- Bitcoin maintains strength above key level despite signs of potential downside.

- Shorts face the sharp edge of the knife as price sustains in the $58k range.

As a seasoned analyst with over a decade of market experience under my belt, I have witnessed countless bull and bear runs in the crypto space. The current Bitcoin [BTC] situation is reminiscent of a game of cat and mouse – the price is teasing the shorts, who are desperately trying to capitalize on any downside move, while maintaining a steady presence above the key $58k level.

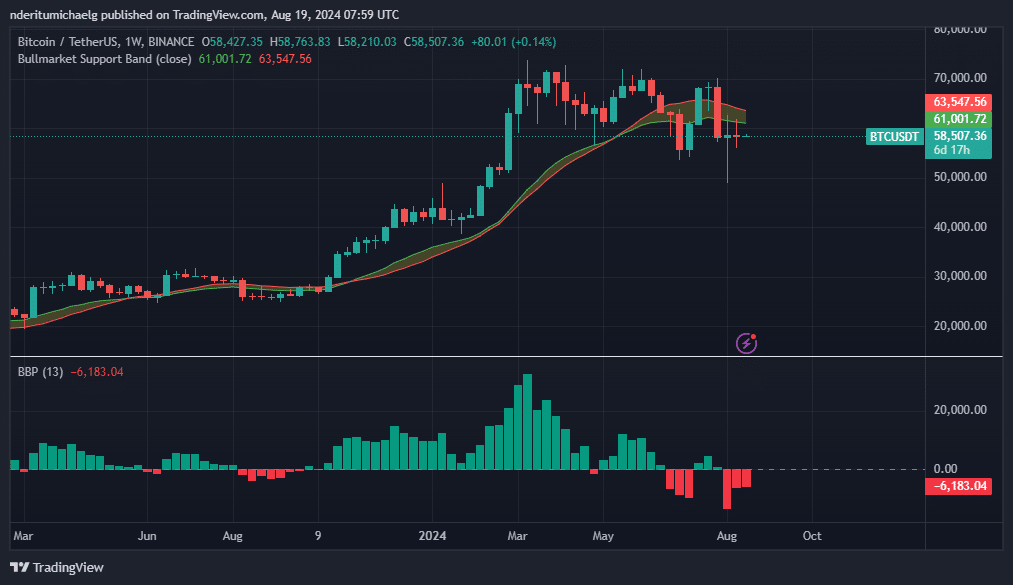

On a weekly basis, Bitcoin (BTC) has concluded below its key resistance level. This has led to an increase in pessimistic sentiments among traders. However, it’s important to note that the market conditions have been challenging for those who are shorting Bitcoin on leverage.

Despite Bitcoin’s efforts to bounce back following its decline earlier in the year, a lack of strong buying pressure has fostered increasing pessimism among investors.

For now, the price of Bitcoin seems to be moving within a limited span, as seen on a weekly chart. Additionally, the price is staying beneath the bullish resistance level, which has been causing further doubts about a potential market recovery among investors.

“The flip of the Bitcoin bull market’s support level is a bearish indicator, pointing towards further price drops. It seems short sellers are increasingly taking advantage of this trend by increasing their bets.”

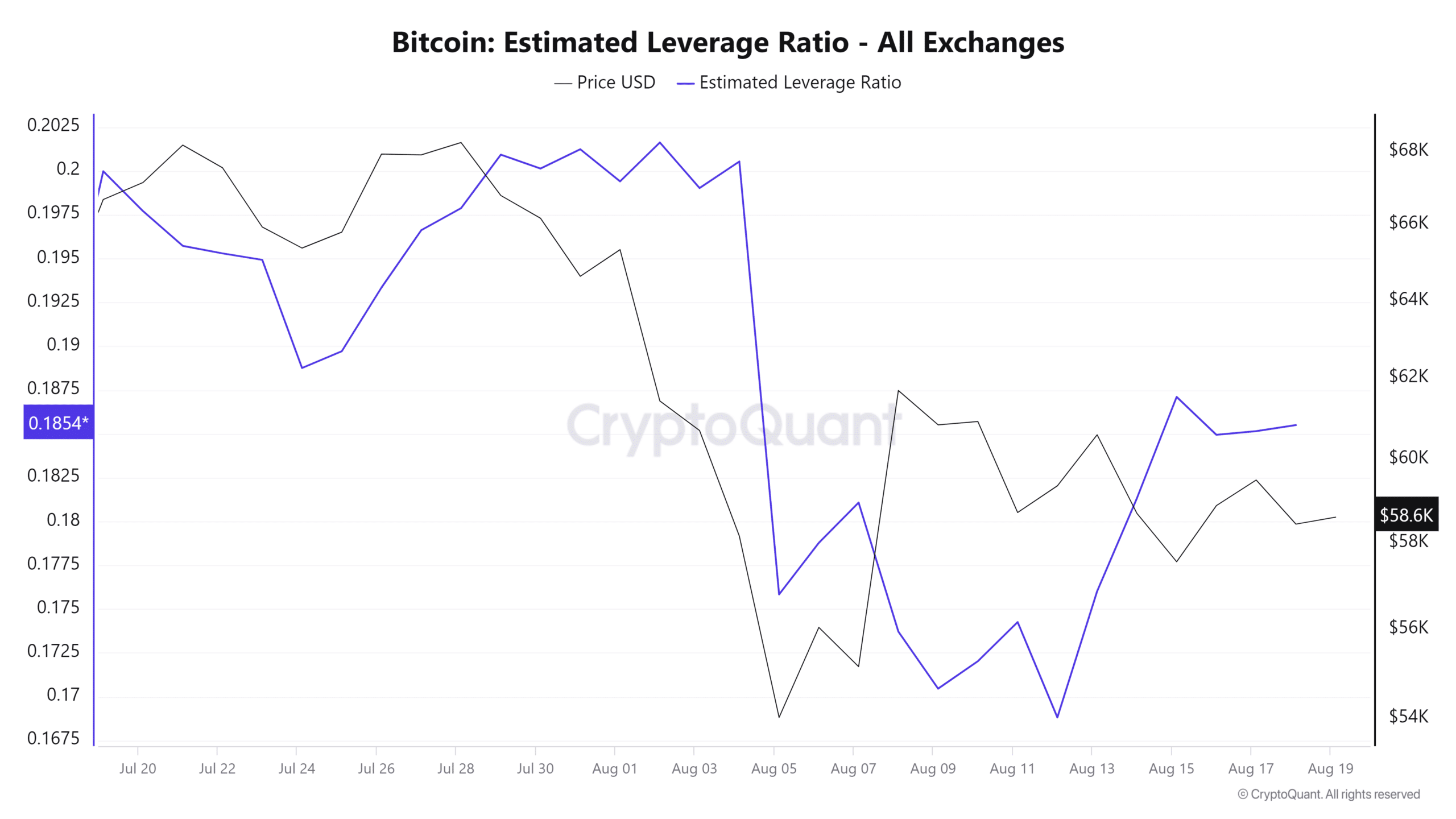

Over the past week or so, there’s been a growing interest in taking on greater risk, as indicated by the decrease in our estimated leverage ratio on August 12. This trend implies that the market expects increased market fluctuations in the upcoming days.

The quantity of Bitcoin leveraged short positions has been increasing, as traders anticipate further price drops. Yet, Bitcoin’s recent market behavior suggests resilience in the face of potential downward pressure around the $58,000 price level.

New information shows that approximately $1.65 billion dollars’ worth of positions using borrowed funds for short selling have been forced to close.

In contrast to these results, the rate of short liquidations remains relatively low as compared to what we’ve seen in recent weeks. However, the primary concern for many Bitcoin investors is whether its value will keep declining further.

Noteworthy points to consider: The relatively small fluctuation in Bitcoin’s value implies that its owners are choosing to keep their investments rather than sell.

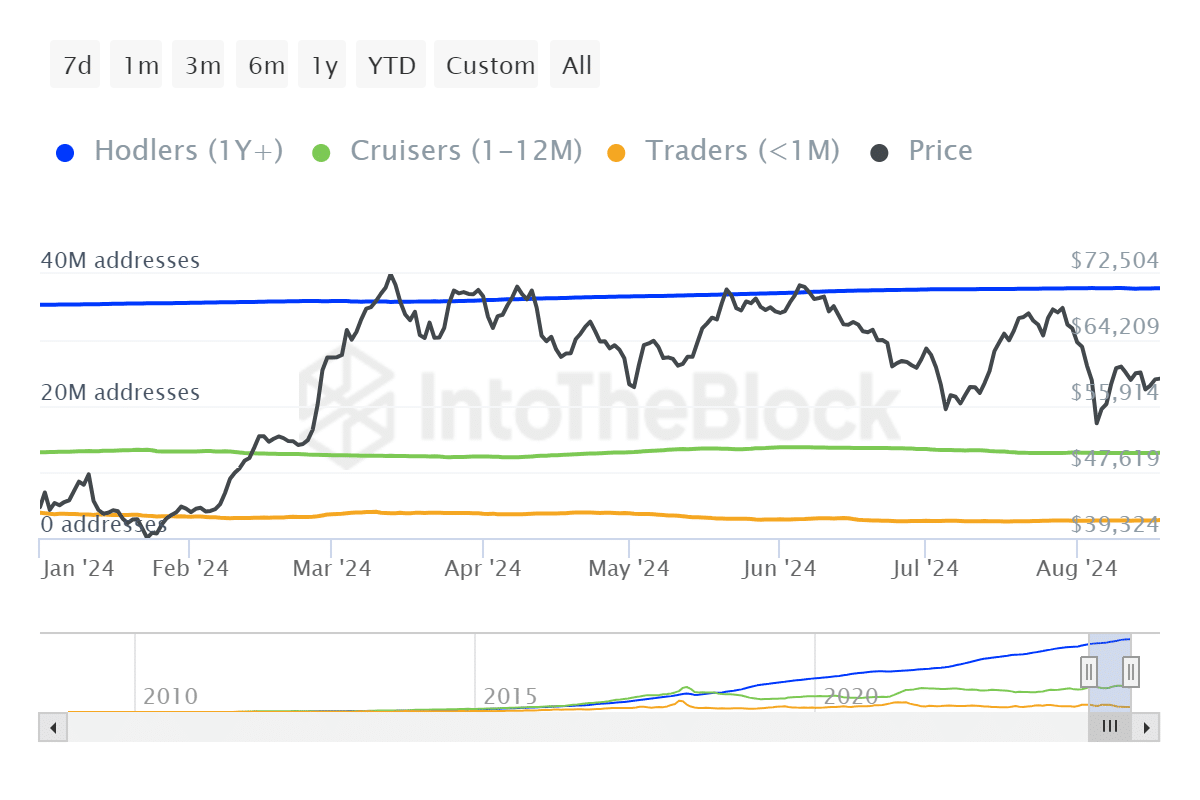

Bitcoin ownership stats by time held reveals that whales continue to HODL. For example, the number of whales HODLing BTC on a YTD time frame grew from 35.33 million addresses to 37.88 million addresses as of the latest stats.

It’s positive when whales (large investors) are holding onto Bitcoin since their collective influence can significantly affect the market. Yet, this same data suggests that smaller-scale investors, or the retail class, have been decreasing in number over the same timeframe.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher, I speculate that one plausible explanation for the observed trend might be due to the increased cost of living and market instability compelling retail holders to offload their assets.

While whales choosing to hold onto their Bitcoin indicates a persistent optimism for its future growth, even in the face of temporary challenges. Each dip observed has been preceded by significant buying activity, acting as a buffer against further price declines.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-19 17:11