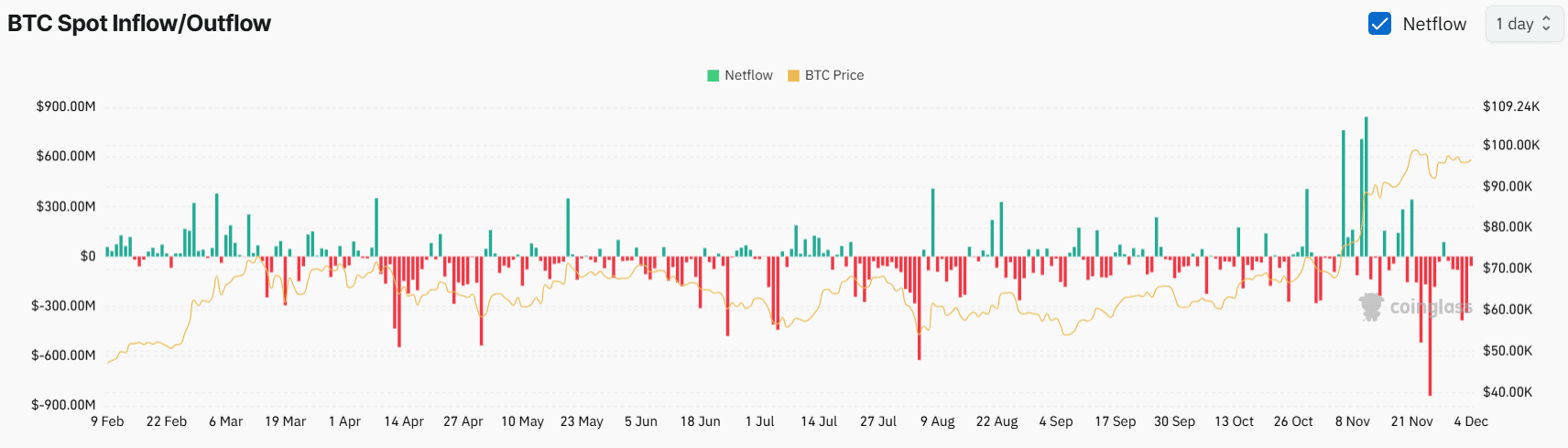

- BTC spot inflow/outflow data reveals that exchanges have seen a significant outflow of $860.52 million.

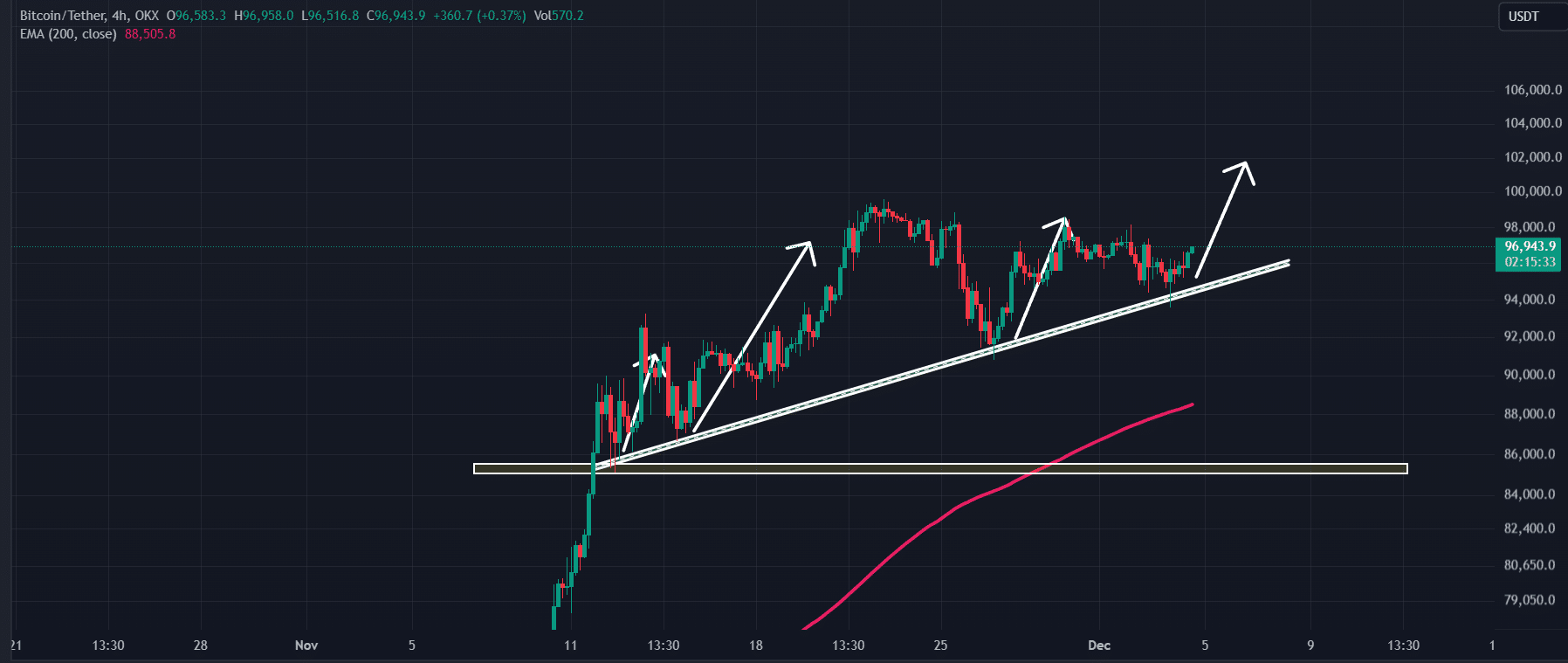

- BTC’s recent price action indicates that it could rise by 3% to reach the $99,588 level.

As an experienced analyst with over two decades in the financial industry, I find myself intrigued by the current state of Bitcoin [BTC]. On one hand, the MVRV metric is flashing a warning sign, suggesting that a correction could be imminent. Yet on the other, whales and institutions continue to show confidence in BTC, as evidenced by the significant $860.52 million outflow from exchanges.

💣 ALERT: EUR/USD Could Crash After Trump’s New Tariff Plans!

Explosive report reveals upcoming turbulence that could upend markets!

View Urgent ForecastIt seems that the world’s leading digital currency, Bitcoin (BTC), is approaching a potentially risky area according to a significant key indicator.

As I write this, the market appears to be bouncing back after a minor dip in prices that occurred shortly following the South Korean President’s announcement of martial law.

Bitcoin MVRV metric sends a warning

As a crypto investor, I’ve noticed that, based on data from Santiment, the typical returns from Bitcoin wallets that have been active over the past month are now treading in potentially risky territory.

In my exploration as a researcher, I’ve noticed that a potential danger zone arises when Bitcoin’s MVRV (Market Value to Realized Value) gets close to or surpasses the 5% mark. At present, this metric sits at +4.2%, suggesting that the price might be on the verge of a correction.

The Metric Value Realized Versus Purchased (MVRV) is an essential tool often employed by traders and investors while strategizing their investments. When the MVRV value approaches 5%, it could suggest an impending price adjustment or correction might occur.

If the MVRM (Moving Average Value Ratio) is near -5%, it could indicate a prospective purchasing chance and hint that a price rebound might be coming soon.

$860 million of outflow from exchanges

Regardless of Bitcoin’s price teetering on uncertain grounds, there’s been a notable surge in whales and institutions displaying faith and optimism towards this digital asset. Data from Coinglass indicates an impressive outflow of approximately $860.52 million from exchanges over the last four days.

This significant transfer indicates that either whales or investors are moving tokens away from exchanges into their personal wallets, with a plan to keep them for an extended period.

Flows going out (exits) can suggest a positive trend too, since they lower the probability of heavy selling and encourage more investors to join in.

Bitcoin technical analysis and key level

Based on the technical assessment by AMBCrypto, Bitcoin appears to be experiencing a rising trend. Lately, it’s been supported by an ascending trendline, and it’s currently moving towards its record high of approximately $100,000.

As an analyst, I am observing a significant pattern in the current market trends. It appears likely that this value may escalate by approximately 3% within the upcoming days, potentially reaching the $99,588 mark.

In a more straightforward manner, it means that Bitcoin’s RSI value is currently 55, which is lower than the level that signals an overbought market. This suggests that there might be potential for Bitcoin to increase its value in the near future.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Currently, Bitcoin is being exchanged around $96,900, and it’s seen a growth of approximately 1.75% over the last day.

Over the same timeframe, there was a slight uptick of 7.5% in trading activity, suggesting an increment in involvement from both traders and investors, reflecting optimistic market sentiments.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-12-04 19:35