As a seasoned crypto investor with a decade-long journey through the digital asset market, I’ve witnessed Bitcoin’s resilience and its uncanny ability to mirror political events, particularly U.S. presidential elections. With the current state of the Fear & Greed Index and BTC price action, I can sense the winds of change brewing.

As a researcher studying the dynamics of Bitcoin, I’m closely watching the upcoming U.S. Presidential elections. The outcome of these elections could potentially trigger a significant rollercoaster ride for BTC, given its strong correlation with global economic and political events. The direction and magnitude of Bitcoin’s movement will be heavily influenced by the election results.

Previously, Bitcoin (BTC) has often exhibited substantial fluctuations in price during election periods. It’s possible that the current situation might also display a comparable pattern.

As reported, the Bitcoin Fear & Greed Index stood at ‘greed’ at the moment, implying a potential price surge could be influenced by the impact of the U.S. election results on cryptocurrency markets.

The voting processes in the U.S., particularly those involving elections, tend to influence the value of digital currencies such as Bitcoin significantly. Given its massive economic standing, the United States holds considerable sway over market fluidity.

In the past three elections, Bitcoin’s value has generally risen as traders have expected favorable profits due to potential positive political shifts.

As a researcher examining the potential impact of the U.S. presidential election on Bitcoin (BTC), I find it intriguing that some analysts predict a significant rally for BTC if Donald Trump were to win, primarily due to anticipation of a pro-crypto stance. Conversely, while a Kamala Harris victory might also bolster BTC, the potential growth could be relatively more restrained compared to the scenario with Trump’s presidency.

Historical BTC price action and MVRV Z-Score

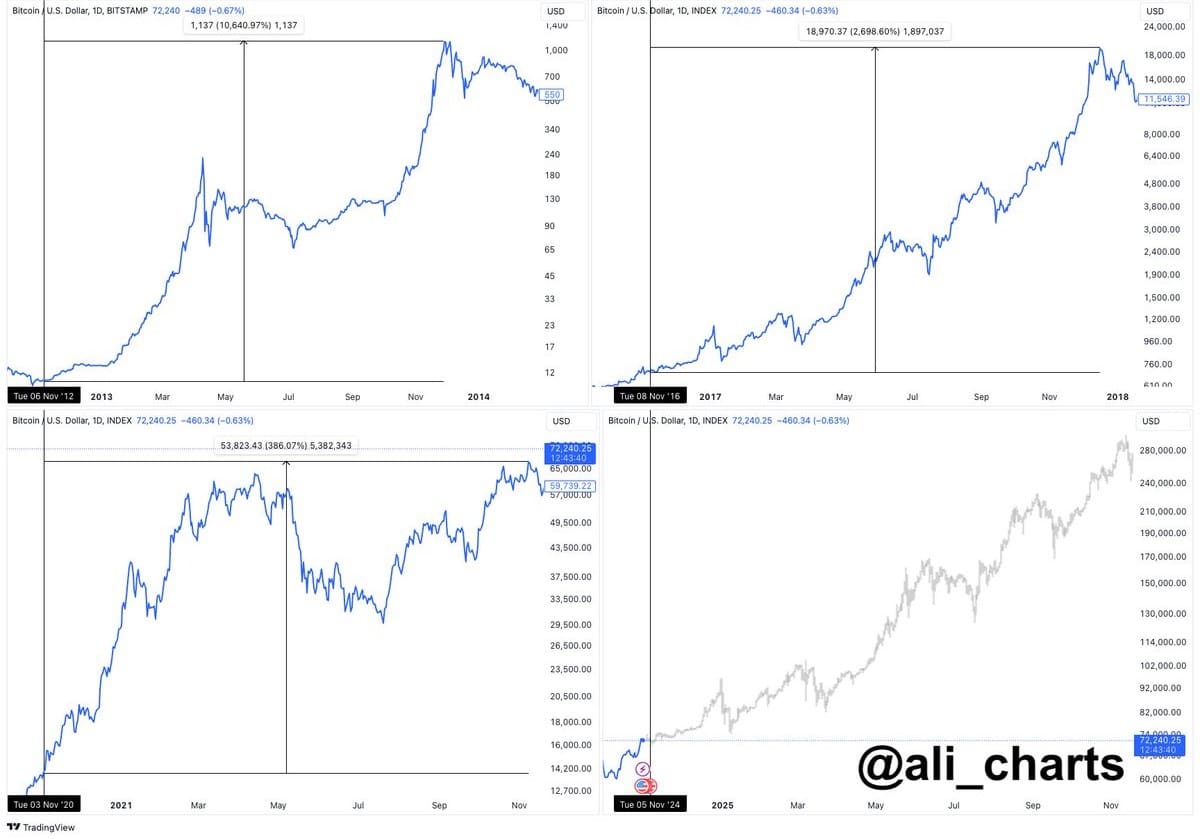

Analyzing past election periods can provide valuable clues about Bitcoin’s possible growth trends. For instance, during the 2012 election, Bitcoin experienced a staggering increase of more than 10,000%, while the 2016 election led to a gain of approximately 2,698%. The most recent 2020 election saw Bitcoin climb by about 386%.

As I delve into my ongoing research, I’ve noticed that with each passing election year, Bitcoin’s returns have progressively shrunk. However, it appears highly plausible that Bitcoin’s behavior will continue to be influenced by the results of this election.

As political debates about Bitcoin and digital currencies grow louder during this period, it’s possible that the volatility of Bitcoin could increase significantly.

If Donald Trump wins the election, it might lead to more dramatic price increases (parabolic moves). On the other hand, if Joe Biden wins with Kamala Harris as Vice President, the market could still see growth, but it may be at a more moderate or gradual rate.

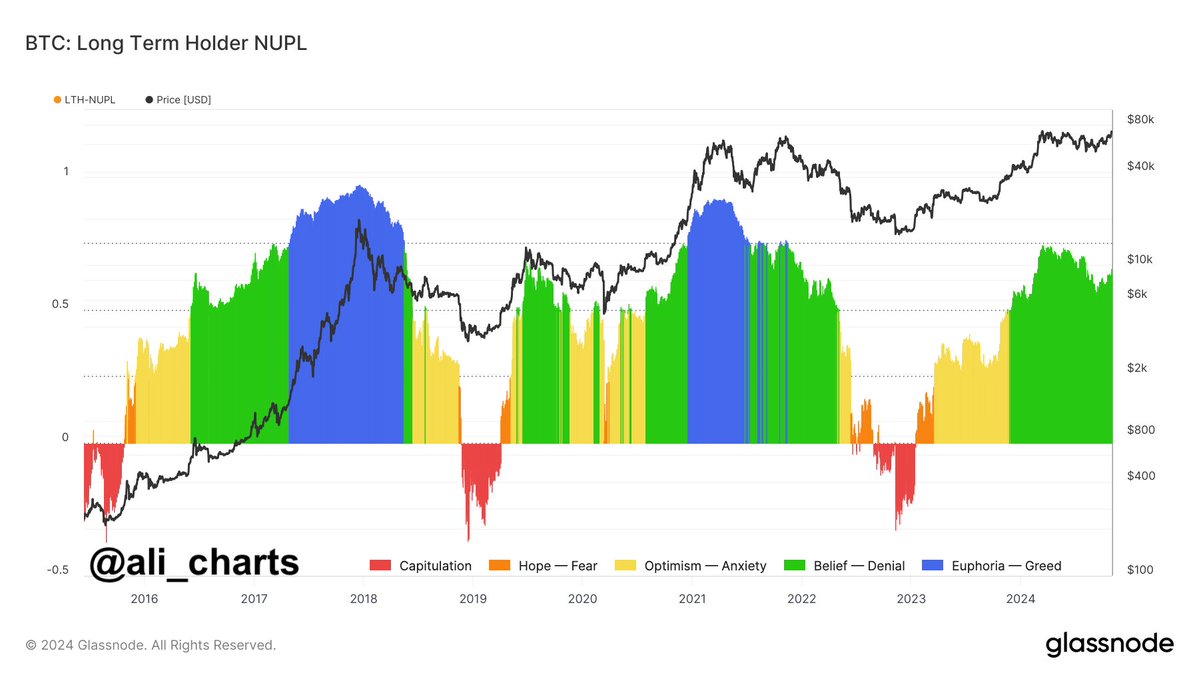

Speaking about Bitcoin’s value, the MVRV Z-Score indicates a high possibility of price increase. This score compares market capitalization with realized capitalization, which helps determine if Bitcoin is being overpriced or underpriced in the market.

Given the current MVRV Z-Score is approximately 2, Bitcoin may continue its upward trend towards around 6. This level could trigger profit-taking among long-term holders, potentially resulting in a subsequent correction.

Historically, this measurement has been a dependable signal for identifying Bitcoin’s high points, and the present readings imply that Bitcoin might not have hit its maximum value just yet.

People adhering to this measure anticipate that Bitcoin might persist in its rising trend, given the increasing demand indicated by growing buying activity.

Active addresses momentum

It seems that technical indicators are pointing towards a possible price surge. Recently, the 30-day moving average has gone over the 365-day moving average, which is known as a “golden cross.” This pattern is typically seen as a bullish sign, suggesting strong upward trends may be on the horizon.

With this blend and the surge in transaction numbers – almost twice as much as last year’s period – it suggests a rise in market interactions and demand for purchasing.

If the 30-day moving average doesn’t continue to stay above the 240-day moving average, it could signal a pause in Bitcoin’s upward trend, reminiscent of the period in mid-2021 when the momentum slowed down.

Read Bitcoin (BTC) Price Prediction 2024-25

The price of Bitcoin appears ready to take substantial steps based on the results of the upcoming election. Although the overall sentiment seems positive, it’s crucial for investors to stay vigilant because market circumstances can change rapidly.

As volatility may rise, the direction of Bitcoin will primarily hinge on the evolving political environment and sustained investor enthusiasm.

Read More

2024-10-31 20:08