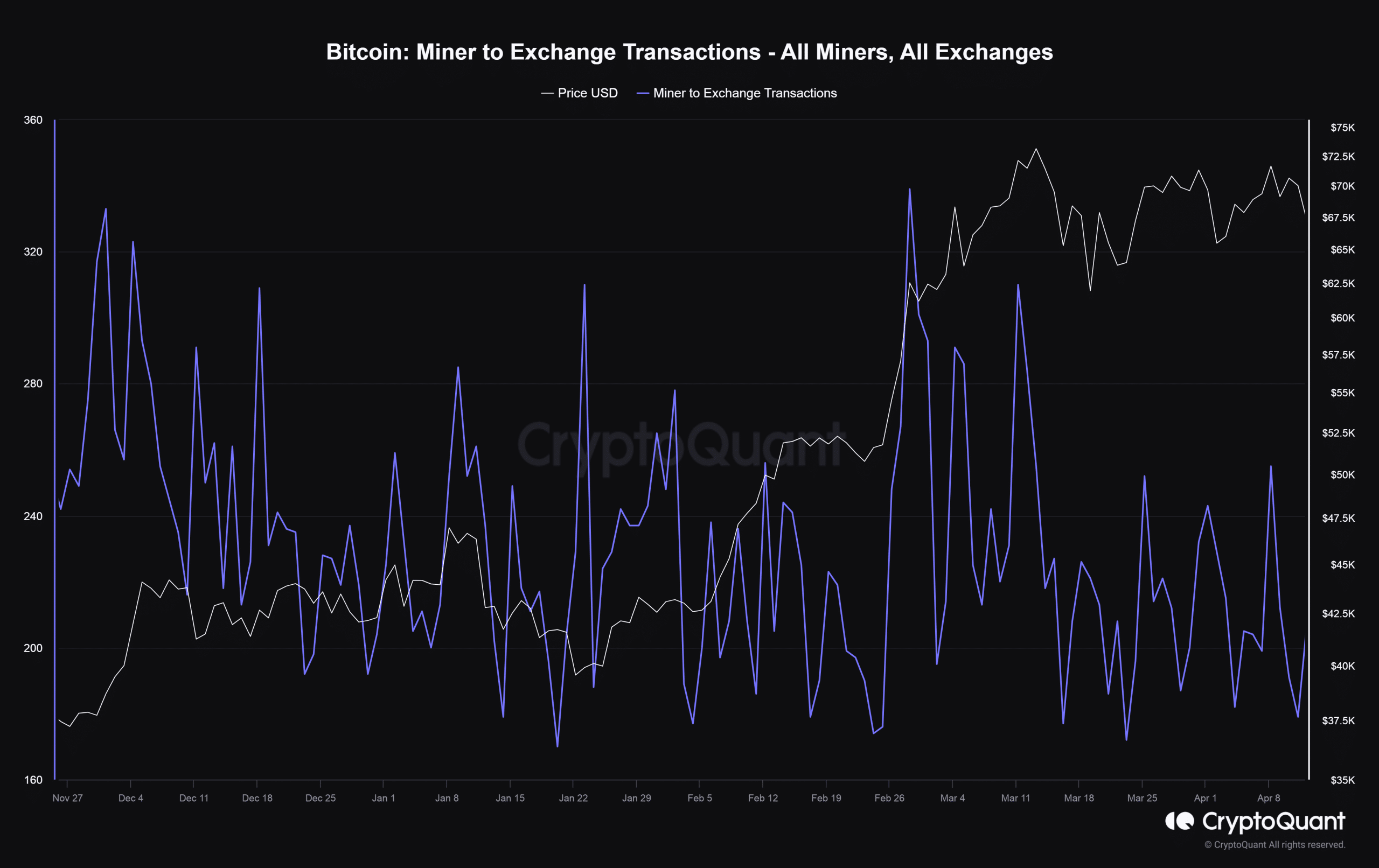

- Last month, miners sold less than 1/3rd of the total coins sold in February

- HODLing might also be motivated by the negative state of the market currently

In about 12 hours, the long-awaited Bitcoin halving will transpire. (Or, The Bitcoin halving is just around the corner, happening in approximately 12 hours.)

Miners, responsible for securing the network and receiving compensation through block rewards, will experience a significant decrease in earnings following this event. In preparation, miners often sell off their cryptocurrencies prior to the reduction in revenue.

This time, however, has been different.

Miners reduce selling pressure

Based on data from a cryptocurrency researcher at CryptoQuant, an on-chain analytics firm, approximately 374 bitcoins have been transferred daily by miners to exchanges identified as “spot exchanges” over the past month. This is significantly less than the average of around one-third more bitcoins that were sent daily to these exchanges back in February.

The researcher found that this action relieved some of the extra pressure causing the king coin to decrease further.

“Miners may have sold off their bitcoin holdings prior to the current market pressure. This early selling could positively impact the market in the near term, given the existing market anxiety.”

Weak returns spurring HODLing?

Moreover, the reason for HODLing could be attributed to the recent market downturn, causing Bitcoin to drop by over 12% in just a week. Miners could be adopting a wait-and-see approach, hoping for a bullish trend following the halving event to maximize profits from their sales.

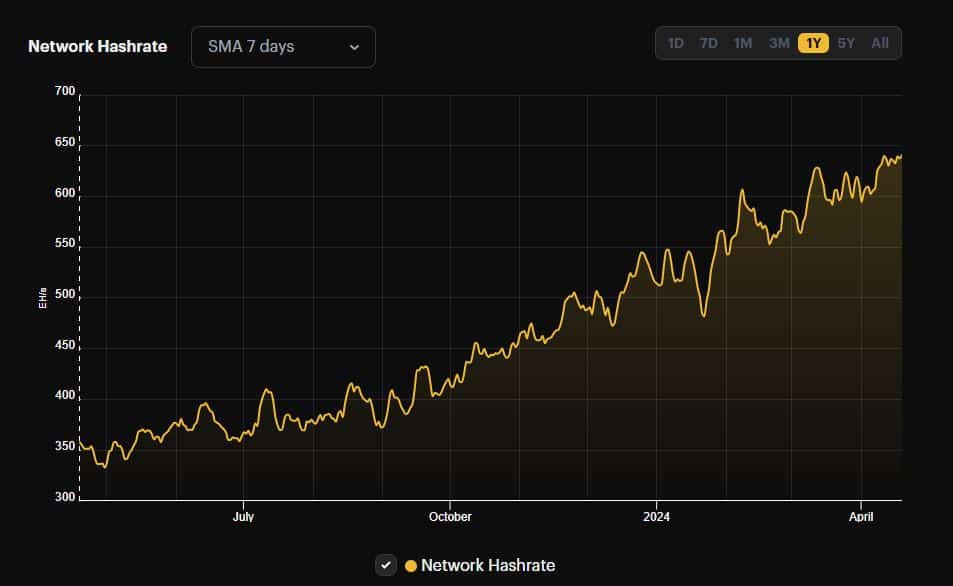

Machines running on full strength

Currently, the mining network’s hash rate reaches an impressive 641 exahashes per second (EH/s). This figure reflects the combined processing power of all miners. Notably, this significant increase occurred prior to the upcoming halving event, suggesting that miners are intensifying their efforts to mine as many bitcoins as possible before rewards are reduced.

In Asian trading sessions on Friday, Bitcoin dipped below $60,000 due to escalating geopolitical conflicts in the Middle East. Nevertheless, savvy investors took advantage of this downturn and bought more Bitcoin, causing its price to rebound to $62,000 by press time.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-19 22:15