-

Bitcoin MVRV momentum shows a potential return to bullish territory.

BTC has surged by 4.95% over the past week.

As a seasoned researcher with years of experience in analyzing cryptocurrency markets, I have witnessed the rollercoaster ride that Bitcoin [BTC] has been on. Over the past week, I have observed an intriguing surge in BTC’s price, which has revived market optimism and sparked a flurry of discussions among analysts.

Over the last seven days, Bitcoin [BTC] has shown a robust surge in value. This price increase has allowed Bitcoin to retake significant resistance points, boosting investor confidence and renewing overall market enthusiasm.

Currently, at the moment I’m writing, Bitcoin (BTC) is being traded for approximately $63,062. Over the last week, this represents an uptrend of about 4.95%.

Over the past week, Bitcoin’s performance has propelled it to post impressive growth on its monthly charts, rebounding from a monthly low of $52,546 with a notable increase of approximately 3.95%.

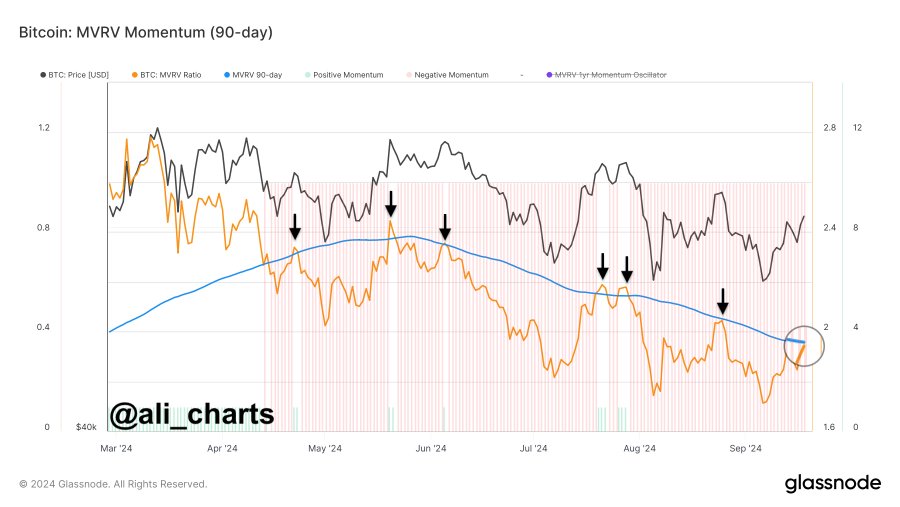

Without a doubt, these latest price fluctuations have ignited a flurry of debate among financial experts. For instance, renowned crypto analyst Ali Martinez anticipates a bullish trend in the near future, pointing to the MVRV momentum as his reasoning.

What market sentiment says

In his analysis, Martinez cited the latest shift of MVRV from negative to bullish territory.

Based on the study, MVRM (assuming you meant MVRV as Market Value to Realized Value) changed to negative momentum towards the end of April. During this stretch, Bitcoin experienced a drop from its peak of $67,241 to a temporary low of $49,577, followed by a brief rebound and another decline.

From the data we’ve gathered, if MVRV can successfully finish its day above its 90-day moving average, it suggests a shift towards a bullish trend after a prolonged period of bearish momentum.

In simpler terms, it suggests that the current decline is likely to end, possibly leading the market to become more positive again, potentially resulting in additional increases.

Previously, the price dipped beneath its 90-day Moving Average around mid-2023. Subsequently, after recovering, the prices leveled off and then experienced a prolonged increase.

Given that the market has seized the chance for purchasing, Bitcoin appears primed for a surge in value.

What BTC charts suggest

According to Martinez’s observations, the Bitcoin market appears poised to reenter a bullish phase following a prolonged downturn. This trend might indicate that Bitcoin’s price is primed for additional growth based on the current market mood.

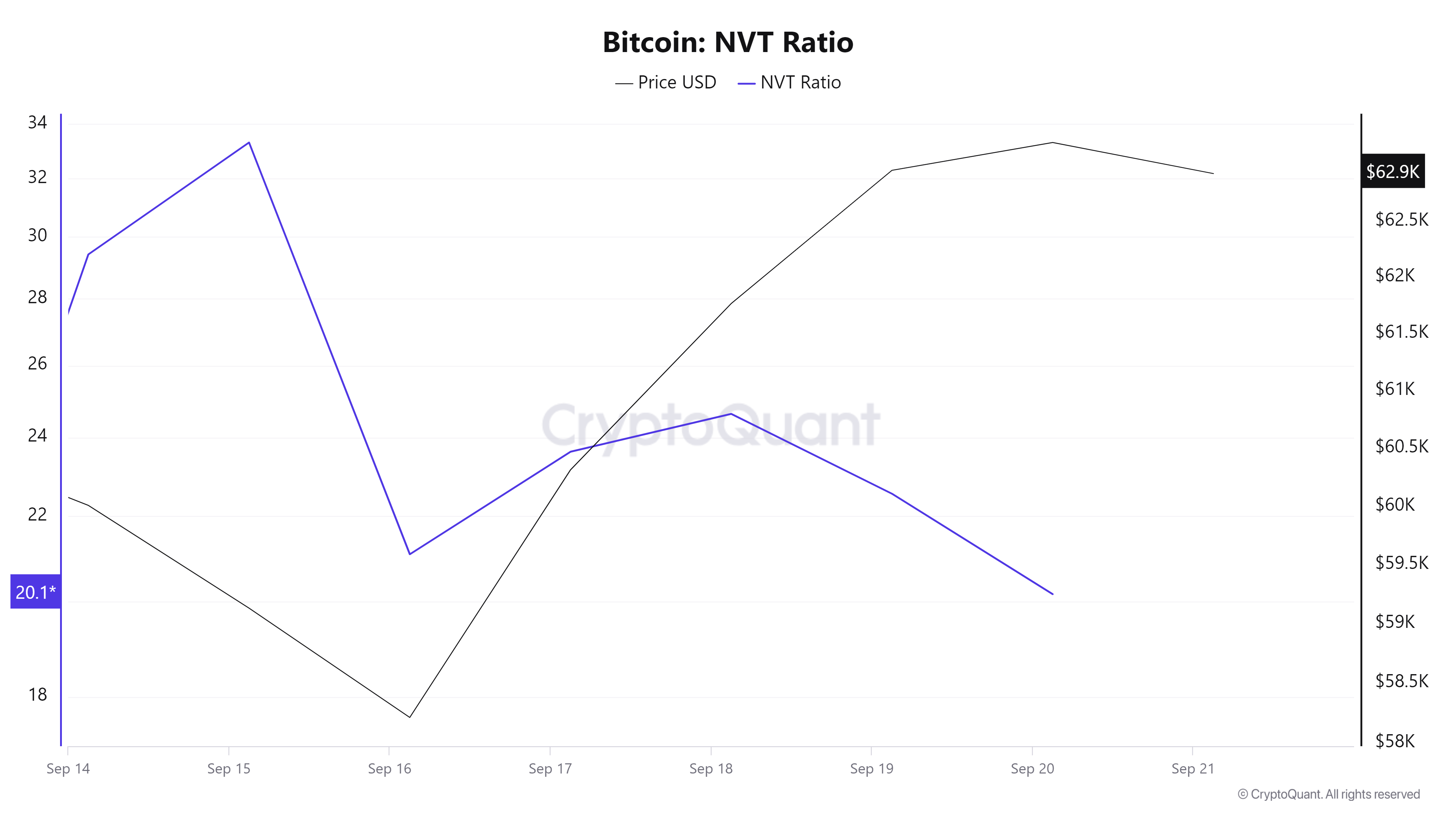

Over the past week, the Network Value to Transactions (NVT) ratio of Bitcoin has dropped from 33.3 to 20.1. This indicates that the number of transactions happening on the blockchain is increasing at a faster pace than its market capitalization.

This acts as a bullish indicator as it implies the network is being used actively and the price is less valued compared to the utility. Such a decline signals investor’s confidence in the network’s long-term viability.

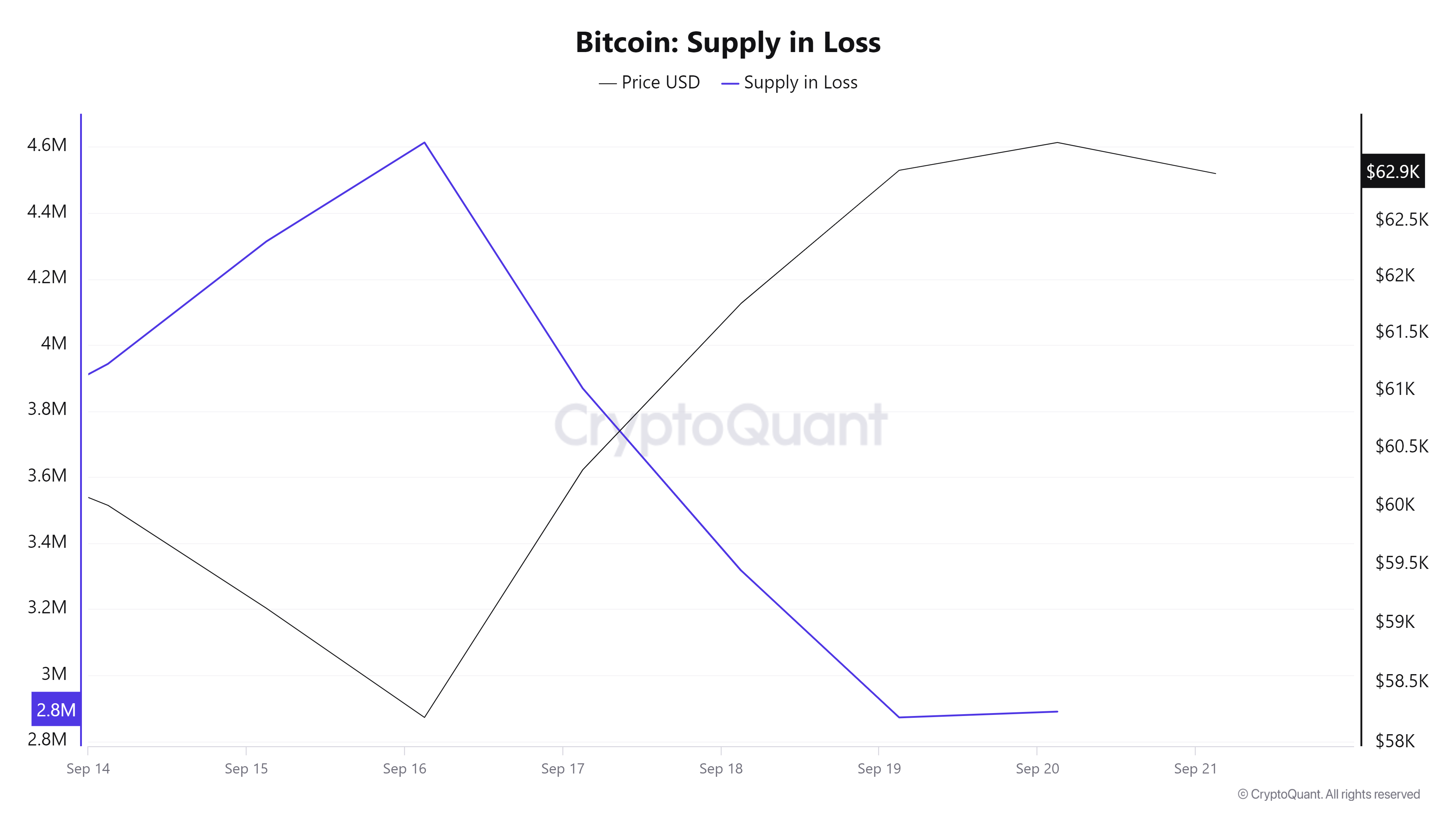

Moreover, the quantity of Bitcoin in circulation has decreased by approximately 1.4 million units over the last week, going from 4.2 million to 2.8 million. This decrease implies that the price of BTC is increasing, causing previously unprofitable assets to become profitable again. This trend is another positive sign pointing towards a rise in value, indicating strong market momentum.

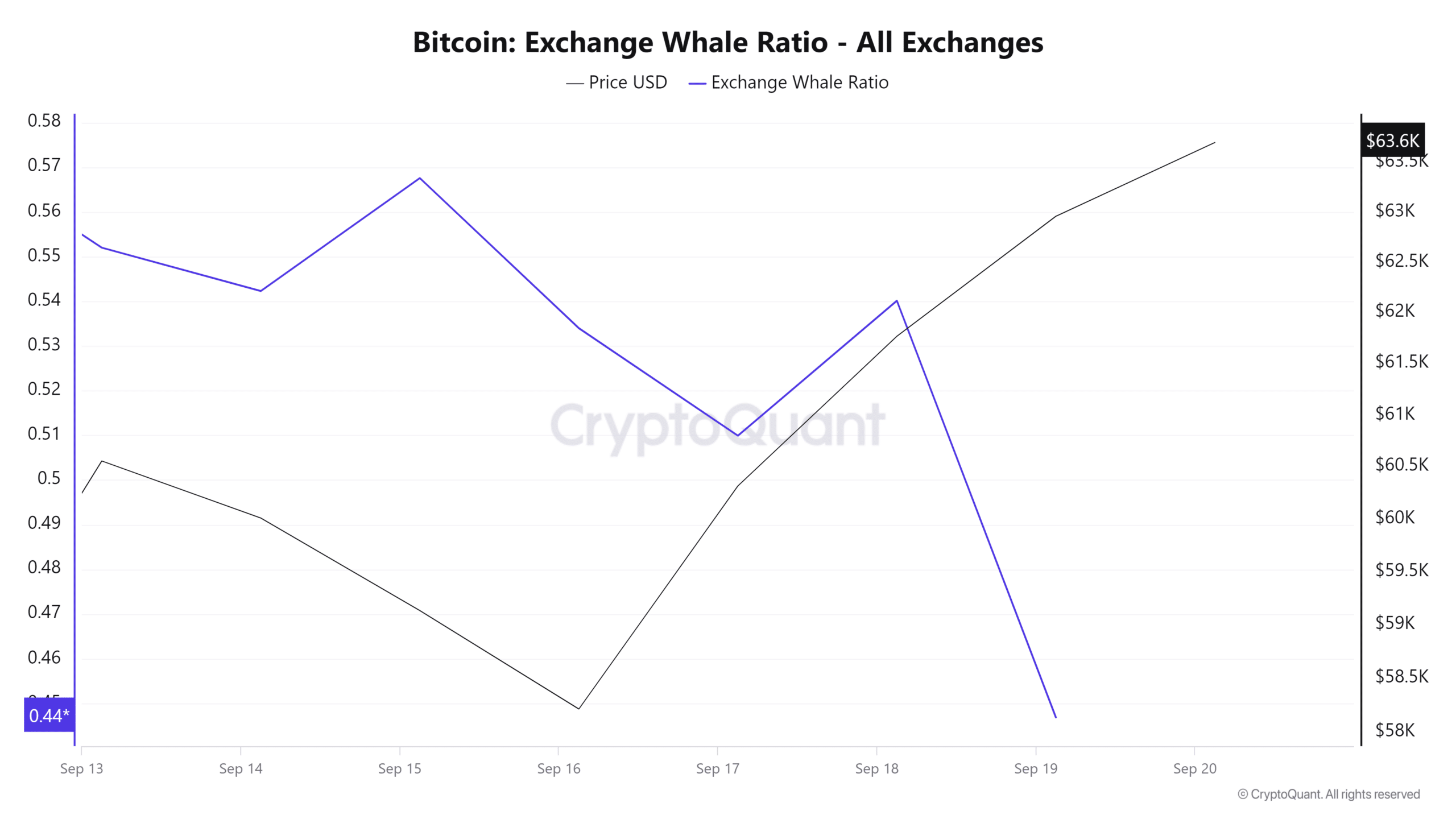

In summary, the ratio of Bitcoins on exchanges compared to its total supply has decreased slightly over the last week, going from 0.13128 to 0.1308. This suggests that Bitcoin holders might be transferring their BTC from exchange platforms into offline wallets for safer storage.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This implies that keeping the asset rather than selling it might be preferable for a longer period. This kind of action decreases the demand to sell, which is often a positive indication, commonly referred to as a “bullish” signal.

Consequently, it’s clear that Bitcoin (BTC) is gaining more preference among investors. If this positive trend continues, Bitcoin might attempt to breach its upcoming resistance level at approximately $64,262.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-09-21 17:12