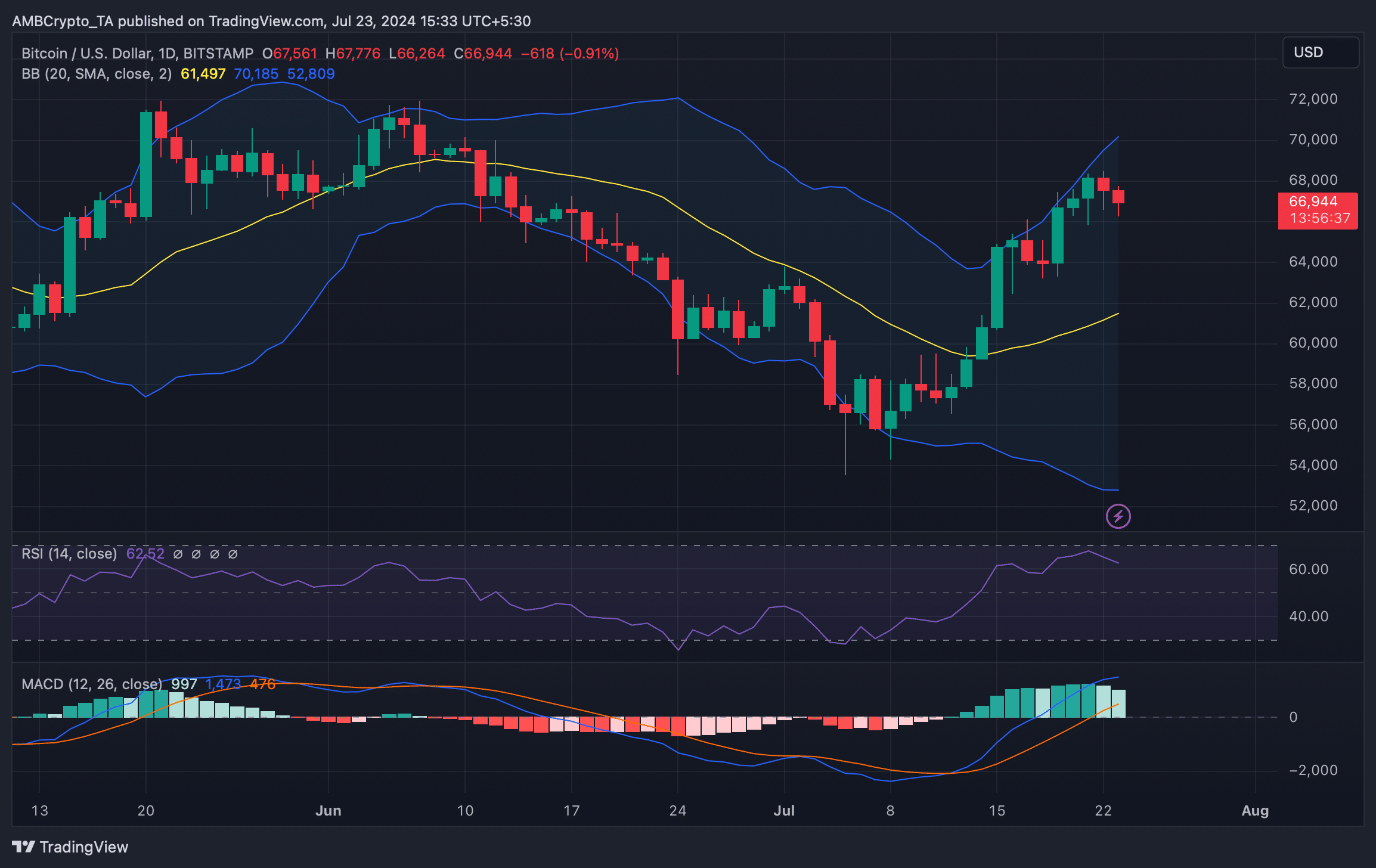

After considering BTC‘s daily price movement through the lens of AMBCrypto, we identified some noteworthy market signals. One such indicator was the touching of BTC’s price against the upper boundary of the Bollinger Bands – a situation known to frequently precede price corrections.

The RSI indicator for Bitcoin took a dip as well, signaling an increased likelihood of a price adjustment based on this and the previous analysis.

Despite this, the MACD technical indicator suggested a bullish trend in the market, implying potential price growth in the near future.

Read More

2024-07-24 00:07