- Bitcoin’s expanding triangle pattern signals high volatility, setting the stage for a breakout or drop.

- MVRV ratio suggests holders are in profit, but there’s room before critical profit-taking levels are reached.

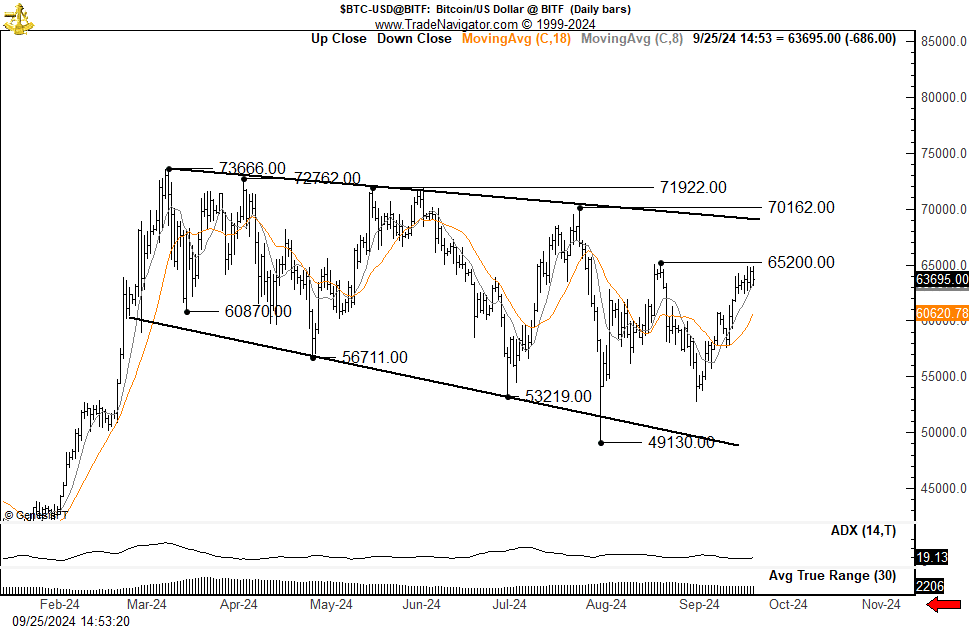

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I find myself closely monitoring Bitcoin’s current expanding triangle pattern. This formation, while often seen as a sign of indecision and increasing volatility, can set the stage for dramatic shifts in either direction – a breakout or a drop.

Currently, the price of Bitcoin (BTC) is creating a widening triangle formation, which has drawn the focus of financial analysts.

As I analyze this market trend, I notice a widening price movement, which indicates that the market is uncertain, showing signs of heightened volatility.

According to crypto expert Peter Brandt, Bitcoin has been forming a series of progressively lower peaks (highs) and troughs (lows), and it’s likely this trend will continue unless the price breaks significantly above the levels reached in July.

The present technological configuration might pave the way for a significant surge or potentially increase the chances of negative developments.

Expanding triangle and support levels

Bitcoin’s widening triangle pattern indicates a growing sense of apprehension in the market, as it is characterized by increasingly large fluctuations, which typically suggest heightened volatility. In the past, similar formations have frequently been followed by significant price shifts, whether they trend upwards or downwards.

Keeping an eye on the key support levels of approximately $49,130 and earlier lows at around $53,219 for Bitcoin is essential. If it drops beneath these levels, it might suggest a possibility of additional price decreases, which could potentially result in larger losses.

Currently, Bitcoin is being exchanged at approximately $63,838.14. In the last day, it has experienced a minute rise of 0.01%. Over the last week, there has been a notable jump of 2.85%.

As an analyst, I find myself poised and alert, watching intently as the market stands tense, anticipating a definitive action. At present, the price is flirting precariously close to significant resistance points.

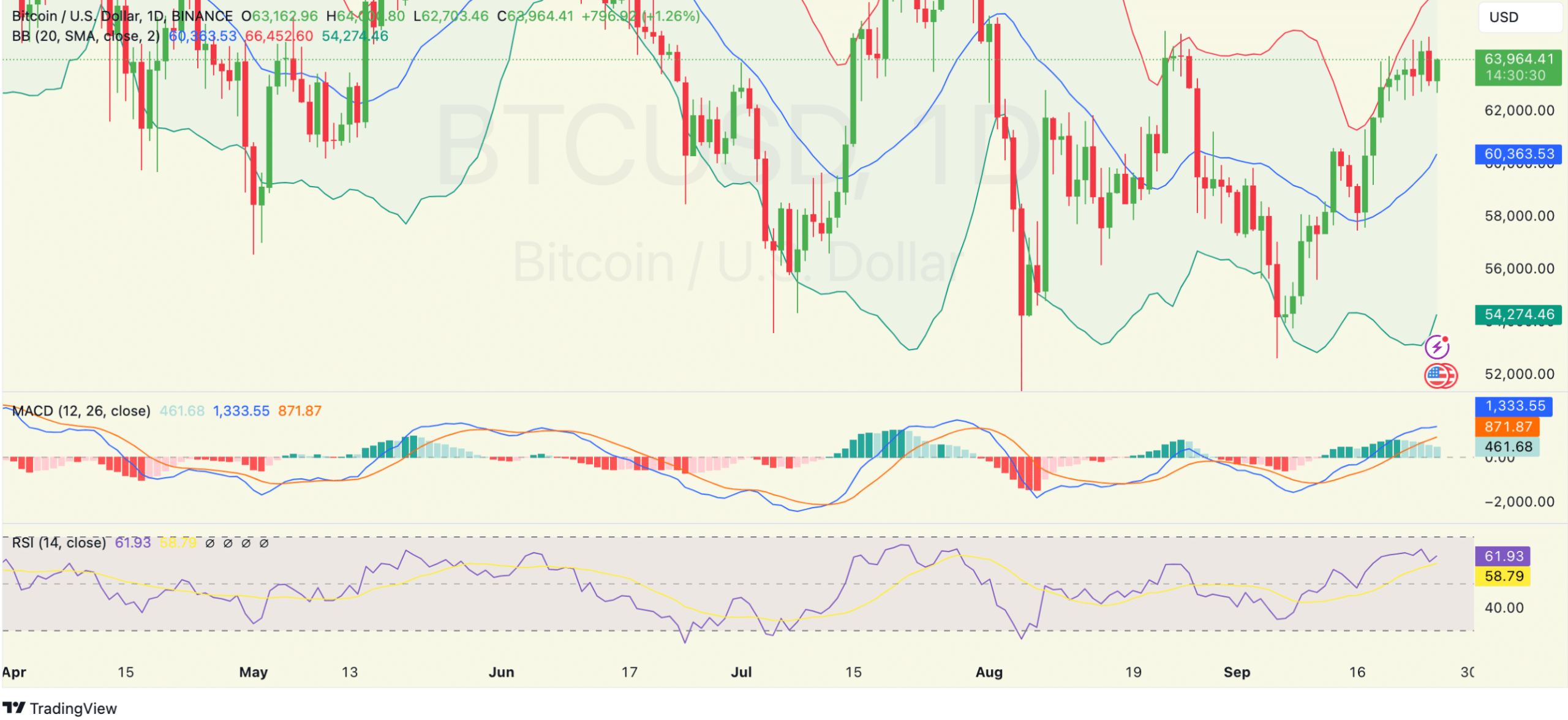

Bollinger bands and momentum indicators

The price action is consolidating near the upper Bollinger Band, which suggests Bitcoin is testing resistance at around $63,800.

As an analyst, I’ve noticed that when the bands widen, there might be an upcoming surge in market volatility, a pattern typically preceding substantial market shifts. If Bitcoin successfully maintains its momentum beyond the current resistance level, such a move could hint at potential continued upward trajectory.

Instead, if this level isn’t maintained, there’s a possibility of a retreat towards the middle band around $60,355.

In simpler terms, when momentum indicators like the MACD (Moving Average Convergence Divergence) have the MACD line positioned above the signal line and it’s in a positive region, this suggests a bullish outlook or optimistic stance for potential price increases.

However, declining histogram bars hint at a slowdown in bullish momentum, raising caution for traders.

Keeping an eye out for a possible bearish crossover might signal an upcoming change, so it’s important to closely watch those technical indicators for potential signs of a trend reversal.

In simpler terms, the Relative Strength Index (RSI), which measures Bitcoin’s price changes, is roughly 61 at the moment. This suggests that Bitcoin is experiencing a strong upward trend, but it’s not yet showing signs of being excessively overvalued.

This indicates that there’s potential for prices to rise more before hitting levels that are usually associated with being overbought, at which point selling (or profit-taking) tends to occur.

If the Relative Strength Index (RSI) goes beyond 70, traders might notice an increase in selling activity, which could result in a drop in prices.

Bitcoin profits near peak?

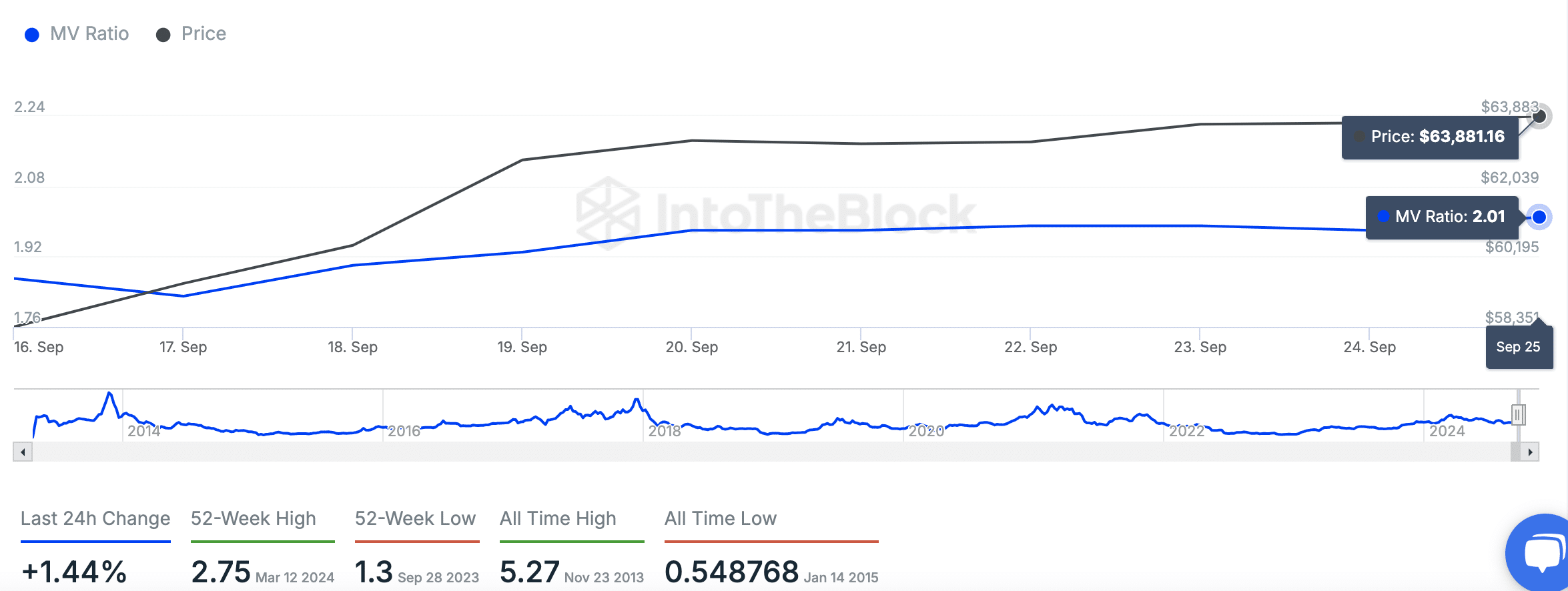

According to on-chain analysis, the Multiple of Realized Value to Market Value (MVRV) for Bitcoin stands at approximately 2.01, meaning the current market value is twice as much as the realized value.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The increase in this ratio indicates that more and more holders are moving into a profitable position. If this trend persists, it may prompt some of them to sell.

Yet, since the MVRV is yet to surpass its 52-week high of 2.75, it suggests that there’s still some space to go before we hit notable profit-taking points in history.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-27 03:04