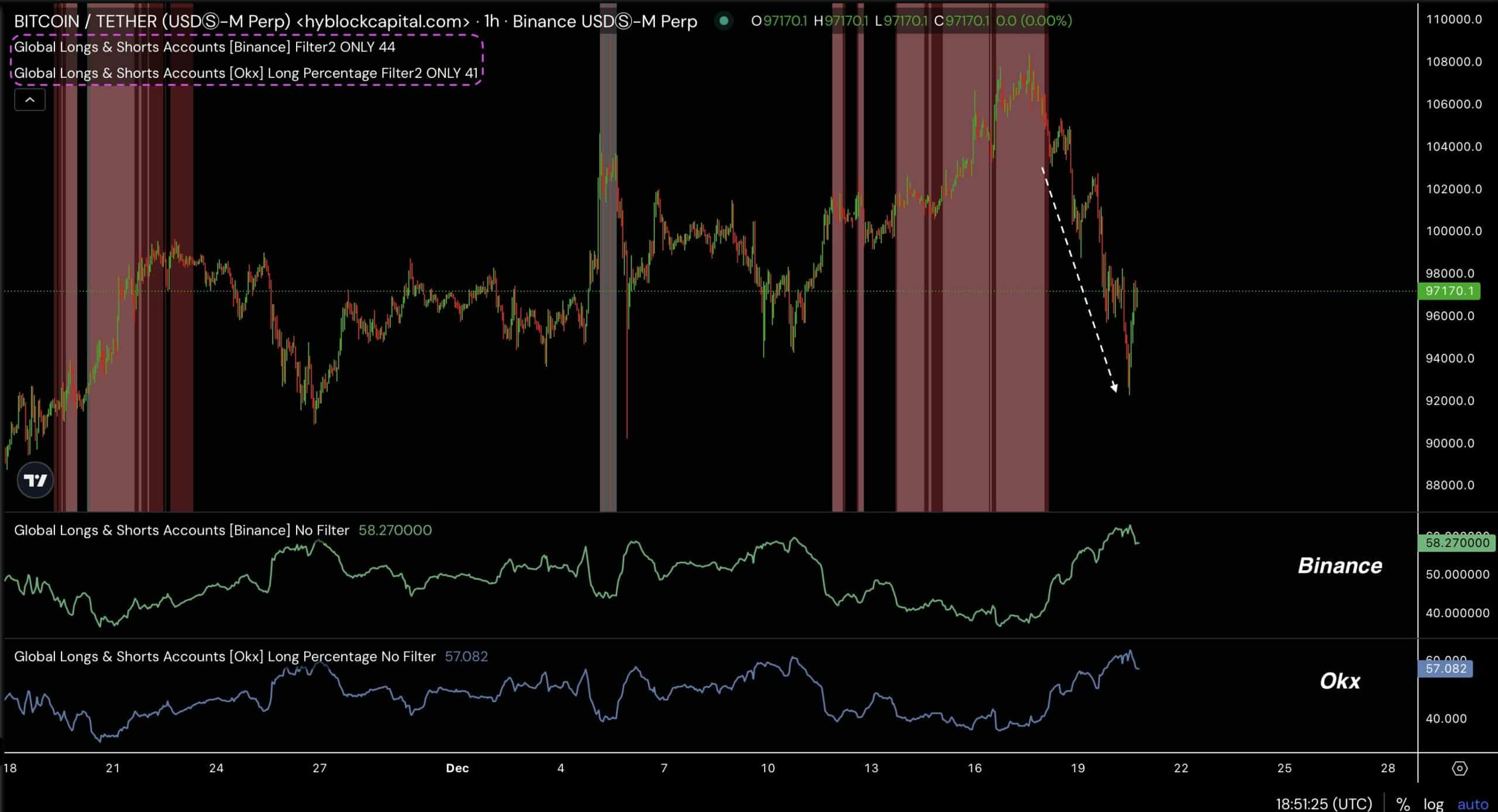

- Bitcoin’s long percentage started to rise as the price fell, trapping longs

- Bitcoin’s demand surged as the Funding Rates remained positive, despite the dip

As a seasoned analyst with over two decades of experience navigating financial markets, I have witnessed countless cycles and trends that defy conventional wisdom. The recent Bitcoin (BTC) price action is yet another example of such a cycle.

As an analyst, I observed an interesting development with Bitcoin (BTC). Despite a steep drop in its price, there was a surge in long positions on platforms like Binance and OKX, indicating that traders found themselves in a prolonged long position predicament. In essence, when BTC’s price dipped to around $92k, the number of long positions increased substantially.

This pattern seems to indicate a future shift, possibly leading to a reversal of the overly optimistic market attitude. Such a reversal might trigger a possible price increase due to short sellers jumping in and long-term investors exiting their positions.

These patterns frequently signal impending major shifts in the market. If the high proportions reach their maximum and start decreasing, this downward trend might set up Bitcoin for a potential recovery.

This move could indicate a change in market attitude, potentially catching short sellers off guard. It’s important to mention that aside from the significant price surge, Bitcoin also exhibited other signs of recovery on its graphs.

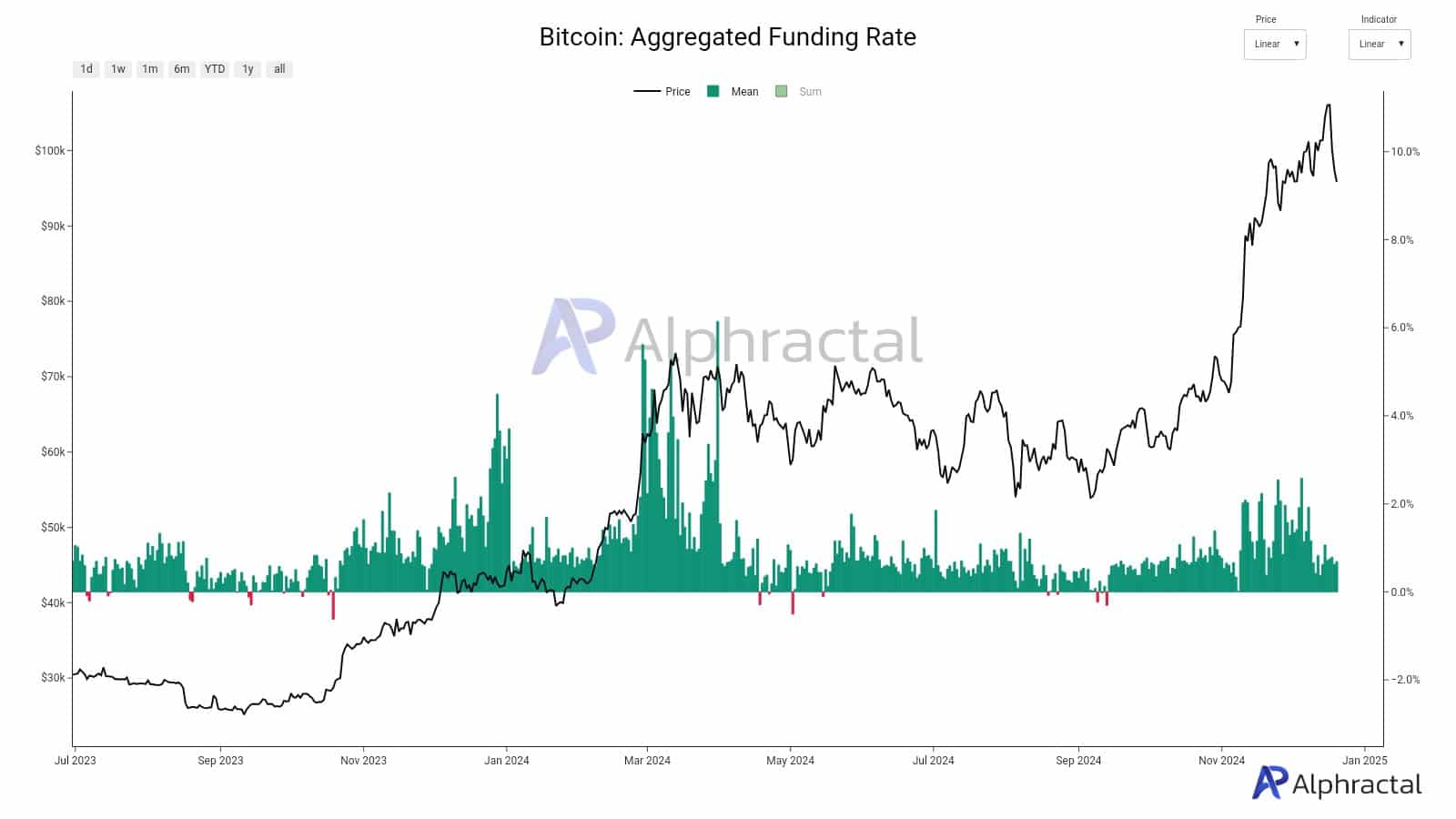

Bitcoin’s Funding Rate

The combined funding rate significantly increased along with the rising cost – Evidence of robust optimism among buyers. Later on, this funding rate stayed high as Bitcoin’s price started falling – Indicating that the market may be overheated.

In simpler terms, traders probably bought more than they sold when prices increased (going long), but the market wasn’t able to maintain the strong demand for buying, leading to a decrease (correction).

The reversal could’ve triggered some investors to sell for profits or short sellers to take advantage of the elevated borrowing cost, leading to increased selling force in the market.

Although there were some concerns, the continuous high funding rate suggested a strong underlying confidence in the market, though caution should still be exercised. If the funding rate remains high or changes direction, it may indicate future market shifts. A steady or reversed funding rate could shape Bitcoin’s short-term trend.

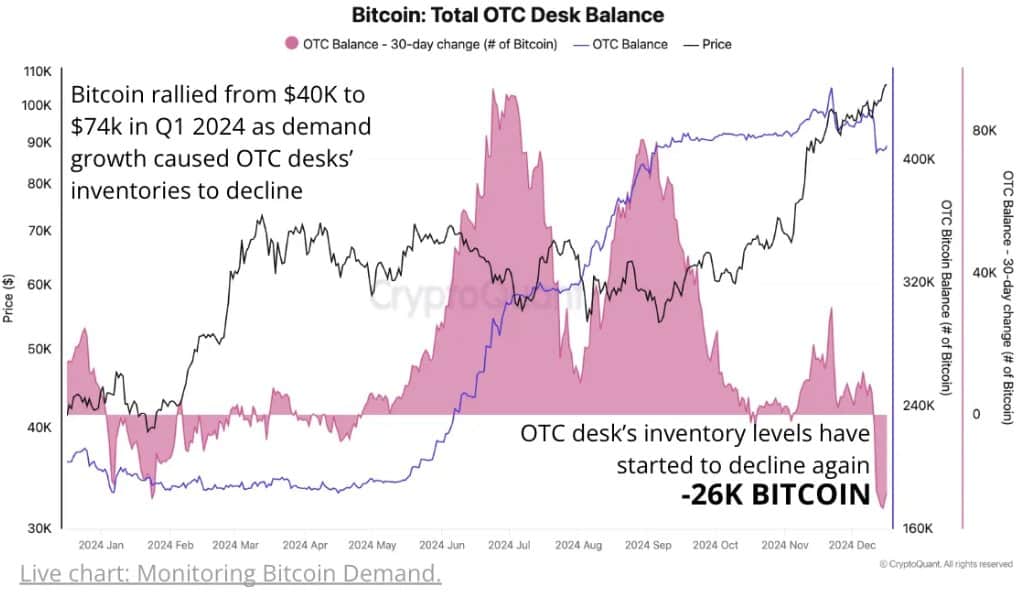

Demand meets brick wall

As a crypto investor, I witnessed an impressive surge in the value of Bitcoin during the first quarter of 2024. Starting at around $40,000, it soared all the way up to $74,000 by the end of the quarter.

This spike was fueled by rising market demand, as the significant decrease in Bitcoin holdings at over-the-counter (OTC) trading desks suggested. In fact, during this timeframe, OTC desks reported their most substantial monthly inventory reduction for the year, amounting to 26,000 BTC – Indicating a narrowing of supply.

The total amounts held on Over-the-Counter (OTC) trading desks decreased by approximately 40,000 Bitcoins between November 2020 and now, indicating a potential reduction in available Bitcoin as the desire for it continues to increase.

It’s clear that the drop in Over-the-Counter (OTC) balances concurrent with increasing prices suggests a robust market trend. This correlation implies that should OTC inventories keep decreasing, it might lead to an even higher Bitcoin price. Particularly if the demand remains steady.

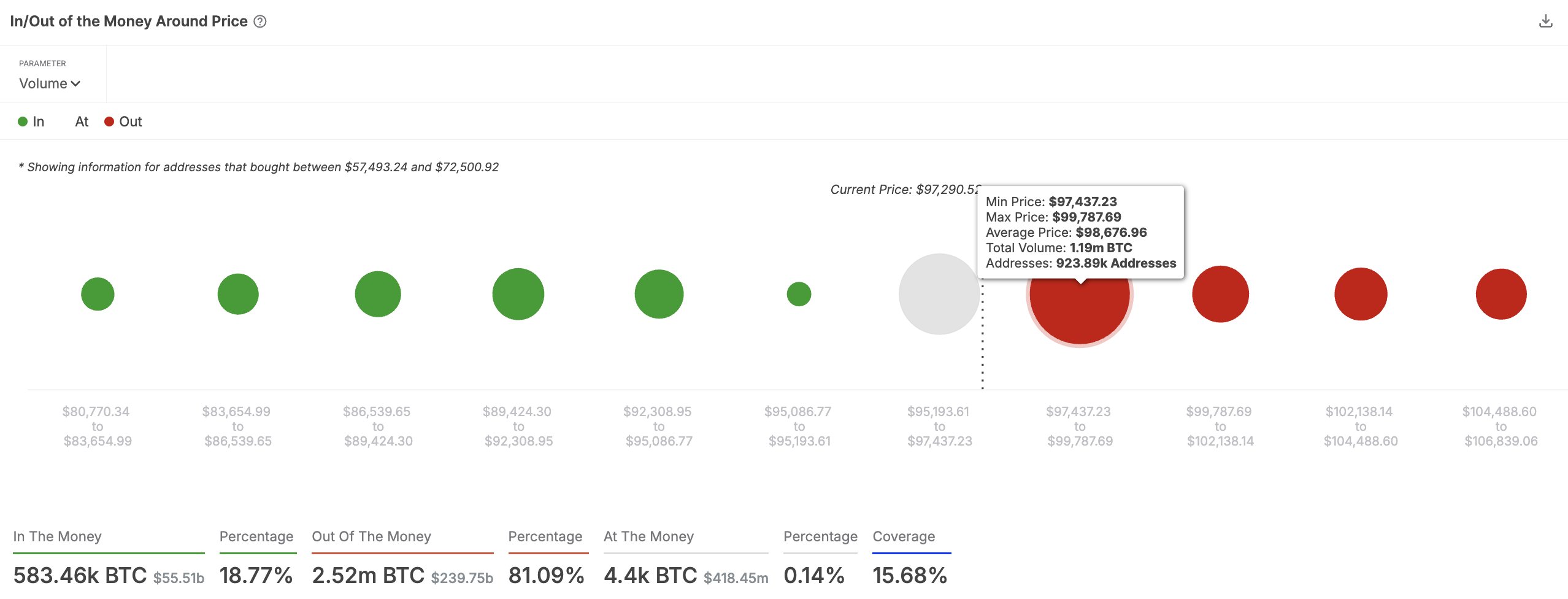

Conversely, there appears to be significant resistance in demand around the price range of $97,500 to $99,800, as approximately 924,000 wallets collectively possess more than 1.19 million Bitcoins.

Should Bitcoin manage to exceed its current resistance level, it could pave the way towards hitting new all-time highs. Overcoming this hurdle suggests a robust wave of purchasing activity, potentially swinging the market mood from bearish to bullish.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-22 00:07