Pray, Gather ‘Round:

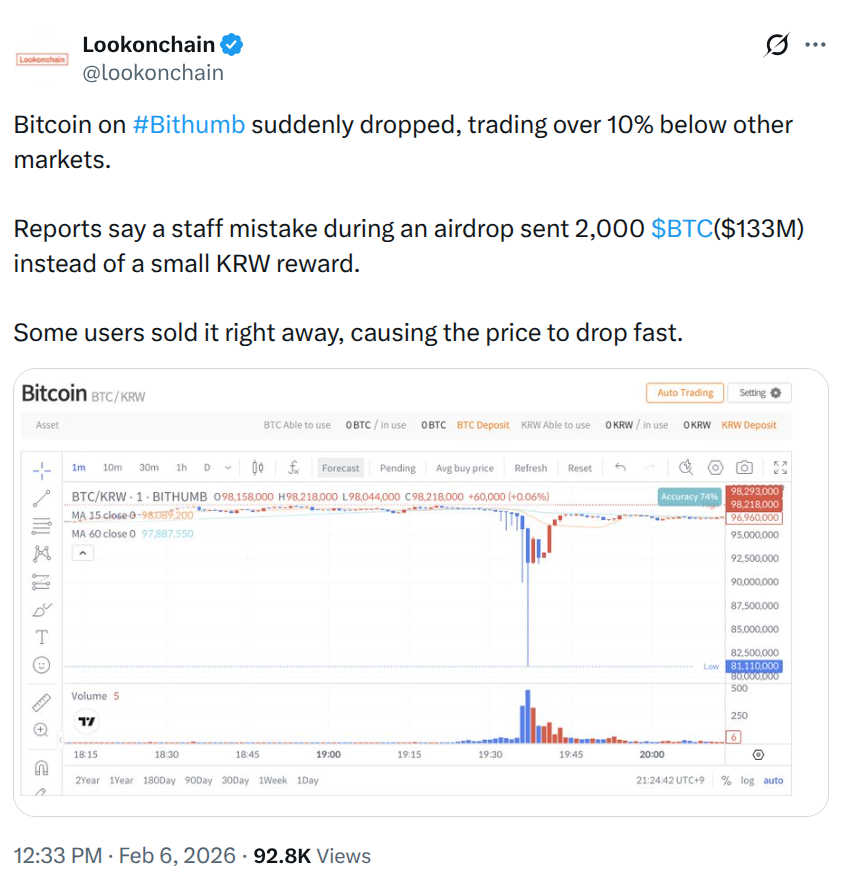

- Oh dear! Bithumb had a wee bit of a “flash crash,” revealing liquidity risks thicker than a London fog, all thanks to a rather scandalous rumor about a 2,000 $BTC airdrop mishap.

- Capital is performing a splendid pirouette away from the capricious world of spot trading into the safer arms of infrastructure that promises to ease Bitcoin’s sluggish pace and wallet-draining costs.

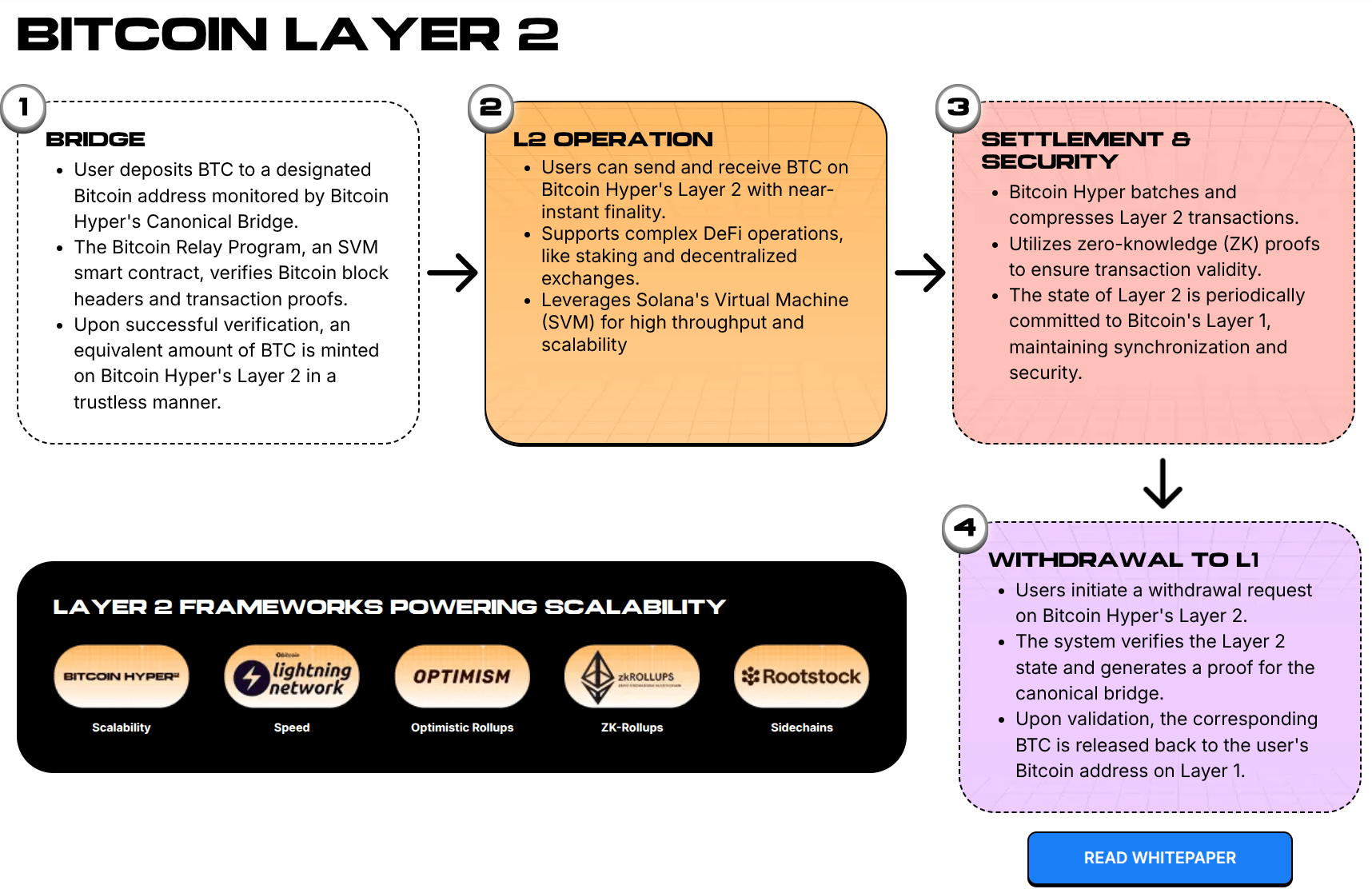

- Enter Bitcoin Hyper, a dashing suitor leveraging the Solana Virtual Machine (SVM) to whisk Bitcoin into the fast lane with high-speed smart contracts and finality quicker than a wink.

Liquidity, my dear friends, is the very essence of crypto. But this week on Bithumb? It resembled a rather gruesome hemorrhage! Our South Korean friend saw a terribly sudden, ghastly plunge in Bitcoin’s price following that infamous rumor about a 2K $BTC airdrop distribution gone awry.

For a few heart-racing moments, order books vanished like a magician’s rabbit. The price wicks tumbled into the depths of despair before our trusty arbitrage bots and market makers could swoop in like knights in shining armor to staunch the bleeding.

Call it a glitch if you must, but really, it was more of an impromptu stress test. Panic ensued from a simple misunderstanding of an internal distribution mechanism, yet the frenetic sell-off followed by a dramatic V-shaped recovery laid bare the fragility of centralized order books during such high-velocity events.

While our Western friends gazed aghast as spreads widened, the ‘ Kimchi Premium ‘ briefly found itself turned on its head. Institutional algorithms feasted on that rare arbitrage window in mere seconds, like hungry seagulls at a seaside café.

This little incident reveals a tale worth telling: Bitcoin, the asset, is positively pristine; alas, the rails we ride upon are clunky and archaic. As legacy infrastructure groans under the weight of volatility, capital has smartly pivoted toward protocols that promise to fix these structural hiccups. Investors are now casting their gaze beyond the drama of CEX wicks and toward the shiny new Layer 2 ecosystem.

Leading the charge? Bitcoin Hyper ($HYPER), a protocol that’s quietly amassing wealth while promising to revolutionize how we shuffle value around on the world’s oldest blockchain – much like turning a trusty old horse into a sleek racecar.

Tackling the Latency Conundrum: Bitcoin Hyper and the SVM Affair

The Bithumb kerfuffle serves as a clarion call regarding settlement layers. When networks get congested or exchange engines throw a tantrum, liquidity traps emerge like weeds in a well-tended garden. Fear not! Bitcoin Hyper aims to rectify this by fundamentally reshaping the Bitcoin transaction architecture.

By integrating the Solana Virtual Machine (SVM) as a Layer 2 execution darling, this project seeks to marry Bitcoin’s rock-solid security with the exhilarating throughput that has made Solana the belle of the ball among high-frequency traders.

This charming integration transforms Bitcoin from a passive ‘digital gold‘ asset into a sprightly, programmable platform. Presently, Bitcoin’s base layer manages a rather dismal 7 transactions per second (TPS) with a leisurely 10-minute block time – practically a snail’s pace for modern DeFi applications!

Bitcoin Hyper employs a decentralized canonical bridge and a modular design: L1 for settling scores, and SVM L2 for dashing executions. The outcome? Finality in sub-seconds and costs so low they hardly register – effectively making high-speed trading a reality and preventing liquidity catastrophes like the one at Bithumb.

The implications for builders are enormous, darling! By supporting Rust-based smart contracts via the SVM, Bitcoin Hyper flings open the doors to complex DeFi swaps, lending protocols, and gaming applications that were previously trapped on less glamorous chains. The market is signaling loud and clear that there’s a hearty appetite for this utility; protocols that can successfully awaken dormant BTC capital are currently stealing the show from mere governance tokens.

DO HAVE A GANDER AT BITCOIN HYPER ON ITS OFFICIAL PRESALE SITE

Smart Money Takes a Bow: Presale Metrics and Whale Delight

While retail traders clung desperately to the Bithumb charts, our more sophisticated actors seem to be twirling gracefully into the $HYPER presale. Internal whispers indicate robust inflows, with the project raking in over $31 million thus far. Such a level of liquidity infusion during a turbulent market suggests that institutional confidence in the ‘Bitcoin L2’ narrative is growing stronger than a fine Cabernet.

On-chain behavior corroborates this delightful trend. Smart money is on the move, with whale purchases as grand as $500K swooping in early. At a current price of $0.0136752, early entrants are banking on the chasm between the current valuation and the vast ocean of unwrapped Bitcoin liquidity waiting in the wings.

The tokenomics structure puts emphasis on alignment over mere mercenary capital. Bitcoin Hyper features a high APY staking program that springs to life immediately post-TGE, paired with a 7-day vesting period for presale stakers. This setup is designed to smooth out post-launch volatility, ensuring liquidity remains sticky rather than fleeting. And let me tell you, sticky is in vogue!

For investors watching the Bithumb calamity unfold from the sidelines, the security of a programmed L2 environment offers a stark contrast to the wild west chaos of spot exchange trading.

SNAG YOUR $HYPER NOW, DARLINGS!

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Goat 2 Release Date Estimate, News & Updates

- Best Werewolf Movies (October 2025)

- 10 Movies That Were Secretly Sequels

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- These Are the 10 Best Stephen King Movies of All Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

2026-02-06 19:54