- So, Bitcoin‘s price prediction just took a nosedive, and it’s not because it saw its reflection in a funhouse mirror. Thanks, U.S. equities market!

- Dropping below mid-range support? More like a dramatic cliffhanger that could lead to a deeper BTC correction to $92k. Cue the suspenseful music! 🎶

Bitcoin [BTC] has lost a whopping 5.88% in the last 24 hours. It was living its best life at $109,588 on January 20th, but now it’s in a slump that even a motivational speaker couldn’t fix.

But don’t worry, this sudden drop isn’t a sign that Bitcoin is weak. It’s just having a moment, like when you realize you’ve been wearing your shirt inside out all day. 😳

Meanwhile, China’s DeepSeek LLM model is crashing the U.S. stock market party. Nasdaq 100 futures are down 2.9%—that’s a lot of zeros disappearing faster than your New Year’s resolutions!

This panic has spilled over into crypto, and everyone’s de-risking like it’s a game of musical chairs before the FOMC meeting later this week. 🎤

Bitcoin price prediction — Range formation will have a play role

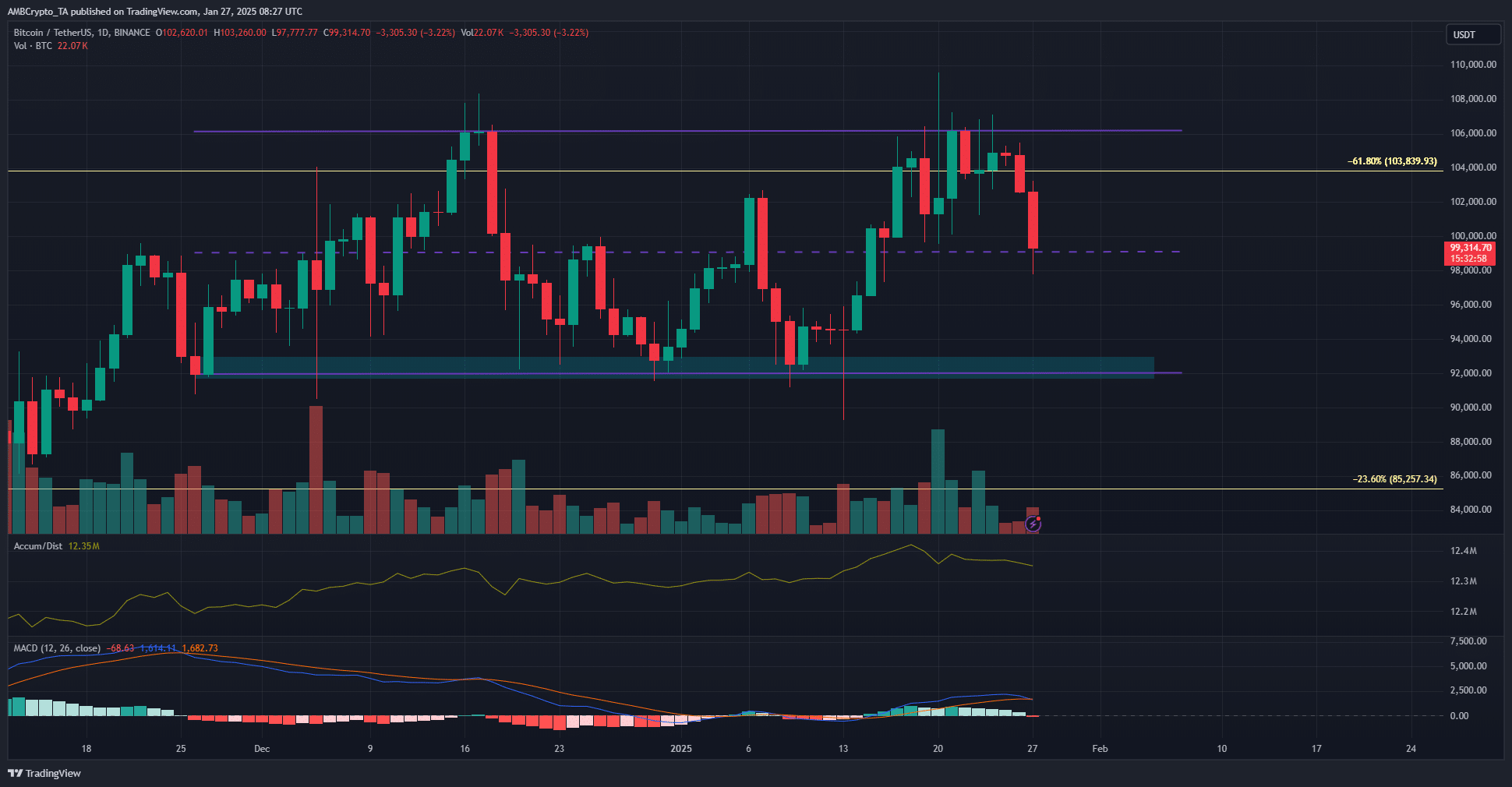

For the last two months, Bitcoin has been playing in a range from $92k to $106k. The mid-range level at $99k is like that one friend who always has to be the center of attention—crucial and dramatic!

Recent selling pressure has brought BTC to the mid-range support, and it’s not looking pretty. Think of it as a bad hair day for Bitcoin.

Trading volume is as muted as a library during finals week, but that could change when the New York trading session opens. So, traders, keep your eyes peeled and your snacks ready! 🍿

If Bitcoin drops below the mid-range level, we might be looking at a deeper price correction to $92k. Yikes!

In short, the Bitcoin price prediction is bearish for now. The MACD on the daily chart is signaling that the bulls are losing strength faster than a contestant on a reality show. 🐂💔

On the flip side, the A/D indicator is making higher lows, which means the selling pressure is more about the U.S. stock market drama than any inherent weakness in BTC. So, breathe easy, folks!

According to Coinalyze data, bearish sentiment is stronger than my coffee addiction. The funding rate has dipped into negative territory during this price drop, while Open Interest is seeing an uptick as prices fall below $102k.

This means more short-selling and bearish vibes in the derivatives market. But don’t panic! Crypto analyst Axel Adler assures us that panic selling isn’t happening—at least not yet. It’s more like a mild case of the jitters.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-01-28 00:10