- Bitcoin reserves on spot exchanges have dropped to their lowest level since 2017

- Rising institutional demand amid the falling supply could trigger a prize squeeze

As a seasoned crypto investor with a decade of experience under my belt, I can’t help but feel a sense of excitement and anticipation reading these recent developments surrounding Bitcoin. The dwindling supply on spot exchanges, a trend not seen since 2017, is a clear indication that the market is changing, and institutional demand is playing a significant role in this shift.

At the current moment, Bitcoin (BTC) is being traded at $101,718 based on recent charts, marking a 1.6% increase over the past 24 hours. It’s no surprise that this digital currency remains the most influential in the market, boasting a market cap exceeding $2 trillion.

As I’ve seen significant returns on my crypto investments lately, the demand for Bitcoin has skyrocketed as well. This surge in demand has led to a scarcity in supply, creating an imbalance in the market. If this trend continues, we might be looking at a potential shortage of Bitcoin supply, which could drive its price upward.

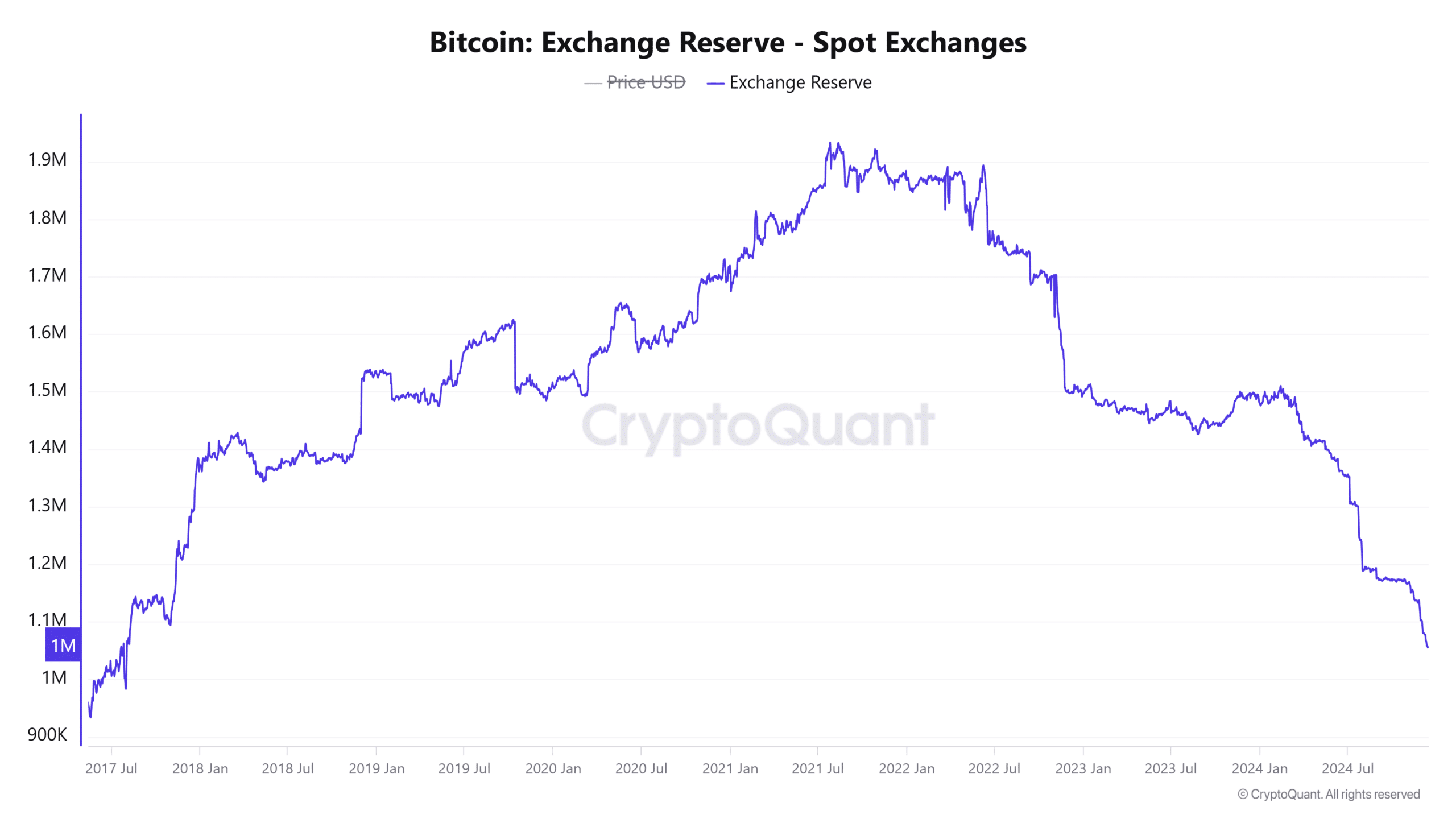

Bitcoin spot exchange reserves hit a 7-year low

According to data from CryptoQuant, the amount of Bitcoin stored in spot exchanges has reached its lowest point since mid-2018, with only about 1,055,716 Bitcoins currently held on these platforms. This decrease in supply is significant because it could indicate reduced selling pressure and potentially higher prices for Bitcoin.

Over the past month, these reserves have experienced a significant decrease, coinciding with Bitcoin’s surge beyond $100,000 to reach unprecedented new peak values.

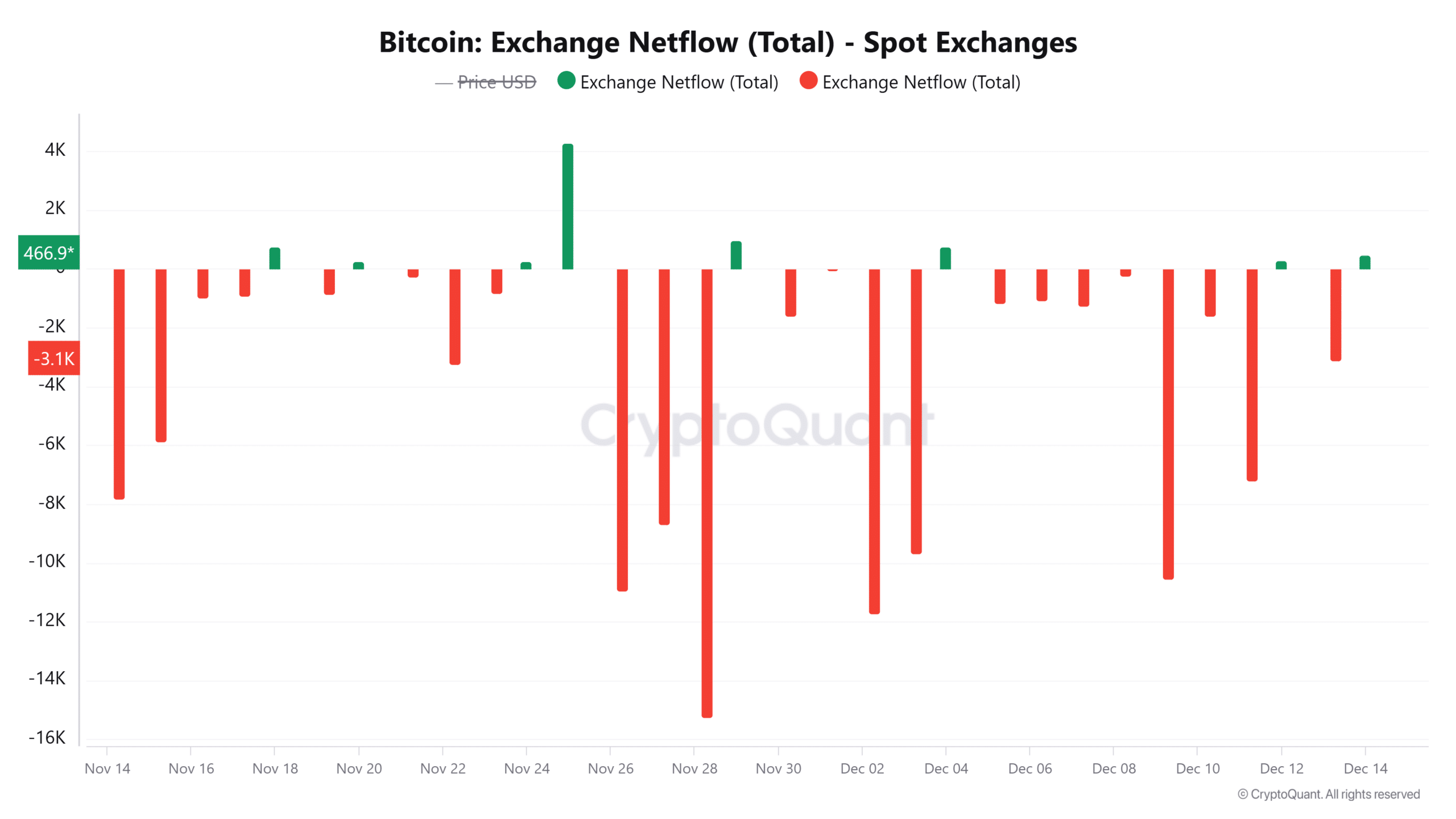

10X Research reports that over the past month, Coinbase – with the largest Bitcoin holdings – saw an outflow of approximately 72,000 Bitcoins. This represents about 10% of the total Bitcoin reserves held by the exchange.

Approximately 29,000 Bitcoins were additionally taken out from Binance during that timeframe, with Kraken’s withdrawals representing over 7% of their total Bitcoin reserves.

Over the past month, the outflow of netflow data shows that Bitcoin experienced 22 days with reduced inflow or even outflow from spot exchanges. This indicates a possible situation where traders are less interested in offloading their holdings.

Moreover, it appears that the majority of traders are opting to keep their Bitcoin, even with its recent growth spikes – Indicating a positive, long-term perspective on its value.

Rising institutional demand

The refusal to offload [Bitcoin] has sparked an increase in institutional interest, evident in the rise of investments into Bitcoin ETFs.

As per SoSoValue’s latest findings, the accumulated investments into Bitcoin Spot ETFs over the past three weeks have exceeded a staggering $5 billion. This influx brings these assets close to controlling around 6% of Bitcoin’s overall market worth.

Inflows to these ETFs have also been positive for the last 12 consecutive days.

Should these inflows continue, they might lead to a further tightening of Bitcoin’s supply, potentially causing its price to increase.

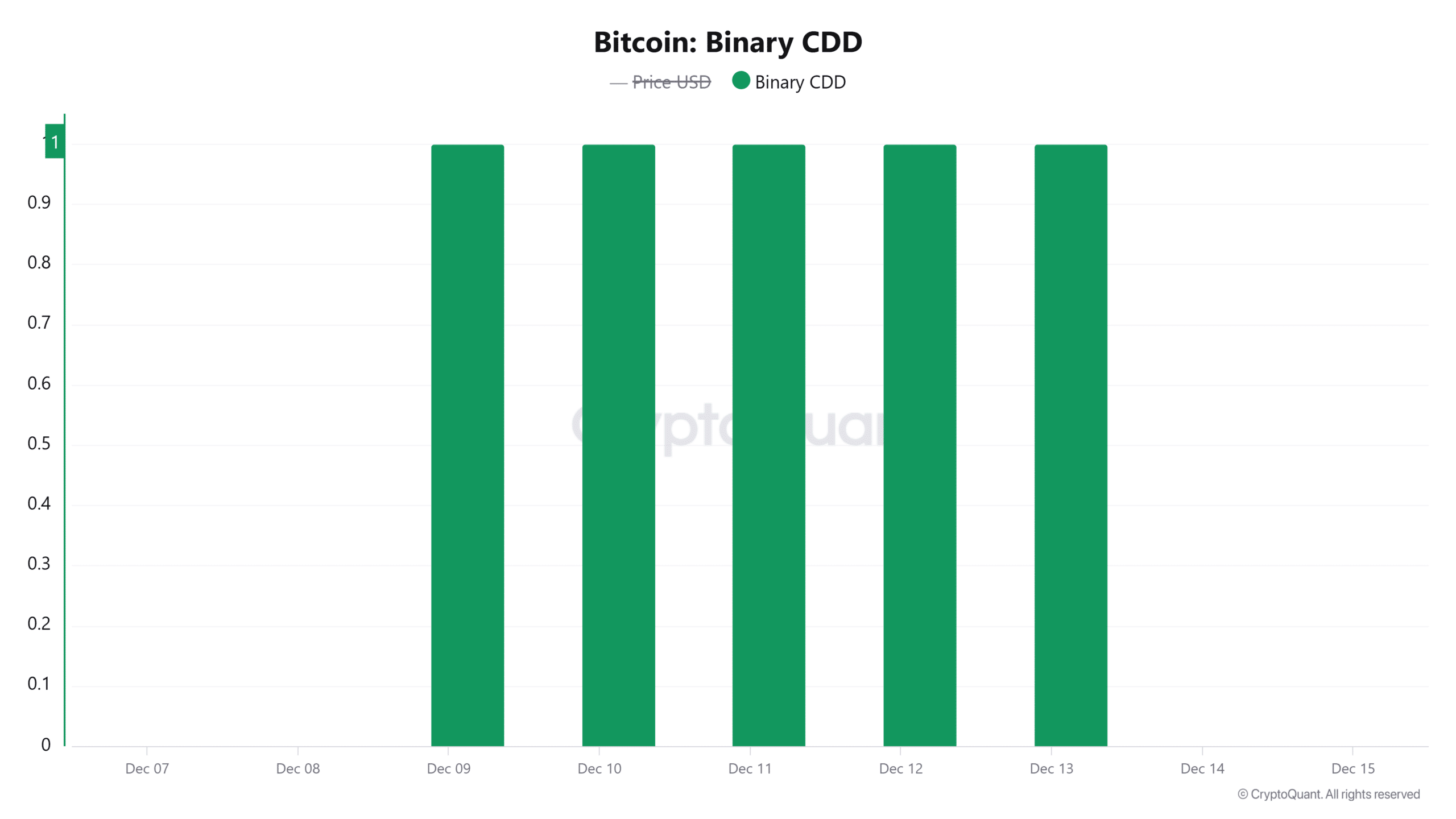

Binary CDD shows….

Long-term Bitcoin owners tend to offload their Bitcoin when the market reaches a temporary peak, as per AMBCrypto’s report. This group began selling Bitcoin earlier this month, which has led to the recent growth spurt coming to a halt.

Over the past five days, the Total Binary Coins Destroyed (TBD) has been consistently set at 1. This suggests that long-term investors might be continuing to sell off their coins for profit.

If this group is offloading Bitcoin, it might prevent a possible shortage of supply if the amount sold is substantial enough to counterbalance the demand pressure coming from buyers.

Read More

2024-12-15 00:07