-

BTC has continued to trade below the $61,000 price range.

BTC saw over $142 million liquidated in the past two days.

As a seasoned crypto investor with a few battle scars to show for it, I must admit that the recent declines in Bitcoin (BTC) have left me slightly uneasy but not entirely surprised. Over the years, I’ve learned that cryptocurrency markets can be as unpredictable as a roller coaster ride on a stormy day.

Over the last several days, Bitcoin (BTC) has seen drops in its value, resulting in a high number of forced sales or liquidations. With Bitcoin’s worth going down, traders and investors have been compelled to adapt to these tumultuous market circumstances, which in turn have influenced recent shifts in investor sentiment.

Bitcoin continue declines

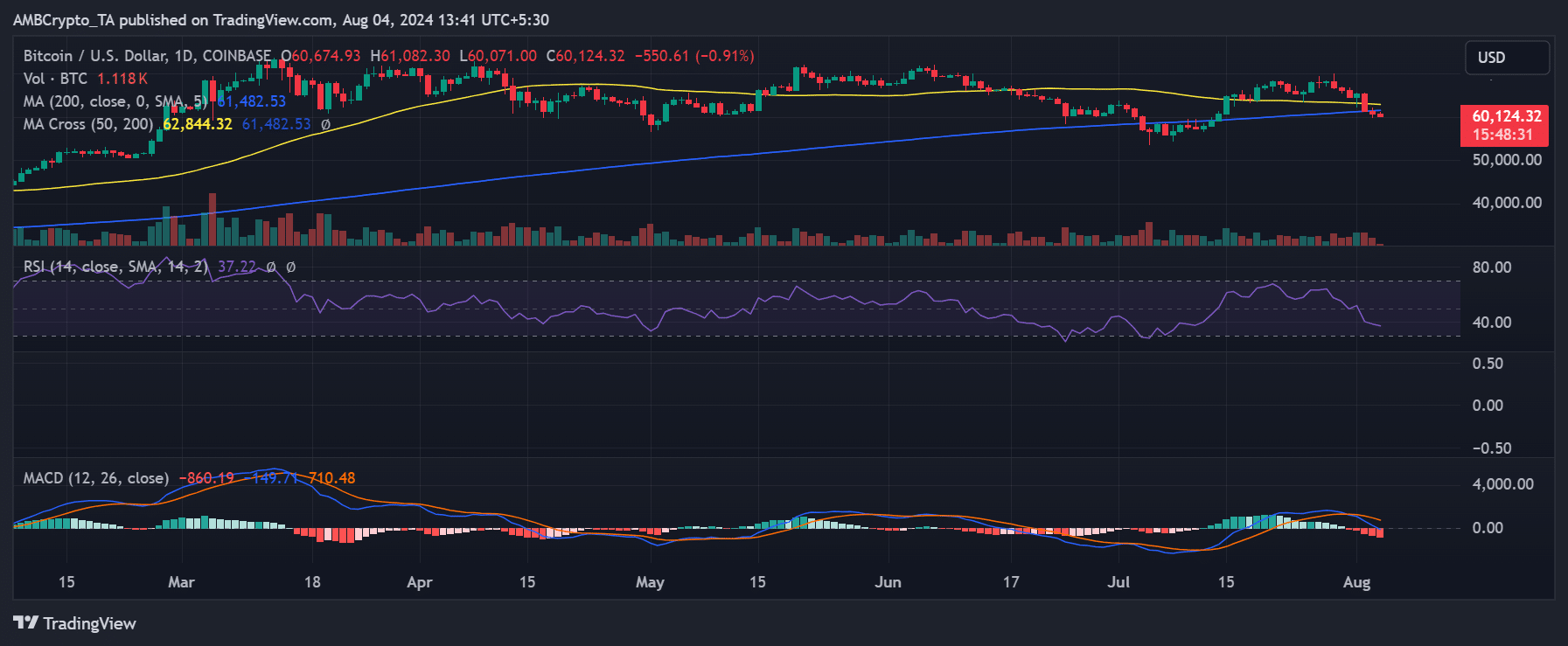

On a daily chart, a notable four-month drop was found when examining Bitcoin (BTC).

On August 2nd, Bitcoin experienced a significant drop of roughly 5.93%, falling from about $65,293 down to around $61,418. This marked the steepest one-day decrease for Bitcoin since April. (Paraphrased)

On the 3rd of August, Bitcoin’s value dipped by approximately 1.24%, ending the trading day at around $60,674. This drop also caused it to fall beneath the $61,000 price range.

Currently, the downward trend persists as Bitcoin is trading at approximately $60,143, marking a nearly 1% further drop. This series of declines has caused Bitcoin to fall below its support level that was previously held by the long moving average (represented by the blue line) around $61,000.

Moreover, the Relative Strength Index (RSI) has fallen under 40, which suggests a growing downward market momentum or bearish trend.

Long Bitcoin liquidations continue

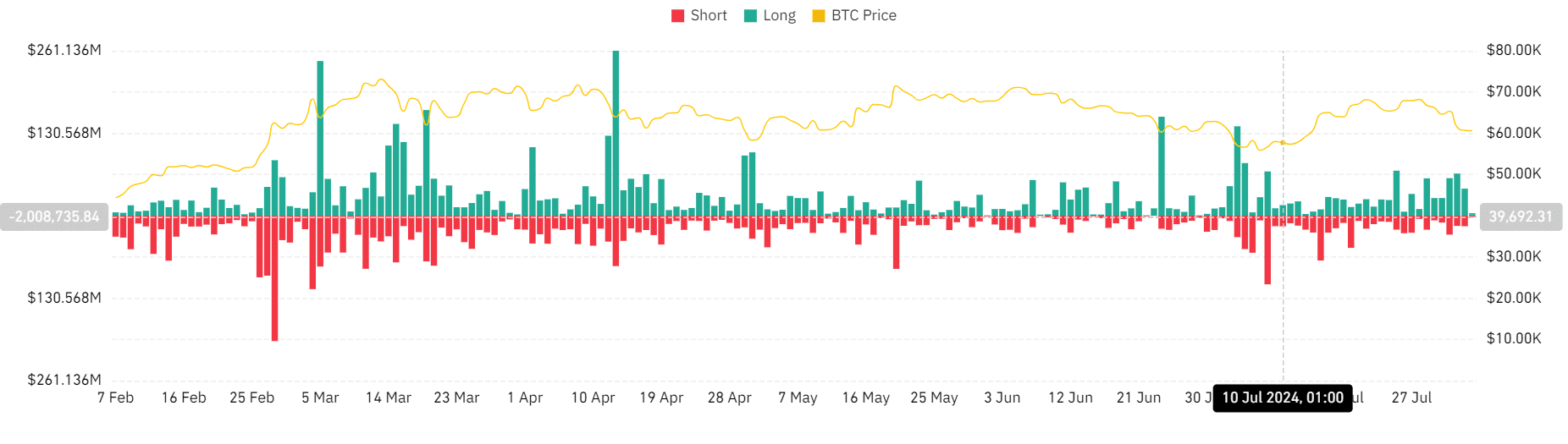

In the past seven days, Bitcoin has experienced a notable dominance of long liquidation volumes.

For the past two days, the combined value of assets being sold off surpassed a staggering $142 million. Specifically, on August 3rd, the daily liquidation volume stood at approximately $60 million, with around $43 million attributed to long positions.

In the last trading day, the total value of assets being sold off amounted to around $83 million. Out of this, positions taken for future price increases (long positions) accounted for about $67 million.

Additionally, the funding rate has exhibited volatility over the past few days.

At the end of the most recent trading session, the funding rate significantly dropped to around 0.0036% from approximately 0.008%.

Over the past eight hours, there were ups and downs, peaking at approximately 0.008%, then falling again to nearly 0.004%. Such variations suggest a high degree of instability and volatility in the market, impacting both trading volumes during liquidation and adjustments in funding rates.

New addresses see mixed movements

Despite Bitcoin’s efforts to maintain a steady price, the count of daily new wallets has displayed fluctuations as well.

In the last three days, there has been a notable decline in the number of new addresses.

Read Bitcoin (BTC) Price Prediction 2024-25

At the start of the current month, based on Glassnode’s data, there were approximately 334,000 newly created addresses. There was a small increase in new addresses towards the end of the last month.

On the other hand, currently, this figure stands at around 304,000 – a significant drop from earlier numbers. This decrease in newly created addresses might indicate a degree of caution among prospective market entrants due to the present volatility in prices.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-08-05 02:16