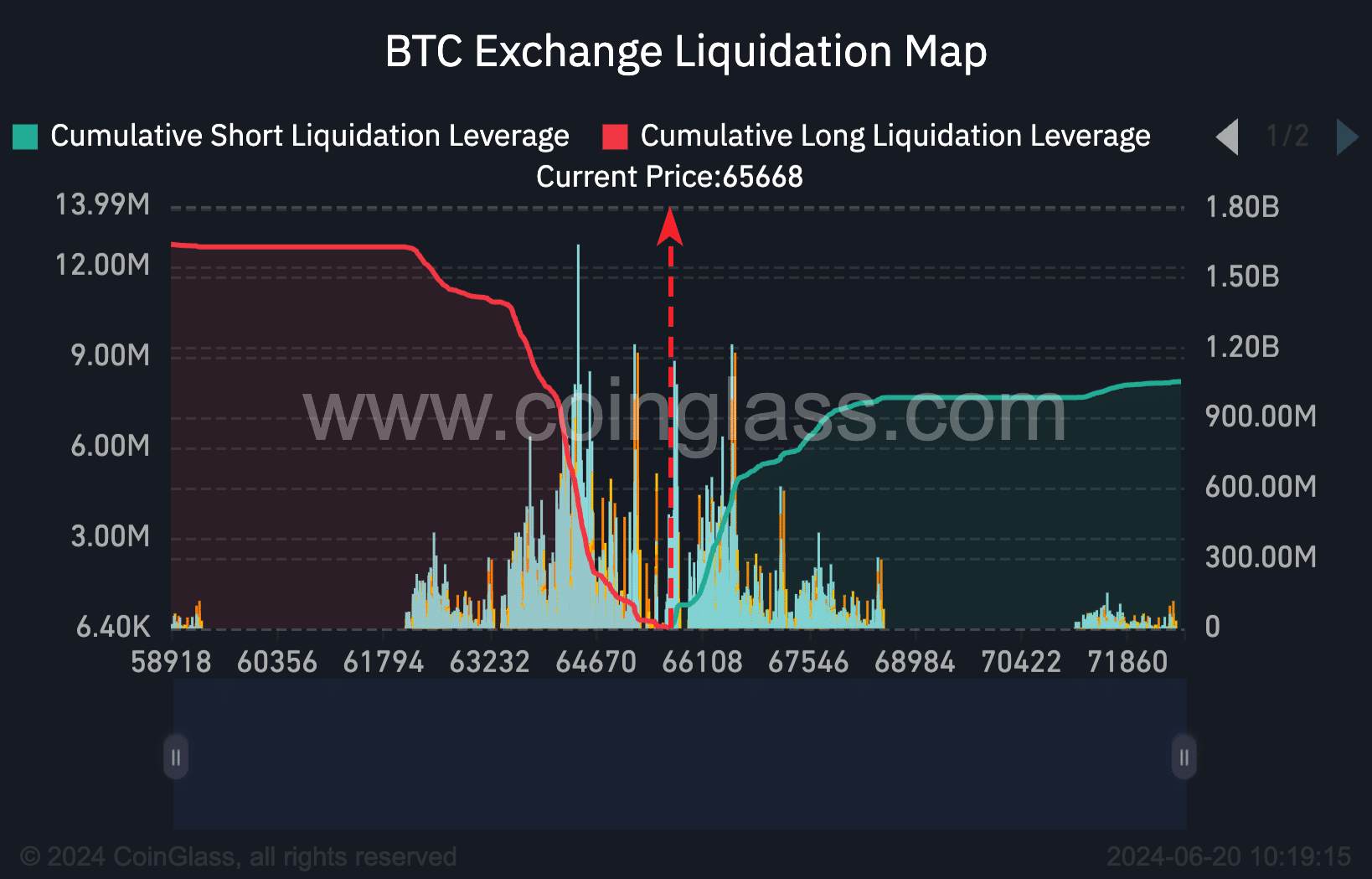

- $1.84 billion in Bitcoin short positions at risk if it hits $70,000.

- Recent bullish signals suggest a potential surge, despite ongoing market corrections.

As an experienced financial analyst, I’ve closely watched the crypto markets for years, and I must admit, the current situation surrounding Bitcoin (BTC) is both intriguing and nerve-wracking.

In the volatile crypto market, Bitcoin’s [BTC] ability to bounce back is being put to the test as it attempts to surpass the significant resistance level of $70,000. This price mark is significant because many traders have set stop-loss orders at this point, which could lead to a large number of sell orders and a potential price drop if reached.

Bearish investors, heavily loaded with short positions, keep a vigilant eye on market movements, as substantial financial risks hinge upon their predictions.

Bitcoin nears key thresholds

At present, the price of Bitcoin stood at $65,802 according to recent reports, representing a modest increase of 0.7% in the previous day’s trading. However, this positive trend masks a more significant loss of approximately 7% experienced over the last week.

The crypto market’s current state shows a robust battle between hope and caution.

The significant number of bearish bets, amounting to $1.84 billion as per Coinglass’ data, could be forced to close if Bitcoin rebounds and reaches the price of $70,000 again – a level not seen since early June.

The possibility of Bitcoin reaching this pivotal price has been a topic of considerable discussion.

Joshua Jake, CEO of Discover Crypto, shared his insights on X (formerly Twitter), stating,

As a researcher observing current market trends, I notice an overwhelmingly optimistic sentiment. Bitcoins and Ethereums‘ liquidation points are piling up. It seems that a price rebound could be just around the corner.

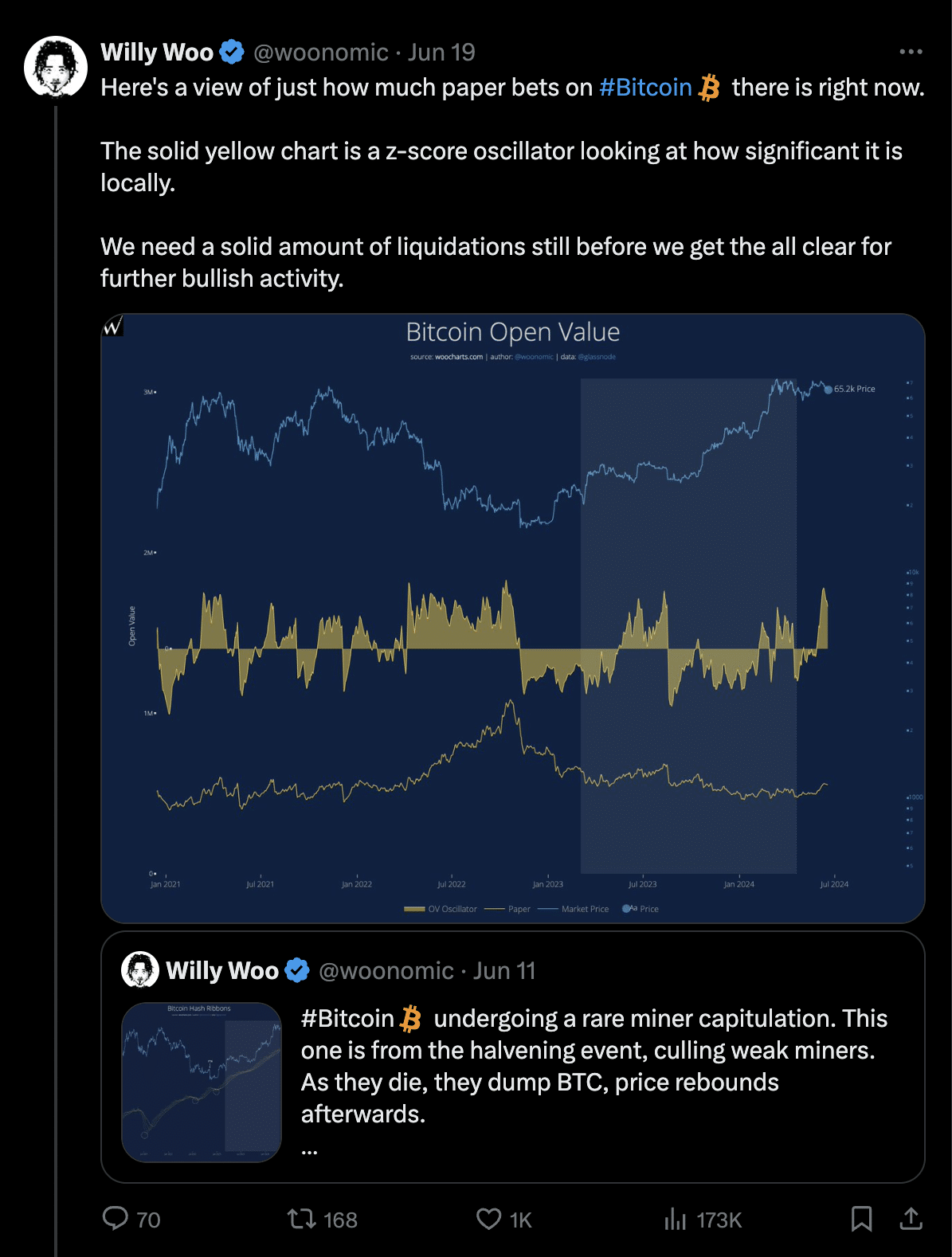

Prominent crypto analyst Willy Woo expressed a similar viewpoint on the same forum, proposing that a significant number of liquidations could occur to pave the way for a renewed bullish trend.

Analyzing BTC’s fundamentals

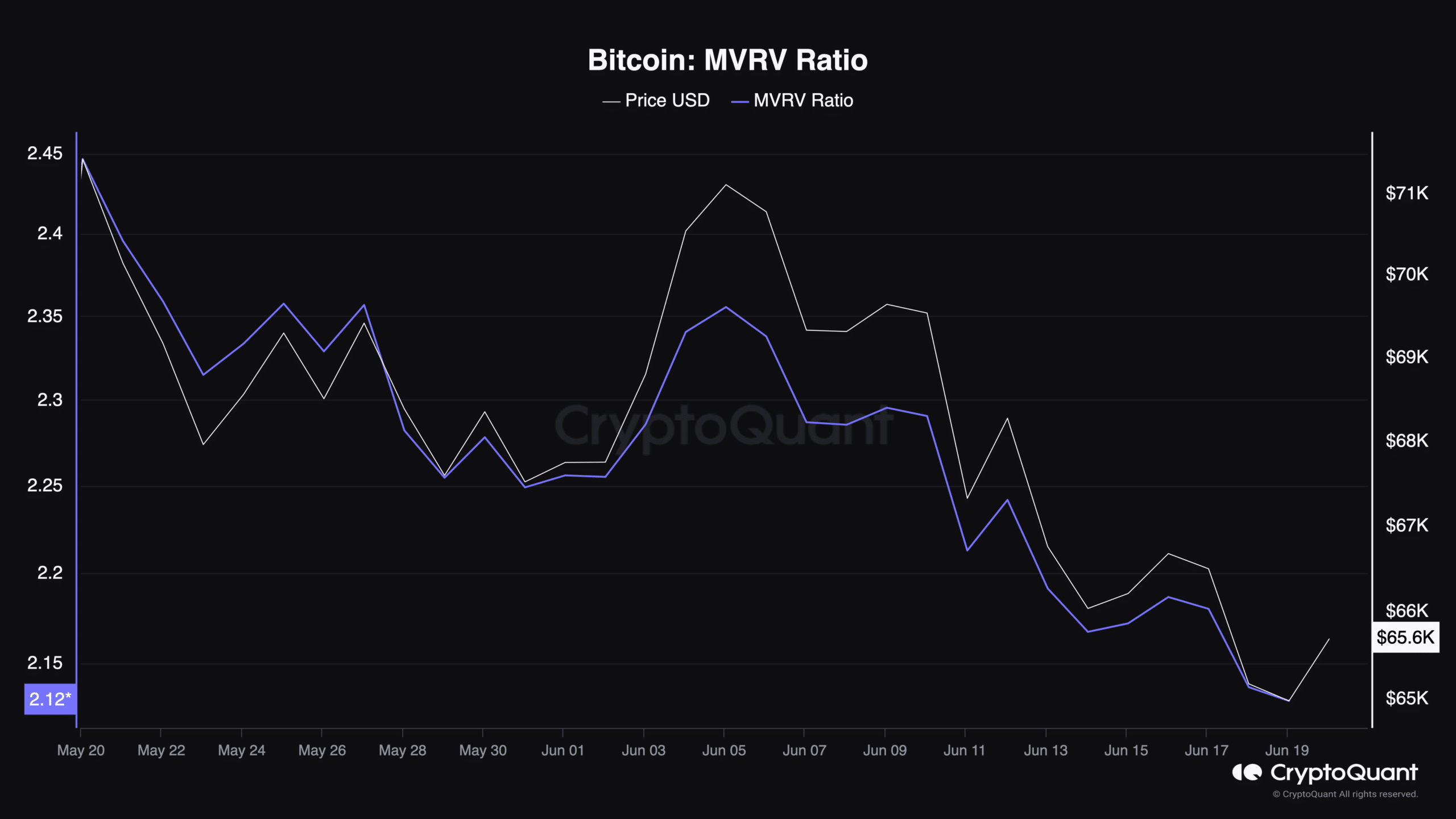

Exploring the core elements of Bitcoin, the MVRV ratio – a measurement that calculates the relationship between a coin’s current market value and its previous realizations – has dipped in tandem with the price, registering at 2.12 based on data provided by CryptoQuant.

As an analyst, I would interpret this graph as indicating that Bitcoin’s current value might be lower than what it’s truly worth. For investors with faith in Bitcoin’s future success, this could represent a promising opportunity to enter the market.

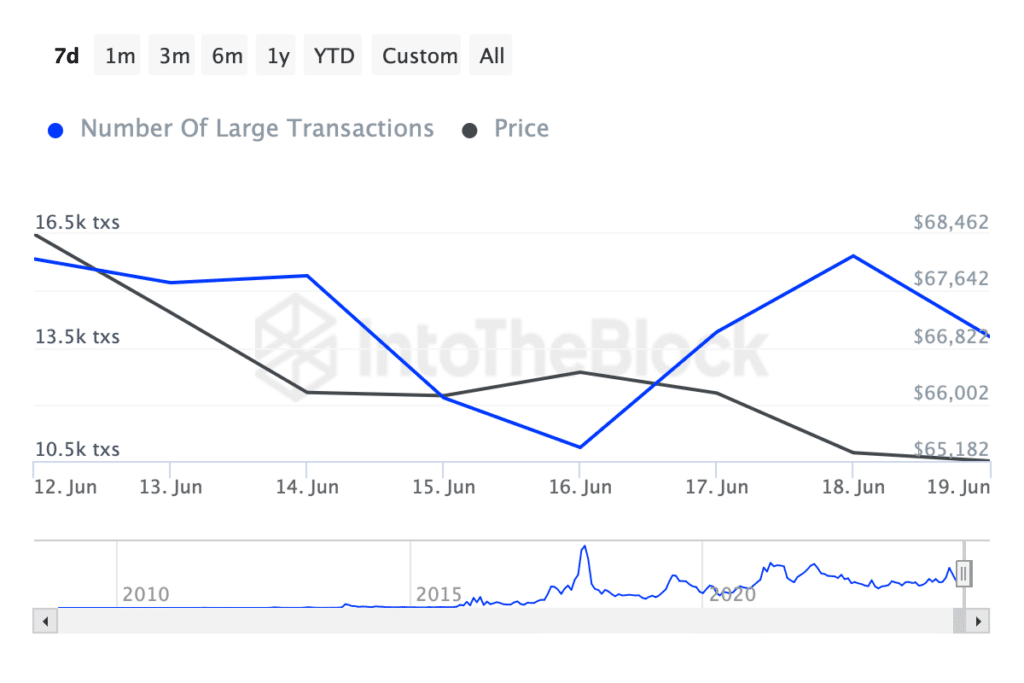

Over the past week, there has been a significant surge in Bitcoin transactions valued over $100,000, rising from fewer than 10,000 to approximately 13,000 such transactions.

As a crypto investor, I’ve noticed an uptick in larger transactions taking place in the market. This trend is typically seen as a strong indication that significant investors or institutions are becoming more active and showing increased interest in the crypto space.

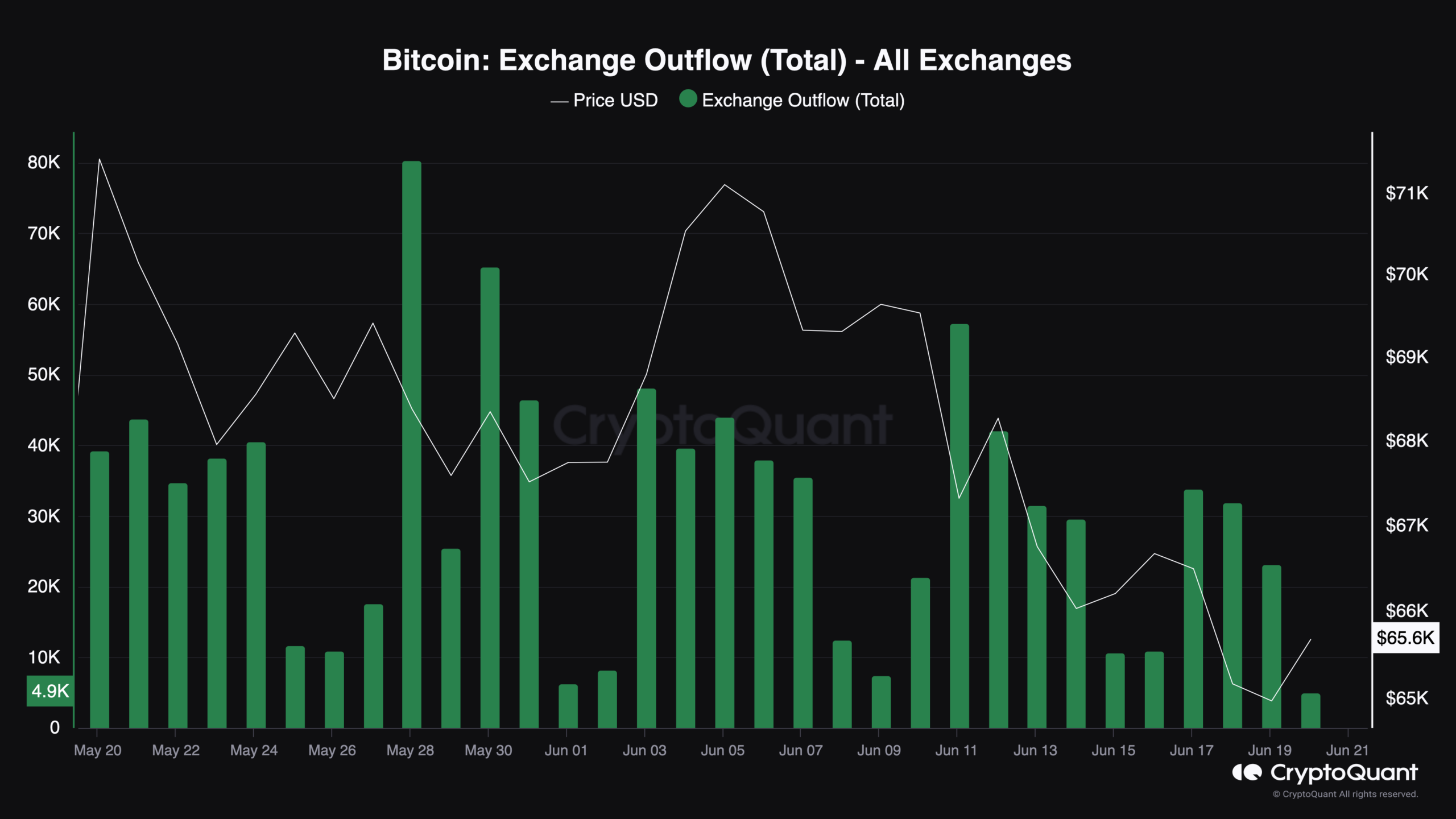

Enhancing the analysis of transactional data, the outflow metrics from CryptoQuant reveal heightened levels of activity.

On June 17th, there was a notable increase in Bitcoin withdrawals from exchanges, amounting to approximately 33,000 coins – a considerable jump compared to the numbers observed in the preceding days.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As an analyst, I observe that significant coin outflows from exchanges might be indicative of investor hoarding. This could potentially foreshadow a price surge as investors transfer their assets into personal wallets, intending to hold them for the long term.

Although AMBCrypto identifies several encouraging signs for Bitcoin, it’s essential to acknowledge their warning: A crucial Bitcoin indicator pointed out by AMBC crypto may trigger a correction, potentially driving down the price to around $54,000.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-20 15:03