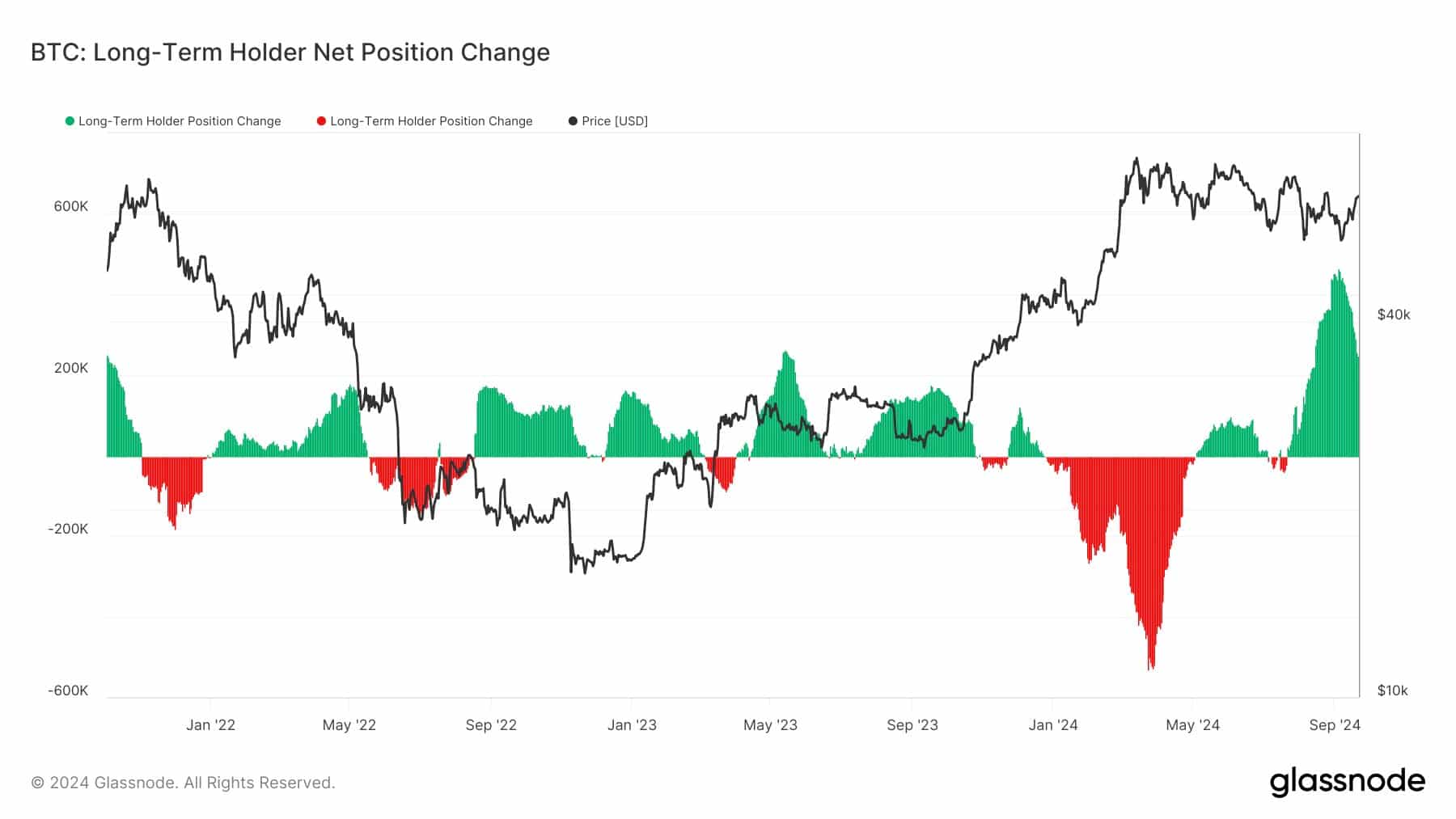

- Bitcoin long-term holders have been buying aggressively.

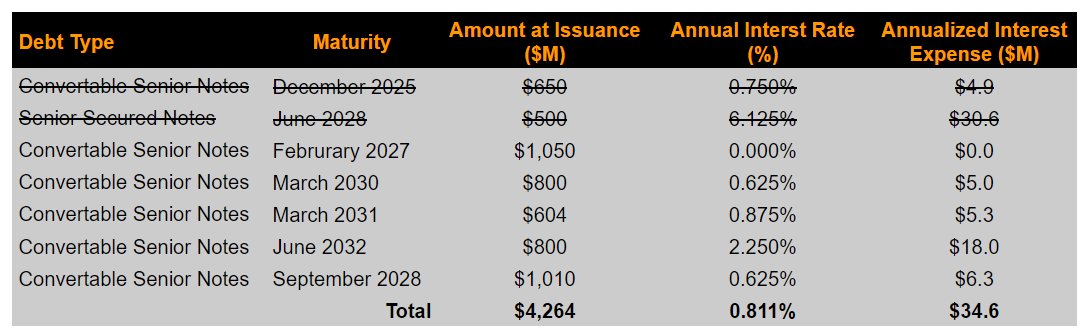

- MicroStrategy’s convertible debt will enable more purchase of Bitcoin.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself increasingly bullish on Bitcoin (BTC). The relentless accumulation by long-term holders and strategic moves by institutions like MicroStrategy are indicative of a growing confidence in BTC’s future potential.

Bitcoin (BTC) showed resilience as the cryptocurrency market regained momentum following a six-month slump. The behavior of long-term investors plays a significant role in guiding Bitcoin traders, providing clues about when to make trades.

For the past two months, there’s been a significant increase in Bitcoin being held for long-term investment. This is the highest rate of accumulation seen in the last three years.

Furthermore, both existing investors and newcomers have jointly acquired more than a million Bitcoins since the beginning of the year 2022.

Such intense purchasing patterns indicate a high level of faith in Bitcoin’s future prospects. Notably, some of the original Bitcoin mining accounts have started operating again, thereby potentially boosting the long-term quantity of Bitcoins in circulation.

In a standout performance, MicroStrategy (MSTR) tops the list of the S&P 500’s top ten performers, bolstered by Bitcoin investments that have yielded more than triple-digit returns, approximately 1000%, since implementing its Bitcoin strategy.

As an analyst, I’ve noticed that recently, Mastercard (MSTR) has chosen to issue convertible debt amounting to $1 billion at a favorable interest rate of 0.625%. The intention behind this move is to retire approximately $500 million worth of senior secured notes carrying a higher interest rate of 6.125%. This strategic financial maneuver is aimed at funding the acquisition of Bitcoins.

This move reduced its blended interest rate to 0.81% from 1.6%, lowering annual interest expenses.

Notably, this debt offering provides MicroStrategy with a stronger financial position, potentially enabling them to purchase additional Bitcoin should its price decrease in the future.

The ongoing acquisitions by major institutions like MSTR position Bitcoin for future growth.

Bitcoin 3-day MACD crossed bullish

Additionally, the Moving Average Convergence Divergence (MACD) of Bitcoin over a 3-day period has moved into a bullish zone, suggesting that its power remains strong as it currently trades above $63,000.

Looking optimistic about surpassing the $65,000 mark imminently, Bitcoin appears to be robust and exhibiting an upward trajectory that involves regaining its 100-day moving average.

It seems wiser to adopt a bullish stance towards Bitcoin right now, given its recent surge, which indicates it could potentially set new record highs. Remaining bearish might prove hazardous in such circumstances.

Performance from cycle lows

Ultimately, examining Bitcoin’s price trends from its cycle bottoms showed a pattern: Over the past three market cycles, Bitcoin usually closes the month of September at a higher price.

Bitcoin is up approximately 300% from the low of the current cycle. If BTC continues its historical pattern and finishes the year between the previous cycles, the price target could potentially reach $108K.

With improving market conditions, this target is becoming increasingly possible.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The growing support from institutions, increased long-term user engagement, and optimistic technological factors suggest that the value of Bitcoin could potentially rise substantially in the coming days.

As investor trust and key players such as MicroStrategy grow, so does the optimistic perspective on Bitcoin, with its value and market influence steadily increasing.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-23 22:15