Ah, the fickle dance of fortune! Late on a Sunday eve, as Europe sipped its final cup of tea, Bitcoin-that darling of the digital realm-took a most dramatic tumble. From the lofty heights of $114,790, it plummeted to a mere $110,680 in a mere ten minutes, a fall of ~3.6%. How quaint! The on-chain whispers and derivatives dashboards, those modern oracles, point to a single leviathan seller and a cascade of liquidations, a financial domino effect if ever there was one. 🌪️✨

The Whimsical Whys of Bitcoin’s Fall

Enter “Sani,” the intrepid creator of TimechainIndex, who, with a flourish, unveiled the first thread of this financial farce on X. A whale, it seems, had grown weary of its hoard and unleashed 24,000 BTC upon the markets via Hyperunite/Hyperliquid. “This entity,” Sani proclaimed, “liquidated their entire balance, sending it all to Hyperunite. They transferred 12,000 just today and continue their merry selling, likely fueling the price’s descent.” How very gauche! 🦈💸

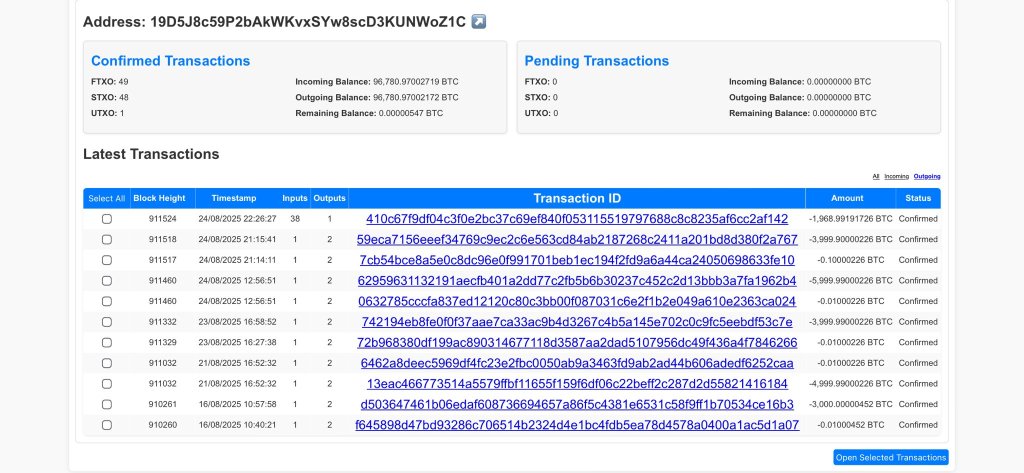

But wait, there’s more! This whale, it appears, still clutches 152,874 BTC across its various lairs, including 5,266 BTC in the address below. The funds, ancient relics from HTX six years past, had lain dormant until this sudden stir. The community, ever the sleuths, speculated on the owner’s identity. “Justin Sun, perhaps?” Sani mused, linking the coins to historic Asian exchange flows. “Likely the very coins China sold years ago.” How deliciously mysterious! 🕵️♂️🔍

Some, ever the cynics, suggested an exchange wallet, given the sheer magnitude. But Sani, with a wave of the hand, dismissed this notion. “The funds,” he argued, “are routed from the cluster to Hyperunite, then Binance-not directly from a Binance wallet. An in-house exchange wallet? Hardly likely.” How very clever of him! 🧐✨

And then, a twist! An account known as MLM (@mlmabc) tracked an aggressive rotation into Ether. “This entity,” they declared, “has sold 18,142 BTC worth $2.04B and is now offloading the last 5,968 BTC ($670M). They’ve bought 416,598 ETH ($1.98B) and longed 135,263 ETH ($642M) on perps, for a total ETH exposure of 551,861 ETH ($2.62B). Oh, and 275,500 ETH ($1.3B) has been staked.” How utterly audacious! 🚀🤑

These flows, it seems, were not born of spontaneity. Last week, Sani had flagged the first stirrings from a dormant address holding 23,969 BTC. “It moved 3,000 BTC after five years of slumber,” he noted. “These funds, withdrawn from HTX six years ago, total 170,703 BTC across multiple addresses. I suspect them to be connected to China’s old sale.” How the plot thickens! 🕰️🔗

Futures positioning, ever the dramatic amplifier, turned a swift selloff into a full-blown flush. Real-time liquidation trackers gleefully recorded $218.29 million in BTC long liquidations on Sunday-the largest since August 1 ($231.77 million) and June 12 ($299.41 million). How the markets weep! 😢💔

Technical context added fuel to the fire. Sunday’s slide created a fresh CME Bitcoin futures “weekend gap,” a magnet for short-term traders. “If BTC opens like this tomorrow,” trader Daan Crypto Trades warned, “we’ll have a sizeable gap. These gaps, you see, have a habit of closing on Monday.” How very predictable! 📉🔮

At press time, Bitcoin traded at $112,511, a mere blip in its grand saga. The markets, ever the stage, continue their dramatic performance. 🌟📈

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Best Thanos Comics (September 2025)

- Goat 2 Release Date Estimate, News & Updates

- Best Controller Settings for ARC Raiders

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

2025-08-25 10:14