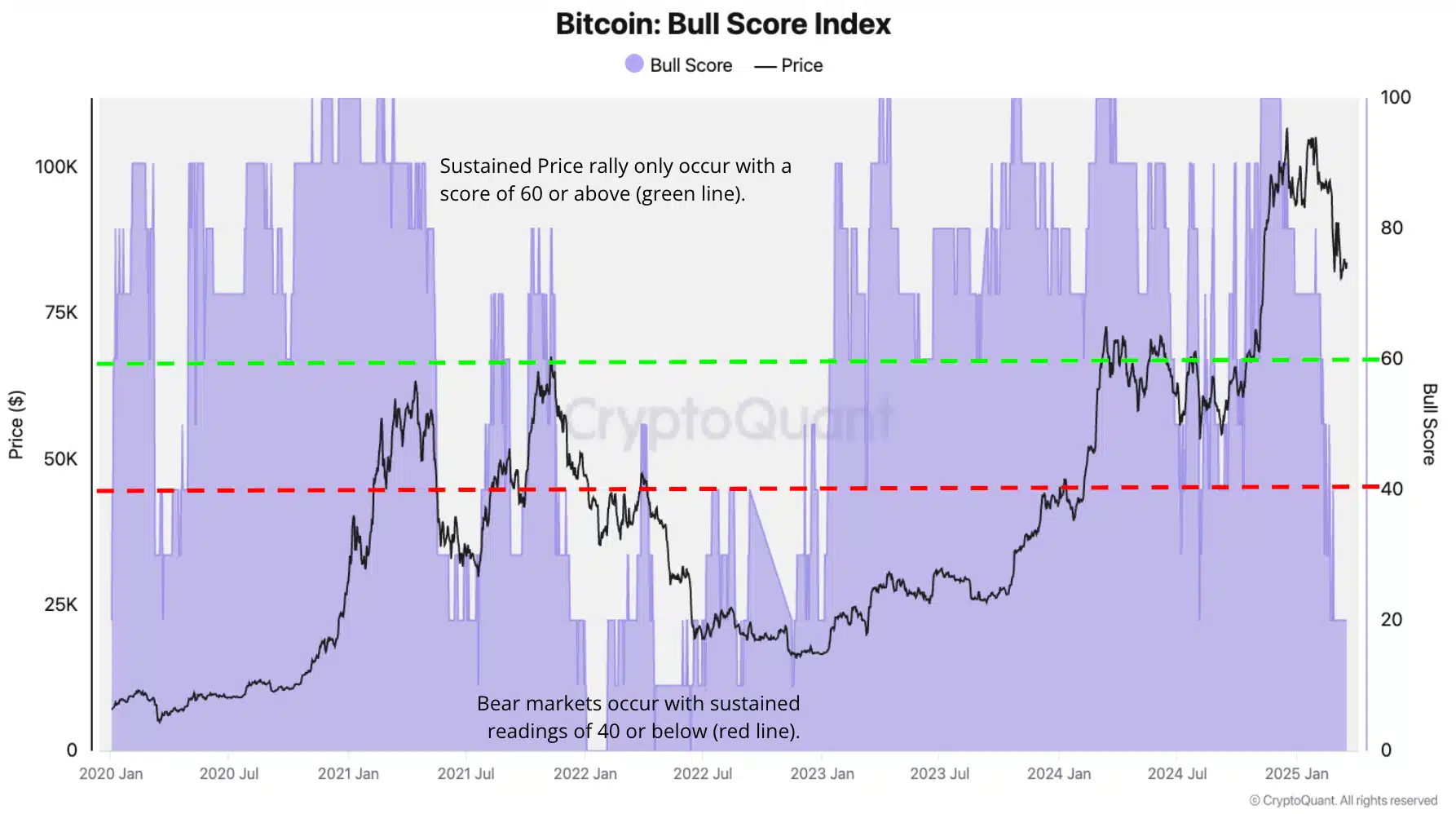

- Oh dear! Bitcoin’s bull score index has plummeted to its 2023 levels, as momentum takes a rather dramatic bow.

- According to the ever-so-reliable Coinbase, April’s U.S. tariffs and earnings reports might just be the villains in this tragicomedy.

In the first quarter of 2025, our dear Bitcoin [BTC] lost its sparkle, dropping a staggering 23% from $109k to a rather pedestrian $84k. CryptoQuant analysts, with their crystal balls, suggest this could herald a longer bearish trend. How thrilling! 🎢

In their weekly report, the analysts noted that the Bitcoin bull score index (BBSI) has taken a nosedive to a 2-year low. It seems the market is feeling a bit under the weather, darling.

“Currently, the index stands at 20—the lowest since January 2023—market conditions are weak, raising concerns that the recent price drop could be part of a broader bearish trend rather than a short-term correction.”

Source: CryptoQuant

The index, which ranges from 0 to 100, tracks bullish signs like network activity, demand, and liquidity. Higher values are the toast of the town, while lower readings are more like last week’s leftovers. The BBSI reading of 20 is reminiscent of the gloomy conditions we saw in 2022 and early 2023. How quaint!

What’s next for Bitcoin?

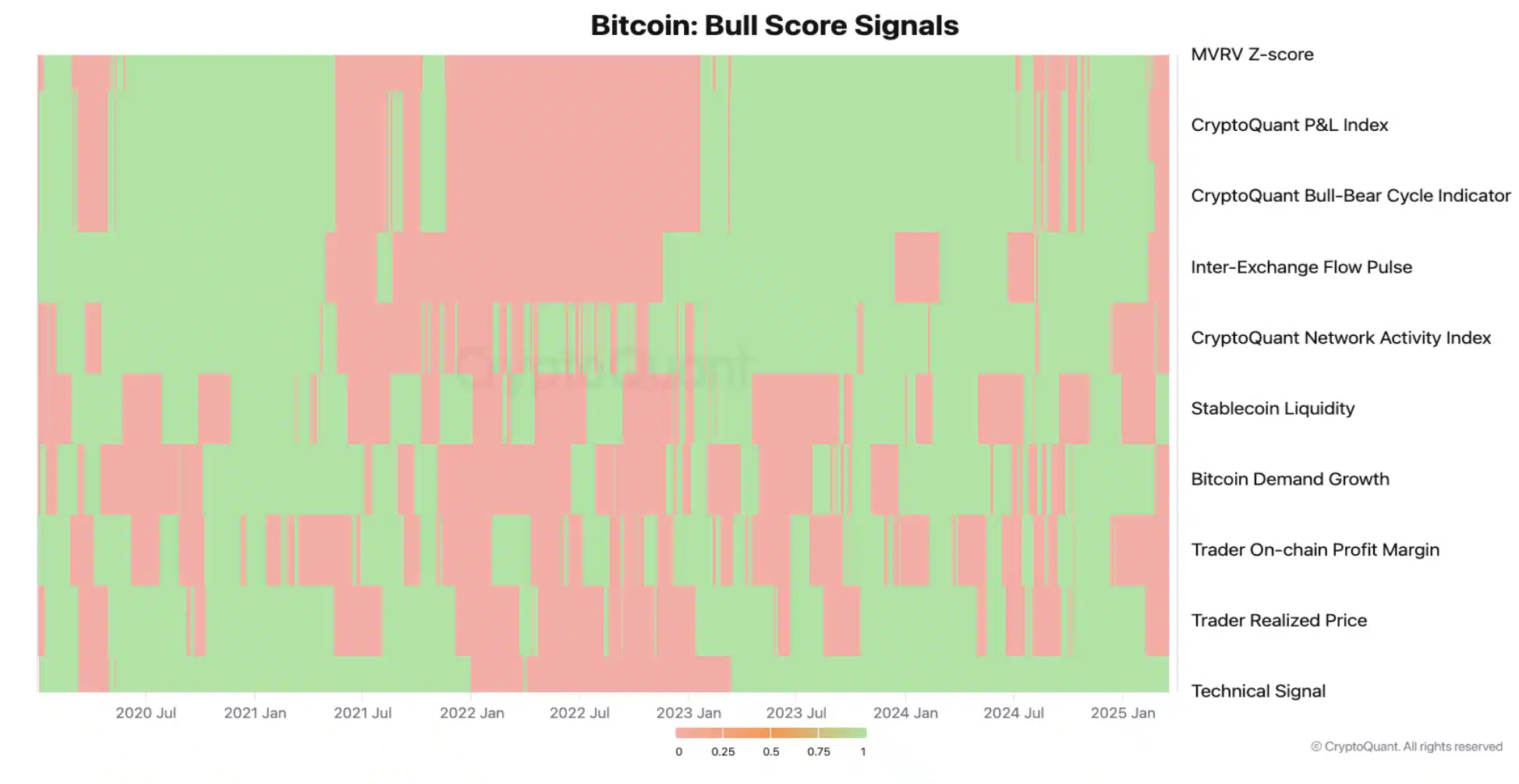

Additionally, the analysts have added that other key on-chain signals, apart from stablecoin liquidity, have been as bearish as a rainy day since mid-February. ☔️

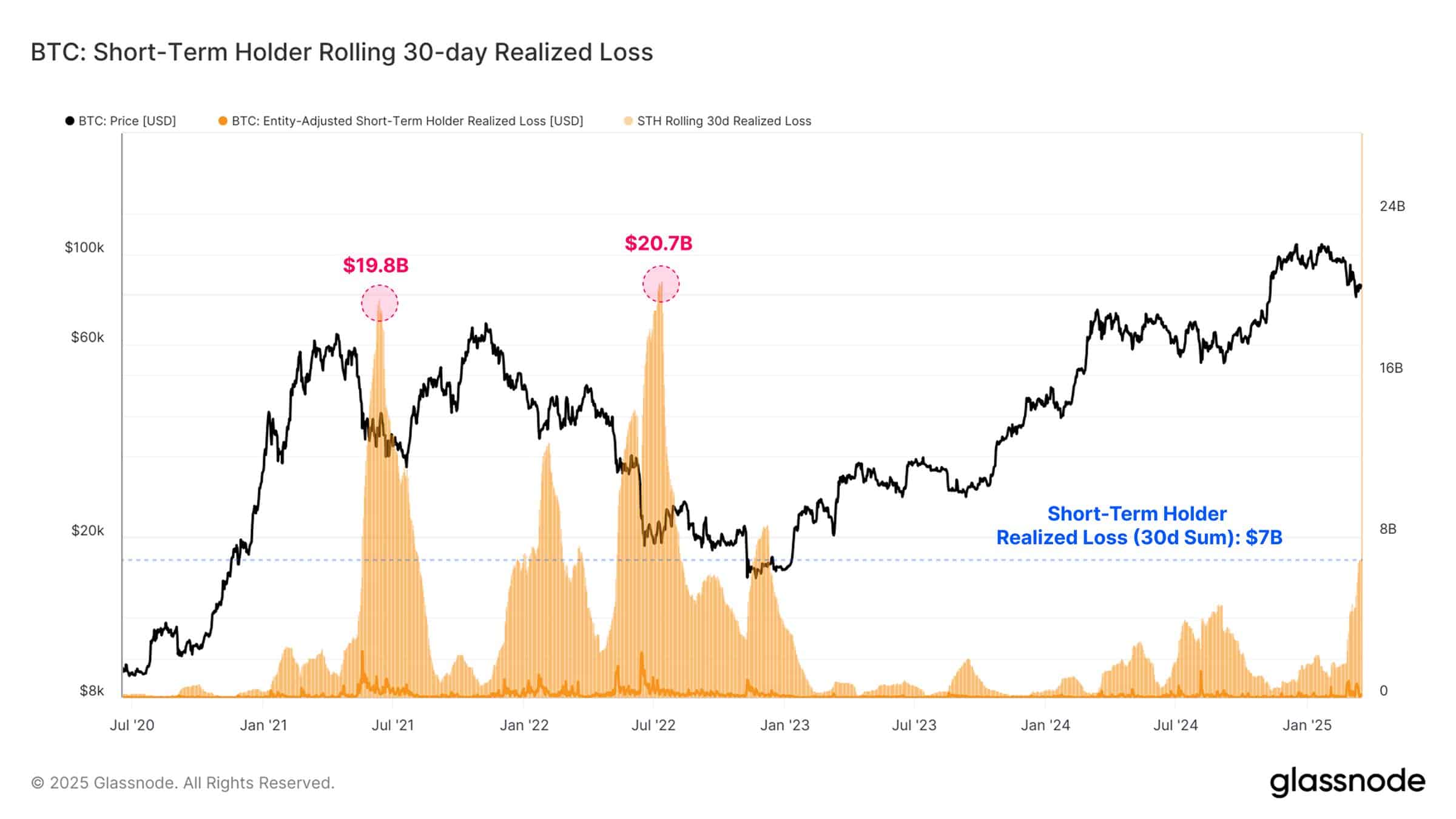

The most distressed group of investors includes STH (short-term holders), who have held BTC for a mere 6 months or less. This group has seen a record loss of $7 billion in the last 30 days, according to Glassnode. But fear not, the analytics firm assures us that these losses are still within the historical levels seen during previous BTC bull runs. How reassuring! 😅

“The rolling 30-day realized loss for #Bitcoin’s STHs has reached $7B, marking the largest sustained loss event of this cycle. However, this remains well below prior capitulation events, such as the $19.8B and $20.7B losses in 2021-22.”

However, our friends at Coinbase analysts are not sharing this optimistic outlook. Macro uncertainty and Trump tariffs have worsened the risk-off sentiment for BTC in Q1. In fact, they warn that new tariff wars in early April could be the plot twist we never asked for. 🎭

“We believe tariffs and 1Q25 earning reports (forward guidance) represent the most important factors for market players to watch in the weeks ahead.”

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-03-22 22:18