-

Analysts are highlighting several catalysts for BTC’s move to an ATH including a potential ‘golden cross’ formation.

Further, both technical and on-chain data signaled a bullish outlook for BTC but after a pullback.

As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous trends and cycles that have shaped the trajectory of various assets. The recent surge in Bitcoin’s price has piqued my interest, as it seems to be following a familiar pattern.

Over the past weekend, Bitcoin‘s value spiked, momentarily reaching $60,000 once more. But currently, its price stands at approximately $58,507.40.

Over the past seven trading days, I’ve observed a rather subtle 0.14% increase in price, but what stands out is a significant 33% surge in trading volumes. This suggests a rising curiosity among investors.

Despite the present slow change in prices, two analysts posit that this pattern is merely temporary and support their optimistic viewpoint.

Based on the insights shared by these analysts, and after conducting our own independent evaluation, it appears that an significant rise in Bitcoin’s value is highly likely at this moment in time, as suggested by our analysis.

Experts’ view on why a BTC rise is imminent

One cryptocurrency expert, known as Moustache, recently issued a gentle warning, drawing attention to a long-term trendline pattern that Bitcoin (BTC) has consistently followed as a barrier for price increases and a floor during declines, over the past 11 years.

Based on the graph he provided, it seems that this trendline could once more play a significant role as a support level, much like it did earlier in the year.

If Bitcoin (BTC) rebounds from this trendline, it might lead to a swift rise, much like the way previous trends saw the same trendline function as support and trigger an upward movement.

Moustache also noted that Bitcoin’s simple moving average indicates a potential rally.

He added

“First ever golden cross of the 50/100 SMA is also in the making.”

If the 50 Simple Moving Average (represented by a red line) goes over the 100 Simple Moving Average (represented by a blue line), Bitcoin could experience a significant price surge, possibly reaching the $60k region or even beyond.

While this bullish outlook is clear, another analyst, Mister Crypto, has added to the optimistic sentiment. He shared a chart demonstrating BTC’s performance post-Bitcoin halving.

In both instances, Bitcoin’s value surged noticeably after halving in 2016 and 2020, setting new record prices every time.

Mister Crypto described this pattern as:

“A #Bitcoin supply shock is coming”

If this historical trend persists, it’s reasonable to anticipate that the price of Bitcoin might fluctuate around the $60,000 to $70,000 bracket in the near future.

Golden Cross might drive BTC’s rise to $70k

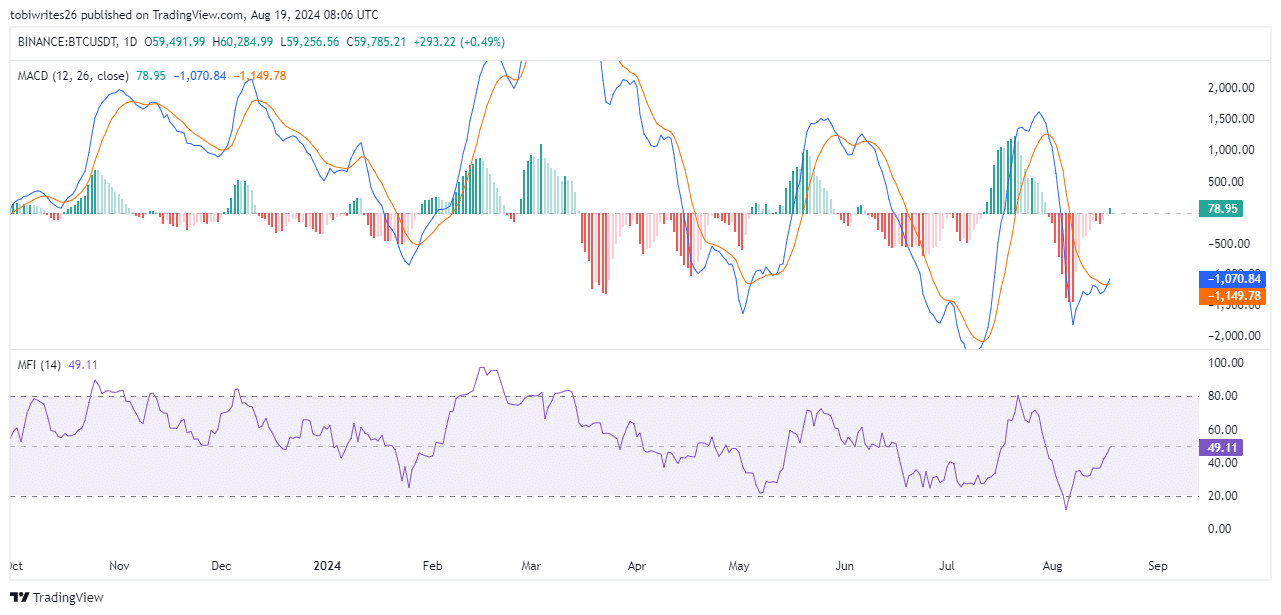

Based on the most recent examination by AMBCrypto, Bitcoin (BTC) has recently experienced a ‘golden cross’ event in its moving average convergence and divergence (MACD) chart indicators.

In simpler terms, a golden cross happens when a moving average indicator’s faster line (represented by blue) goes over the slower line (orange). This event often indicates a positive shift in the market trend, suggesting a potential increase in the asset’s price.

As I observed recently, when a particular pattern emerged on July 12, Bitcoin’s price climbed significantly from around $56.5k to roughly $70k by July 29. If this trend persists, we might expect similar peaks in the upcoming weeks.

An examination of the Money Flow Index (MFI), a technical tool combining price and volume information to detect overbought or oversold situations and predict price fluctuations, shows that buyers are slowly gaining dominance in the market.

Over the last several days, the Money Flow Index (MFI) has been consistently rising and is presently at 49.11. If this upward momentum continues, we might see Bitcoin’s price reaching or surpassing $70,000 in the near future.

Anticipated pullback before a leg-up

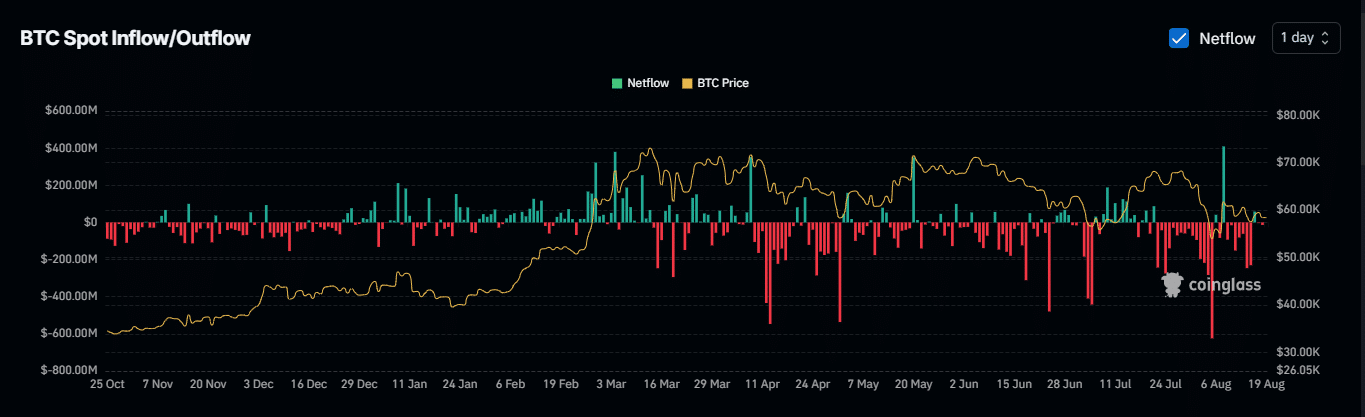

Over the course of both weekly and daily periods, an analysis of Netflow data related to Bitcoin (BTC) reveals a largely optimistic or bullish market trend according to Coinglass.

Transferring Bitcoin (BTC) from exchanges to cold storage indicates that owners are less likely to trade their BTC immediately, as moving funds to cold storage often means a desire for long-term holding.

This reduction in BTC supply on exchanges could drive up demand, potentially pushing prices higher.

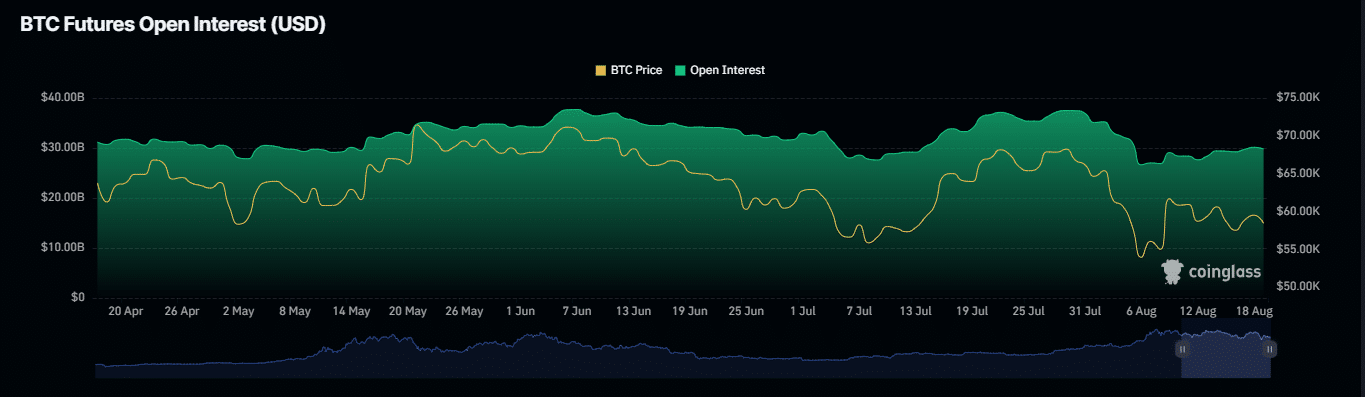

Translating that into simpler terms, “The Open Interest (OI), which is the sum of outstanding derivative deals such as futures or options yet to be settled, can also suggest stronger signs of optimism in the market.”

Between August 12th and August 19th, the value of OI increased from $27.64 billion to $29.81 billion, suggesting an increase in buying activity and a possible upcoming price surge.

In the short term, several long-term traders have experienced forced selling based on data gathered by Coinglass.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As someone who has been trading for years, I’ve seen firsthand how margin calls can be a daunting experience. It’s that moment when market movements work against your long positions, forcing you to sell quickly to meet margin requirements. This can lead to a chain reaction of selling, often resulting in a sudden drop in the market value. It’s a reminder that trading isn’t always about making profits; it’s also about managing risk and being prepared for unexpected market swings.

In other words, this current state could indicate that Bitcoin may temporarily dip before climbing towards potential record-breaking peaks again.

Read More

2024-08-20 01:12