-

There were notable movements from a category of long BTC holders.

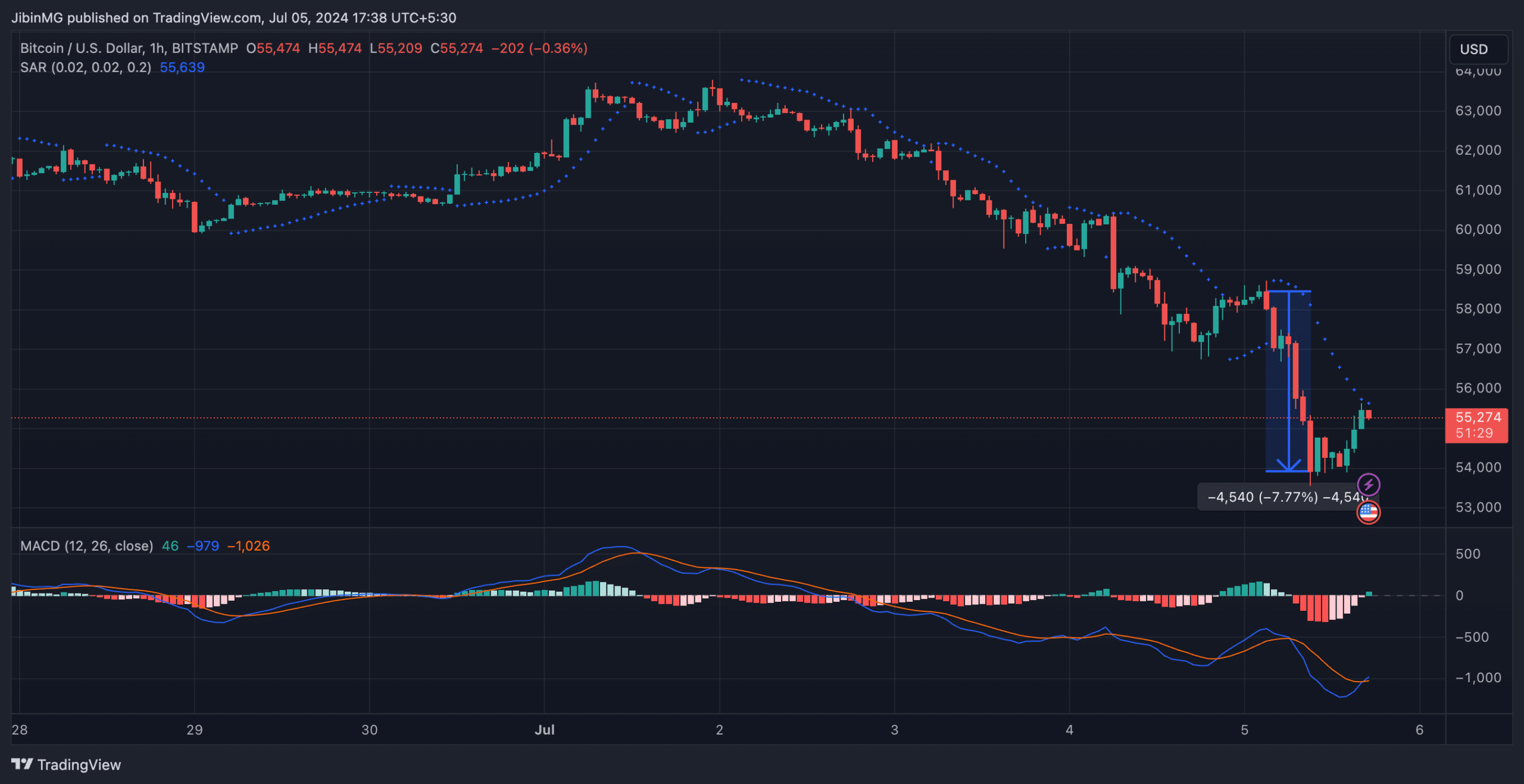

BTC dropped below a critical support line in the last 24 hours.

As a researcher with extensive experience in cryptocurrency markets, I find these recent developments in Bitcoin (BTC) concerning. The notable movements from a category of long-term BTC holders, coupled with Bitcoin’s drop below a critical support line, suggest that the market is experiencing increased volatility.

Bitcoin, the largest cryptocurrency, has experienced a disappointing week, with its value decreasing by nearly 9% over the past seven days. The market downturn was significant enough that BTC dipped below the $54,000 mark briefly before rebounding to a current price of $55,275 as reported.

As an analyst, I’ve observed that Bitcoin [BTC] has dropped in price significantly over time, reaching a crucial chart level in the process. Consequently, long-term investors have become wary and may be considering their next moves. This trend could potentially be connected to recent developments surrounding an exchange with a ten-year history that experienced a collapse.

Long-term BTC holders make moves

Recent findings from AMBCrypto’s examination of Bitcoin’s Spent Output Profit Ratio (SOPR) for long-term investors and age groups have surfaced some intriguing patterns. Specifically, the SOPR value for long-term holders has risen above 10.

Despite a downturn in Bitcoin’s price, these holders managed to make substantial profits by transferring their Bitcoins to exchanges. The SOPS (Spent Output Profit Ratio) figure, which is currently above one as shown on the chart, supports this observation.

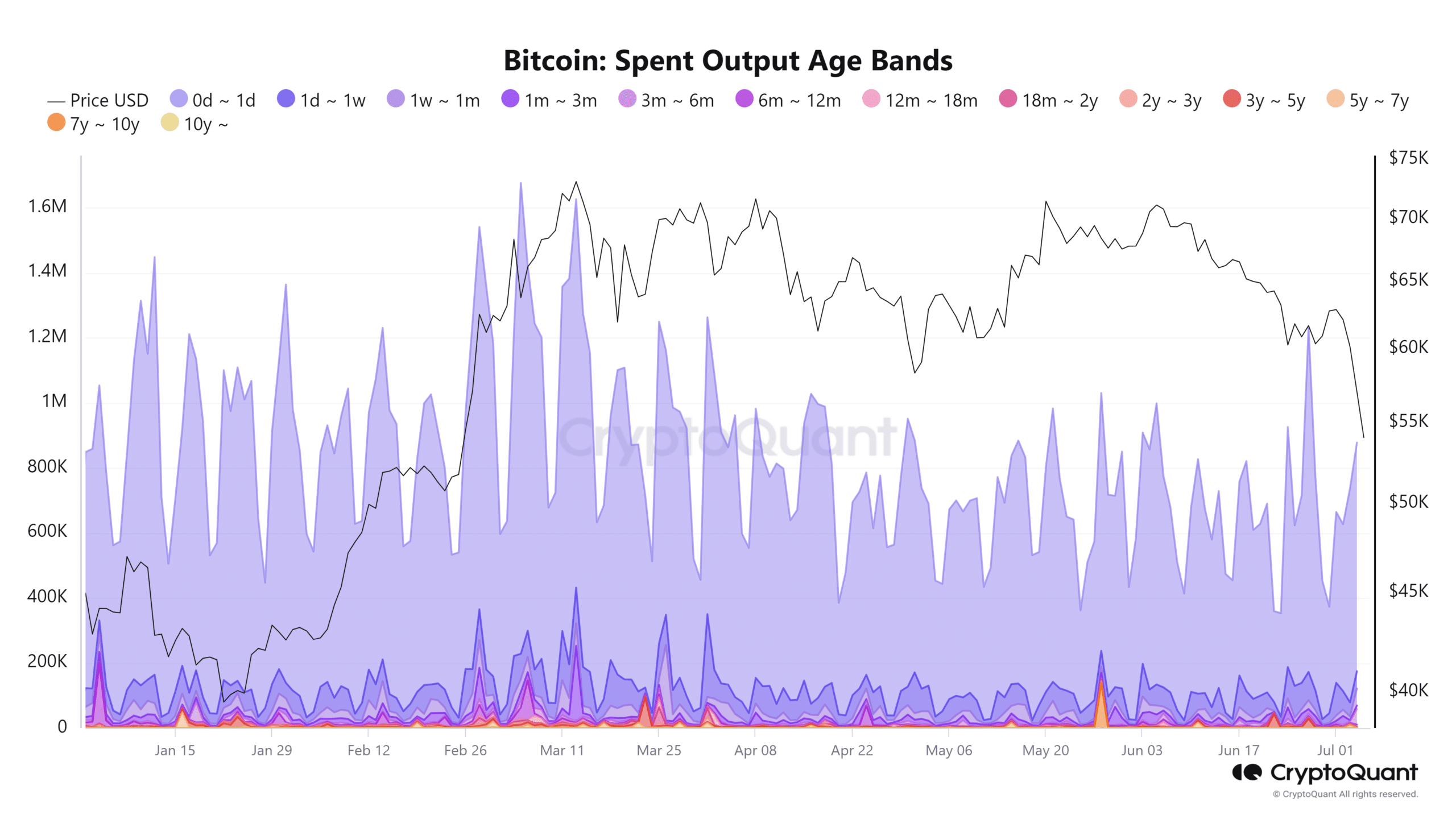

As a cryptocurrency analyst, I’ve found that AMBCrypto’s examination of Spent Output Age Bands offered valuable perspectives on distinct cohorts of Bitcoin investors who have recently engaged in transactions after holding their coins for extended periods.

As an analyst, I’ve noticed some intriguing trends in the Bitcoin transaction data. Specifically, I found that individuals holding between 5 and 7 years had the most significant activity on July 3rd, with over 10,000 Bitcoins exchanged during that day. This marked a noteworthy increase in transaction volume for this particular group, making it one of the busiest days in recent months.

The Mt.Gox angle

Alongside the effect of Bitcoin’s price drop, the latest news regarding the collapsed exchange Mt. Gox may sway the decisions of long-term investors.

Recent data shows that a significant quantity of Bitcoins from Mt. Gox’s holdings has been transferred to new digital wallets. Some of these coins were moved to “hot” wallets.

The exchange is making ready to reimburse its creditors with additional compensation, over ten years since its bankruptcy.

The transfer of 47,229 Bitcoins worth around $2.71 billion from Mt. Gox, as reported by Arkham, holds notable importance.

As Mount Gox prepares to refund approximately $8.5 billion in Bitcoin to its creditors, this upcoming action may encourage long-term investors to transfer their coins.

As an analyst, I would interpret this situation as follows: Given the upcoming large-scale Bitcoin repayments, there’s a possibility that some investors might be selling off their holdings in anticipation of a potential price decline. In other words, they could be acting out of fear that the BTC price may drop even further due to these repayments.

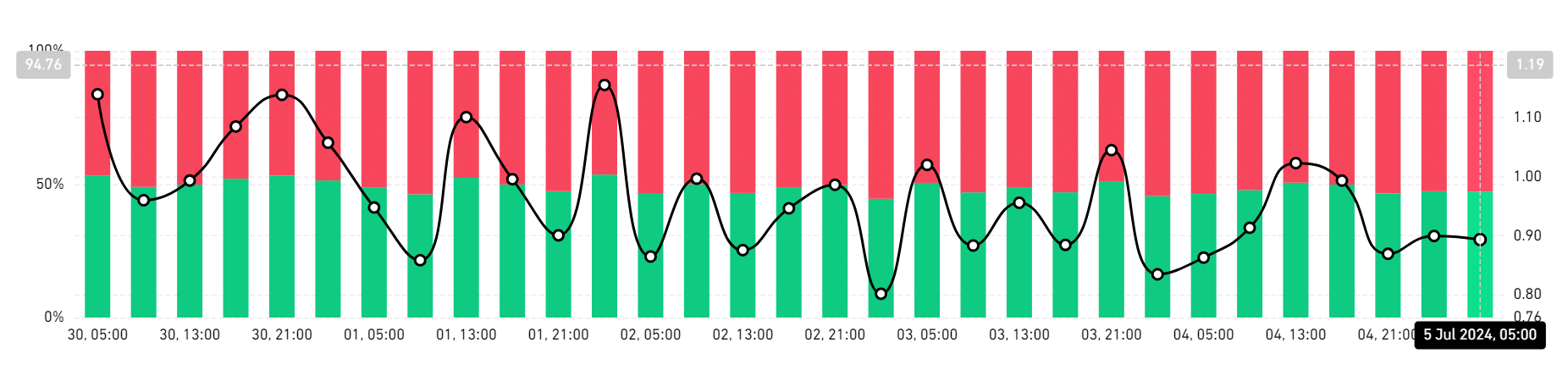

More shorts dominate the Bitcoin trade

As of now, I observe Bitcoin’s price hovering around the $55,300 mark in my daily chart analysis. Notably, short sellers appeared to be leading the market dynamics during the last 48 hours according to recent assessments.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I’ve been keeping an eye on the Bitcoin long/short ratio chart provided by Coinglass. On the 4th of July, I noticed that a larger proportion of investors were holding short positions compared to long ones. Specifically, there were 52.64% short positions versus 47.36% long positions.

The short ratio has slightly increased to 52.81%, while the long ratio has decreased to 47.19%.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-07-05 16:08