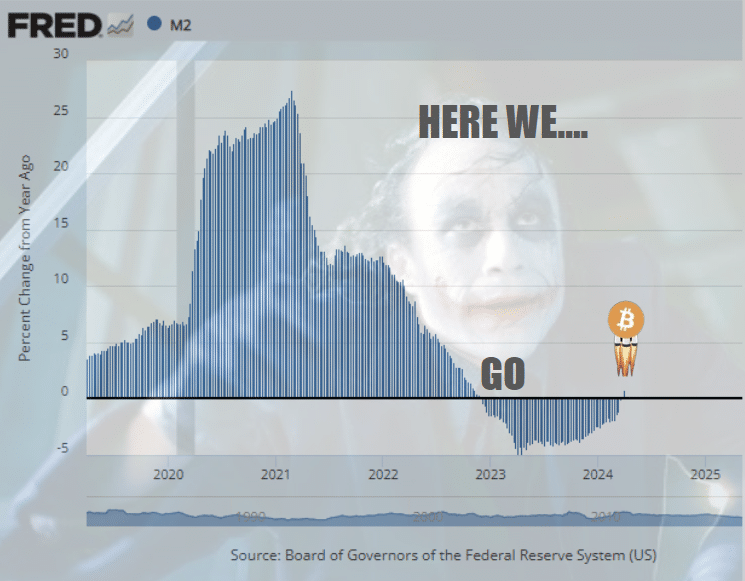

- M2 Money Supply’s positive trend suggests greater liquidity could boost Bitcoin

- Despite this optimistic signal, other metrics point to bearish pressures on the cryptocurrency

As an experienced financial analyst, I find the recent positive trend in M2 Money Supply quite intriguing and potentially bullish for Bitcoin. The historical correlation between increasing money supply and heightened investment in assets like Bitcoin during periods of rising inflation cannot be ignored. However, it’s essential to remember that other market indicators suggest ongoing bearish pressures on the cryptocurrency.

Following significant adjustments, Bitcoin is experiencing a notable rise in value as indicated by its price charts. The digital currency has surged by nearly 5% within the last 24 hours, reaching a current price of $62,850 at the moment of writing. This uptrend has propelled Bitcoin from its previous range around $57,000 in just a few short days. Consequently, the cryptocurrency’s market direction might be shifting towards an improvement.

As an analyst, I’ve noticed an intriguing concurrency between a recent favorable update from Apollo Sats’ co-founder and a noteworthy change in the M2 Money Supply trend. The exec revealed that as of May 1, this key economic indicator has transitioned from a negative to a positive year-over-year growth rate.

In essential terms, this update represents a significant boost to monetary flow, a phenomenon that has historically set the stage for elevated investment in assets such as Bitcoin when inflationary pressures intensify. As expressed by trader and financial author Oliver L. Velez in recent discourse, this development holds notable implications.

The M2 Money Supply is on an unprecedented surge, so get ready with a firm grip and pile up your investments. Every dip in the price of Bitcoin should be seen as an opportunity to buy more at a discount. Disregard the pessimists who spread fear and doom, we are still in the early stages of Bitcoin’s bull market.

Implications of M2 Money Supply’s shift on Bitcoin

The M2 Monetary Supply signifies the total amount of cash and short-term deposits circulating nationwide. When it shifts into a positive growth phase, it’s a common economic signal that may prompt investors to consider assets known for their strong performance during periods of elevated inflation.

As a cryptocurrency market analyst, I’ve observed that significant shifts within this space have historically led to exceptional gains, surpassing the returns seen in traditional financial markets.

Recent improvements in the M2 supply have fueled buzz among cryptocurrency traders, raising expectations of a prolonged surge in Bitcoin’s value.

Despite the rosy perspective linked to the M2 supply’s growth, it’s important to take into account other market signals suggesting persistent bearish trends.

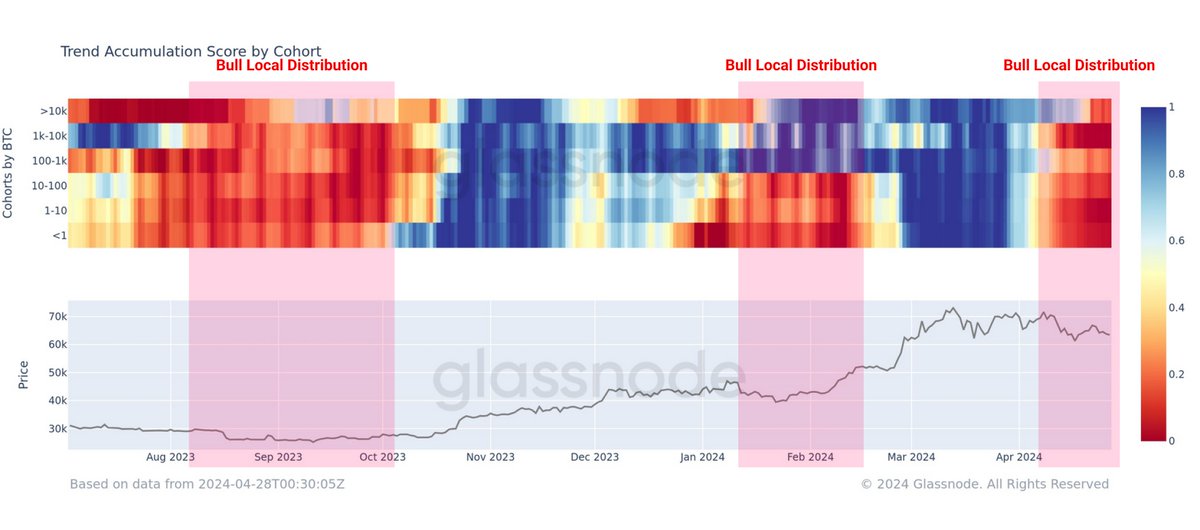

As a crypto investor, I’ve noticed some intriguing insights from a recent analysis conducted by Glassnode. They reported that Bitcoin experienced heightened net outflows among all investor groups in the month of April. This observation suggests that there has been consistent selling pressure in the market.

As I delved deeper into Bitcoin’s technical analysis, my findings painted a nuanced picture. The 4-hour chart revealed an intriguing development: an order block had appeared, suggesting that the price could experience a reaction or possibly reverse direction. This theory was bolstered by two distinct candle patterns. Firstly, a bullish spinning top emerged, which typically foreshadows a potential price reversal. Secondly, a bullish engulfing candle followed suit, further strengthening the case for a shift from bearish to bullish market conditions.

As a researcher examining these chart formations, I’d interpret it this way: The short-term trends indicate potential for bullish advances, but my analysis reveals a broader market outlook marked by caution and hesitancy.

Crypto analyst Ali Martinez has added to the current market discourse by pointing out a recent buy signal from Bitcoin’s Market Value to Realized Value (MVRV) ratio. This observation provides an additional perspective on the ongoing market trends.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-05-04 11:35