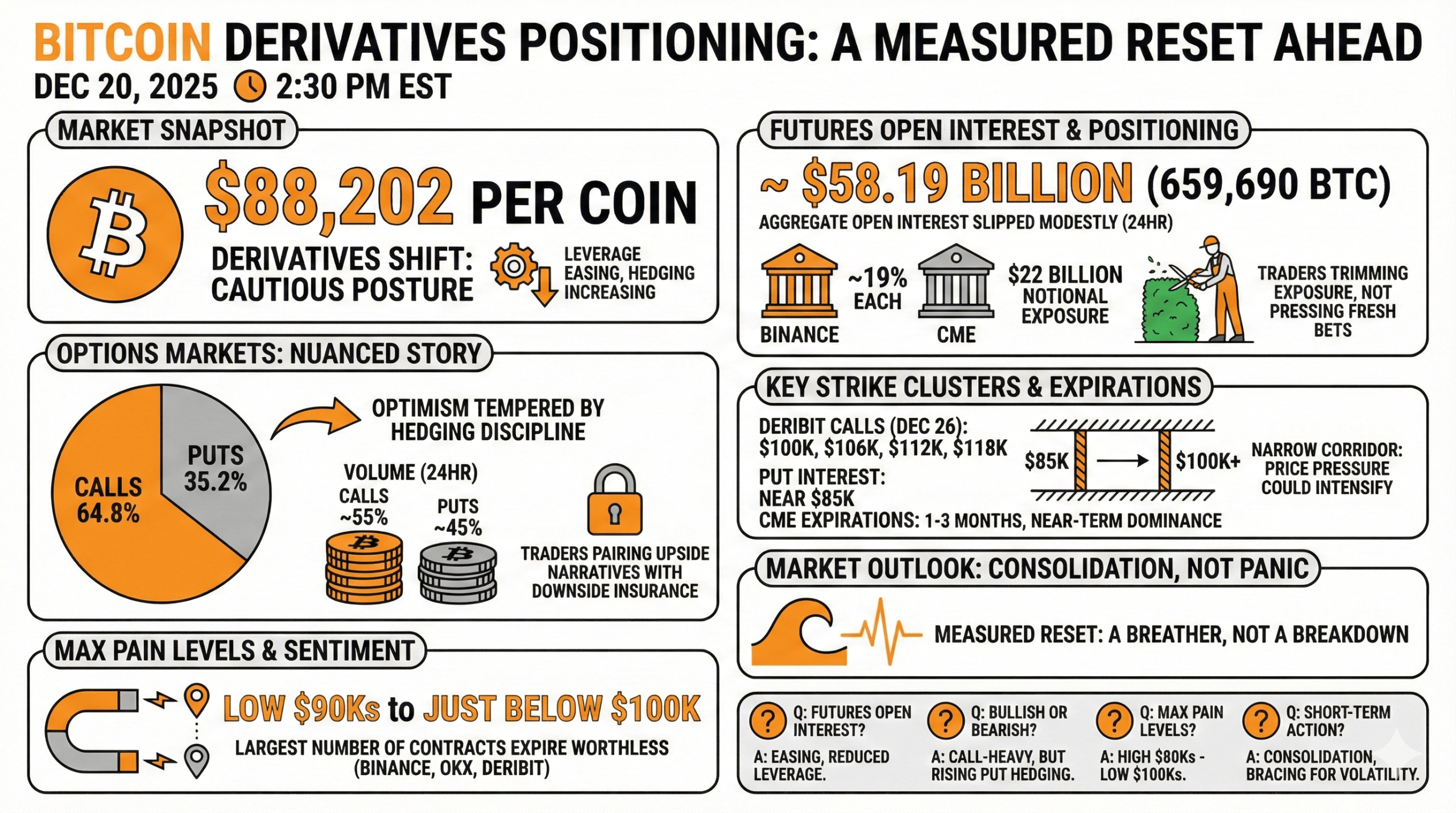

Bitcoin was hanging out at $88,202 per coin at 2:30 p.m. EST on Dec. 20, basically doing its best impression of a Zen master while derivatives markets were like, “Uh-oh, maybe we should tone it down a notch.” After the Dec. 19 options expiry, everyone suddenly remembered they had a safety net. Futures leverage? Eased. Options positioning? Thicker than a rom-com plot. Traders? More into protection than a high school prom night. 🕶️💼

BTC Derivatives: Hedging Like It’s Hot 🌡️

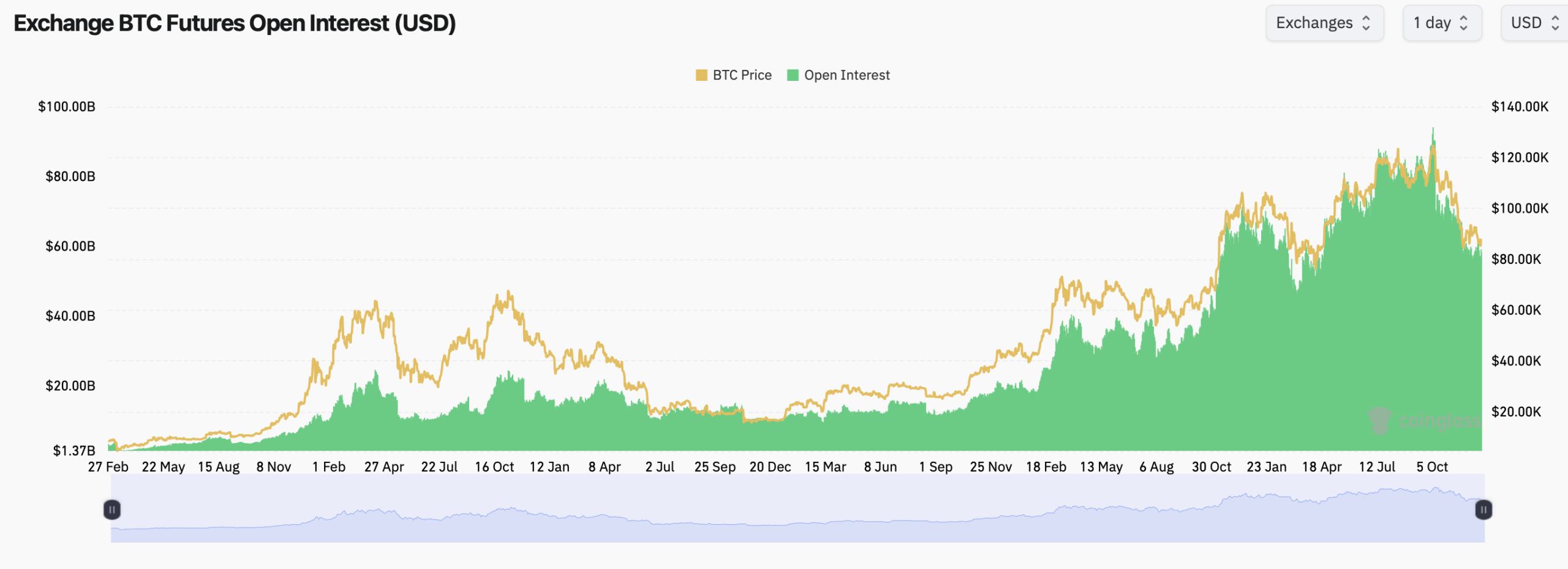

According to coinglass.com, Bitcoin (BTC) futures open interest (OI) is chilling at $58.19 billion, which is like 659,690 BTC in outstanding contracts. Sure, it’s still high by historical standards, but it’s slipped a smidge in the last 24 hours. Traders are basically Marie Kondo-ing their portfolios: “Does this leverage spark joy?” No? Buh-bye. 🧹✨

The futures leaderboard is a tight race, with Binance and CME neck and neck, each holding about 19% of total Bitcoin futures OI. Binance is slightly ahead with 123,780 BTC in open positions, while CME is right behind at 123,040 BTC. Together, they’re the LeBron and Steph Curry of leveraged Bitcoin trading. 🏀💰

Meanwhile, Bybit, MEXC, and Gate are like the supporting cast, while OKX had a mini glow-up in short-term open interest. But poor BingX? They’re having a moment, with sharp drawdowns in OI across every time frame. Someone get them a deleveraging intervention, stat. 🚨💔

Options Markets: Bullish, But With a Side of Anxiety 🦬😬

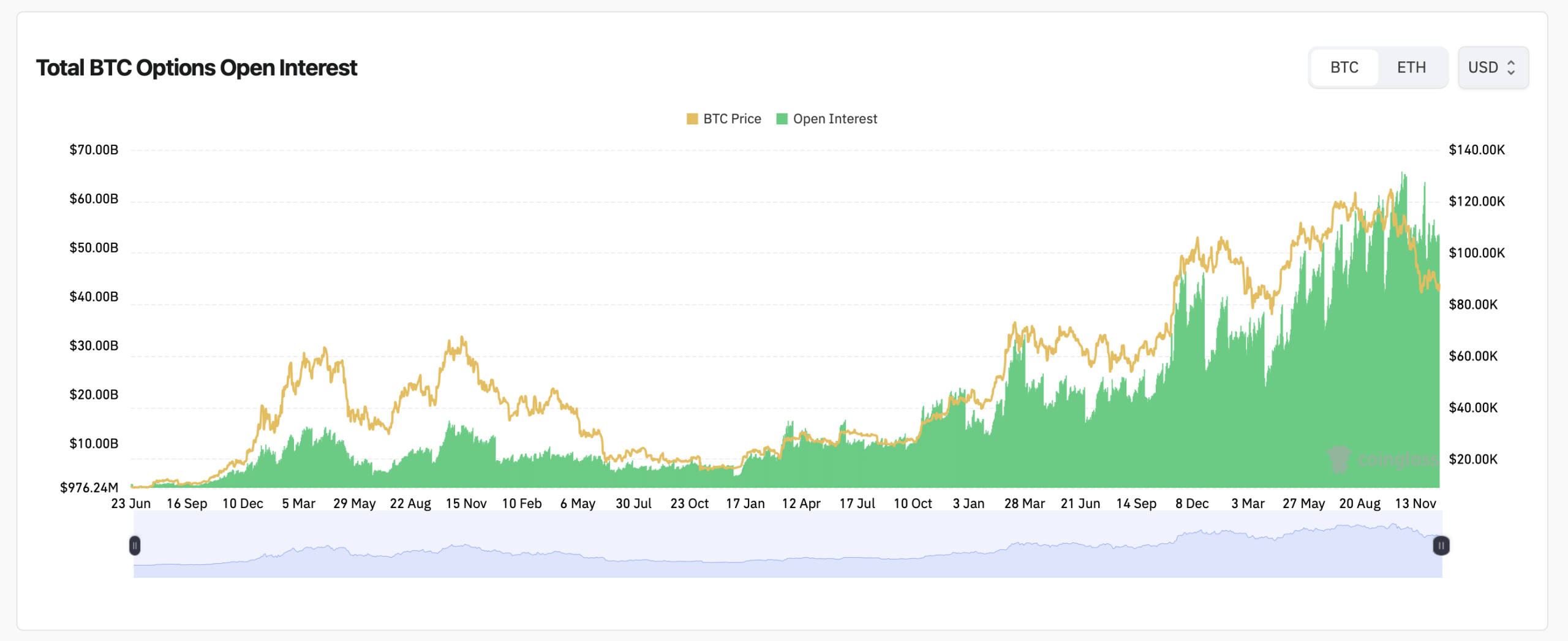

Options markets are like that friend who’s optimistic but always has a backup plan. Total Bitcoin options OI is climbing, but it’s getting a little crowded in here. Calls are at 64.8%, while puts are at 35.2%. Translation: Traders are like, “Yeah, we’re bullish, but let’s not get too cozy.” 🌈🛡️

Volume data backs this up. Calls are at 55%, but puts are holding their own at 45%. It’s like traders are saying, “I’ll take the upside, but with a side of downside insurance, please.” 🍔🍟

The most active options strikes are on Deribit, with calls at $100k, $106k, $112k, and $118k expiring Dec. 26. But there’s also a cozy little put party at $85k. It’s like a financial tug-of-war, and the rope is Bitcoin’s price. 🪢💸

Speaking of Dec. 26, there’s a $23-$24 billion Bitcoin options expiry happening at 8:00 UTC. That’s right, quarterly, annual, and structured products all saying, “See you next year!” It’s like New Year’s Eve for Bitcoin, but with more math. 🎉📆

Max pain levels? They’re hanging out in the low $90k range on Binance, while OKX and Deribit are eyeing the high $80k to low $100k zone. These are the prices where the most options expire worthless, basically Bitcoin’s version of a magnet. 🧲💲

CME options data from cryptoquant.com shows a ton of contracts expiring in the next one to three months. Traders are keeping it short and sweet, like a financial haiku. 🌸📝

So, what’s the takeaway? Bitcoin’s derivatives markets aren’t panicking, but they’re definitely taking a breather. Leverage is getting a trim, options are being handled with care, and price expectations are narrowing. For a market that loves drama, this is basically a spa day. 🧖♨️

FAQ ❓

- What’s up with Bitcoin futures open interest?

It’s easing up, like traders are finally taking a chill pill. 🌬️💊 - Are options traders team Bull or Bear?

They’re team “Let’s Hedge This,” with calls leading but puts gaining ground. 🦬🐻 - Where’s the max pain for Bitcoin options?

Between $80k and $100k, basically Bitcoin’s comfort zone. 🛋️💲 - What’s next for Bitcoin’s price?

Consolidation and volatility, because why not? 🎢🤷♀️

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- Resident Evil Requiem cast: Full list of voice actors

- Best Shazam Comics (Updated: September 2025)

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- The 7 Best Episodes Of Star Trek: Picard, Ranked

2025-12-21 00:45