- Bitcoin has surged 4% thanks to the ‘Christmas Rally,’ with secret Santas driving the momentum.

- However, psychological risks remain, keeping the bull rally just out of reach.

As a seasoned researcher with over two decades of experience in the financial markets, I’ve seen my fair share of market swings and trends. The recent Bitcoin surge, fueled by the ‘Christmas Rally,’ is indeed an interesting development. However, as we all know, what goes up must eventually come down – or so it seems.

10 days back, Bitcoin (BTC) reached an all-time high (ATH) of $108,000. This peak is one it has been aiming for since the “Trump boost.

As a cryptocurrency investor, I too have felt the surge in cautious sentiment, despite the market showing no signs of overheating and greed levels remaining moderate. However, the Federal Open Market Committee’s (FOMC) warning of a “cautious” 2025 outlook has certainly given me pause for thought, causing me to tread more carefully in my investment decisions.

As a consequence, Bitcoin plummeted dramatically, erasing most of the progress achieved during the closing stages of the electoral process.

As a possible adjustment approached, numerous individuals decided to sell when the price hit around $94,000, resulting in approximately $7.17 billion in earnings being collected.

Although it may appear disappointing, the departure of inexperienced investors is frequently viewed as a ‘beneficial’ pullback, paving the way for new participants to join and seize the current offerings.

Currently, as Bitcoin nears the $100K mark again, is there a surge of new investment coming in, or are investors still cautious due to the recent unexpected drop’s lingering impact?

Risk-averse investors exit amid caution

After the large withdrawal, Bitcoin exchange reserves reached a peak of 2.427 million – the biggest increase since last November.

Holders who have held for less than five months are selling off and realizing their gains, as indicated by the short-term holder’s Spent Output Profit Ratio (SOPR) reaching 1.04.

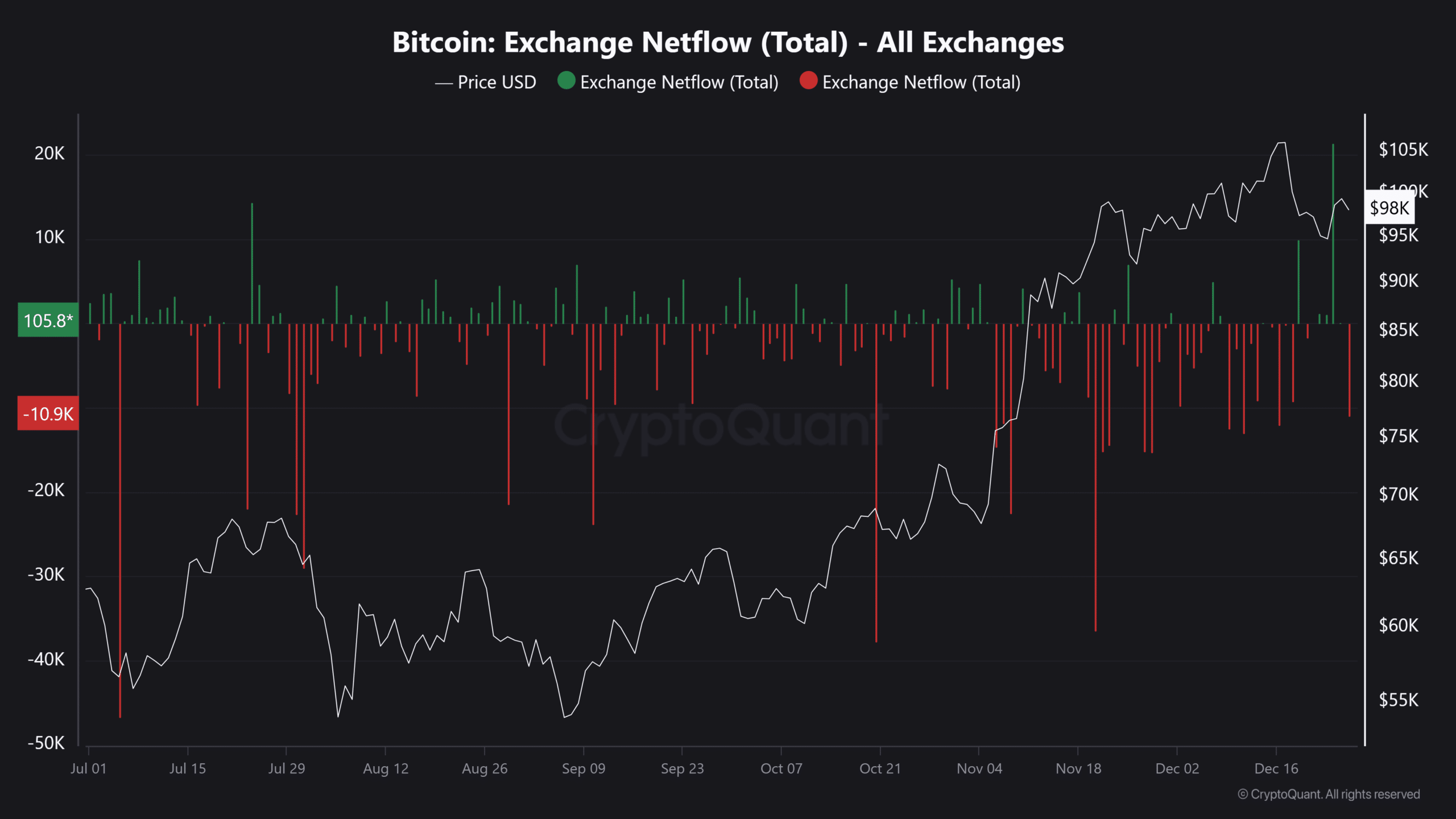

Furthermore, there was a significant increase in Bitcoin flowing into exchanges, marking a five-month peak, as approximately 21,000 BTC were deposited, with the average price being around $98,000 per coin.

This drop took Bitcoin to around $92K, its lowest point in more than two weeks, as the price at $94K showed itself to be a significant area for investors cashing out their profits.

Source : CryptoQuant

But just as things seemed to be heading south, the holiday cheer kicked in.

After experiencing a 4% surge, Bitcoin moved out of the $88K-$90K range and returned to the $98K-$100K price bracket. However, it might still be subject to a further decline towards that lower range.

Although there’s been some recovery, the demand for Bitcoin from institutional investors via ETFs has persisted at a slow pace, marking the continuation of a four-day streak where funds have been flowing out.

This suggests that the current price point has yet to attract significant institutional capital.

In terms of consumer purchases, there’s been an uptick, but it hasn’t reached the level that suggests a significant “accumulation” is imminent. As the New Year enthusiasm grows, Bitcoin could fluctuate between $100K and $105K. However, reaching a new all-time high seems not to be immediate.

Fundamentally, ‘risk’ plays a significant role here. As the memory of recent losses lingers among investors, psychological barriers might discourage fresh investments from coming in.

So, is Bitcoin heading south?

Historically, the first three months of every year have tended to see growth or upward trends in Bitcoin. This is due to a situation where the available supply is low compared to the high demand, leading to an economic imbalance that favors Bitcoin’s price increase.

Given the current trends we’re seeing, it wouldn’t be unexpected for Bitcoin to deviate from its usual behavioral pattern.

In simpler terms, by 2025, external factors may grow stronger, potentially creating a major challenge. The absence of distinct economic indicators might make it difficult to navigate, even if the performance on the blockchain remains robust.

If Bitcoin doesn’t surpass its old record high before mid-January, predicting a full-blown bull market at this moment might be jumping the gun.

As an analyst, I find myself observing a situation where there’s a notable lack of significant retail and institutional investment capital available. This could potentially imply that even influential players such as MSTR may not have enough firepower to ignite a robust market rally on their own.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Instead, a consolidation in the $95K–$98K range could be just what Bitcoin needs to build momentum for the next big move.

By applying pressure on their profitability and sparking a renewed fear of missing out (FOMO), this strategy would encourage cautious investors to stay involved, potentially leading to a surge in market activity over the coming two weeks and setting the stage for an upswing.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-26 15:04