- Lo and behold! Bitcoin‘s Futures market has witnessed a staggering $10 billion in Open Interest vanish into thin air.

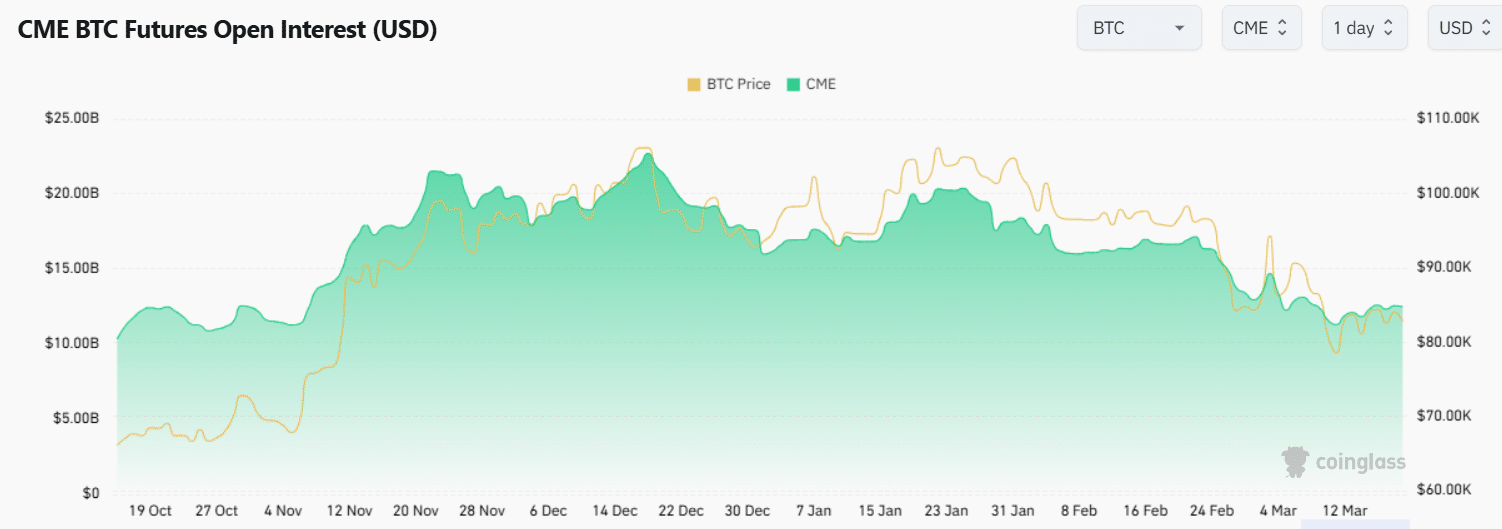

- Indeed, the CME Open Interest has plummeted by a remarkable 45% from the 18th of December to the 18th of March.

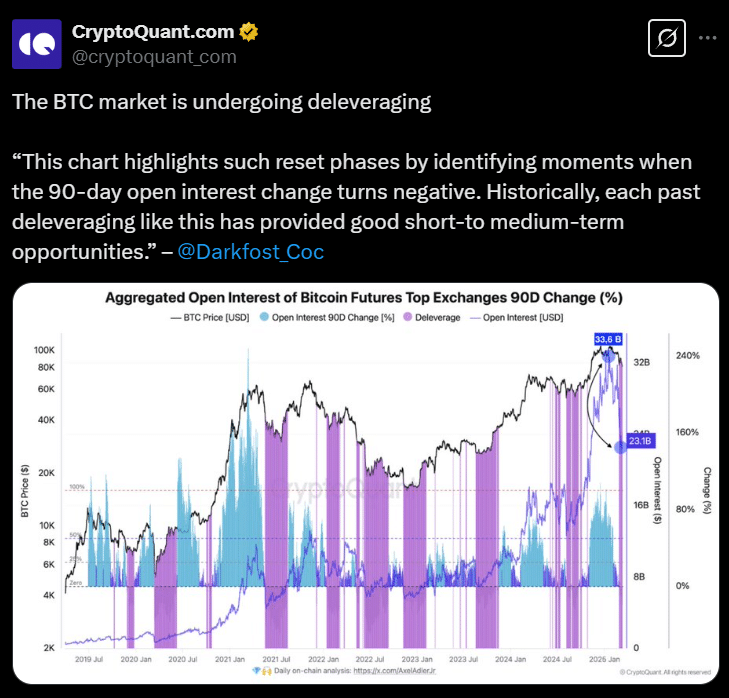

In the grand theatre of Bitcoin’s [BTC] Futures market, we find ourselves amidst one of the most significant deleveraging spectacles, with a staggering $10 billion in Open Interest having been swept away since the dawn of January 2025. The zenith of this folly was reached on the 17th of January, when the figure stood at a princely $33 billion. How delightful! 🎭

As a certain CryptoQuant analyst has observed, this was indeed an all-time high in market leverage, a veritable feast for the speculative soul.

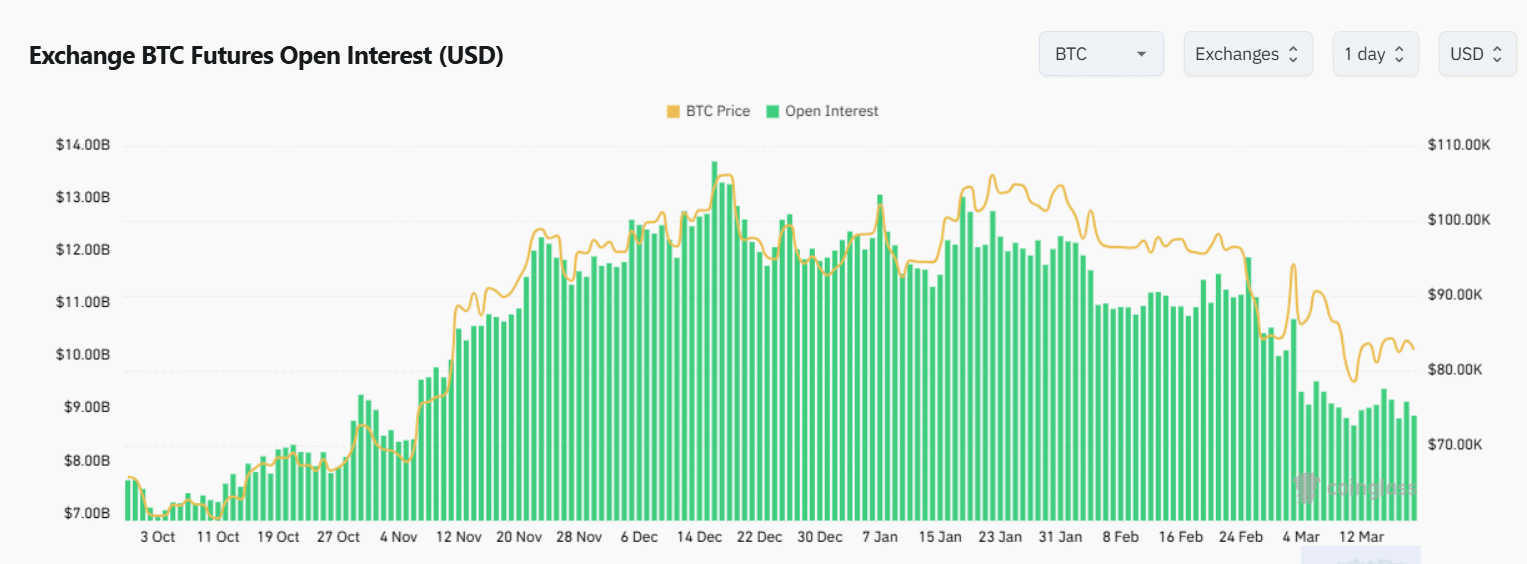

Between the 20th of February and the 4th of March, the Open Interest took a most dramatic plunge of $10 billion. One might say it was akin to a tragic play, where uncertainty from both domestic and international political affairs, coupled with market-wide liquidations, played the role of the villain.

CryptoQuant analysts, in their infinite wisdom, have deemed this phase a natural market reset, a phenomenon that has historically heralded short- to medium-term bullish trends. How quaint! 🧐

Alas, this decline is not the first instance where excessive leverage has led to a market reset. History, it seems, has a penchant for repeating itself.

History repeats itself: Echoes of March 2024

In a most similar fashion, March 2024 bore witness to Bitcoin’s sharp retreat from $69,000 to $59,700, compelling a wave of compulsory exits from leveraged positions, amounting to a staggering $1 billion. Oh, the drama! 🎭

This correction, dear reader, also facilitated a normalization of Funding Rates across major cryptocurrencies, thus paving the way for a sustained rally later in the year. How fortuitous!

As history would have it, deleveraging cycles often coincide with external economic and geopolitical developments, further amplifying market reactions. One might say the market is as fickle as a debutante at her first ball!

Reportedly, the latest wave of deleveraging was influenced by external geopolitical tensions and ongoing macroeconomic shifts, adding a delightful layer of complexity to our market dynamics.

A series of market reactions ensued following Donald Trump’s recent proclamations regarding crypto, which included his audacious claims of ending “Joe Biden’s war on Bitcoin and crypto.” Oh, the audacity! 😏

Market-wide deleveraging, it must be noted, does not occur in splendid isolation. The movements of Funding Rates provide further insight into how traders adjusted their risk exposure during this tumultuous period.

From $104k to $82k — What really happened?

By late February, the Open Interest on Bitcoin Futures contracts had fallen below $60 billion, a notable decline from $70 billion in January, as per the esteemed Coinglass data.

Bitcoin’s Futures Open Interest on Coinglass has illuminated the connection between the reduction of leverage and the movements of price. Between December 2024 and March 2025, Bitcoin’s Open Interest fell from $13.70 billion to $8.86 billion, confirming a 35% decline in OI during this period, alongside a 20% drop in Bitcoin’s price. How curious! 🤔

This suggests that the December rally was indeed fueled by excessive leverage, which was later unwound as sentiment shifted, much like a well-timed plot twist.

Funding Rates flip

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2025-03-18 19:08