- Analysts point to BTC’s historical alignment with previous market cycles, indicating strong potential for a sustained rally.

- Both traders and long-term holders are driving demand, showing growing confidence in the asset’s prospects.

After having closely followed and analyzed the cryptocurrency market for several years now, I find myself increasingly convinced that Bitcoin is poised for continued growth. The historical alignment with previous market cycles, coupled with the current bullish sentiment among traders and long-term holders, suggests that we may be on the cusp of an extended rally.

For the past month, Bitcoin [BTC] has significantly increased by 47.52%, establishing itself as one of the leading market contenders. Interestingly, in just the last day, its value has climbed by 1.78%, indicating that buying momentum remains high and unabated.

As a researcher observing market trends, I find myself increasingly optimistic about Bitcoin (BTC). The surge of positive sentiment among investors suggests that BTC is poised to continue its upward trajectory over the coming weeks.

Historical trends indicate BTC is primed for an upswing

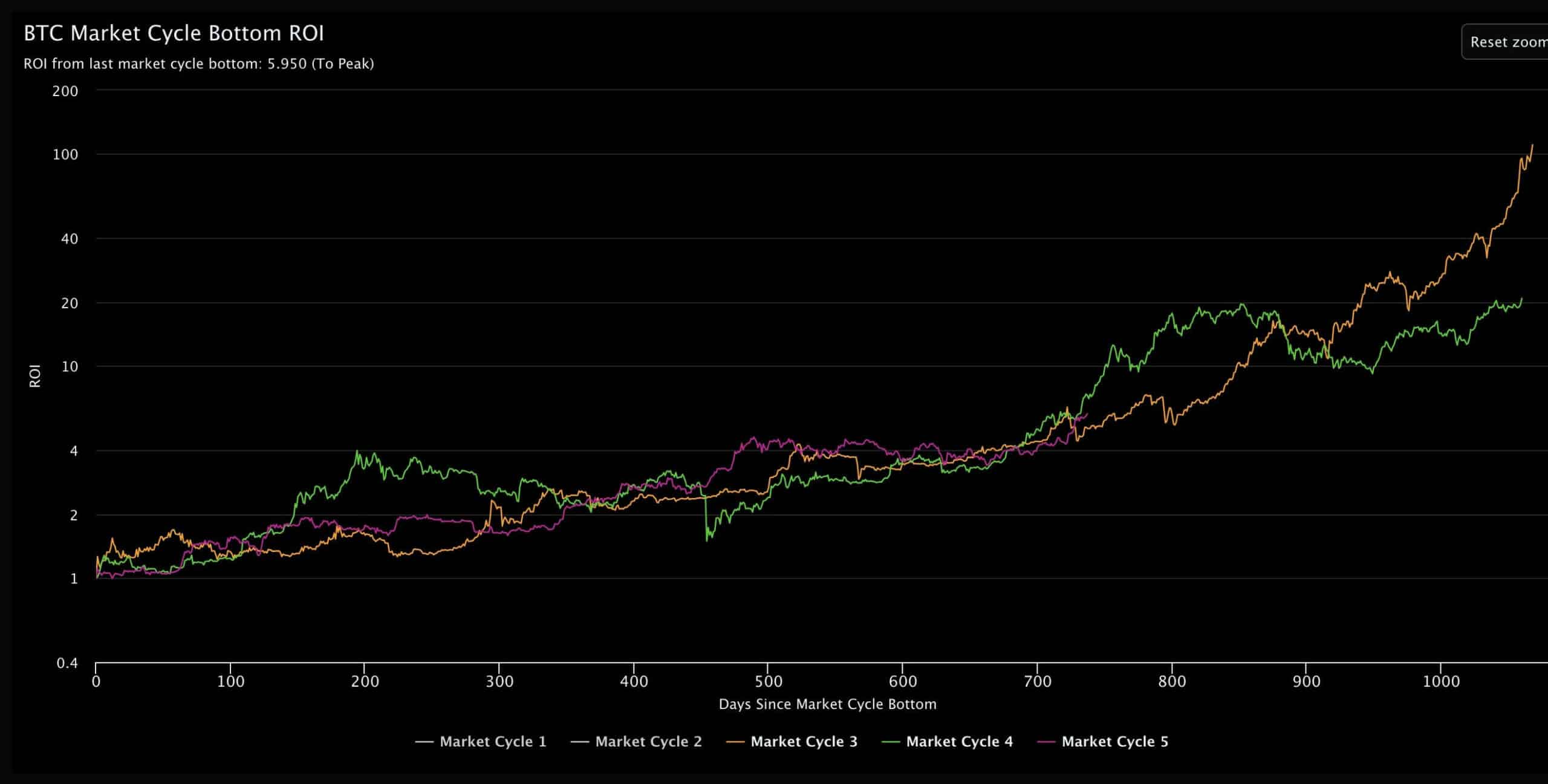

Analysts are using a set of data called the BTC Market Cycle Bottom ROI, which tracks Bitcoin’s performance throughout different market cycles, to support their belief that it could still experience more growth.

The data reveals that BTC’s current trajectory aligns closely with the patterns observed in the last two cycles. If this trend holds, Bitcoin could experience steady, incremental growth from its current price levels.

The runs of the bull market in 2017 and 2021 seem to have mirrored each other, hinting that the current surge could persist until 2025 if past patterns recur.

AMBCrypto undertook additional examination to determine if the prevailing market trends align with a prolonged bullish perspective.

BTC prepares for long-term growth as buyer activity increases

Bitcoin (BTC) is exhibiting robust optimistic indications, with investors readying themselves for what might be a prolonged upward trend.

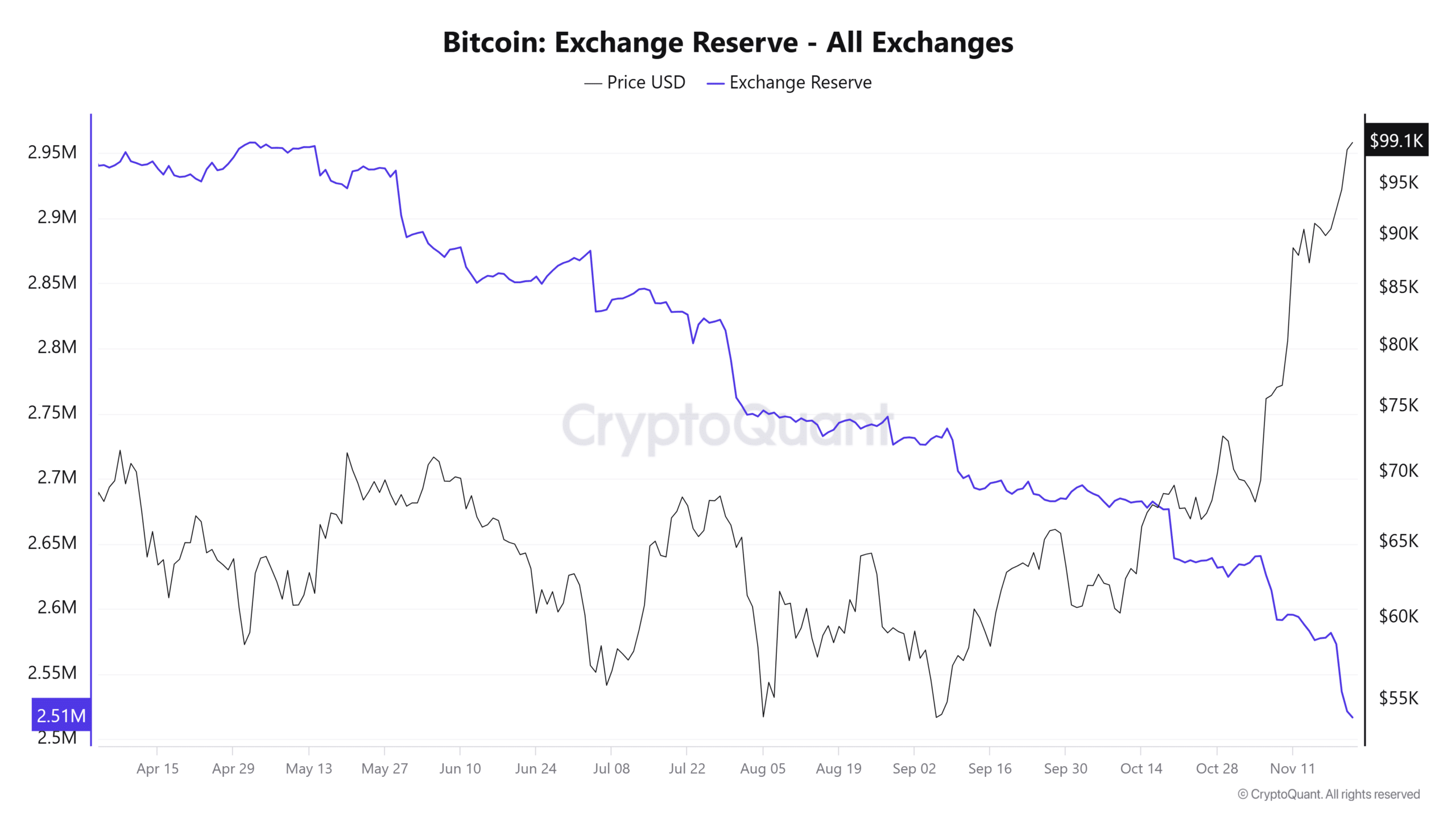

The amount of Bitcoin held on cryptocurrency exchanges, known as The Exchange Reserve, has significantly dropped. Currently, there are approximately 2.516 million Bitcoins left on these platforms, representing a 0.72% decrease over the past day and a total decline of 2.63% in the last week.

This reduced supply suggests increasing demand, a trend often linked to upward price momentum.

The Exchange Netflow shows a substantial decrease of approximately 87.02% in the last 24 hours. Over 15,000 Bitcoins have been transferred from exchange platforms to personal wallets, indicating a growing inclination towards holding rather than trading.

As an analyst, I find that instances of negative netflows – where outflows surpass inflows – often suggest that investors are positioning themselves for potential long-term growth and price appreciation.

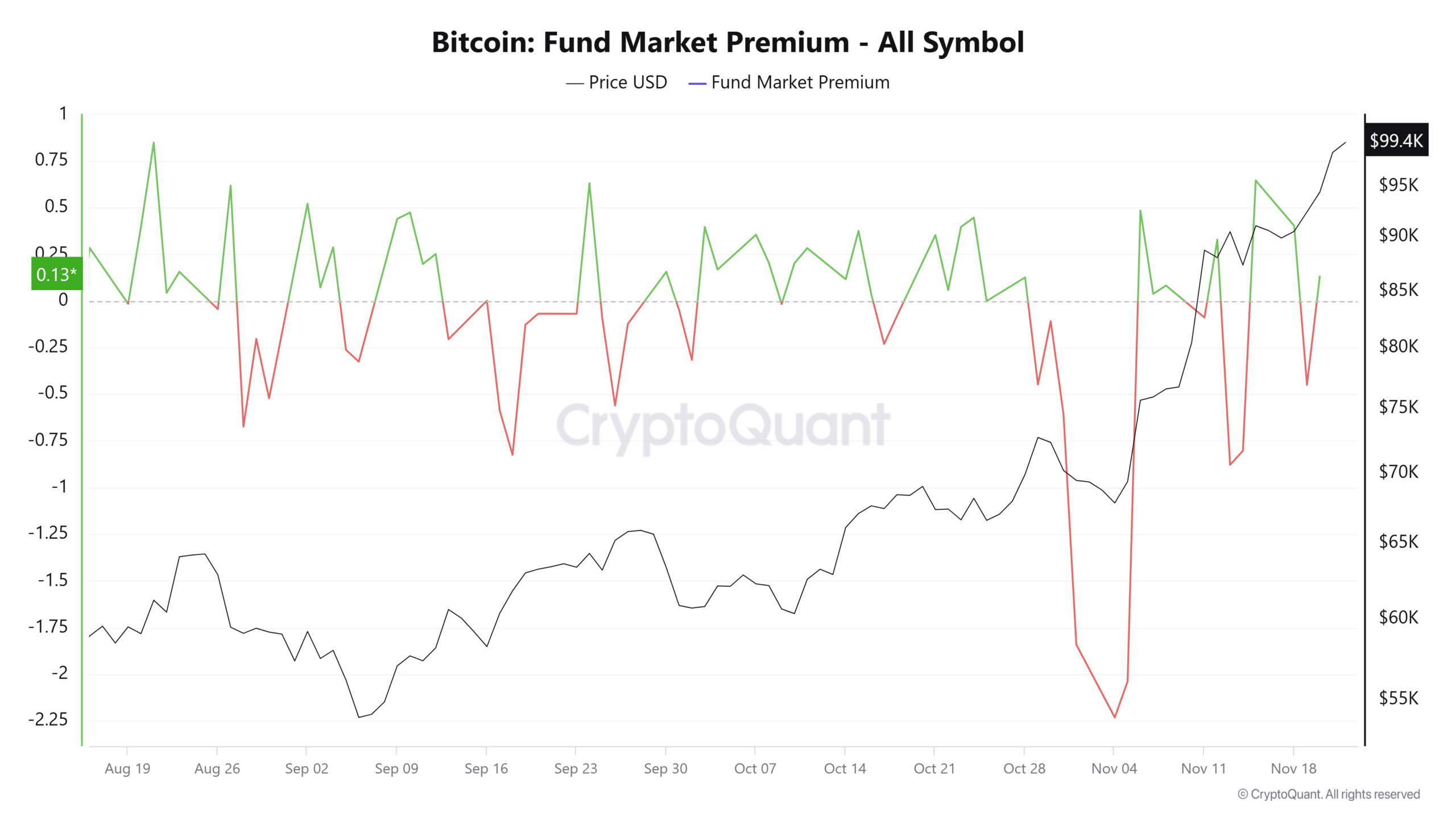

Boosting our certainty even more is the Fund Market Premium, which remains positive and currently stands at 0.13074, having surpassed the zero line yesterday.

The measurement of the difference between a fund’s trading price in the market and its actual worth, represented by Net Asset Value (NAV), is frequently employed when assessing Exchange-Traded Funds (ETFs) and similar types of funds such as Grayscale. This method is often used to evaluate their true value.

A positive premium highlights strong investor demand and reinforces the bullish sentiment.

As Bitcoin’s exchange reserves decrease, inflow lessens, and there’s a higher demand compared to supply, it seems poised for continuous, long-term expansion.

Broader market sentiment fuels BTC’s bullish momentum

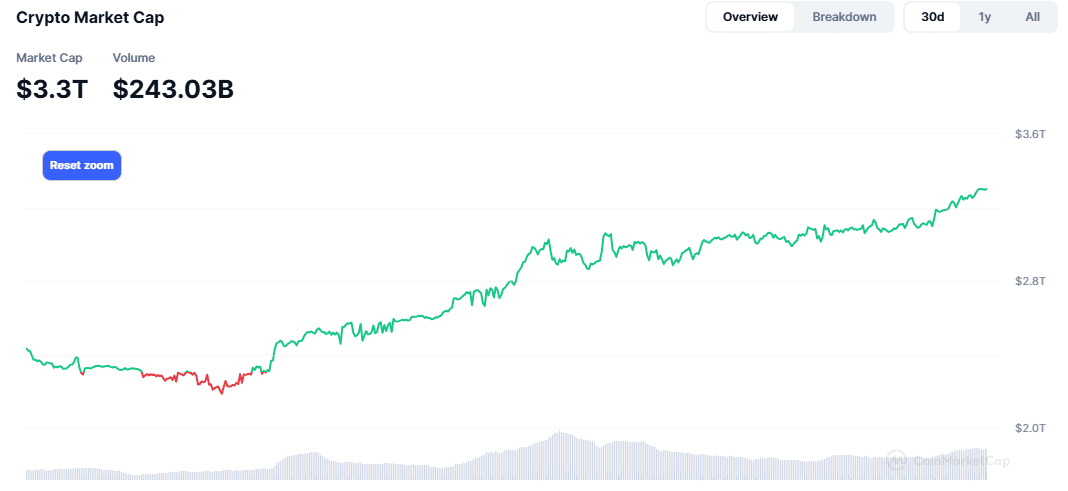

In simpler terms, the overall trend in the crypto world remains positive, suggesting that Bitcoin could continue to rise in value.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As of now, the overall value of all cryptocurrencies combined has increased by 4.63%, standing at approximately $3.3 trillion. A substantial portion of this, about $1.97 trillion, is attributed to Bitcoin. This underscores Bitcoin’s leading role and its increasing attractiveness to investors.

If the overall value of the cryptocurrency market keeps rising, it might bring more funds into Bitcoin, making it even more attractive to investors and potentially strengthening its growth trend.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

2024-11-22 18:16