- Bitcoin Coinbase Premium Index is now positive.

- This signals a spike in coin accumulation by US-based investors.

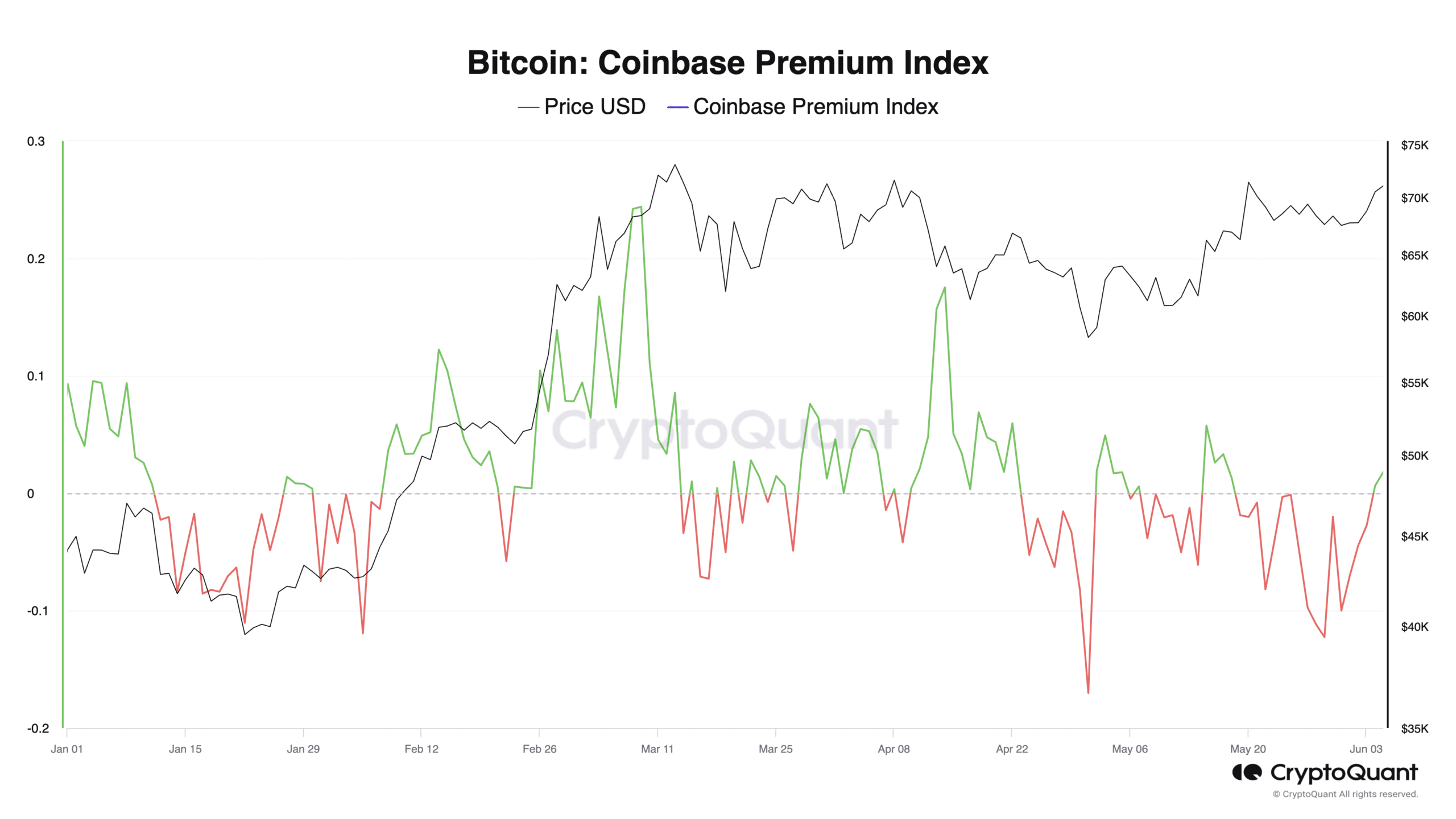

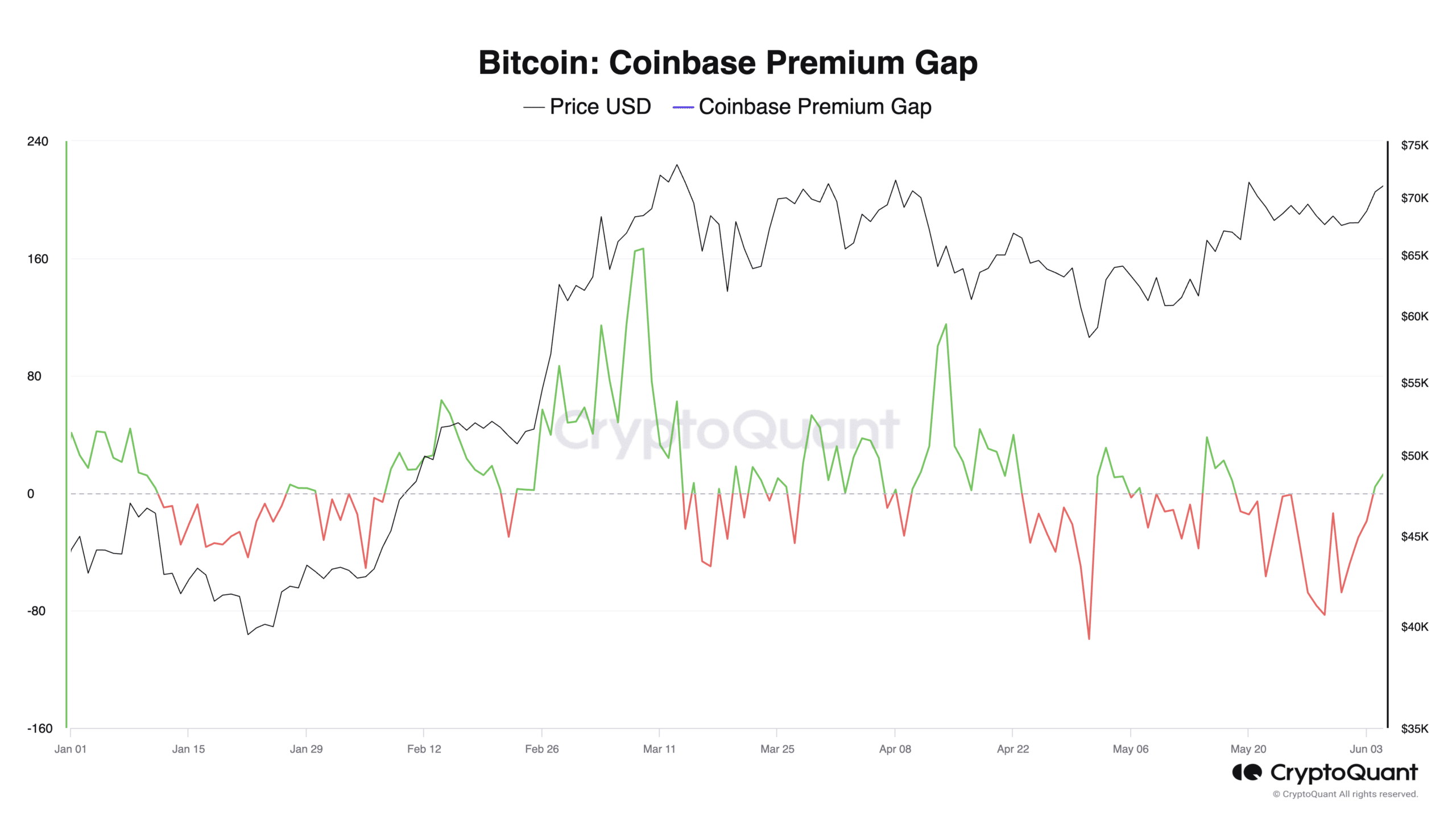

As a researcher with extensive experience in cryptocurrency markets and analysis, I find the recent development in Bitcoin’s [BTC] Coinbase Premium Index (CPI) noteworthy. The fact that it has turned positive after a ten-day streak of negative values is an indicator of increased buying interest from US-based investors. This trend is further corroborated by the Coinbase Premium Gap, which currently stands at 4.48.

In a recent analysis published under the pseudonym BQYoutube on CryptoQuant, it was discovered that Bitcoin’s [BTC] Coinbase Premium Index (CPI) has shifted from negative to positive values after approximately ten consecutive days of showing negative readings.

The gap between Bitcoin’s prices on Coinbase and Binance signifies this metric. A positive value implies that Bitcoin costs more on Coinbase than Binance, indicating substantial demand from American investors, leading to increased buying activity.

When the value becomes negative instead of positive, it indicates a decrease in trading activity on the US exchange.

At press time, BTC’s CPI was 0.006.

At present, the increased action among Bitcoin investors based in the United States is evident. The difference between the Bitcoin buying price on Coinbase and the global market price stood at a significant 4.48 dollars.

Based on information from CryptoQuant, this marked the initial occasion for the metric to register a positive value since 18th May.

BTC traders in Korea look away

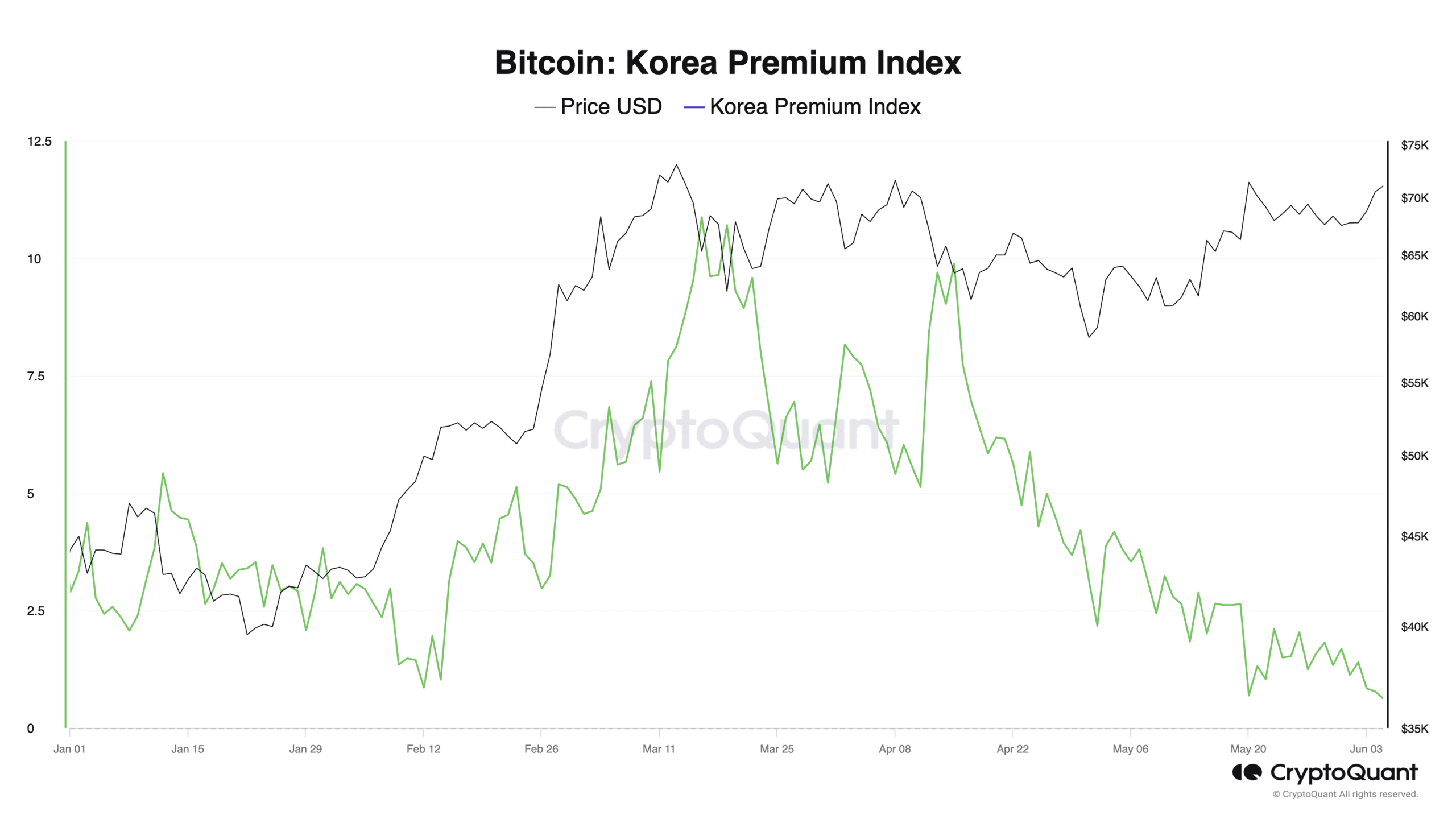

As a researcher studying the Bitcoin market, I’ve observed that the Korean Premium Index (KPI) for Bitcoin has been decreasing since the 15th of April. This index is also known as the Kimchi Premium and represents the difference in BTC prices between South Korean exchanges and those on other platforms. Despite this downward trend, it’s important to note that the KPI still hovers above the zero line.

As a researcher studying Bitcoin’s market trends, I’ve observed that the Kimchi Premium – the price difference between BTC on international exchanges and those in South Korea – reached a low of 0.78 at the time of my analysis. This indicates a subdued appetite for the cryptocurrency among Korean investors thus far in the year.

Negative sentiment follows the coin

I’ve been closely monitoring my Bitcoin (BTC) investment lately. At the moment, each BTC coin is being traded around $71,148. Over the past thirty days, its value has surged by an impressive 10%. On May 21st, there was a brief peak where BTC reached $71,315 before experiencing a correction.

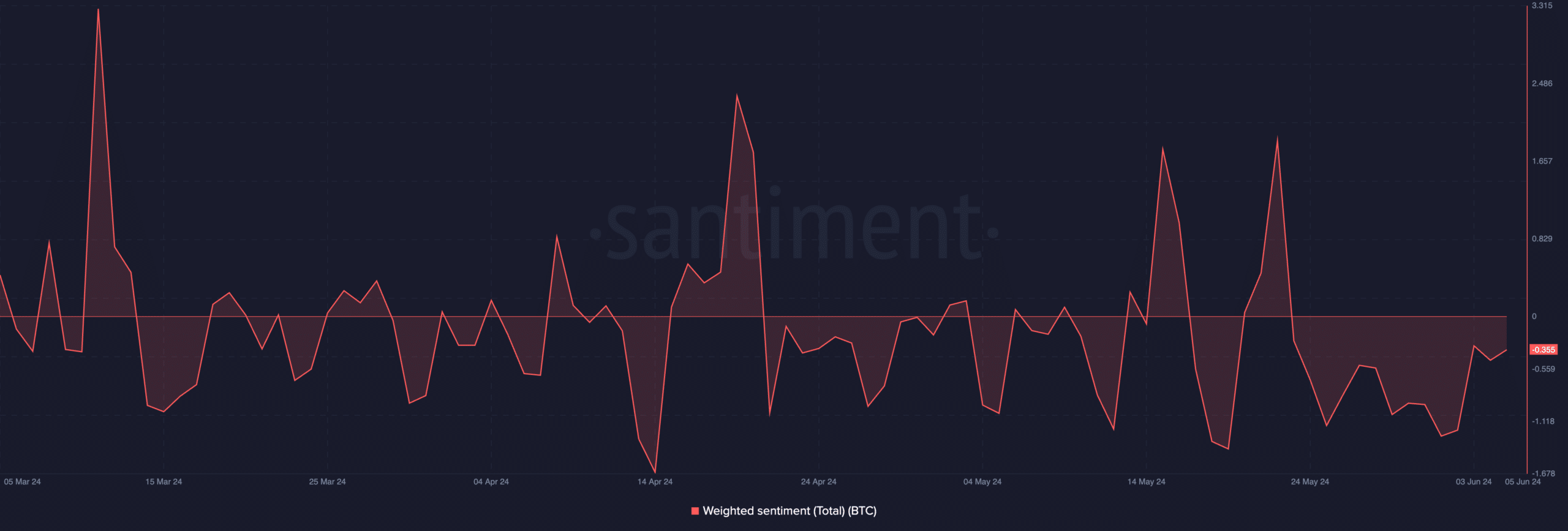

Despite BTC‘s recent price surge, a negative outlook lingers around the cryptocurrency. At present, its sentiment score stands at -0.355. Intriguingly, this pessimistic trend began on May 24th, and it has persisted ever since.

Despite recent price surges, investors and traders remain cautious and skeptical about the top cryptocurrency’s future value.

This has been the case even with the daily profits made by coin holders.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

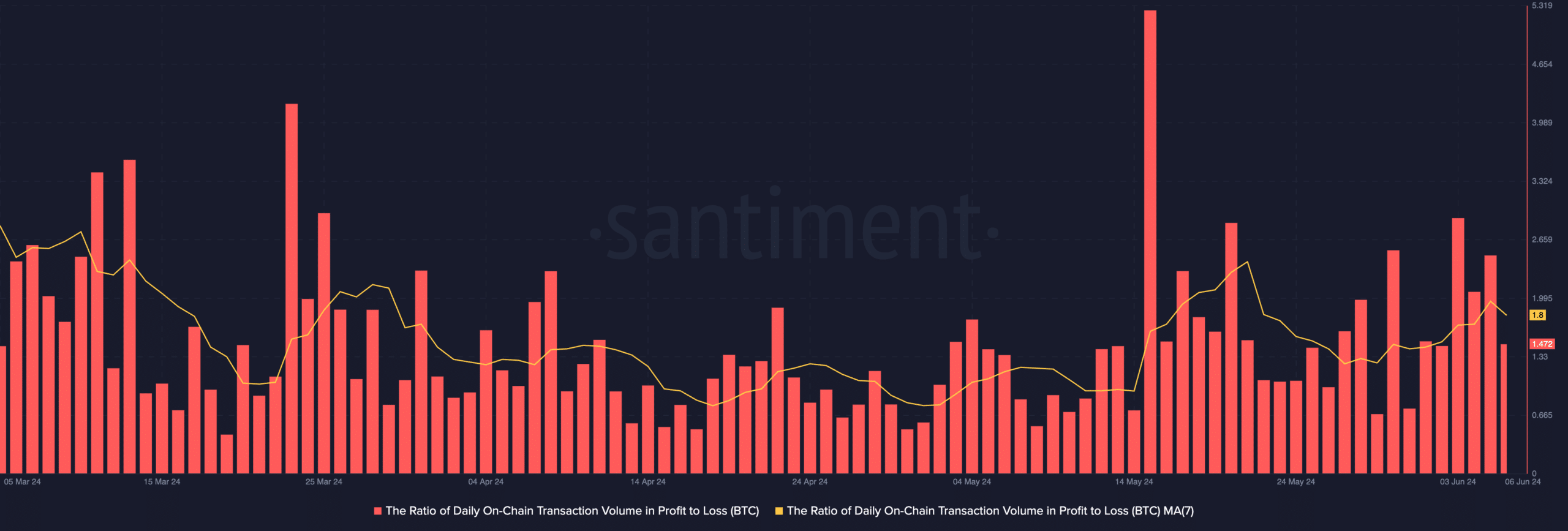

The cryptocurrency analysis platform, AMBCrypto, calculated the daily difference between Bitcoin’s transaction volume in profits and losses over a seven-day period, resulting in a ratio of approximately 1.8.

For every transaction where someone lost money with Bitcoin within the recent timeframe, there were approximately 1.8 profitable transactions on record.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-06-07 07:03