-

The borrowed funds in BTC have hit a yearly high.

The price continues to struggle around the $60,000 price range.

As a seasoned crypto investor with battle scars from the 2017 bull run and the infamous 2018 bear market, I must admit that the current state of Bitcoin (BTC) has me both exhilarated and cautious. The BTC price hitting a yearly high is always a reason to celebrate, but the surge in borrowed funds and the Estimated Leverage Ratio suggests we’re treading on thin ice.

Bitcoin (BTC) has just surpassed a major psychological threshold, reaching prices in the $60,000 bracket. This achievement, though, has also introduced substantial stress as some large investors are cashing out and Bitcoin’s Estimated Leverage Ratio is now at its highest point in a year.

Bitcoin leverage hits a year-high

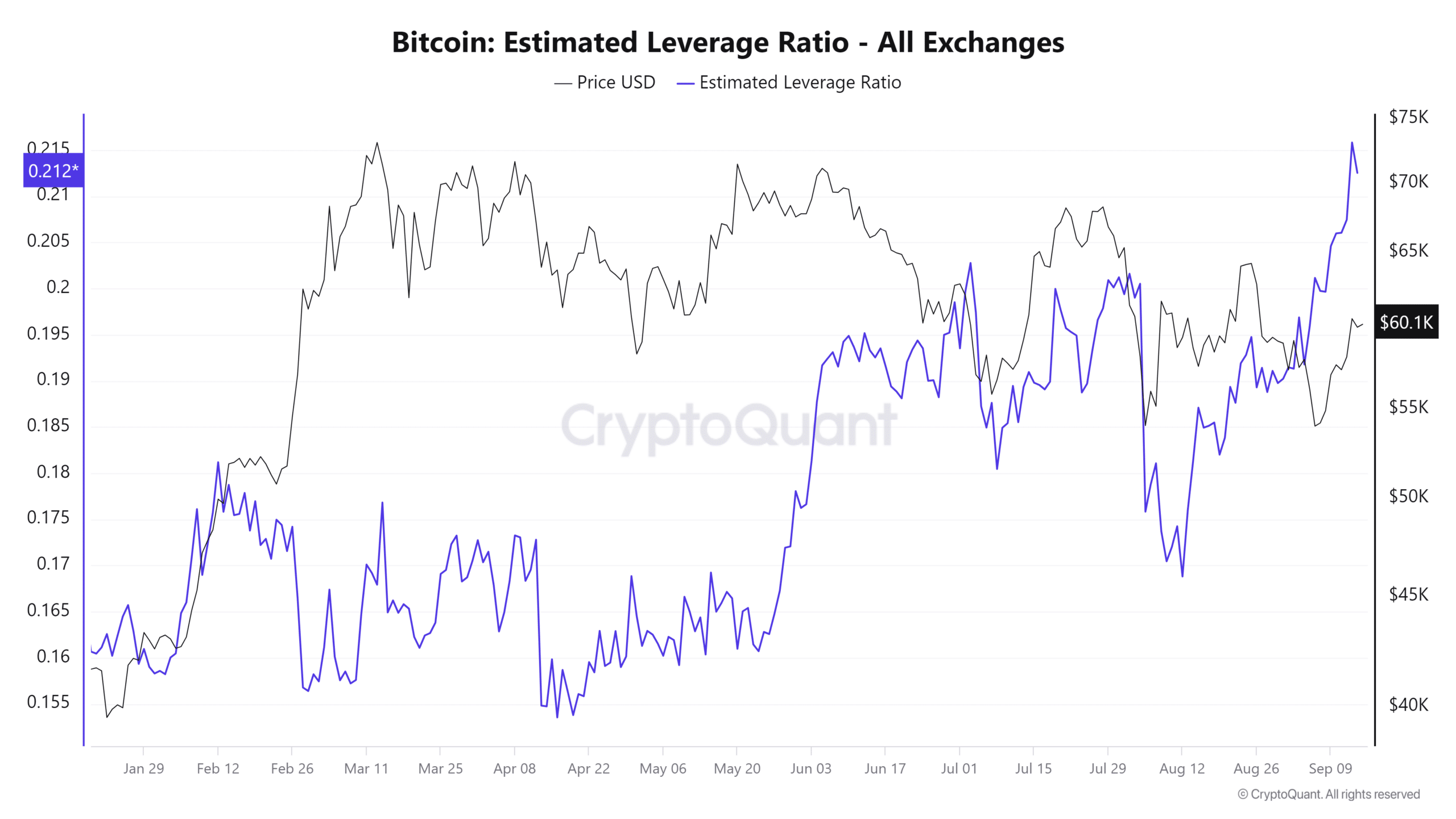

Based on information from CryptoQuant, the estimated leverage ratio for Bitcoin reached a peak of 0.216 this year – the highest point recorded since 2024. This measure signifies the amount of borrowed funds that are being employed in Bitcoin trading transactions.

A higher level of leverage often indicates that traders are assuming greater risks. If the price of Bitcoin goes against these leveraged positions, it could potentially lead to increased losses for those traders.

If this happens, it might trigger mass sell-offs because highly leveraged trades are forcibly terminated. Such events frequently cause swift decreases in prices.

Furthermore, an increasing debt-to-equity ratio may indicate heightened price instability. With higher levels of borrowed funds in play, both upward and downward market swings tend to be magnified.

Should Bitcoin’s price keep climbing while the use of leverage increases, there’s a risk that the market may become excessively heated. Any sudden decrease in price could then trigger substantial forced sell-offs (liquidations).

An unexpected decrease in Bitcoin’s price might lead to forced sales (liquidations), potentially resulting in a swift fall of the BTC price.

Bitcoin faces resistance after price break

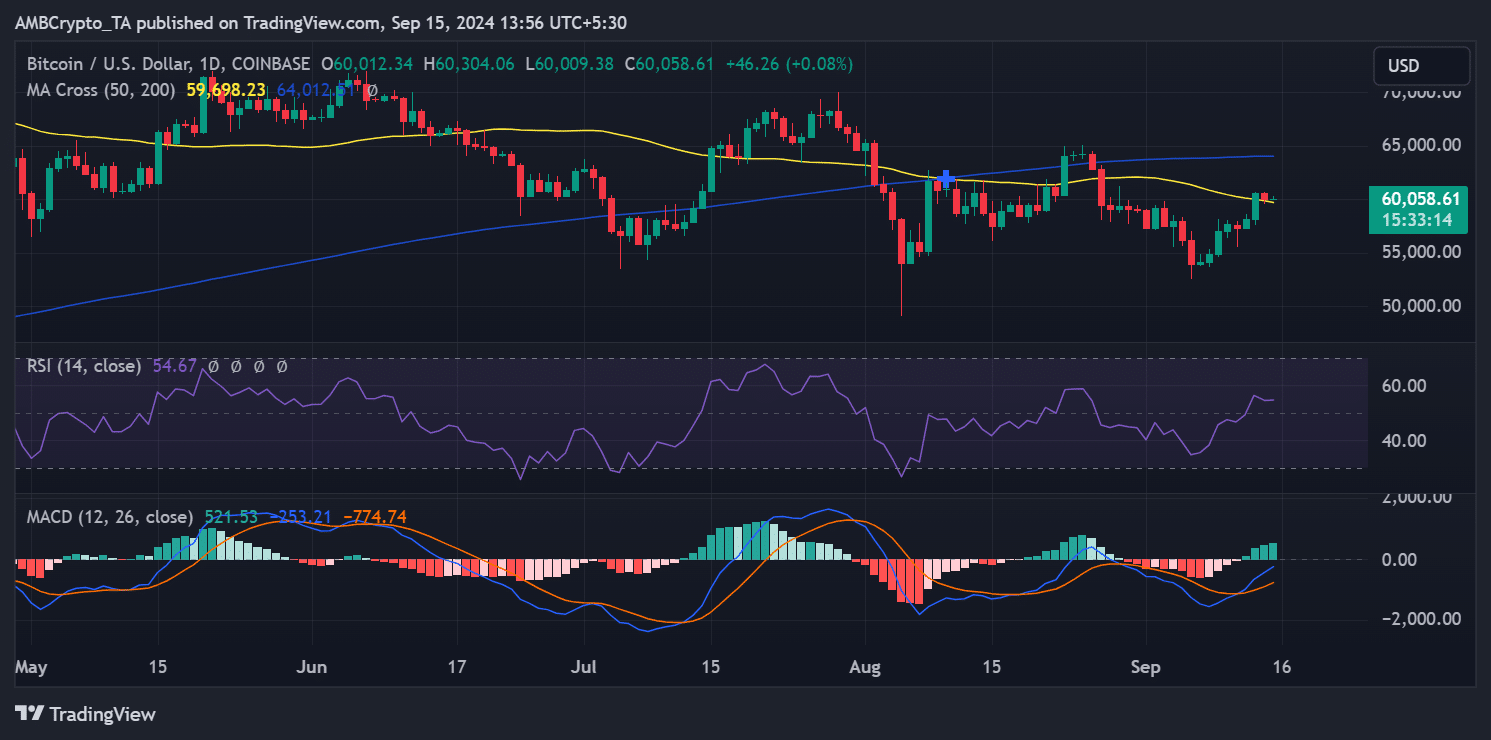

On the 13th of September, Bitcoin saw a spike of more than 4%, and subsequently managed to move above its temporary moving average, with trades occurring around the price point of approximately $60,543.

Nevertheless, it found difficulty in maintaining its pace, as indicated by subsequent developments. In the subsequent trading day, Bitcoin decreased by approximately 0.8%, reaching roughly $60,012.

At the moment, Bitcoin is seeing a modest rise in trading, currently priced at approximately $60,095. However, the subsequent surge seems weak, suggesting that the asset may have experienced significant selling, as some investors appear to be cashing out following Bitcoin’s recent increase.

Whales take advantage of price rise

According to data from CryptoQuant, large Bitcoin holders (or “whales”) capitalized on the latest price increase by cashing out their gains. When Bitcoin surpassed the $60,000 mark, these whales saw a significant increase in their realized profits.

Read Bitcoin (BTC) Price Prediction 2024-25

Whale addresses reportedly took profits exceeding $50 million, capitalizing on the price increase.

Engaging with the whale (large investors) in Bitcoin trading emphasizes the current price point’s resistance, as these big players secure their profits. This action might induce temporary fluctuations in Bitcoin’s price due to short-term market instability.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-16 03:03