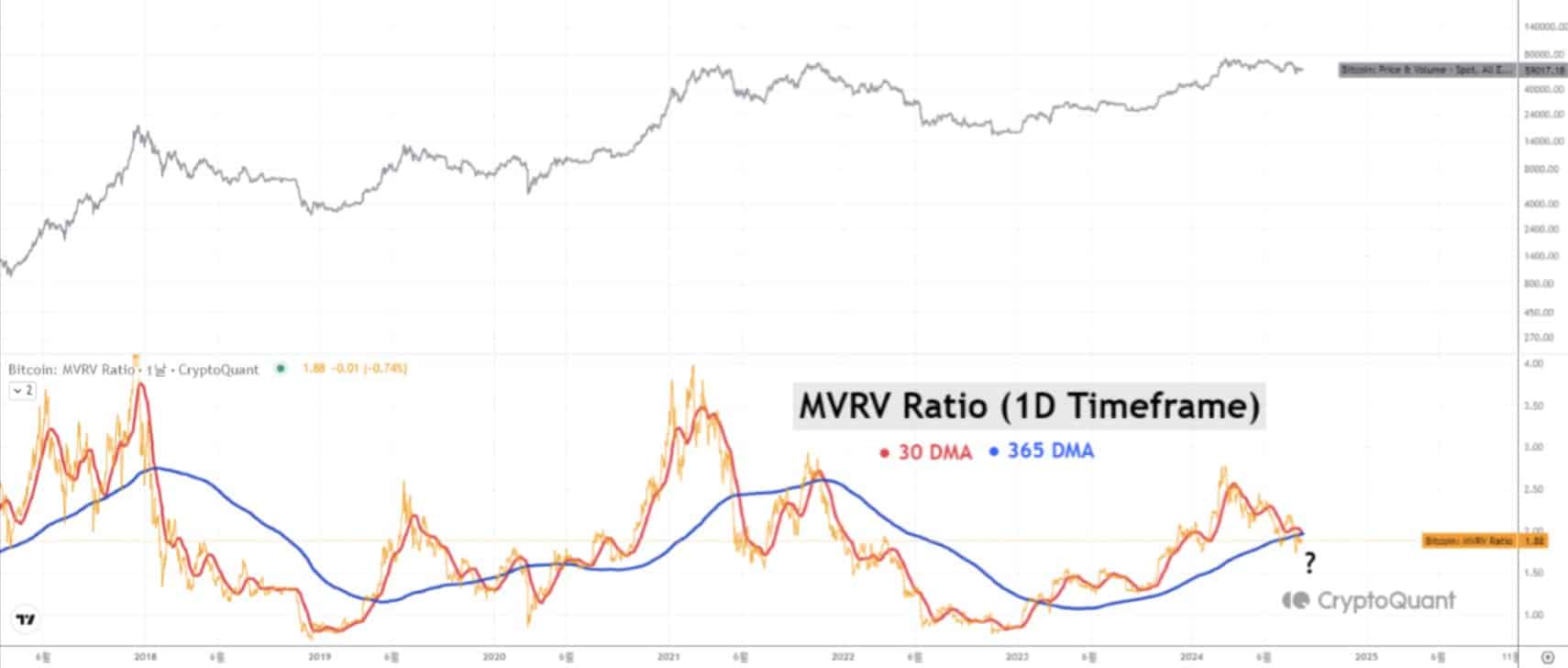

- Bitcoin’s MVRV ratio at risk of Death Cross.

- Bitcoin reserves on all exchanges are at historic lows.

As a seasoned researcher who has been following Bitcoin’s trajectory for more than a decade, I must say that the current state of affairs is both intriguing and somewhat nerve-wracking. The MVRV ratio at risk of Death Cross, coupled with historically low exchange reserves and skyrocketing institutional demand, presents a complex picture.

In the year 2024, Bitcoin (BTC) hit an unprecedented peak, igniting curiosity among institutions, administrations, and prominent investors. The attractiveness of Bitcoin Exchange-Traded Funds (ETFs) skyrocketed, with institutional ownership soaring to a staggering 27%.

Meanwhile, there’s growing unease because the MVRV ratio for Bitcoin might experience a “Death Cross,” potentially indicating a downward market trend.

Previously, when a Death Cross occurred in the MVRV (Market Value to Realized Value) momentum, it usually signaled an extended period of downward price trends. Keep an eye out for whether the 30-day moving average will continue to drop.

If the downward trend continues, it may suggest unfavorable results, but should the 30-day moving average manage to hold up against the 365-day moving average and begin to ascend, this could be a sign of an impending rise in Bitcoin’s price.

Bitcoin and gold correlation

Right now, the value of one Bitcoin compared to one ounce of gold is approximately 23.4, which is lower than its peak in 2021. If this ratio falls below 20, it might indicate a downward trend for Bitcoin, suggesting potential bearish movements.

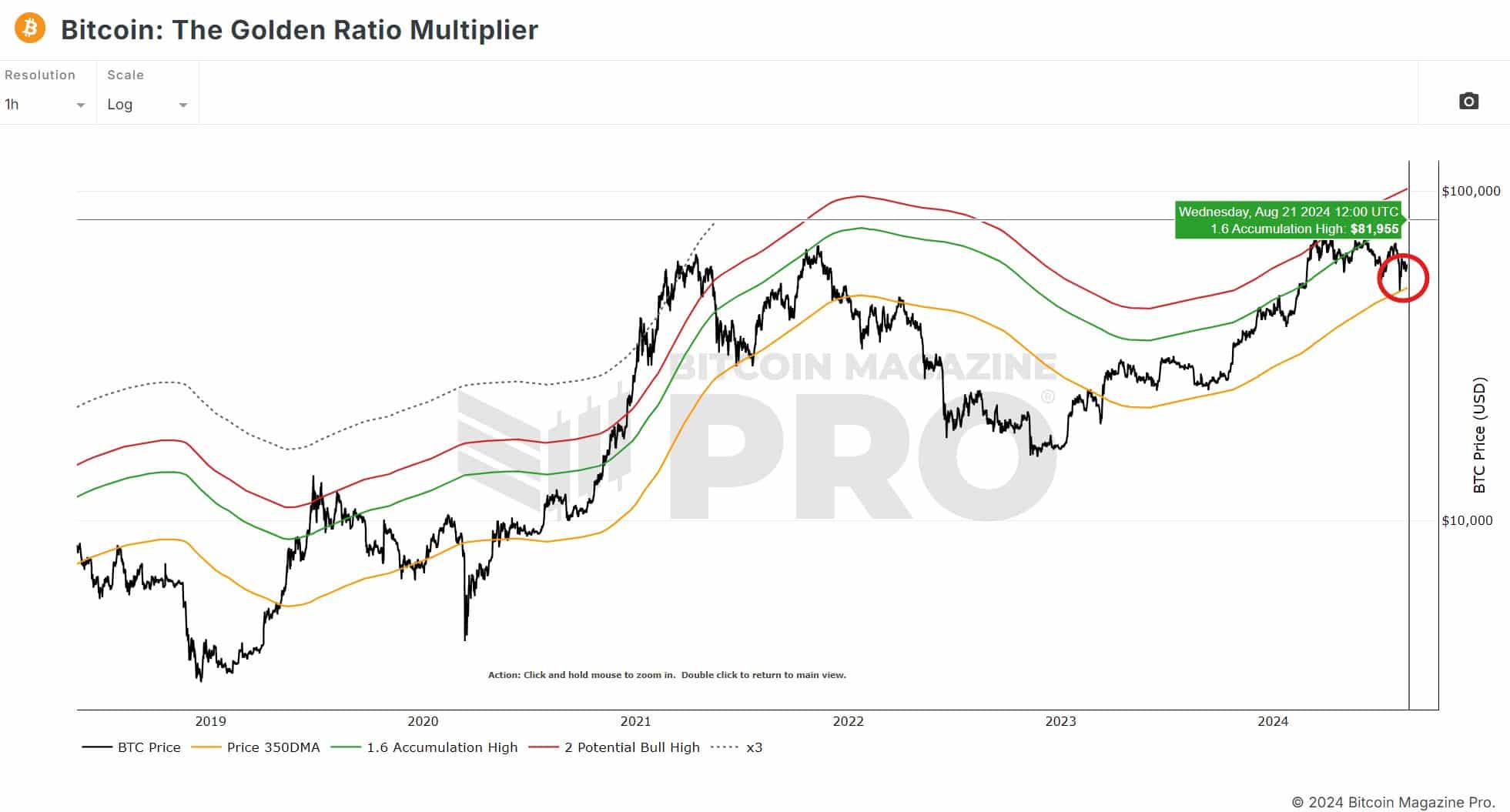

Should the BTC-Gold correlation continue to climb beyond 32.5, it could suggest a positive trend. Notably, Bitcoin has just rebounded from its 350 Day Moving Average (DMA) based on the Golden Ratio Multiplier, which is typically a bullish signal for me as an analyst.

Despite a steady pattern of trading between $50,000 and $70,000 over the past five months, there’s lingering uncertainty about whether Bitcoin will return to the $51,000 mark or push higher towards the 1.6 times level at $82,000.

Reserves and institutional demand

The amount of Bitcoin held on exchanges has reached record lows, but interest from institutions is higher than ever before.

In this situation, there might be a tightening of supply, leading to a temporary decrease in prices as they attract more funds, followed by a possible sharp increase due to increased demand.

As the available Bitcoin (BTC) decreases, the interest and desire to own it among investors is likely to increase, leading to potential fluctuations in the market’s prices.

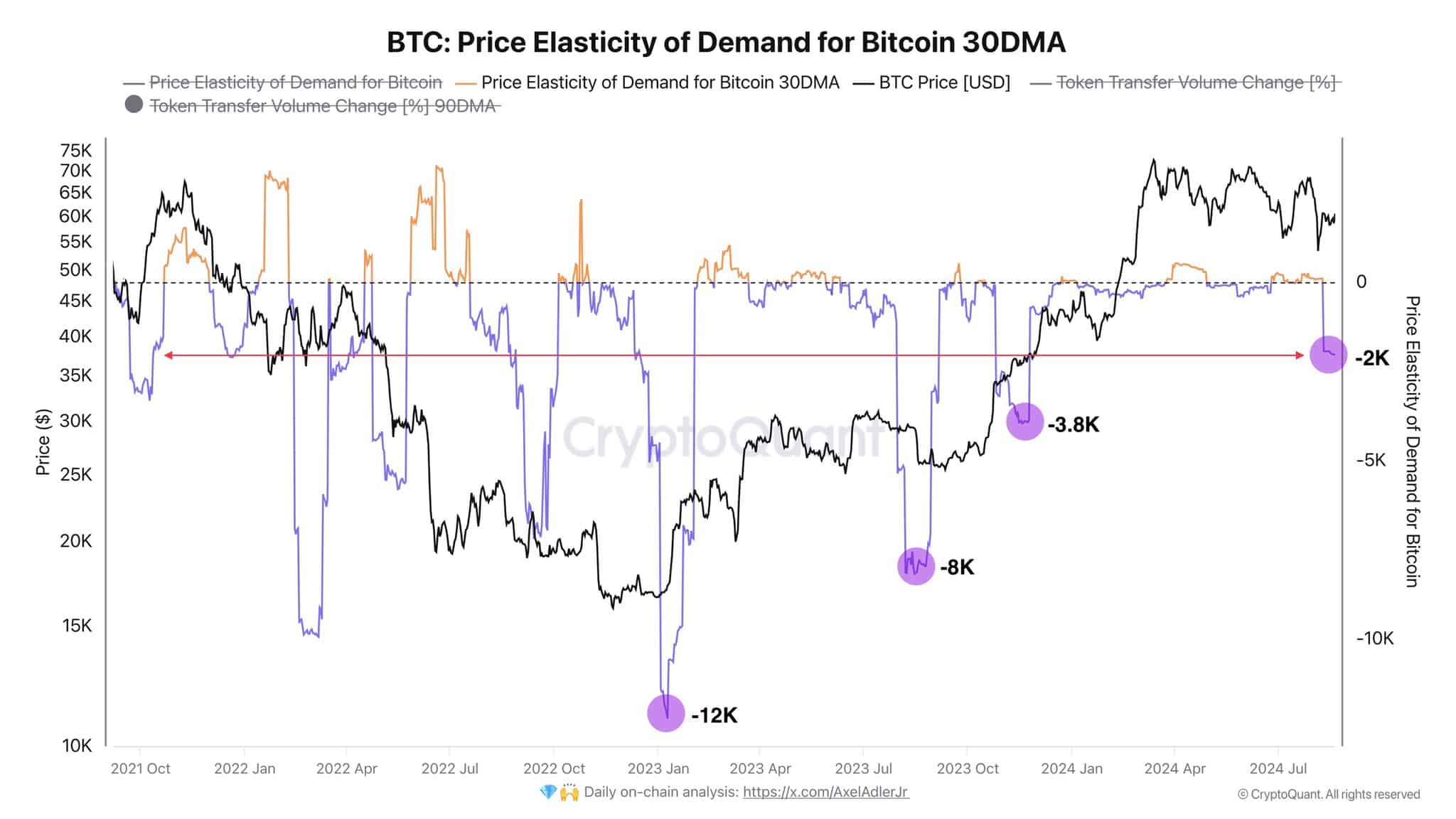

Price elasticity of demand for Bitcoin

The flexibility of demand for Bitcoin suggests that when its price goes up, the number of transactions made tends to decrease, while a drop in Bitcoin’s price typically leads to an increase in transactions.

A reverse correlation implies that a significant increase in Bitcoin demand might necessitate a decrease in its price.

As someone who has closely followed the cryptocurrency market for several years now, I have learned to expect the unexpected. Based on my observations, it appears that Bitcoin (BTC) could find itself in a tricky situation where it might first dip bearish before experiencing a surge driven by increased demand at lower prices. This phenomenon is not uncommon in the volatile world of cryptocurrencies, and I have seen it happen multiple times in the past. It’s a classic case of market psychology, where investors are hesitant to buy when prices are high but become more confident as they drop, leading to a sudden surge. However, this is not financial advice; always do your own research before making investment decisions.

Keeping a keen eye on the MVRV Death Cross and the Bitcoin-Gold ratio is crucial, as these indicators could significantly influence Bitcoin’s future pricing trends.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- How to Get to Frostcrag Spire in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

- The Boys season 4: Release date, cast, trailer and latest news

- Botched’s Dr. Paul Nassif & Wife Brittany Reveal Sex of Baby No. 2

2024-08-22 19:04