-

BTC bulls are targeting $64K, eyeing $68K as the next resistance level.

Can they overcome four days of failed attempts to push BTC above this key target?

As a seasoned analyst with over two decades of market observation under my belt, I find myself intrigued by Bitcoin’s current standoff at the $64K mark. The parallels to the August rally are undeniable, yet the volatility and inconsistency in this cycle have kept me on my toes.

Bitcoin enthusiasts aim for the $64,000 milestone, an important threshold previously touched during the late-August surge. Hitting this level could be a pivotal moment in its trajectory.

As a crypto investor, I’m mindful of history and keen on preventing similar downturns. Therefore, it’s crucial for us ‘bulls’ to effectively combat any bearish forces that may arise. If we manage this successfully, the next potential resistance level could solidify around $68K.

Bitcoin: Bull run hinges on $64K

Source : Coinalyze

Presently, Bitcoin’s trajectory appears similar to the pattern seen in early August, as it has climbed up to approximately $64K following a dip below $55K. Yet, unlike the previous 18-day uptrend, which was characterized by fluctuating bearish tension, the current surge seems less volatile.

Instead, although this pattern displays a greater number of green candlesticks for consistency, its growth pace is not as stable, leading to fluctuations that worry investors.

Due to ongoing market turbulence, rather than interest rate reductions fueling optimistic expectations, Bitcoin has failed to reach the $64,000 level again, currently standing at $63,543 for the fourth consecutive day beneath that threshold.

Furthermore, the benchmark has undergone testing on five separate occasions since March, coinciding with Bitcoin’s all-time high (ATH) at $73K. Interestingly, it wasn’t until July that the bulls successfully thwarted a decline, propelling Bitcoin to $68K.

Simply put, the $64K mark has been a crucial turning point for Bitcoin.

Although volume indicators suggest a rising market (bullish trend), it remains uncertain if other investors will support a price surge, or if bears will continue to hinder Bitcoin’s upward momentum.

Current price may be out of reach

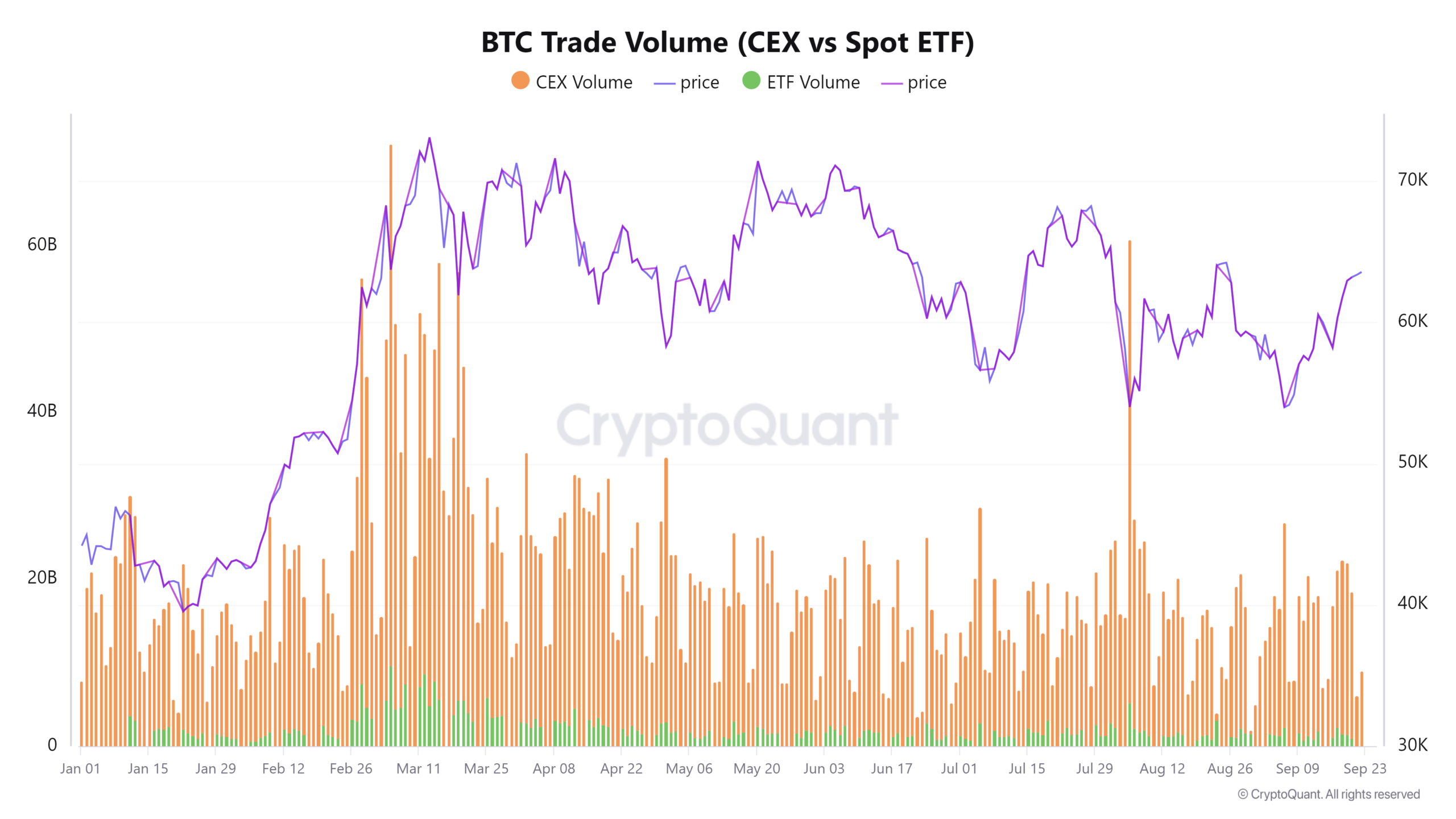

For the last two days, the trading volume of Bitcoin on cryptocurrency exchanges has significantly decreased from $17 billion to $6 billion. This steep decline might intensify price fluctuations, causing apprehension among investors about a possible change in trend direction.

The graph could signal a possible market peak, which is typically associated with lessened trading on centralized exchanges.

In contrast, when the trading volume increases significantly as Bitcoin (BTC) experiences a steep drop, it often signifies a good chance for purchasing at a discount, or a favorable dip-buying moment.

Source : CryptoQuant

According to AMBCrypto, a decrease in trading activity could point towards one of two scenarios: either investors are taking profits from their Bitcoin investments following the September cycle, or they are holding off and anticipating a price drop to purchase BTC at a more affordable rate.

If this trend continues, it might well pave the way for an increase in betting against Bitcoin. This, in turn, could potentially prevent a price surge from happening. But remember, these are predictions and the situation could change unexpectedly.

There might still be hope

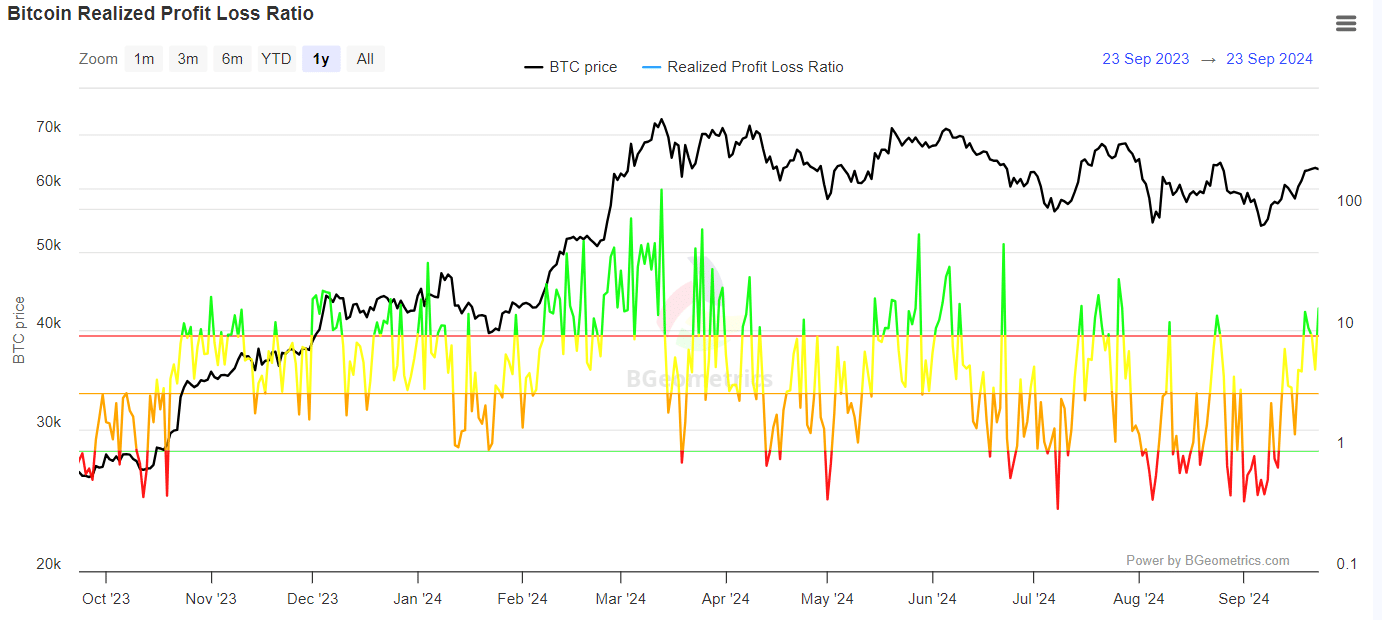

With the most unpredictable month wrapping up, the possibility of an “Uptober” might indicate a shift towards bullish trends in the market, a hint of optimism clearly depicted in the graph that follows.

On the day Bitcoin suffered a slight 0.37% decrease, the Ratio of Purchase to Last Sale (RPL) dipped, suggesting losses. Nevertheless, most subsequent transactions have been executed at prices above the initial purchase cost.

Source : BGeometrics

Adding to this analysis, large transaction volumes have surged, with transactions exceeding $100K seeing significant activity.

It’s evident that bulls are attempting to break through the resistance keeping Bitcoin under the $64K threshold. Right now, the decrease in Centralized Exchange (CEX) trading volume is amplifying the influence of short positions, serving as an obstacle.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If the market settles down, showing that sellers are making profits, fear of missing out (FOMO) might encourage a more prolonged investment.

In the end, it’s essential to keep an eye on trading volumes at Centralized Exchanges (CEX) together with market speculation. If their influence isn’t controlled, they could potentially drive Bitcoin’s price down below $60K.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-25 00:08