- Ah, the post-halving spectacle of Bitcoin may waltz into 2025, propelled by the grand accumulation of whales and the ever-so-dignified interest of institutions.

- In the short term, Bitcoin’s dalliance with consolidation hints at a potential ascent, with a support cushion nestled between $83,000 and $84,000 for further gains.

With Bitcoin’s latest halving now a mere whisper in the annals of time, the gaze of the market turns to what could be the most pivotal act in this theatrical cycle.

Historically, halving events have been the harbingers of dramatic price rallies, typically within a span of 12 to 18 months, and lo and behold, 2025 appears to be no exception to this grand narrative.

Whales, those enigmatic creatures of the deep, are quietly amassing their treasures, institutional interest is gaining momentum, and analysts are projecting new heights on the horizon—how delightfully optimistic! 🐋💼

Yet, beyond the historical script, a new set of variables pirouettes into view—regulatory shifts, ETF inflows, and the ever-looming specter of macroeconomic uncertainty.

The question is not merely if Bitcoin will rally, but how the forces shaping this cycle will redefine the very essence of a bull market. A veritable conundrum! 🤔

Is the peak already in?

Historically, Bitcoin’s most explosive gains have graced the stage 12 to 18 months post-halving.

Each past cycle has witnessed substantial price appreciation long after the halving, culminating in peaks that arrive fashionably late, well after the initial post-halving fervor has cooled.

With the most recent halving now behind us, this timeline suggests a potential market zenith sometime between mid and late 2025. How thrilling! 🎉

While it’s tempting to ponder if the peak is already in, historical precedent suggests otherwise. Oh, the irony!

Though institutional inflows and ongoing regulatory developments may alter the shape of this cycle, the odds favor more runway ahead. A delightful prospect!

For now, the data implies that the current bull market may still be warming up, rather than winding down. How positively invigorating! ☕️

Whale accumulation suggests more upside ahead

Supporting the case for a continued bull run is the behavior of Bitcoin’s largest holders, those magnificent whales.

Over the past week alone, these behemoths have accumulated more than 60,000 BTC—a resounding vote of confidence that aligns with historical post-halving trends. Bravo! 👏

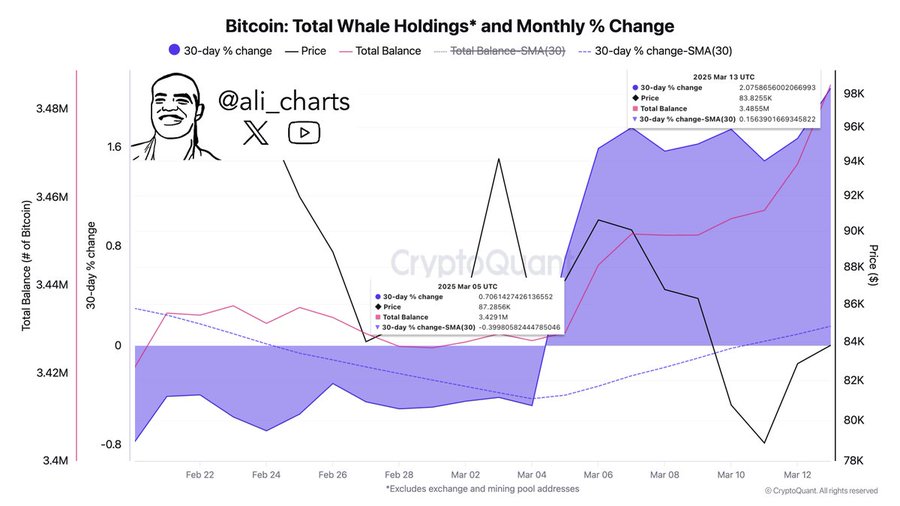

Latest data reveals a sharp uptick in total whale holdings—now above 3.45 million BTC—along with a notable positive swing in the 30-day percentage change. How splendid!

This surge in accumulation typically signals a bullish outlook from long-term investors, who tend to front-run major price moves. A most astute observation!

When paired with the post-halving historical window that points to mid-late 2025 for a cycle top, this renewed whale activity adds fuel to the thesis that Bitcoin’s current rally still has room to run. How exhilarating! 🚀

Short-term consolidation, but momentum may return

Despite the bullish longer-term signals, Bitcoin’s short-term outlook remains a delightful mélange of uncertainty. The daily chart reveals BTC hovering around the $84,000 level, following a pullback from recent highs. How dramatic!

The RSI languishes at 44.20, suggesting weak momentum and leaving room for further downside before the asset becomes oversold. Meanwhile, OBV has been trending downward, reflecting declining buying pressure. Oh, the suspense!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-03-16 17:15