- Our dear Bitcoin, it seems, is flirting with the notion of reaching a local pinnacle, with those pesky momentum indicators whispering tales of overextension. 📈

- One cannot help but wonder, is the grand pullback on the horizon? 🤔

On a day not so long ago, the2nd of March, our beloved Bitcoin [BTC] embarked on a most spirited rally, surging by a daring9.44% in a single day – a feat unmatched in three months!

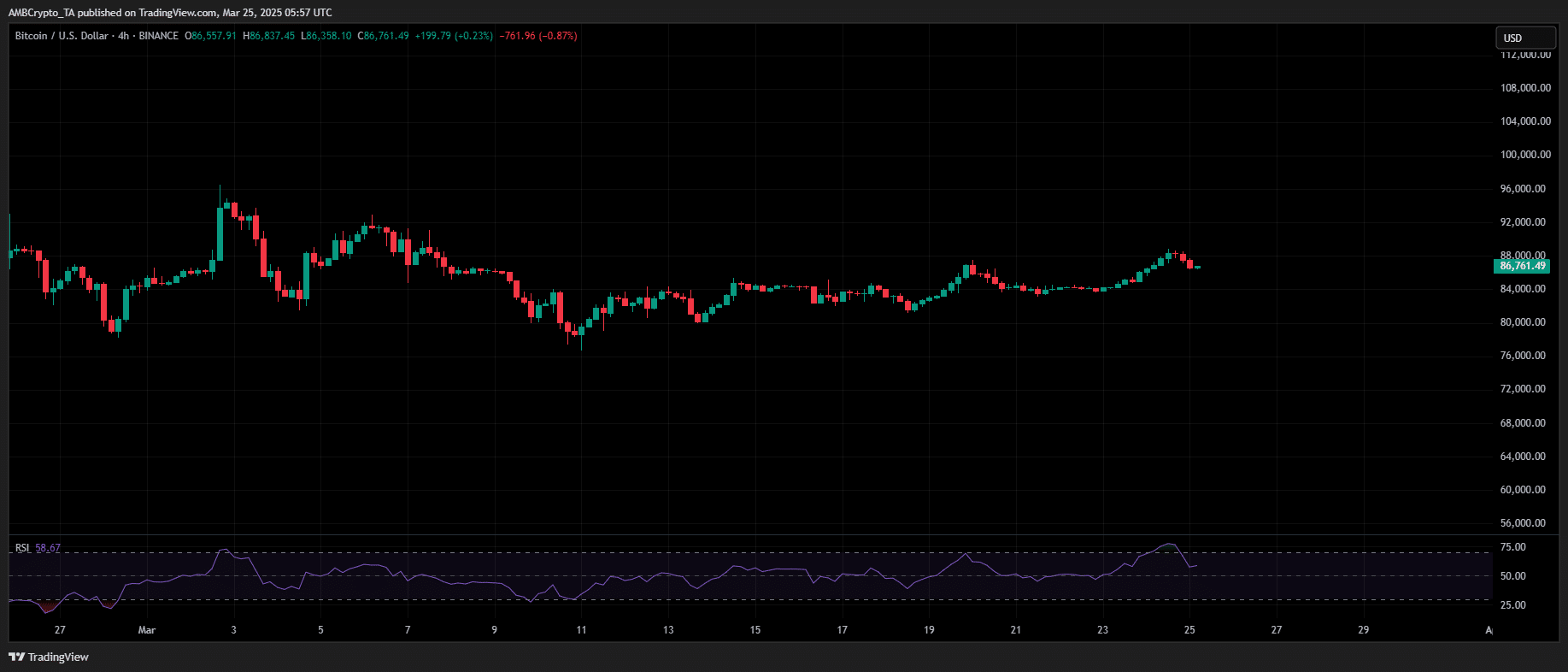

As the4-hour RSI ascended to the lofty heights of70, the market’s capricious nature reversed course, leading to a rather dramatic14.13% decline to $81,500 within a mere10 trading sessions. 📉

The last such inflow of capital was witnessed during the election run, a time when BTC soared to its then-all-time high of $88,400 on the11th of March, propelling the4-hour RSI into the perilous realm of overbought territory.

Despite the ominous reading, the bulls, ever valiant, absorbed the sell-side liquidity, purged the market of weak hands, and propelled BTC to a glorious peak of $92,647 but two days later. 🐂💪

Moving forward, the Relative Strength Index (RSI), a most insightful momentum oscillator, measures the velocity and alteration of price movements on a scale from0 to100.

Traditionally, an RSI exceeding70 suggests that an asset may be overindulging in its own success, hinting at the potential for a price pullback, whilst an RSI below30 implies it may be unappreciated, indicating a potential for a price rebound.

Historically, when Bitcoin’s4-hour RSI ventures into overbought territory, it signals a bullish fervor, yet has often been the harbinger of sharp price corrections.

Now, three months hence, Bitcoin has reclaimed the $88k threshold for the first time in17 days. Yet, on the4-hour chart, the RSI has once more surged near80. 🚀

With the likelihood of profit-taking looming large, can the bulls muster the strength to absorb the sell-side pressure, or is another March-style correction imminent? 🤞

Bitcoin poised for a pullback

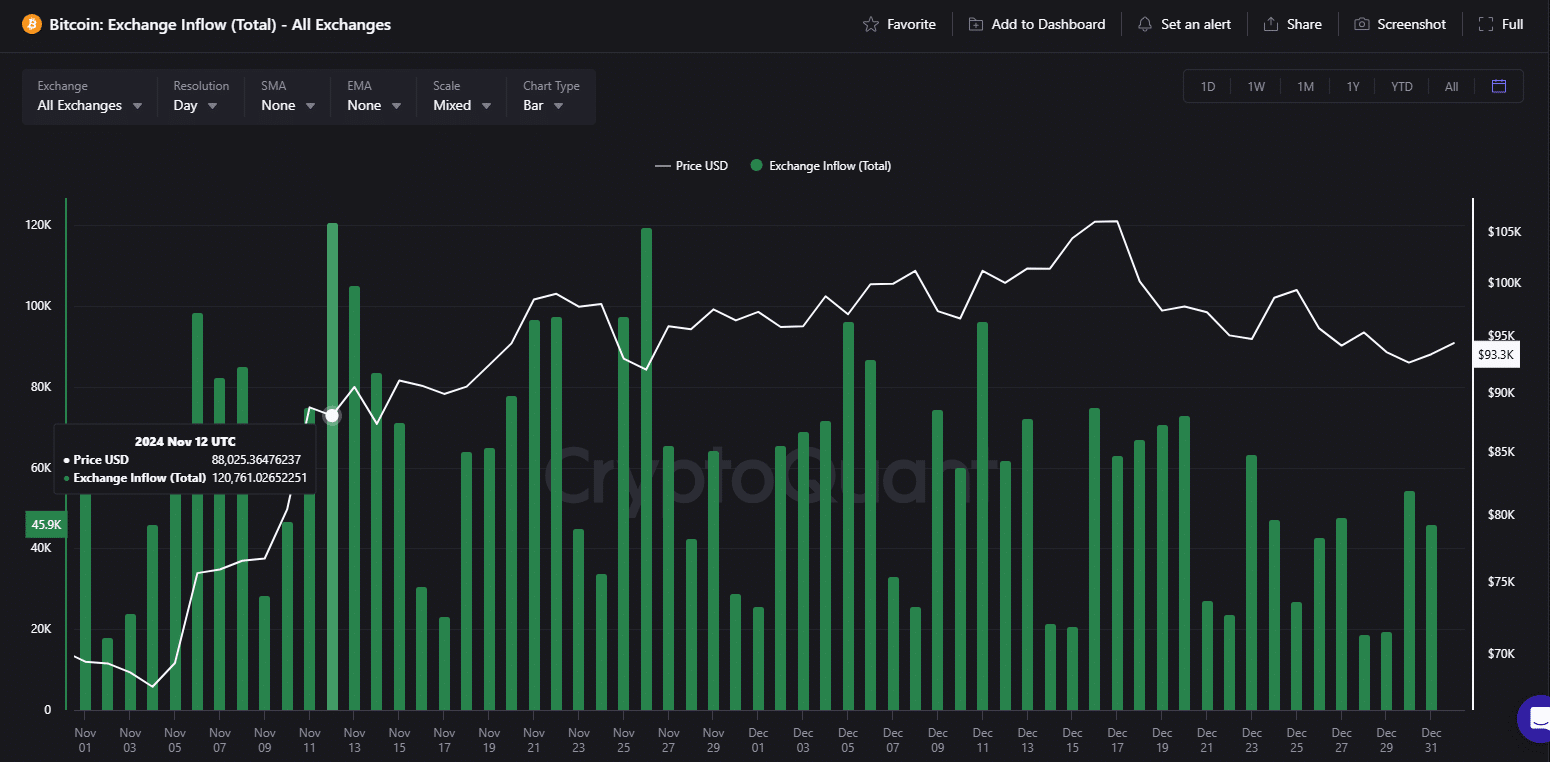

Our astute friends at AMBCrypto have uncovered a most intriguing pattern. On the12th of March, as Bitcoin’s RSI signaled overextension, Bitcoin ETFs registered their second-highest inflow – a staggering $1.114 billion.

This revelation suggests that sustained institutional demand played a pivotal role in cushioning the impact of120,761 BTC, valued at $10.67 billion, that inundated exchanges in a single-day sell-off. 💼💰

As of this writing, Binance spot demand remains robust, with net outflows indicating continued Bitcoin accumulation. The derivatives market, too, reflects a bullish disposition. 📊

Meanwhile, both long- and short-term SOPR (Spent Output Profit Ratio) have flipped above0, affirming that holders are now basking in profit. 🤑

However, with Bitcoin’s4-hour RSI in an overbought territory, the pressure for profit-taking could escalate, potentially triggering short-term volatility. For Bitcoin to ascend toward $90k, sustained buying momentum is of the essence. 💸

Yet, with “reciprocal” tariffs set to take effect on the2nd of April, market uncertainty looms large. Should resistance hold firm, a corrective move toward the $82k–$83k range appears a likely prospect in the near term. 🎢

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- The Battle Royale That Started It All Has Never Been More Profitable

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

2025-03-25 17:19