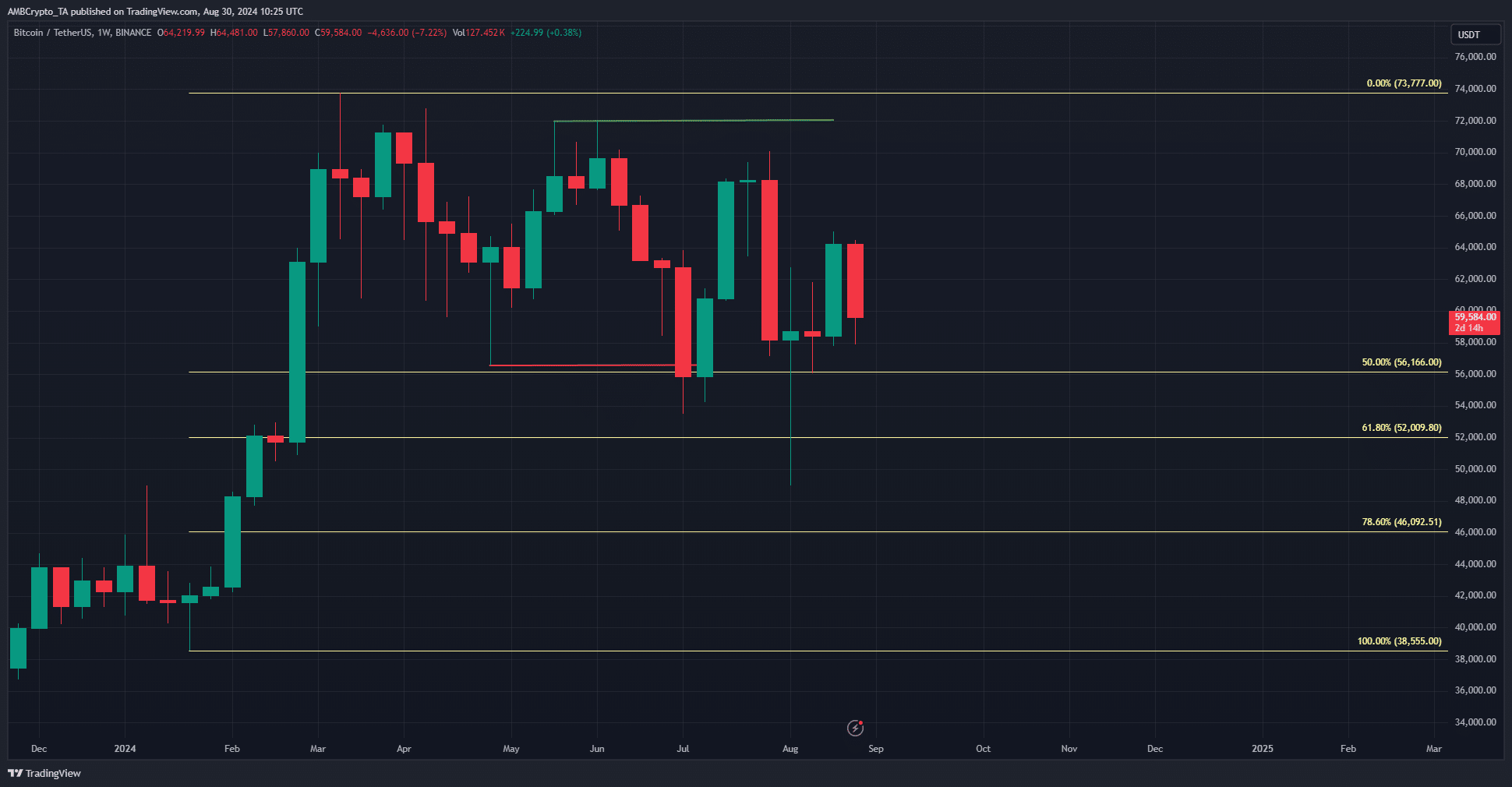

- Bitcoin has lacked the momentum to break key resistance levels in recent months.

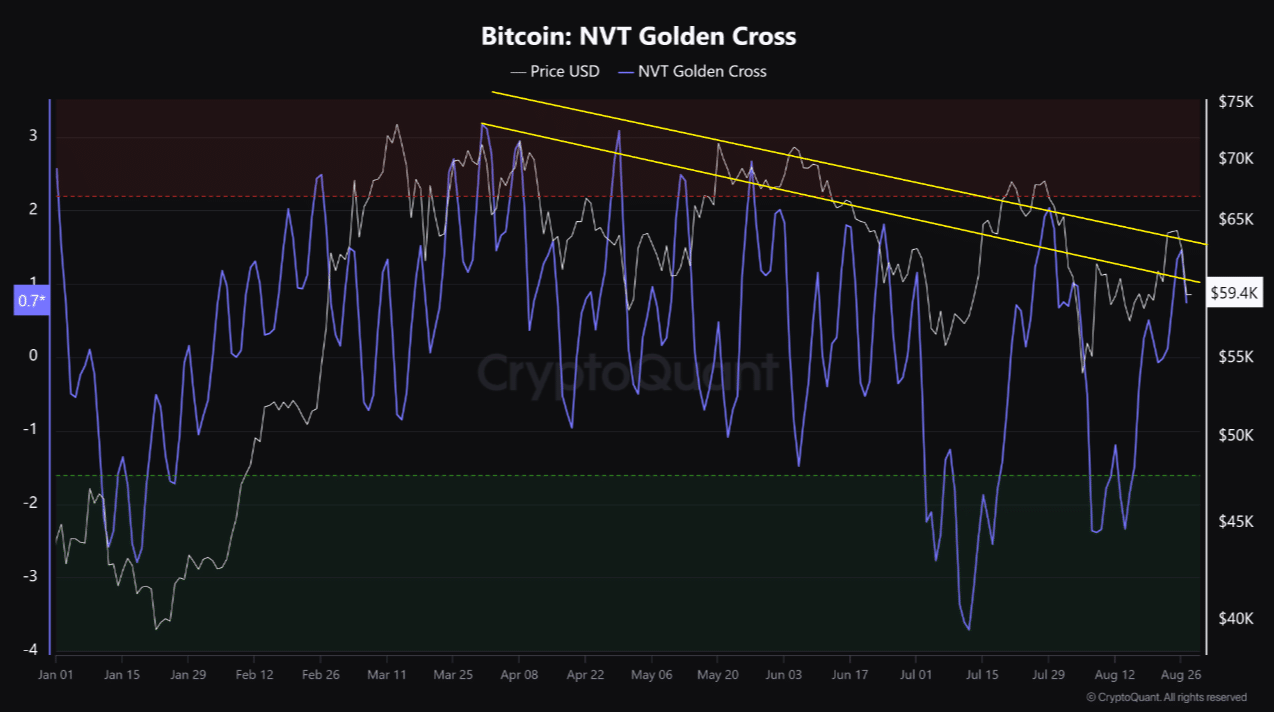

- The waning bullish momentum was evident in the Bitcoin NVT Golden Cross metric.

As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I’ve seen my fair share of bull runs and bear markets. The current state of Bitcoin [BTC] leaves me feeling like a rollercoaster that just took a steep drop without warning.

Bitcoin [BTC] was in a tough position at press time.

1) Inflows into spot ETFs have been decreasing, and a significant decline in prices led to substantial sell-offs. Moreover, a large amount of Bitcoin being withdrawn from Binance didn’t help improve the market mood.

Looking at the weekly overview, the market’s overall trend continues to lean towards bearishness. No fresh high has been set, and Bitcoin, the leading cryptocurrency, has been creating progressively lower peaks since April. Could this signal further price decreases for traders to be mindful of?

The Bitcoin Golden Cross trend

As a crypto investor, I’ve noticed an intriguing pattern pointed out by Burrak Kesmeci on CryptoQuant: Over the past six months, the peak points of the Bitcoin NVT Golden Cross have been showing a downtrend. This could potentially indicate a shift in the market dynamics for Bitcoin.

The values of the peaks fell from 3.17 on the 31st of March to 1.46 on the 26th of August.

The NVT Golden Cross Metric examines both short-term and long-term changes in the NVT value, creating a signal indicator similar to Bollinger Bands.

In simpler terms, if the network’s value exceeds 2.2, it might be overvalued, whereas a value less than -1.6 suggests a possible market low.

Since late March, the decrease in Bitcoin’s maximum values suggests it may currently be underpriced compared to its transaction activity, making it a potential accumulation point.

It also highlighted the bulls’ inability to force a breakout past key resistance levels such as $70k.

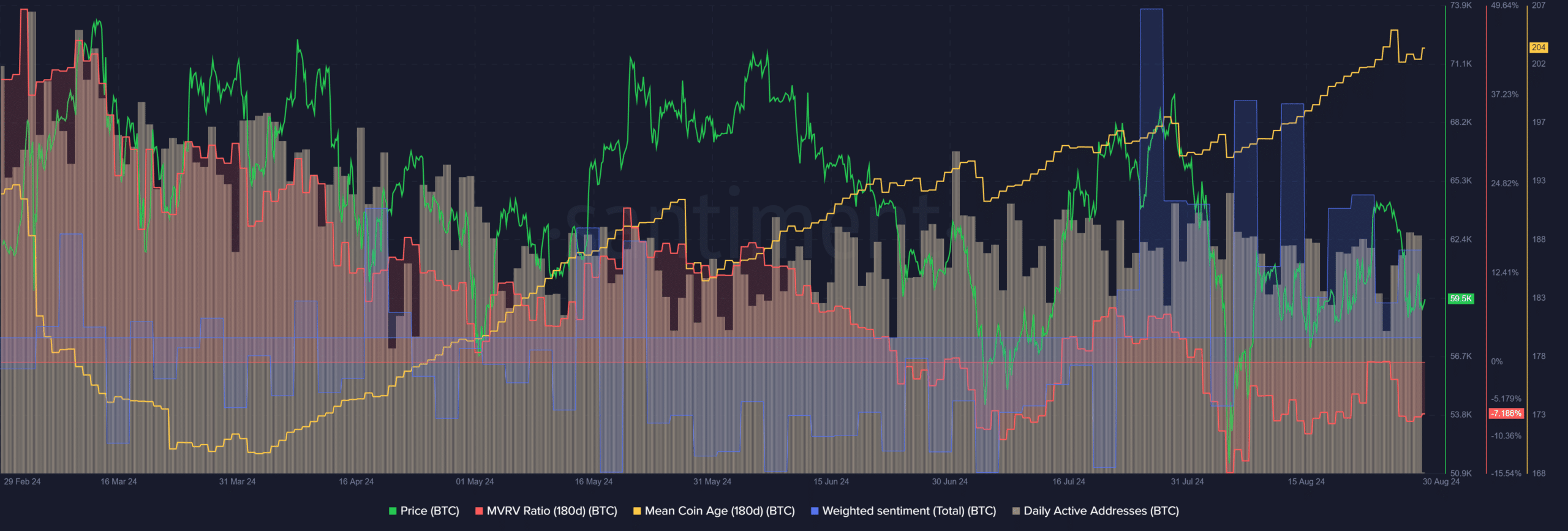

On-chain data supports the bullish side

Over the past few months, the average age of coins (which has been around 180 days) has consistently increased since late March, despite the fact that the overall cryptocurrency market has displayed bearish trends during this period.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Additionally, despite a volatile Bitcoin market during the last month, there was notably high engagement on social media platforms.

The MVRV was negative to show holders were at a loss and that the asset was likely undervalued. Meanwhile, the daily active addresses metric has been stable since June.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-31 04:07