-

Bitcoin has recently dipped to $57,770, marking a 21% decline from its peak.

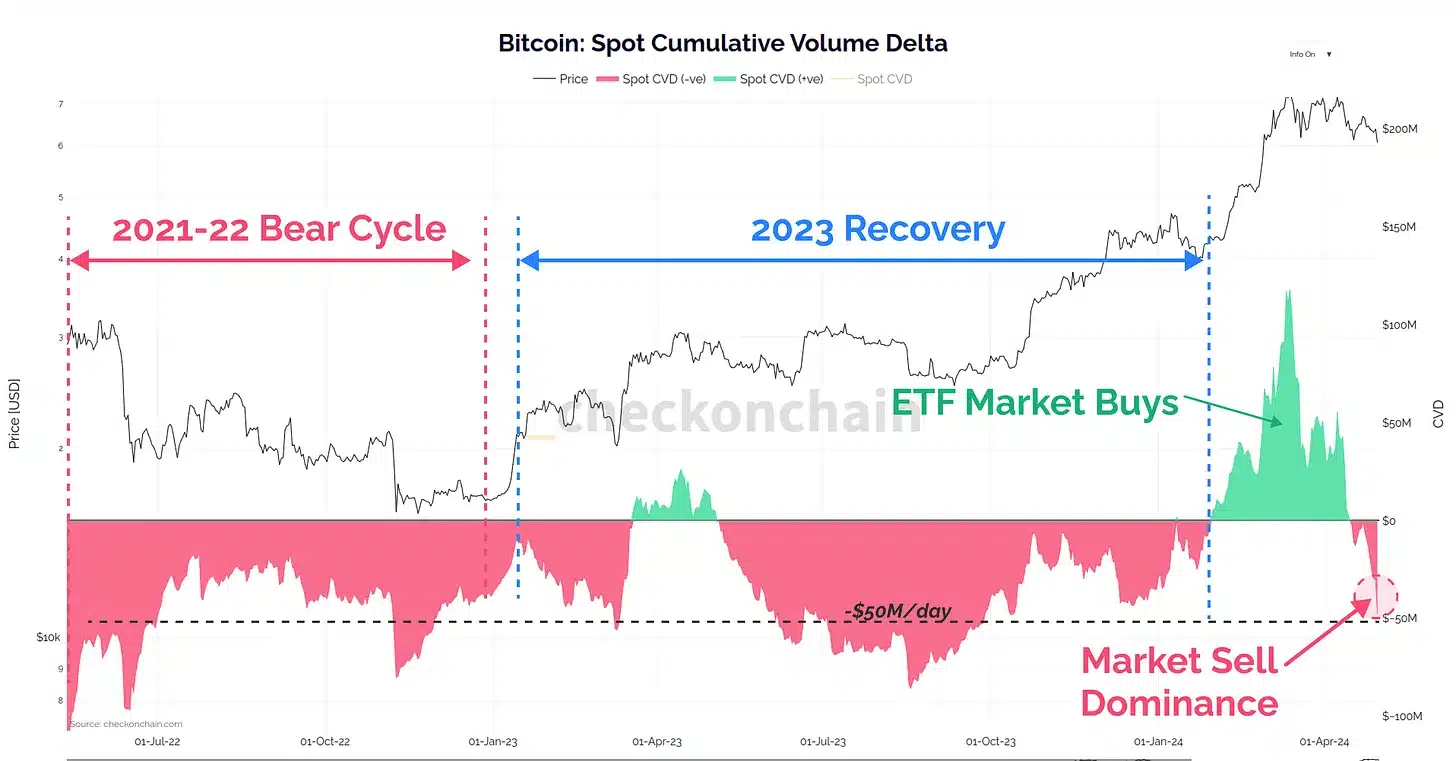

There is a shift in BTC Cumulative Volume Delta (CVD) to sell side pressure.

As a crypto investor who has witnessed the rollercoaster ride of Bitcoin’s price movements over the past few years, I can’t help but feel a mix of emotions as I observe the recent dip in BTC‘s value. The 21% decline from its peak to around $57,770 is indeed concerning, especially given the significant shift in Cumulative Volume Delta (CVD) to sell-side pressure.

The cryptocurrency sector has experienced notable price fluctuations in recent times, with Bitcoin taking the helm in this downturn. In just the past week, Bitcoin’s value dropped approximately 21% from its March high of over $73,000 – a considerable shift that significantly altered market conditions.

I’m currently observing Bitcoin’s price at around $57,770. Unfortunately, it’s trending downwards, showing a minor decrease of 0.2% over the past 24 hours.

Market mechanics and the role of derivatives

James Check, an expert in on-chain analysis, explored the reasons behind Bitcoin’s recent downturn in a comprehensive report. He identified parallels between the present market scenario and the 2021 market crash. During that event, overreliance on leveraged positions in Bitcoin futures contracts resulted in a sudden and painful price drop.

In this situation, the scenario appears to deviate somewhat from the norm. Although there’s a significant rise in long positions being closed out, it’s important to note that the total open interest for futures contracts isn’t excessively high given the market’s size. This implies that derivatives may not be the main instigator of the ongoing sell-off.

Instead, Check suggests looking at the on-chain and spot market data for clearer insights.

The Cumulative Volume Delta (CVD) shows a notable change, moving towards increased sell activity. This means that sell orders are about $50 million greater in volume than buy orders each day.

This change represents a move away from the intense purchasing behavior that marked Bitcoin’s peak price.

The ETF influence and future outlook

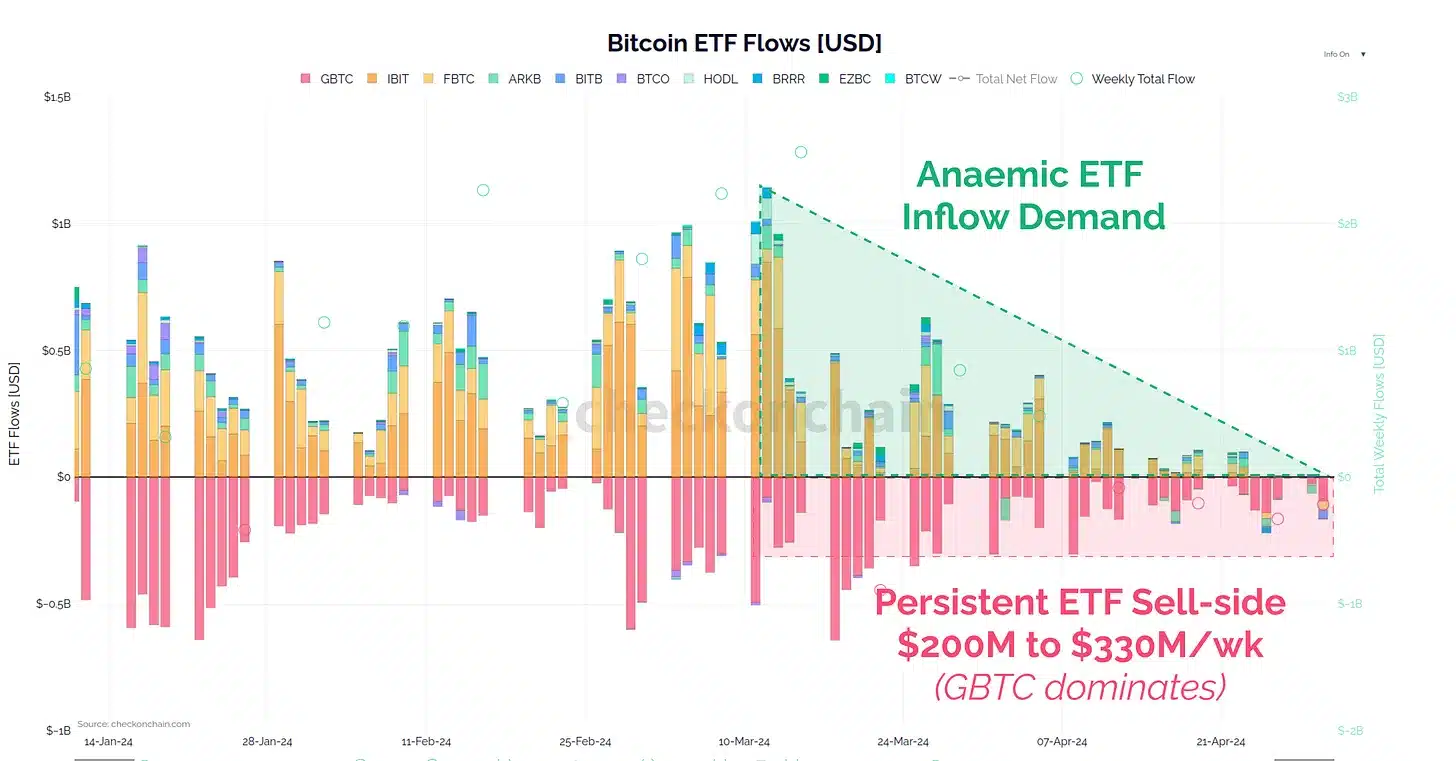

As a crypto investor, I’ve noticed that the market’s reaction to recent ETF (Exchange-Traded Fund) activities provides valuable insights into investor sentiments. Specifically, Bitcoin ETFs have seen muted interest from investors, with noticeable withdrawals occurring over the past few weeks.

As an analyst, I’ve observed a significant decrease in investments, totaling between $200 million and $330 million, flowing out of the Grayscale Bitcoin Trust (GBTC) and other institutional investment funds. This trend implies a waning appetite for these assets among larger investors.

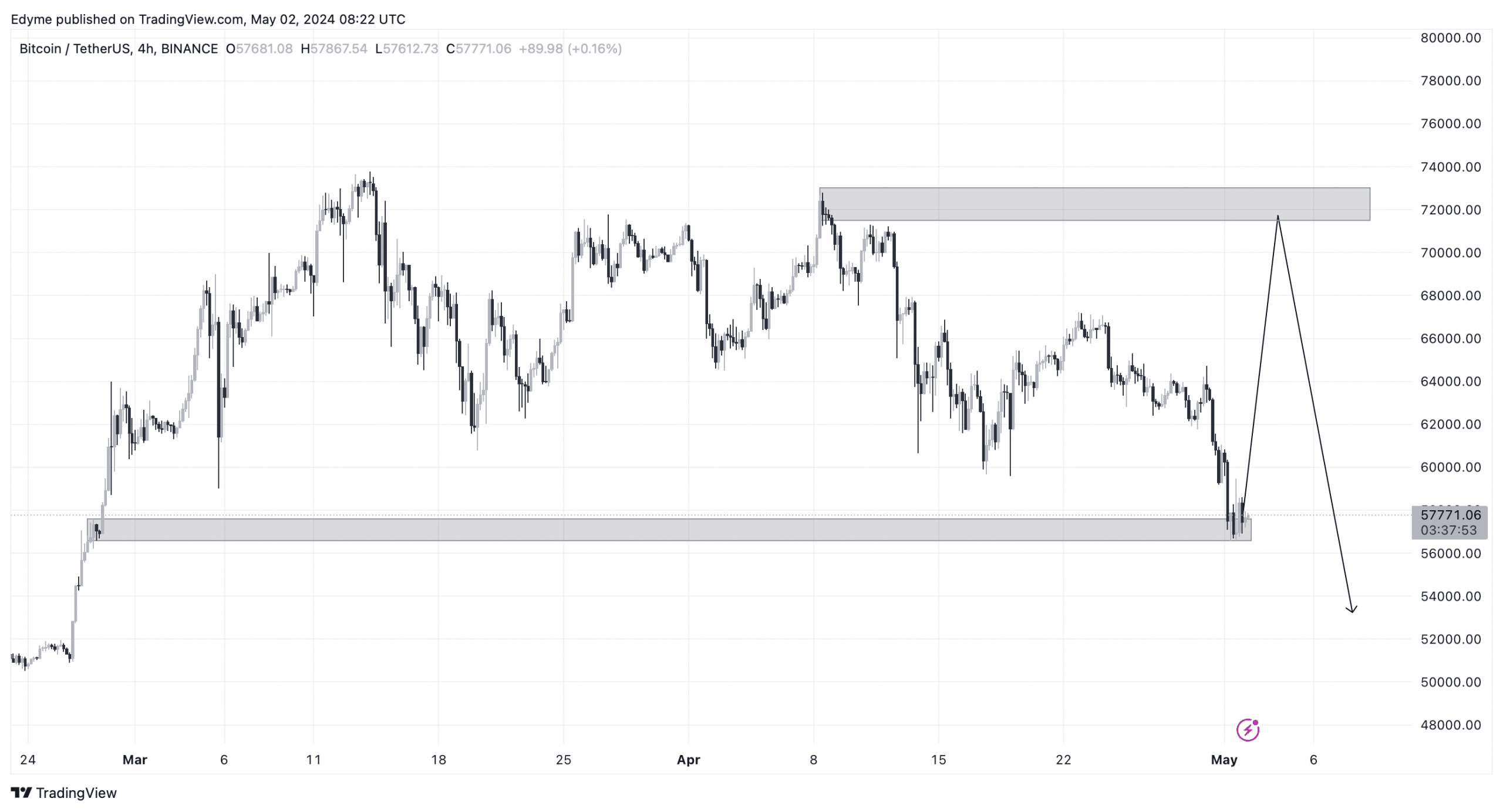

Although the present situation looks dismal, there’s reason to believe that a recovery may be on the horizon. In terms of technology, Bitcoin has shattered its support and headed southward.

On the 4-hour chart, the price has reached a significant support area. This area, marked by a past concentration of buy orders, has previously triggered price increases.

Significantly, this role may spark a short-term surge, enabling Bitcoin to amass more resources at elevated prices before potentially declining further.

As a researcher, I’ve come across some intriguing perspectives from notable analysts like Michael van de Poppe. They believe the market could be approaching a bottom based on their analysis. Van de Poppe specifically points out that altcoins are gaining ground against Bitcoin. Historically, this trend has indicated the start of broader market recoveries.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-05-02 19:04