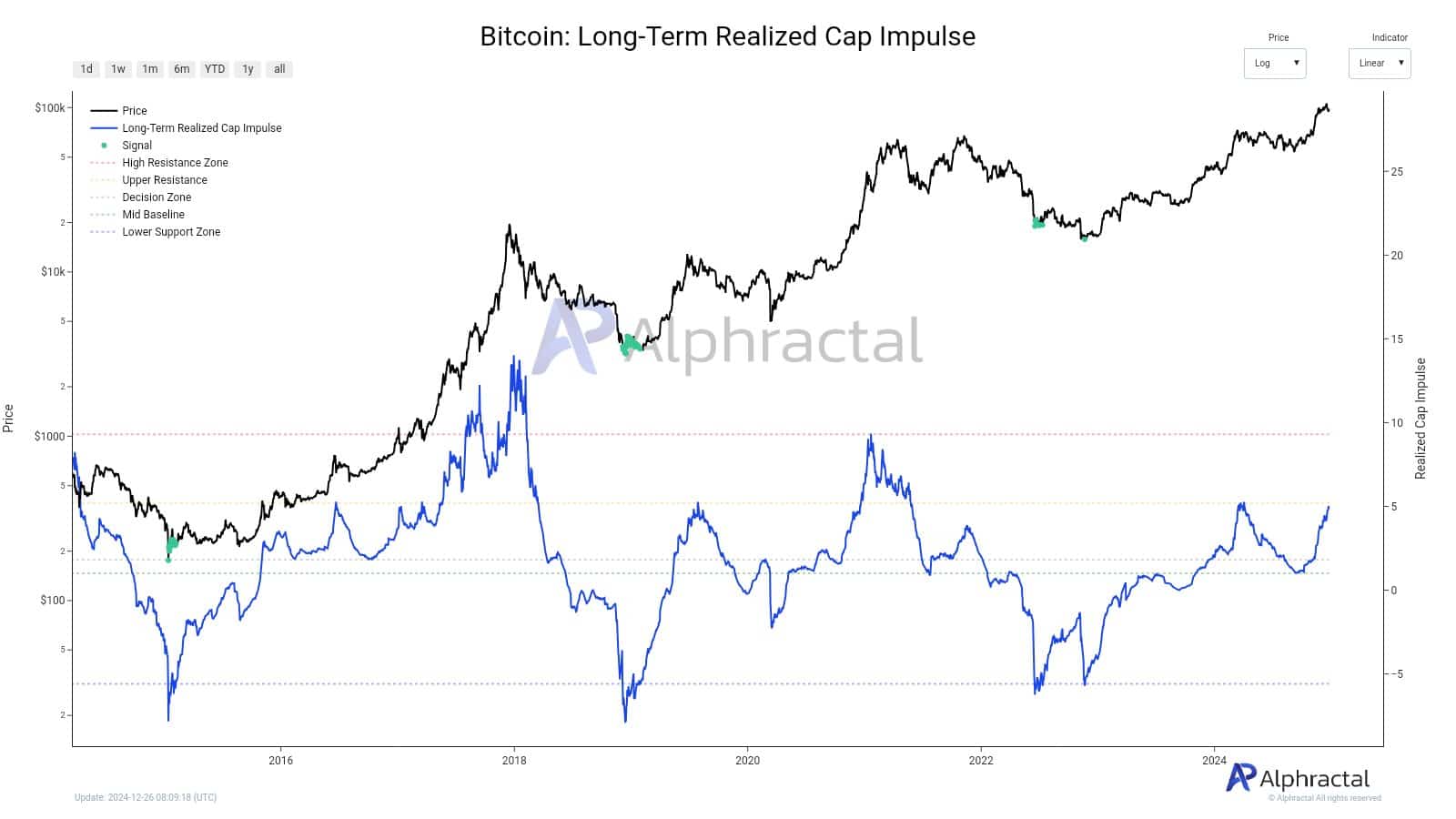

- Bitcoin’s realized cap hit its 2019 and March 2024 resistance levels

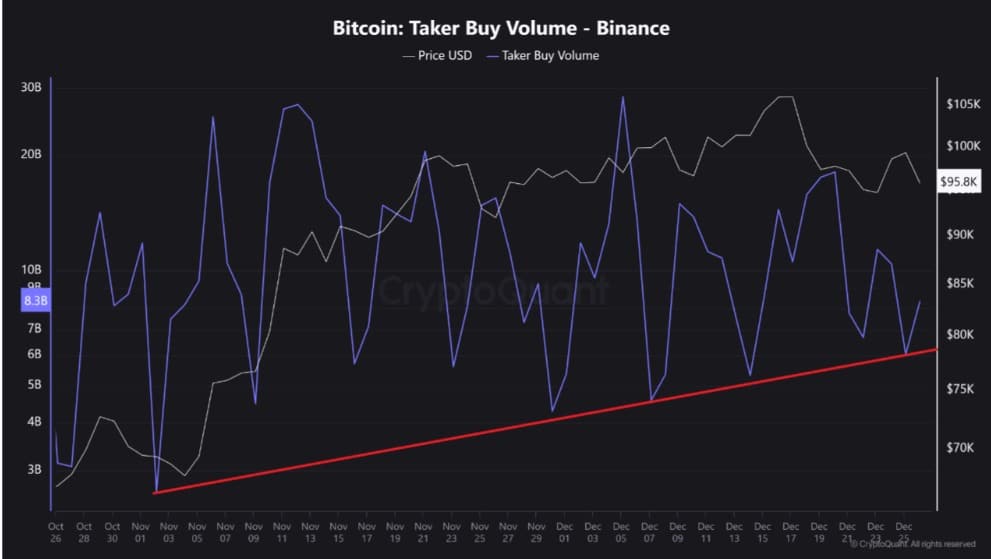

- Binance taker buy volume climbed to $8.3 billion too

As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends that have shaped the economic landscape as we know it today. The recent developments in the Bitcoin [BTC] market, specifically the surge in its realized capitalization and Binance taker buy volume, have piqued my interest.

Over the past seven days, Bitcoin [BTC] has been confined in a narrow trading band, oscillating between approximately $97,000 and $92,000. Despite efforts by market bears to drive prices lower, bullish investors have persistently countered these attempts.

Despite facing challenges, Bitcoin (BTC) has consistently stayed above $90k for the past 39 days. This resilience can be traced back to increased purchasing activity from various sectors of the market.

Bitcoin’s Realized Cap hits 2019, March 2024 levels

As I delve into my ongoing analysis with Alphractal, it appears that Bitcoin’s realized capitalization has mirrored the same resistance levels witnessed in 2019 and March 2020. This potential increase could be seen as a testament to sustained buying interest among investors, given the rising demand we are observing.

In March of 2024, Bitcoin’s realized capitalization experienced a significant increase, coinciding with BTC’s price reaching a new all-time high for that year, peaking at $71,000. Interestingly, following the market recovery from the 2018 bear market, Bitcoin climbed from $3,000 to $13,000 between February and April of 2019. Upon reaching this resistance level in 2019, the prices fell back to $7,000, and by March of the same year, they had dropped even further to $56,000 before April.

In the last two cycles, we’ve seen that an increase in Bitcoin’s (BTC) realized capitalization directly follows its price trend. An uptick in this metric suggests growing buying pressure, even as the price continues to climb higher.

Observing Bitcoin’s Binance market, we note an increasing trend in taker buy volume, currently at approximately $8.3 billion. Typically, a large number of taker orders indicates significant demand, a factor that often leads to an increase in price due to increased buying pressure.

Over the past month, it has shown a pattern of forming increased bottom levels, which indicates growing investor interest and rising demand, signified by stronger purchasing pressure.

Given the growing enthusiasm among buyers, it’s clear that the demand stays strong. There’s a good chance that the Bitcoin realized capitalization will surpass its former resistance thresholds.

Should the realized cap of Bitcoin surpass the resistance points it encountered in 2019 and 2024, we can expect Bitcoin’s price to continue climbing. Conversely, if it fails to exceed these levels, it may indicate that Bitcoin’s annual growth has already reached a substantial level, potentially leading to a decrease.

What do BTC’s charts suggest?

As a researcher, I recognize the encouraging findings presented in my analysis; however, it’s crucial for me to delve deeper and interpret other market signals to ensure a comprehensive understanding of the situation at hand.

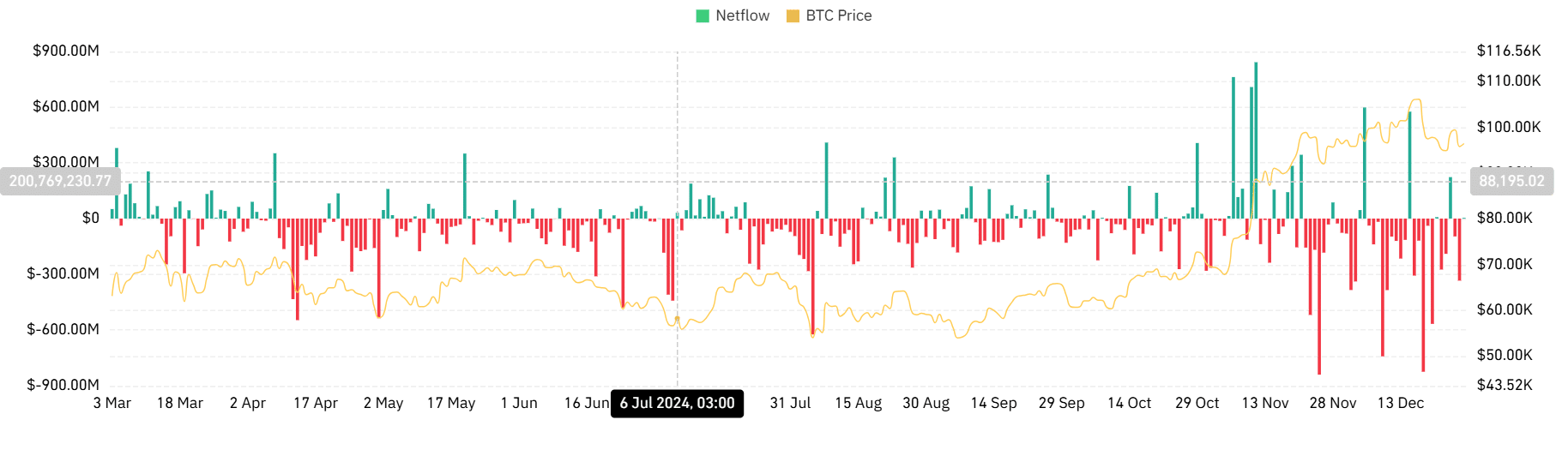

According to AMBCrypto’s analysis, Bitcoin is currently noting strong market demand.

Initially, we notice a drop in demand by examining the continuous decrease in spot netflows over time. Specifically, data for this period went from $597 million to $-334.1 million over the last month. This trend implies that perhaps demand is surpassing supply, as investors seem to be consistently adding more holdings.

Furthermore, we observe an increasing tendency toward purchasing, which is indicated by a consistently positive Chaikin Money Flow (CMF) since November. This prolonged positivity suggests robust demand for the cryptocurrency, with investors continuing to invest in the market.

From my perspective as a crypto investor, even though Bitcoin’s realized cap has touched its former resistance level, the demand for it is still substantial. This suggests that there’s potential for Bitcoin to grow further. If this demand persists and buying pressure drives the price upward, Bitcoin could aim for around $98,900 in the near future.

However, if the yearly growth is already done, Bitcoin could start declining to $92,200.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-12-27 17:11