It appears, according to the latest esteemed computations from CryptoQuant (who always know everything), that Bitcoin BTC $118,441 is gracefully striding into the ‘late’ phase of its current bull market romp. Ah, the drama of market cycles… what a charming spectacle! 🎭

Recent whispers from the wise sage, Axel Adler Jr., tell us that the dance between fresh and seasoned investors suggests there’s still some glitter left in this rally—more room to twirl and dip before the curtains fall.

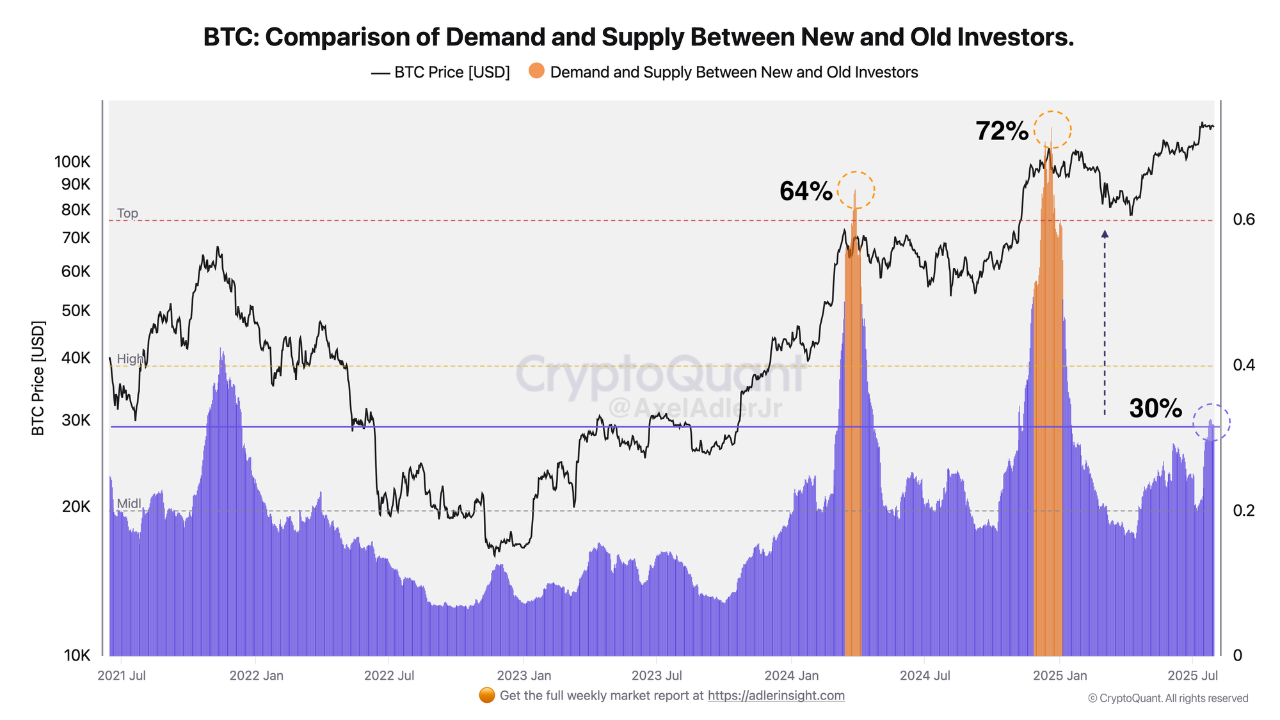

History, that old gossip, reveals that the grand finales traditionally happen when new investors dominate more than 65% of the scene. Currently, it’s merely 30%. So, do hold your breath, or better yet, your wallets—there’s still some show to watch! 💃

Demand versus supply—must be the latest courtroom drama in crypto-land | Source: CryptoQuant

As for the romantic tension in our financial play—new capital keeps flowing in like enthusiastic fans at a concert, yet the antique holders are quite the patient lot: some of them are holding tight, not yet eager to sell, thus keeping the drama balanced and lively.

Further support from SoSoValue reports that in the last couple of months, Bitcoin’s ETFs have mostly been bought, with only seven days of outflows—because who doesn’t want a steady stream of investor love? 💖

Bitcoin Sedately Gliding While the Big Fish Pick Their Spots

Technical wizard Ali Martinez (the man with charts worth a thousand words) suggests as long as BTC stays above $105,450, we could be eyeing $125,230 or even reaching for a lofty $141,770—the market’s version of a scenic valiant hike.

If Bitcoin holds above $105,450, wonders might happen—like a rise to $125,230, possibly touching $141,770. Fingers crossed and charts aligned! 📈

— Ali (@ali_charts) July 31, 2025

Meanwhile, the Federal Reserve’s indecisiveness is the latest plot twist—Chair Powell’s cryptic silence has quieted some nerves, though traders remain on the edge like spectators at a tennis tournament after a surprise serve.

Despite slow progress and the usual investor fluttering to other shiny new cryptos, whales (the big, fat, crypto whales—no, not the whales doing the backstroke) keep building their empire. Santiment reports a whopping 218,570 BTC purchased since late March—like a giant game of crypto Monopoly. 🐋

Charles Edwards, a man of significant insight, notes that treasury gobbling on July 29–30 alone was nearly 30,000 BTC—imagine the ease with which whales buy up the whole ocean!

While everyone fussed over Fed antics, Bitcoin’s treasury titans just had one of their biggest buying sprees. Coincidence? I think not! 🕵️♂️

— Charles Edwards (@caprioleio) July 31, 2025

Bursting with confidence, institutional investors accounted for 97% of all transactions—an astronomical figure last seen before Bitcoin multiplied itself like rabbits on Easter in August 2020. If history is any guide, the sky’s the limit—say, over half a million dollars, give or take! 🚀✨

If institutional buying keeps up, we might be looking at a $500,000 Bitcoin someday. Just saying, don’t shoot the messenger—or the moon rocket. 🚀

— Charles Edwards (@caprioleio) July 31, 2025

Read More

- Best Controller Settings for ARC Raiders

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- How to Get the Bloodfeather Set in Enshrouded

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- How to Build a Waterfall in Enshrouded

- Meet the cast of Mighty Nein: Every Critical Role character explained

- EA Sports FC 25: Best Players for Aim Assist Evolution

- 7 Things That Still Don’t Make Sense About Thunderbolts*

- Everything Coming to Netflix This Week (October 20th)

2025-07-31 17:27