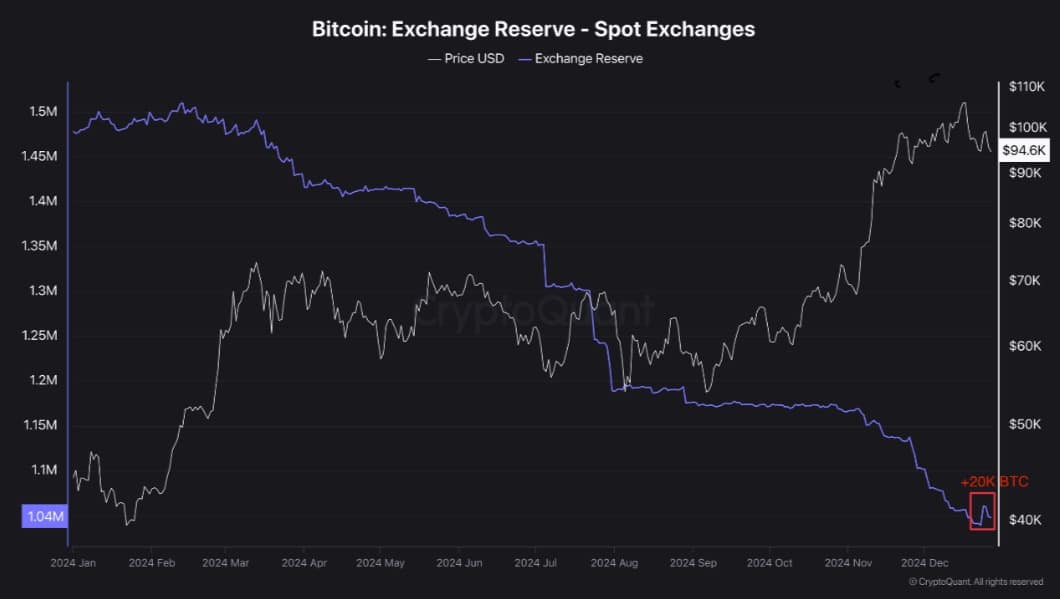

- Bitcoin’s exchanges reserves saw an upswing with +20k BTC inflows

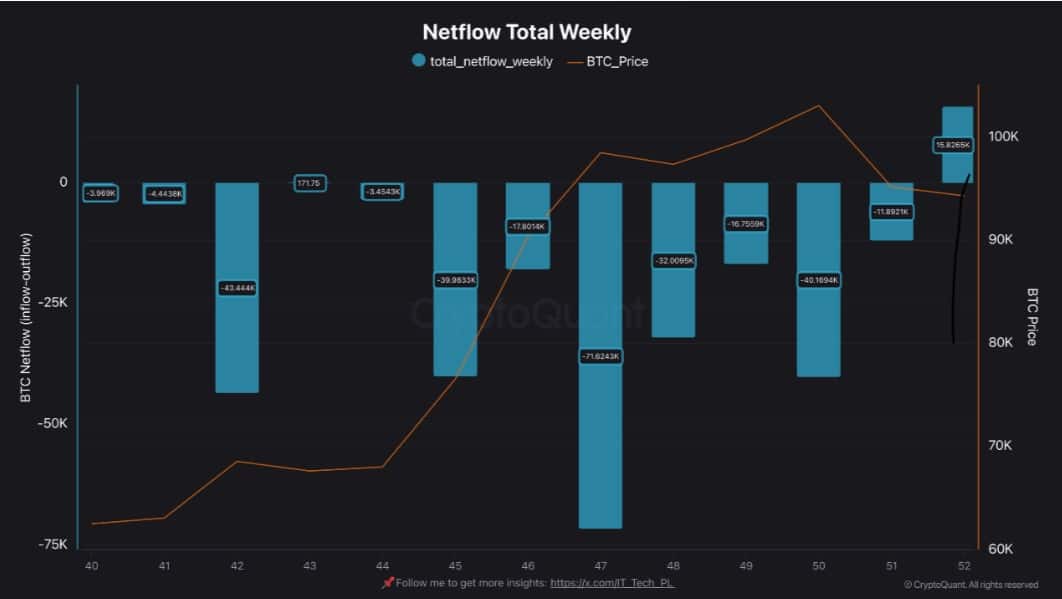

- Bitcoin’s netflow turned positive after weeks of decline

As a seasoned researcher with over a decade of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The recent surge in Bitcoin’s exchange reserves and netflows has piqued my interest, as it often serves as an early warning sign for potential market corrections.

After reaching its peak of $108,000 on the price charts, Bitcoin [BTC] has been facing difficulty in moving forward on these charts. In reality, this cryptocurrency has been moving horizontally over the last fortnight. At the moment of writing, Bitcoin was being traded at $94,480 after experiencing a 2.01% decline within the previous 24 hours.

It’s no secret that the current market situation has sparked discussions among analysts regarding Bitcoin’s possible price trend, and some predict it could experience a downturn.

One of the well-known analysts from Cryptoquant, namely IT Tech, has forecasted a possible market adjustment due to increasing reserves and inflows.

Bitcoin’s reserves and exchange netflows soar

Based on Cryptoquant’s analysis, Bitcoin’s performance indicators suggest a possible shift in market trends.

Example – The inflow of 20,000 Bitcoins into BTC’s spot exchange reserves has significantly increased lately, contrasting the regular decrease observed in the past month as investors moved their assets away from exchanges.

When the amount of Bitcoins held in reserve wallets consistently increases, it suggests that more Bitcoin is being transferred to exchanges.

Typically, this suggests a desire to engage in buying or selling transactions, possibly leading to increased supply. Consequently, it might serve as an early warning sign for short-term market fluctuations or adjustments.

Furthermore, the net flow of Bitcoin on all trading platforms shifted positively, registering an increase of approximately 15,800 Bitcoins. This change in direction suggests a reversal from the previous downward trend. When net flows become positive, it means that deposits into exchanges are exceeding withdrawals, indicating increased activity and potential buying interest.

When there’s an increase in inflows (netflows) and a growing reserve, it suggests that Bitcoin investors may be more likely to engage in actions aimed at realizing profits.

The shifts in the market could be indications of increasing wariness among investors or a change in overall market opinion. Essentially, it seems that investors might be planning to cash out their profits or foresee a possible adjustment in prices.

As I delve deeper into my analysis, if these two indicators persistently increase, I anticipate a heightened market turbulence for Bitcoin, potentially causing a short-term price decrease.

Impact on BTC Charts?

Typically, an increase in transactions at exchanges often reflects investors’ diminished trust in the market, suggesting a dominant bearish outlook.

This bearishness is not only prevalent among retail traders,

However, it’s worth noting that a significant increase has been observed in the number of large wallet holders. According to IntoTheBlock, the ratio of these large holders’ net flow to exchange net flow has jumped dramatically within the last week, rising from -0.04% to 0.27%. This marked rise suggests that whales have been transferring assets to exchanges – a pattern that typically precedes selling. Such behavior often puts pressure on the price to decrease due to the potential for increased supply.

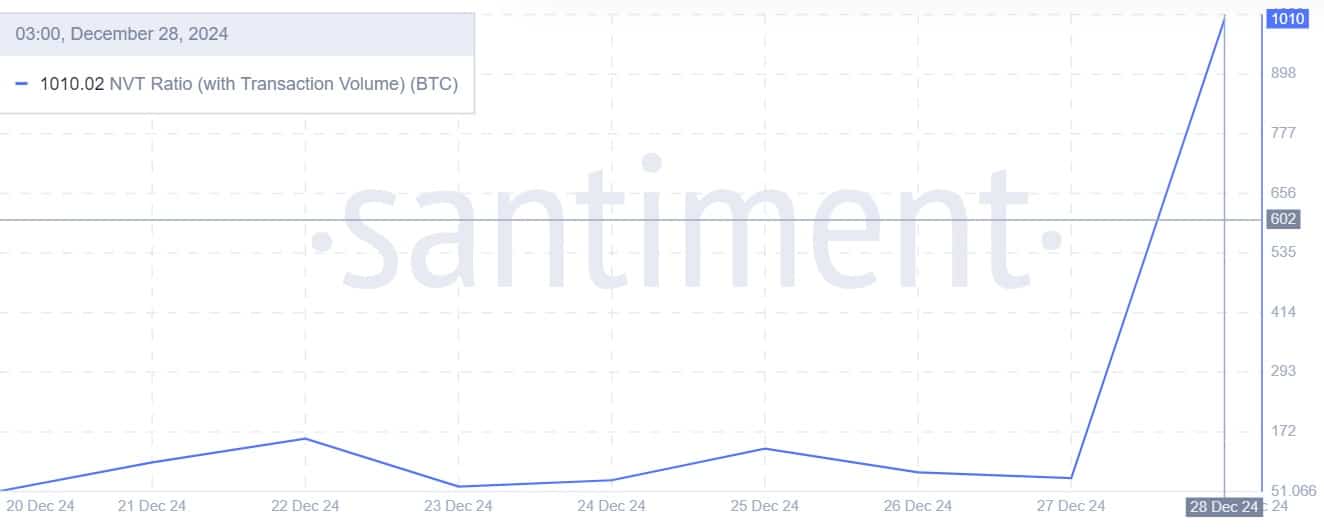

To summarize, the Network Value to Transaction Volume (NVT) ratio, including transactions, surged significantly to reach 1010.02. This suggests that Bitcoin’s market capitalization is remarkably greater than its daily transaction volume, implying a potentially high value relative to its trading activity.

In the past, when the NVT ratio surges to unusually high levels, similar to what we’ve witnessed recently, it has frequently been a precursor for market adjustments or corrections. This is because markets typically rebalance themselves according to the essential foundations beneath them.

In simpler terms, it appears that the present market trends might lead to a possible market adjustment or downturn. If the existing investor mood continues, Bitcoin’s price could experience drops according to the charts.

There’s a possibility that the value of Bitcoin might decrease to around $92,700. If it doesn’t manage to maintain this level as support, there’s potential for a further drop to approximately $86,000.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-12-28 15:04