-

After a 20% monthly fall, BTC’s price appreciated by 2% in the last 24 hours

Most metrics suggested that BTC would remain bullish in the short-term

As a researcher, I have been closely monitoring the cryptocurrency market, particularly Bitcoin (BTC), over the past few weeks. The recent price trend of BTC has been concerning, with a significant monthly decline of around 20%. However, the last 24 hours brought some relief to investors as the crypto appreciated by 2%, trading just under $57k at press time.

As a researcher studying the cryptocurrency market, I’ve noticed that Bitcoin‘s [BTC] price has been trending downward for quite some time. However, there was an anomaly on July 6th when the price didn’t follow this pattern and instead showed signs of growth, resulting in a green day for Bitcoin.

Despite its minimal 24-hour recovery, the leading cryptocurrency’s growth wasn’t on par with other cryptos witnessing double-digit percentage gains within the last day. Nevertheless, it may be on the verge of making a significant turnaround soon.

Bitcoin turns green

I’ve experienced a turbulent past month as an investor in Bitcoin. The price took a significant hit, dropping almost 20%. This downward trend continued last week as well. However, there have been some positive developments over the last 24 hours that have brought relief to Bitcoin holders. Yet, despite this improvement, Bitcoin remains a long way from reaching its previous peak prices. At the moment of writing, BTC is trading around $57k.

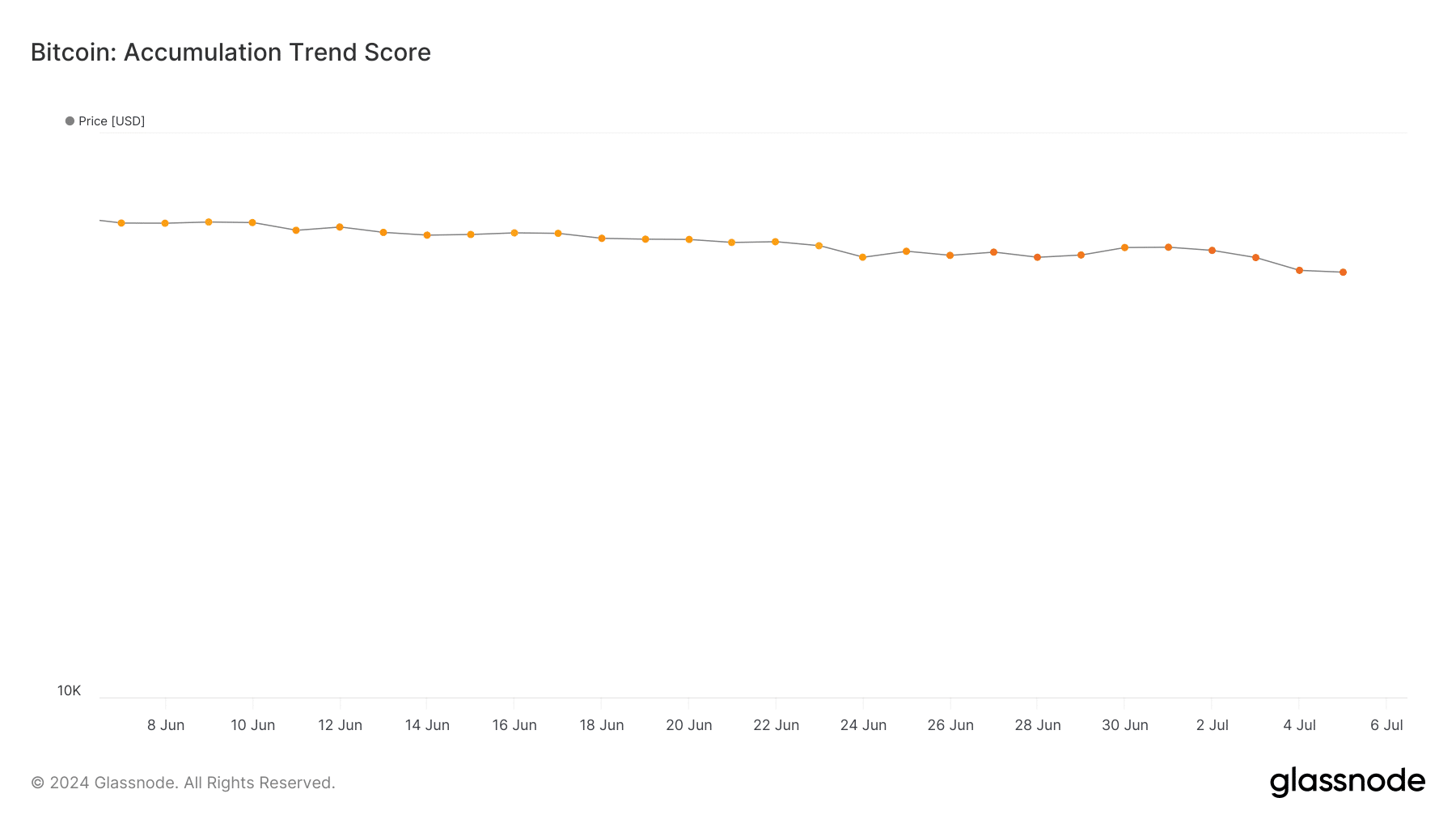

CryptoQuant’s data analysis by AMBCrypto indicated an increase in Bitcoin’s exchange reserves during the previous month. This signifies that investors were offloading their Bitcoins. Furthermore, Bitcoin’s accumulation trend score remained between 0.16 and 0.11. Typically, a higher value closer to 1 implies stronger buying pressure.

It’s important to note that the Accumulation Trend Score signifies the proportion of entities with significant Bitcoin holdings that are currently increasing their coin quantities on the blockchain.

Will BTC recover anytime soon?

As a dedicated researcher following the cryptocurrency market, I came across an intriguing revelation from Captain Faibik, a well-known industry analyst. In a recent tweet, he disclosed potential insights into Bitcoin’s (BTC) sudden decline in value on the charts.

Based on my analysis, I’ve observed that Bitcoin’s price has been confined within a broadening yet descending channel, referred to as a falling wedge pattern. To restore bullish sentiment, it is essential for Bitcoin buyers to surmount the $61k resistance level.

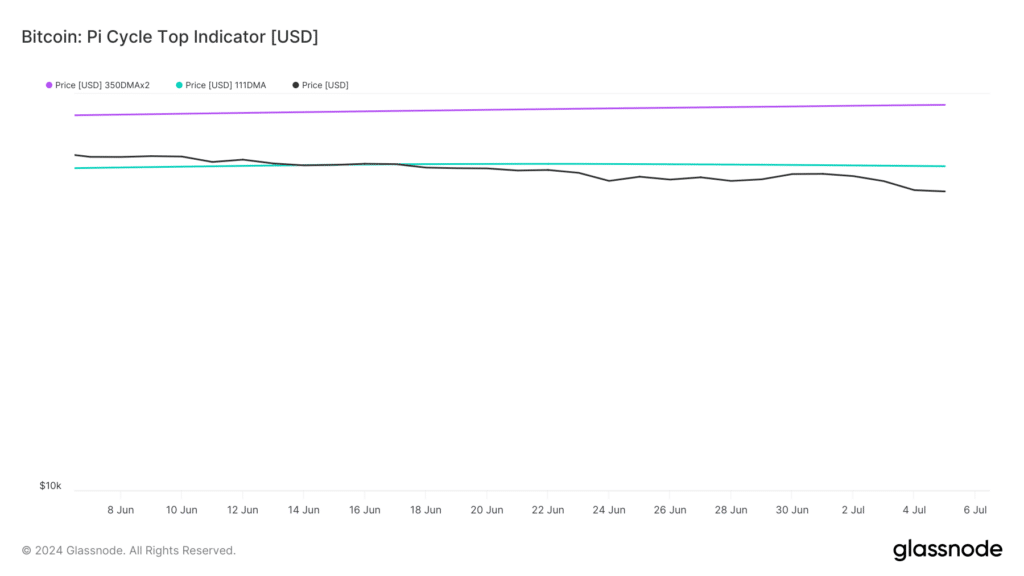

As a crypto investor, I’ve been keeping a close eye on AMBCrypto’s analysis regarding Bitcoin’s (BTC) Pi Cycle Top indicator. Based on their assessment, BTC has been lingering below its potential market bottom for an extended period.

Based on my analysis as a crypto investor, I’ve identified potential lows and highs for Bitcoin at around $65,000 and $93,000 respectively. Additionally, the fear and greed index for BTC showed a reading of 23, indicating that we were in a “fear” phase. Historically, such market conditions have often been followed by price increases.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Apart from this, it looked pretty optimistic on the derivatives market front too.

According to AMBCrypto’s examination of Coinglass’ statistics, the long/short ratio for Bitcoin has risen as well. An uptick in this indicator implies that a greater number of long positions exist in the market than short positions.

As a researcher studying the cryptocurrency market trends, I have observed that the long/short ratio indicates a predominantly bullish sentiment towards Bitcoin over the past 24 hours.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-07 02:15