- The volatility in the Bitcoin market has declined significantly.

- AxelAdlerJr, in a new report, found that this has dropped to historical levels.

As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I find the current state of the Bitcoin (BTC) market intriguing. In a recent report, I, AxelAdlerJr, have discovered that volatility in BTC’s price action has dropped to historically low levels.

According to a recent analysis by the anonymous cryptocurrency expert known as AxelAdlerJr at CryptoQuant, the Bitcoin market is experiencing subdued price fluctuations at present.

As an analyst, I examined BTC‘s two primary indicators of volatility and observed that they have been decreasing over the past few weeks. This reduction in volatility signals a lower likelihood of a brief price fluctuation in Bitcoin.

As a researcher studying Bitcoin’s market behavior, I began by examining its historical volatility using the Garman-Klass Realized Volatility metric. This measurement calculates Bitcoin’s price fluctuations by considering its highs, lows, opening, and closing prices over a defined timeframe. Essentially, it provides an insight into Bitcoin’s price stability or instability during that particular period.

Based on AxelAdlerJr’s analysis, the volatility of Bitcoin’s price, as measured by its Garman-Klass Realized Volatility, has fallen to 20%. A low reading for this metric suggests that the asset’s price swings have decreased.

Based on historical analysis, a dip in the indicator’s value to this level over the past six years has consistently been followed by notable price fluctuations for Bitcoin.

Additionally, the researcher examined Bitcoin’s Volatility Index by calculating the 30-day simple moving average (SMA). This indicator reflects the extent of Bitcoin’s price changes during a given time frame.

Just like the Realized Volatility of a coin’s Germán-Klass measurement, the Volatility Index of Bitcoin has dropped as well, indicating a decreased level of price volatility for the primary cryptocurrency.

The CryptoQuant analyst points out that the index’s value has fallen to surprisingly low figures, a occurrence that has happened just four times over the past six years.

BTC’s price swings are minimal

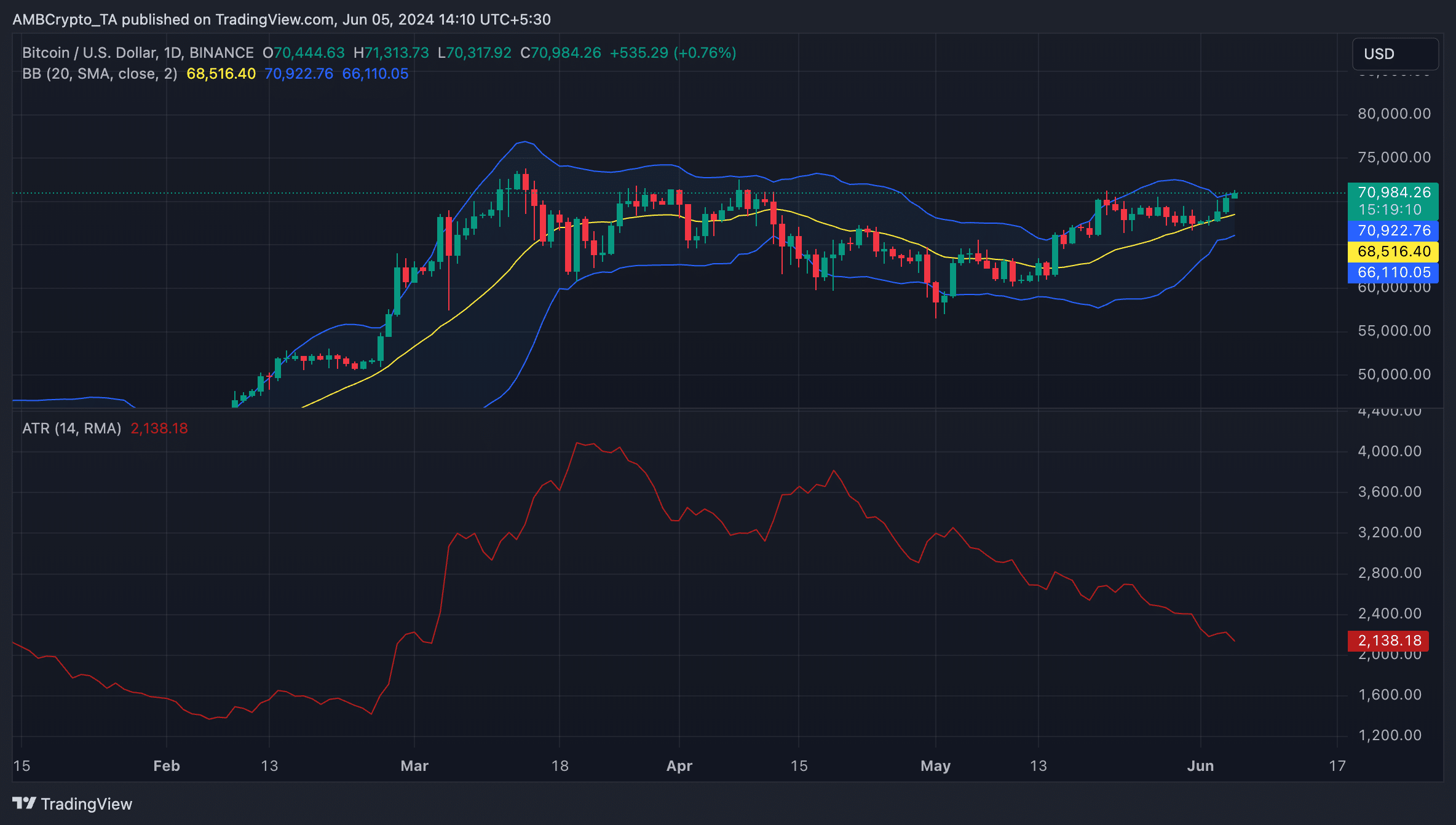

As a cryptocurrency analyst, my evaluation of the coin’s price movement was supported by the findings from AMBCrypto’s analysis of its Bollinger Bands and Average True Range indicators.

The distance between BTC‘s Bollinger Band’s upper and lower limits grew smaller in recent readings, indicating a decrease in market volatility.

The decreasing average range between Bitcoin’s recent highs and lows, as indicated by the Average True Range (ATR), supports the ongoing downward trend. This technical indicator gauges market volatility by determining the average difference between significant price movements over a given time frame.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

When the indicator drops, it implies a decrease in market volatility and indicates that the asset’s price is moving within a specific range. Currently, Bitcoin is priced at 2138.35, and its Average True Range (ATR) has decreased by 44% compared to its value on April 19th.

According to AxelAdlerJr, the current low volatility in the BTC market is a good sign. “

As a crypto investor, I’ve been observing the market closely, and my analysis suggests that we’re currently experiencing a bullish structure. The prolonged period of low volatility may soon give way to a significant price surge, indicating the beginning of a new bullish trend in the market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-06 07:03