-

Bitcoin’s slip below its STH Realized Price might capitulate the price to $53,000.

Maintaining support at $69,178 may drive BTC to $92,237.

As a researcher, I have closely followed Bitcoin’s price movements and trends for quite some time. Based on my analysis of recent data from reliable sources like CoinMarketCap and on-chain analytics platforms such as Glassnode, I believe that Bitcoin’s slip below its STH Realized Price might lead to further price declines, potentially pushing the coin down to around $53,000.

Bitcoin’s value is poised to finish the month with a decline for the initial time since the new year, based on data from CoinMarketCap. Currently, the digital currency is priced at $63,431. On average, this signifies a 9.71% decrease in value over the past thirty days.

As the month of May draws near, there has been speculation about whether Bitcoin (BTC) can bounce back from its recent slump. Some market analysts have proposed a potential relief, while others have presented a less optimistic outlook.

Instead of relying on anecdotal evidence and individual perspectives, AMBCrypto examined significant indicators that may influence a cryptocurrency’s price in the upcoming month.

Beware! Conviction is not reality

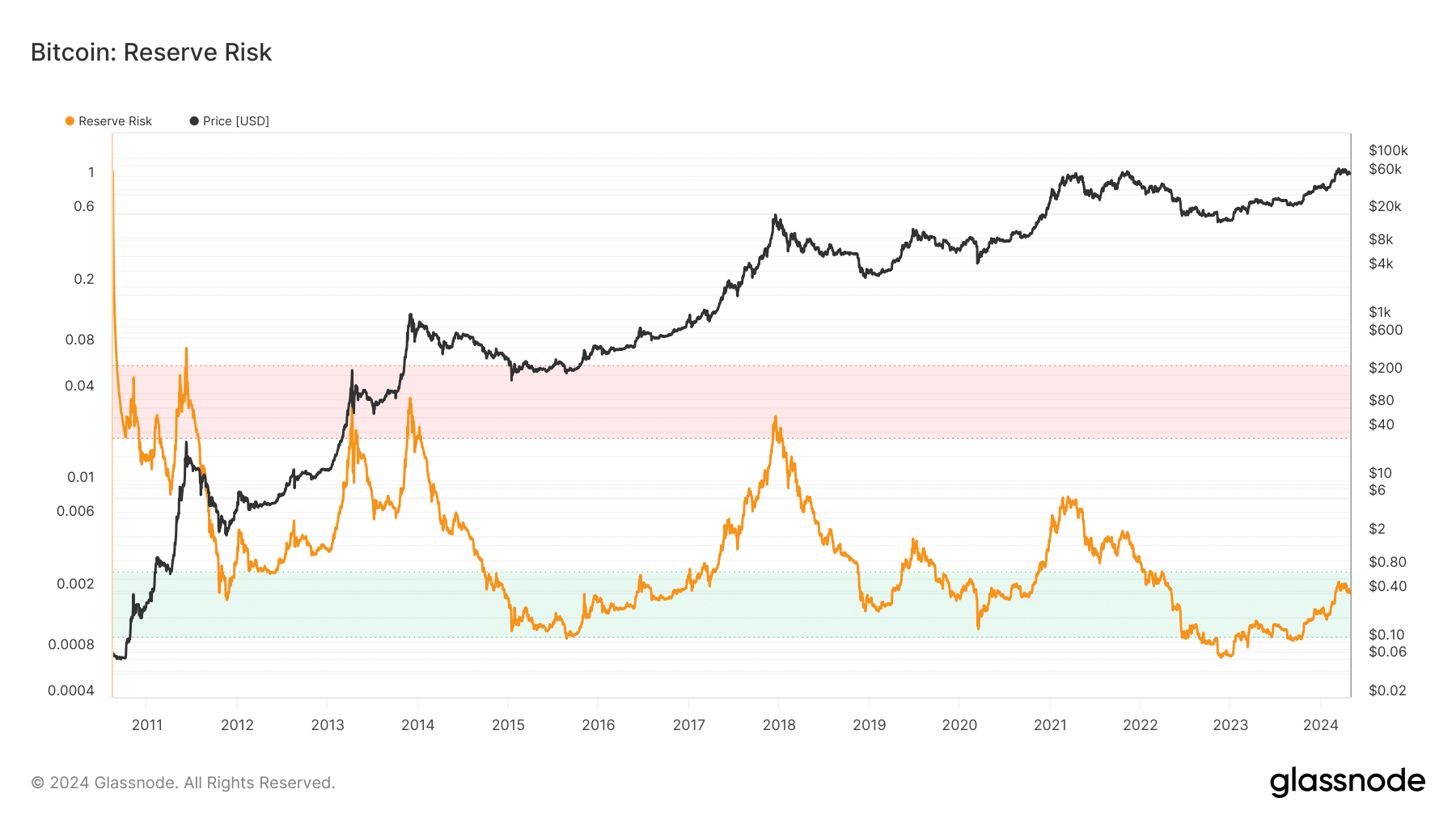

The Reserve Risk, a metric offered by the on-chain analysis firm Glassnode, reflects the degree of conviction among long-term investors regarding the current market price.

As a crypto investor, I’ve learned that when the price of Bitcoin is high but my confidence in the investment is low, it may not be an ideal time to take on significant risk. In such situations, the potential reward might not justify the current price. Conversely, if the value of Bitcoin is declining but my confidence is increasing, I might see this as a sign that the market could be poised for a turnaround and the price could potentially rise again.

As of the current news update, the Reserve Risk stood at 0.002. This figure signified a high level of confidence among Bitcoin holders regarding the cryptocurrency’s price. Moreover, considering the recent price drop over the past month, it might be a prudent move for investors to begin purchasing more BTC in preparation for further price growth.

As a researcher studying the Bitcoin market, I would advise keeping an eye on the potential increase in accumulation. Should this trend continue, it could push the price of Bitcoin closer to $70,000. This bullish scenario might leave bears in an unfavorable position. Additionally, monitoring the Short Term Holder (STH) Realized Price can provide valuable insights into market sentiment and potential price movements.

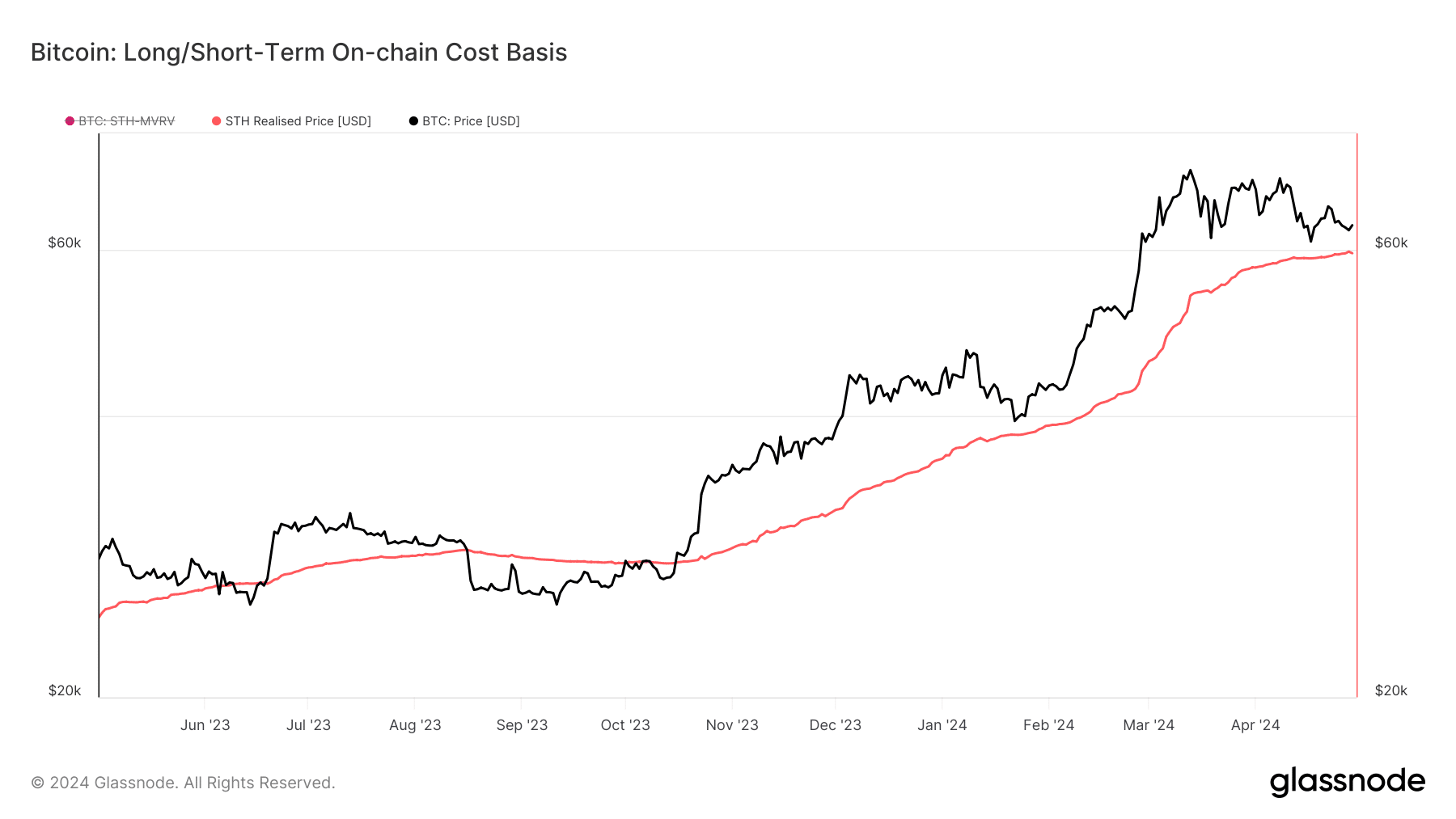

As a crypto investor, I keep a close eye on my average cost basis for my Bitcoins, which is represented by the Realized Price. Whenever the current market price for Bitcoin dips below this Realized Price, I become cautious as it could potentially signal that the coin has reached a local peak in its price trend.

Has the path to $92,237 begun?

If Bitcoin’s value remains above the current realized price of $59,586, there could be more gains on the horizon. However, if Bitcoin’s value were to fall below this price, its spot value might decrease and potentially reach as low as $53,000.

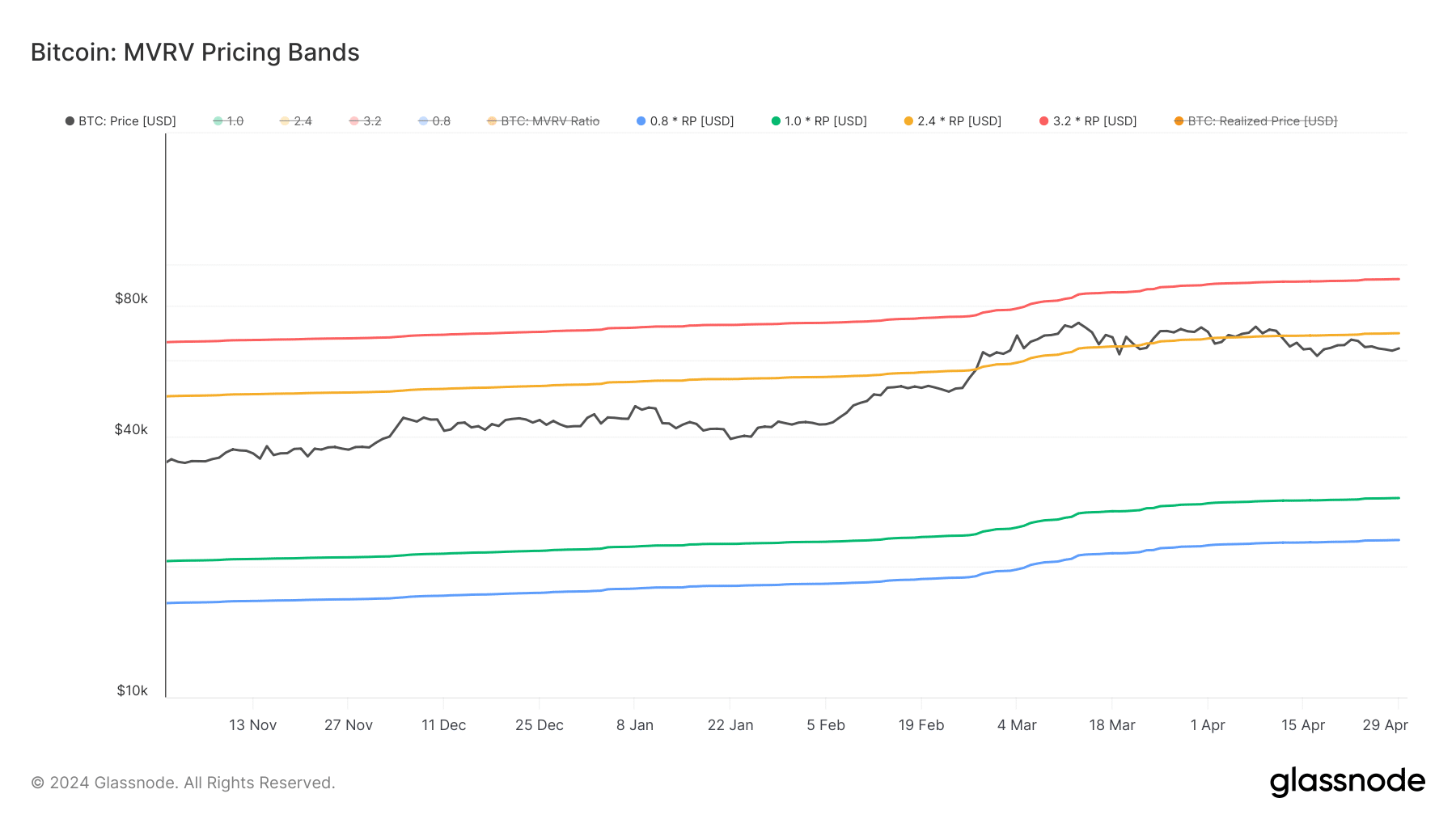

As an analyst, I can explain that we have another method to determine Bitcoin’s price threshold to prevent a massive sell-off, often referred to as capitulation. We employed the use of MVRV (Market Value to Realized Value) Pricing Bands for this assessment. In simpler terms, MVRV Ratio shows the difference between the current market price and the average price at which Bitcoin was last bought by investors.

As a crypto investor, I use various price models to help me identify potential cycle tops and bottoms in the market. Currently, according to the MVRV (Moving Average Realized Value) pricing bands, if the price reaches a Realized Price of $69,178, it could lead to an increase in value up to $92,237.

As a researcher examining the Bitcoin market, I would express it this way: The longer-term outlook for Bitcoin remains positive, but in the near term, buying pressure is necessary to counteract the recent heavy selling.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Should a surge in accumulation come in, then a drop below $59,586 might not happen.

The value of the coin may surpass $69,000, which could lead to it reaching $73,000 or even more by the end of May.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2024-05-01 00:07