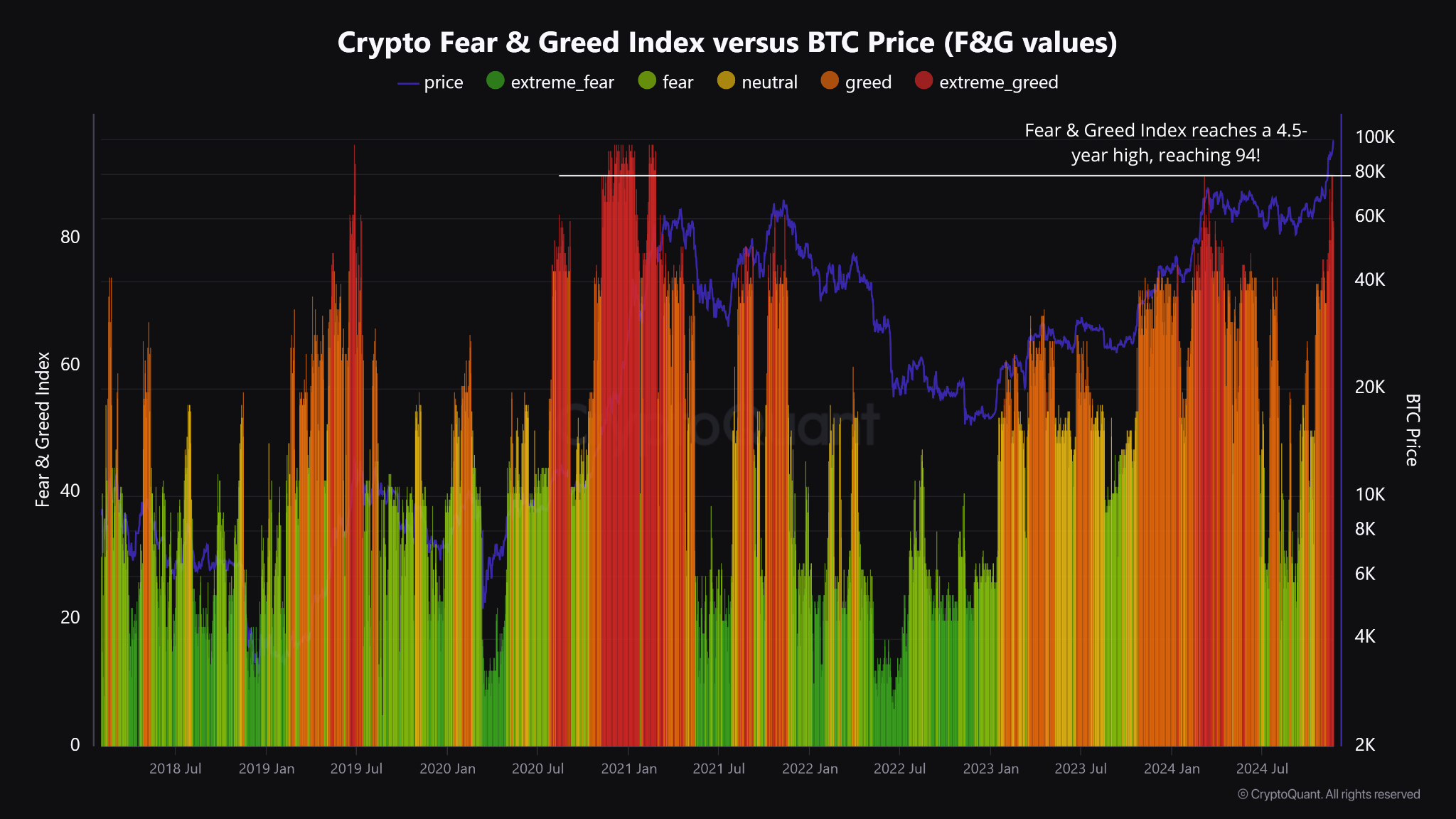

- BTC’s ‘extreme greed’ hit 2020 highs, which preceded a 50% price pullback.

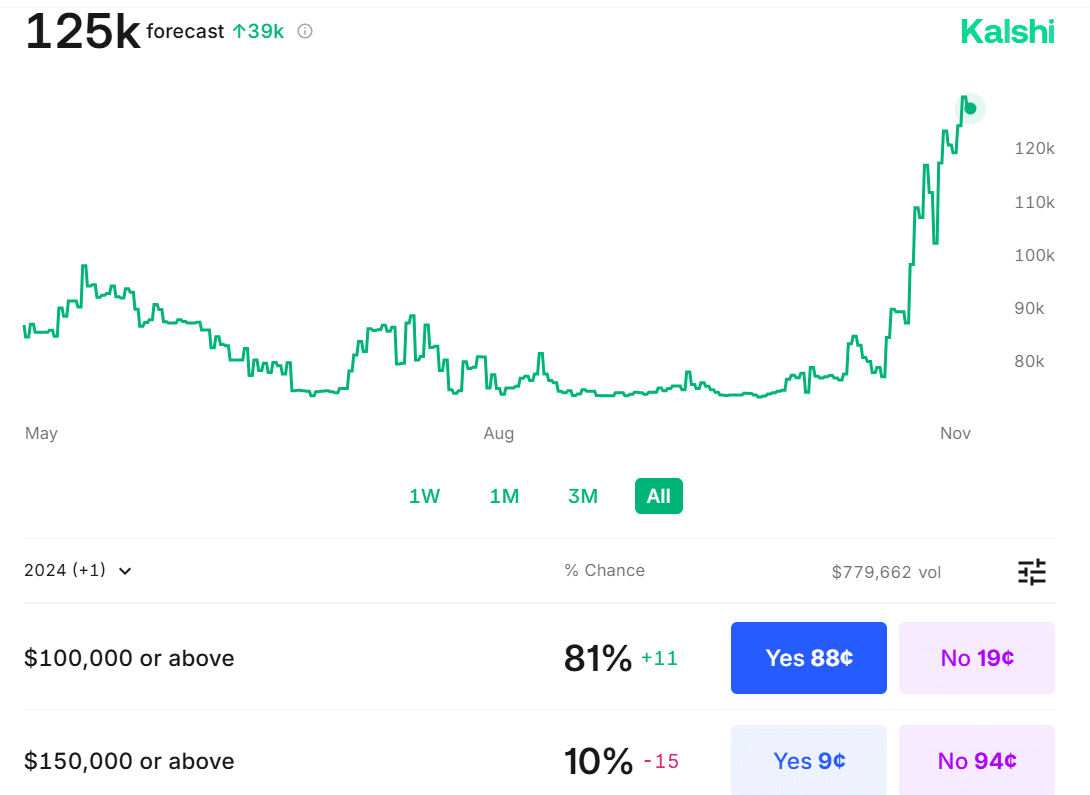

- Markets were pricing highly the likelihood of BTC soaring above $100K.

As a seasoned analyst with over two decades of market experience under my belt, I’ve seen countless bull and bear cycles unfold. The current Bitcoin [BTC] scenario reminds me starkly of 2020, when we witnessed an unprecedented surge followed by a significant pullback.

The anticipation that Bitcoin‘s [BTC] value could reach $100K has driven the market to an ‘extreme greed’ state in 2020, a condition often followed by a decrease in price by around 50%.

According to CryptoQuant data, BTC’s Fear and Greed Index (FGI) hit a 4.5-year high of 94.

Remarkably, the recent development seems to have followed a similar trajectory as the one observed in 2020. A ‘high greed’ level of 94 was reached in November 2020.

Approximately three months into February 2021, Bitcoin (BTC) experienced a 20% drop. By mid-year, this decline extended to a total of 50%. However, prior to this setback, BTC had surged an impressive 250% over a span of just three months.

Markets pricing above $100K

Additionally, it’s important to mention that Bitcoin experienced a significant drop of 250% during the first half of 2021. However, it managed to surge back by 120%, reaching a peak of $69K during the second half of the same year – marking a cycle high.

As a researcher, I’ve been closely observing market trends, and it seems plausible that we might witness a cooling phase in either the early or late parts of 2025. Similar expectations have been shared by many cycle analysts, including Alex Kruger, who has consistently maintained this outlook.

“In 2021, the top signals started to roll in February.”

Will the pattern influence BTC between now and early or late 2025?

Currently, projections from prediction markets suggest that Bitcoin could potentially exceed $100K, with a likelihood of about 81%, while there’s a 10% chance it might even reach $150K by the end of this year, as per Kalshi’s analysis.

According to VanEek’s projections, the cryptocurrency might reach a peak of $180,000 in its current cycle.

The firm cited the pro-BTC regulatory environment and post-2020 election phase of +10% funding rates. Part of its mid-November BTC report read,

Looking ahead, we expect another stretch of strong results, similar to the performance we saw following the 2020 election where consistently high funding rates led to an impressive 260% increase over a 186-day period. Our prediction for a price of $180k continues to be feasible.

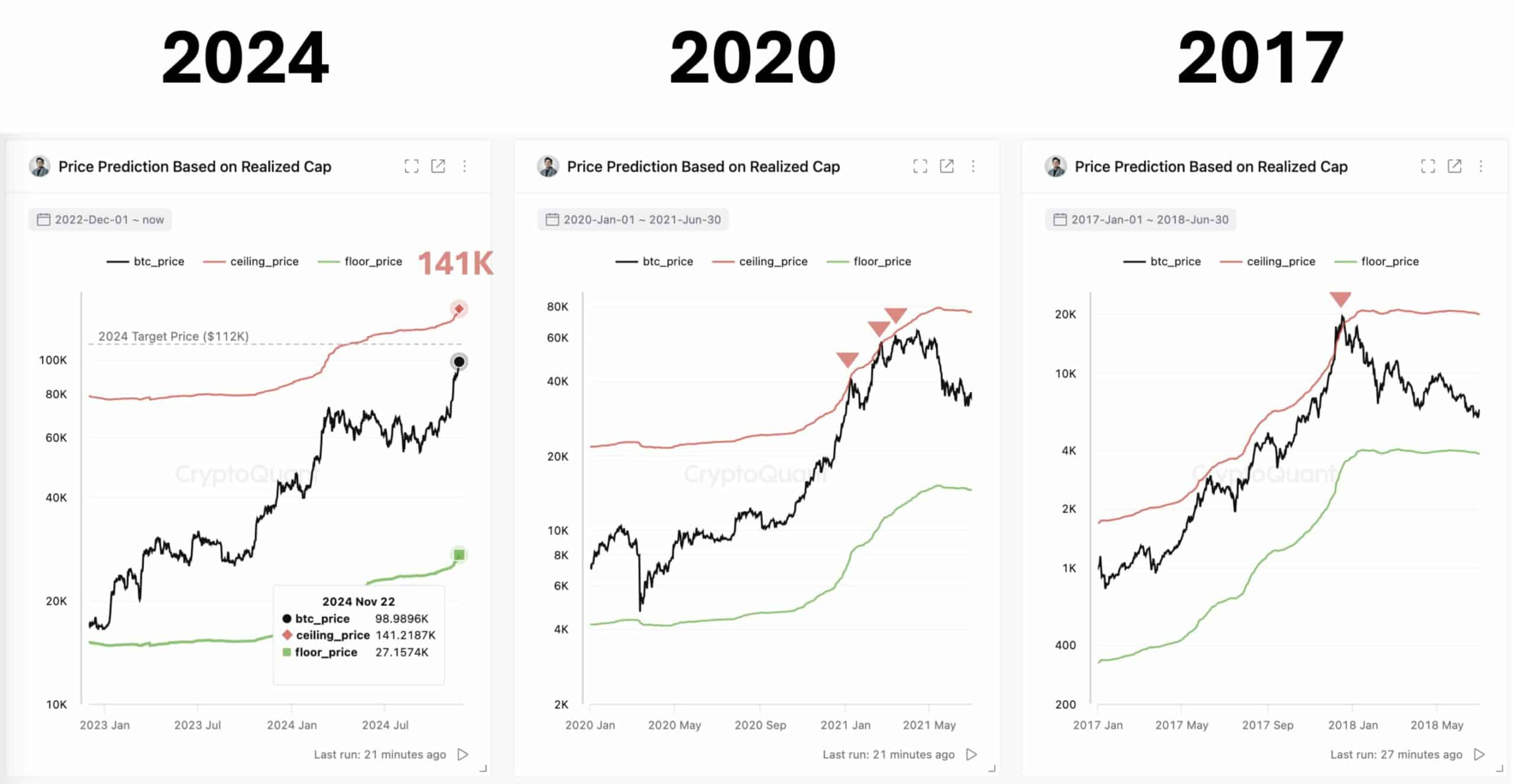

As a researcher delving into the realm of cryptocurrencies, I’ve come across projections by CryptoQuant’s founder, Ki Young Ju. He anticipates a more modest cycle peak at approximately $141,000 and sets his sights on a 2024 target price of $112,000, based on the realized capitalization methodology.

He noted that the market was not yet overheated. In 2020 and 2021, BTC topped after tapping the upper band of the realized cap.

Essentially, there was a belief that Bitcoin (BTC) might surge past $100K, given the high ‘extreme greed’ sentiment among investors. Yet, signs of a possible peak may emerge as early as 2025.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-24 14:15