- Bitcoin’s price rebounds above $97,000, rising 2.3% after dropping to $94,000—like a phoenix rolling in digital soot. 🐉

- A shift in the MVRV ratio and dormant coin movement may indicate long-term holders are pulling strings with finesse. 🤔

Bitcoin [BTC], that indulgent oracle of modern avarice, has performed yet another pirouette in the theatre of speculation. After slumping to $94,000 like a melancholic Shakespearean hero, it has regained its composure with a 2.3% leap, dancing back above $97,000. Bravo! 🕺

But, dear reader, is this an act of triumph or mere whimsy? Let us peer into the murky depths of Bitcoin’s labyrinthine soul for enlightenment.

According to CryptoQuant—a guild of Bitcoin whisperers—a peculiar tremor rippled through the blockchain on the 10th of February. Approximately 14,000 Bitcoins emerged from their Rip Van Winkle-like slumber of seven to ten years. A retro blast from the [crypto past](https://pollinations.ai/referral?topic=crypto)! 🚀

Strangely, these coin-reawakenings were not rushed to exchanges, quashing notions of a panic sale. Instead, they remained where they were, like guests refusing to leave a party. Suspicious? Yea, verily. 🙃

“It’s important to note that the average acquisition price of these coins is quite low, which could influence the holders’ future decisions regarding potential sales.” —CryptoQuant Analyst, presumably sipping tea 🍵

Bitcoin’s MVRV Ratio: The Aristocrat of Charts 🎩

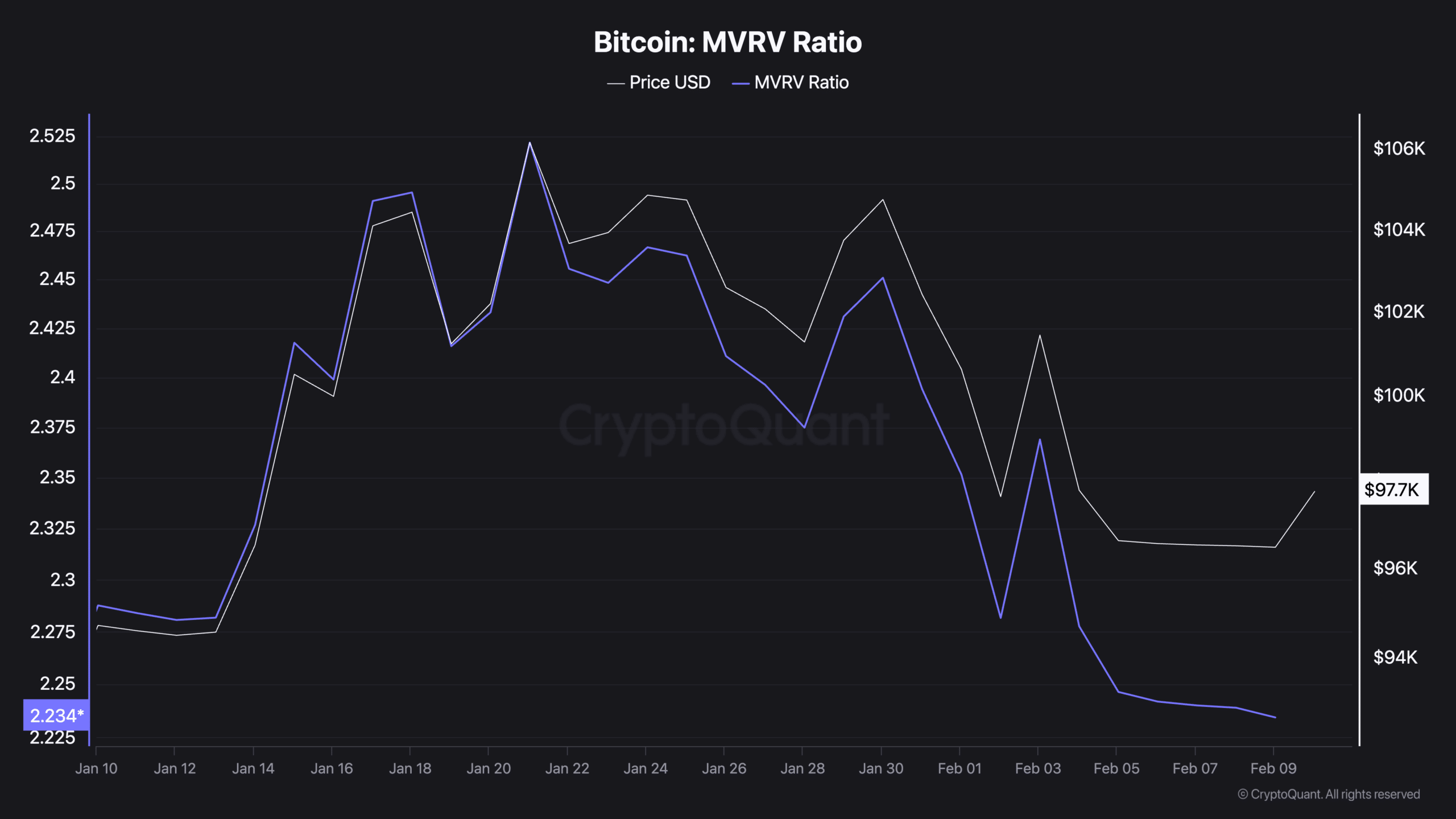

Now let us bask in the dazzling complexity of the MVRV ratio, the belle of Bitcoin’s analytical ball. This indicator—part fortune-teller, part harsh critic—compares Bitcoin’s market capitalization to the realized value of all coins, calculated as their last recorded price winked at by the blockchain.

In mathematical terms: MVRV is the “Are-we-rich-or-just-fooling-ourselves?” ratio. Recent downward trends in this metric tell a tale of potential long-term investment bargains—or a market that’s clutching its pearls in anxiety. 💸🥴

On the 21st of January, the MVRV stood at a rather regal 2.52. By the 9th of February, after Bitcoin’s moody nosedive, it pouted at a modest 2.23. Statistics have never been so dramatic. 😤📉

Historically, a drooping MVRV ratio is like a clearance sale banner for long-term investors: “Buy here, you fools!” But should this decline persist, it may point to reluctance among market players, clutching on to their coins like misers faced with charitable requests. 🫣

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2025-02-11 06:18